Chainalysis' Acquisition Of Alterya: A Deeper Dive Into AI Integration

Table of Contents

Enhanced Blockchain Data Analysis Capabilities with AI

The integration of Alterya's advanced AI capabilities significantly boosts Chainalysis's existing blockchain data analysis platform. This synergy promises unprecedented speed, accuracy, and predictive power in uncovering illicit activities within the complex world of cryptocurrency transactions.

Improved Speed and Accuracy

Alterya's AI algorithms are designed to process massive datasets with unparalleled efficiency. This translates to:

- Faster transaction tracing: Quickly identifying the origin and destination of cryptocurrency transactions, even across multiple exchanges and wallets.

- More efficient identification of suspicious activities: Pinpointing potentially illicit transactions with greater accuracy, reducing the workload on human analysts.

- Reduced false positives: Minimizing the number of legitimate transactions flagged as suspicious, improving the efficiency and effectiveness of investigations.

AI algorithms can sift through millions of data points, identifying subtle patterns and anomalies that would be impossible for human analysts to detect manually. This enhanced speed and accuracy dramatically reduce investigation times and improve the overall effectiveness of AML/KYC programs.

Advanced Pattern Recognition & Predictive Analytics

Beyond simply identifying suspicious activity, Alterya's technology enables advanced pattern recognition and predictive analytics. This allows Chainalysis to:

- Proactively detect fraud: Identify emerging fraud schemes and predict future illicit activities before they escalate.

- Improve risk assessment: Develop more accurate risk scores for individual transactions and entities, enabling more targeted compliance efforts.

- Establish early warning systems: Receive timely alerts about potential threats, allowing for proactive mitigation strategies.

Machine learning models trained on vast historical datasets can identify complex patterns and predict future trends in cryptocurrency transactions, enabling a more proactive and preventative approach to combating financial crime.

Strengthened AML/KYC Compliance Solutions

The combination of Chainalysis's expertise and Alterya's AI significantly strengthens AML/KYC compliance solutions, offering businesses a more robust and efficient approach to regulatory compliance.

Automated Compliance Processes

The integration of Alterya's AI will automate and streamline crucial AML/KYC processes, leading to:

- Reduced manual effort: Automating tasks like identity verification, transaction monitoring, and sanctions screening frees up human analysts to focus on more complex investigations.

- Increased efficiency: Streamlined processes lead to faster onboarding of clients and quicker processing of transactions.

- Faster client onboarding: The automation of KYC checks allows for a much quicker and smoother onboarding process for new clients.

AI-driven automation significantly reduces the operational burden associated with compliance, allowing businesses to focus on their core operations while maintaining regulatory compliance.

Improved Risk Assessment and Mitigation

The combined power of Chainalysis and Alterya provides for a more sophisticated and effective risk assessment and mitigation framework:

- More precise risk scoring: AI-powered risk scoring models provide more accurate assessments of risk associated with individual transactions and entities.

- Tailored compliance programs: Businesses can create customized compliance programs based on their specific risk profiles.

- Proactive mitigation of financial crime: By identifying and addressing risks proactively, businesses can prevent financial crimes before they occur.

AI-powered risk scoring helps prioritize investigations and allocate resources more effectively, maximizing the impact of compliance efforts.

Expansion of Chainalysis's Market Reach and Product Offerings

The Alterya acquisition significantly expands Chainalysis's market reach and enhances its product portfolio, offering clients a more comprehensive and powerful solution for blockchain analytics.

Broadened Client Base

The integration of Alterya's technology opens doors to a broader range of clients, including:

- Expansion into new markets: Access to new geographical markets and customer segments.

- Increased market share: Strengthened competitive position within the blockchain analytics market.

- Access to new customer segments: Attracting clients seeking enhanced blockchain analytics solutions for specific needs.

The combined capabilities of Chainalysis and Alterya create a more compelling value proposition for a wider range of businesses operating in the cryptocurrency space.

Enriched Product Portfolio

The acquisition results in a more comprehensive suite of solutions, offering clients:

- More comprehensive suite of solutions: A wider range of tools and features for blockchain data analysis.

- Integration with existing platforms: Seamless integration with existing Chainalysis platforms and workflows.

- Enhanced user experience: A more intuitive and user-friendly platform for accessing and analyzing blockchain data.

The enriched product portfolio positions Chainalysis as a leading provider of comprehensive blockchain analytics solutions.

Conclusion

The acquisition of Alterya by Chainalysis signifies a pivotal moment in the evolution of blockchain analytics. By integrating Alterya's cutting-edge AI capabilities, Chainalysis significantly enhances its data analysis prowess, strengthens its AML/KYC compliance solutions, and expands its market reach. This integration promises to redefine how businesses navigate the complexities of the cryptocurrency landscape. To stay ahead in the evolving blockchain space, explore the enhanced capabilities of Chainalysis's AI-powered solutions and request a demo today. Learn more about the future of blockchain data analysis and the power of Chainalysis's AI integration.

Featured Posts

-

Duong Den Chung Ket Miami Open 2025 Djokovic Va Alcaraz Dung Do

May 18, 2025

Duong Den Chung Ket Miami Open 2025 Djokovic Va Alcaraz Dung Do

May 18, 2025 -

The Night Snl Went Live And Unfiltered 103 5 Kiss Fm Recap

May 18, 2025

The Night Snl Went Live And Unfiltered 103 5 Kiss Fm Recap

May 18, 2025 -

Pregnant Cassie Ventura And Alex Fines Mob Land Premiere Red Carpet Photos

May 18, 2025

Pregnant Cassie Ventura And Alex Fines Mob Land Premiere Red Carpet Photos

May 18, 2025 -

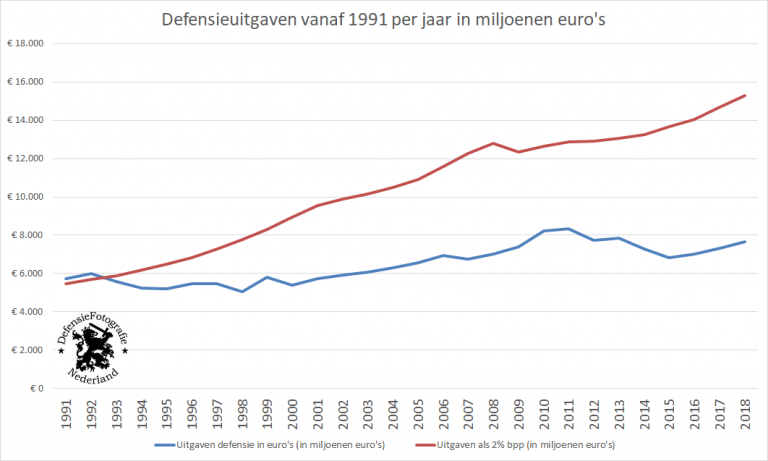

Meer Steun Voor Groei Nederlandse Defensie Industrie

May 18, 2025

Meer Steun Voor Groei Nederlandse Defensie Industrie

May 18, 2025 -

Trump Condemns Springsteens Treasonous Remark

May 18, 2025

Trump Condemns Springsteens Treasonous Remark

May 18, 2025