Check Today's Personal Loan Interest Rates

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into the process of finding the best deals, it's essential to understand what influences personal loan interest rates.

Factors Influencing Interest Rates

Several key factors determine the interest rate you'll receive on a personal loan. These factors work together to create your individual interest rate profile:

- Credit Score: This is arguably the most significant factor. A higher credit score (generally above 700) typically qualifies you for lower interest rates. Lenders view you as a lower risk.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates. Lenders perceive a greater risk associated with larger loans.

- Loan Term: A longer loan term (e.g., 60 months vs. 36 months) will generally result in a higher interest rate because you're borrowing the money for a longer period.

- Income: Lenders assess your income to determine your ability to repay the loan. A stable and higher income can improve your chances of securing a lower rate.

- Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, significantly impacts your interest rate. A lower DTI indicates better financial health.

- Lender Type: Different lenders (banks, credit unions, online lenders) have varying lending criteria and interest rate structures. Credit unions often offer more competitive rates for members.

Types of Personal Loans and Their Rates

Personal loans come in various forms, each potentially carrying different interest rates:

- Secured vs. Unsecured: Secured loans (backed by collateral like a car or savings account) usually offer lower interest rates than unsecured loans (which don't require collateral).

- Fixed vs. Variable Interest Rates: Fixed-rate loans have a consistent interest rate throughout the loan term, providing predictability. Variable-rate loans have an interest rate that fluctuates based on market conditions.

Average Interest Rate Ranges (Approximate): These are averages and can vary significantly based on the factors mentioned above.

- Secured Personal Loans: 6% - 18% APR

- Unsecured Personal Loans: 9% - 25% APR

APR vs. Interest Rate

It's crucial to understand the difference between APR (Annual Percentage Rate) and the stated interest rate. The APR includes the interest rate plus any additional fees (origination fees, late payment fees, etc.). The APR reflects the true cost of borrowing.

- Example: A loan with a 10% interest rate and a $200 origination fee will have a higher APR, reflecting the total cost of the loan over its term.

How to Check Today's Personal Loan Interest Rates

Now that you understand the factors influencing rates, let's explore how to check current personal loan rates.

Online Comparison Tools

Using online comparison tools is a highly efficient way to compare personal loan rates comparison across multiple lenders.

-

Advantages: Saves time, allows for easy rate comparison, provides a comprehensive overview of various loan options.

-

Trusted Comparison Sites (Examples): Note: Always research and choose reputable sites. (Insert reputable comparison website links here – be mindful of affiliate links disclosure).

-

Caution: Be wary of predatory lenders offering unrealistically low rates. Always verify the lender's legitimacy before submitting any personal information.

Directly Contacting Lenders

Another method is to visit the websites of individual lenders (banks, credit unions, online lenders) or contact them directly to inquire about their best personal loan rates.

- Banks: Often offer a wide range of loan products but may have stricter lending requirements.

- Credit Unions: Typically offer lower rates to their members but may have limited geographical reach.

- Online Lenders: Can offer competitive rates and a streamlined application process, but it is crucial to check for legitimacy.

Pre-qualification vs. Application

Before committing to a full application, take advantage of pre-qualification options.

- Pre-qualification: A soft inquiry that doesn't impact your credit score; helps you understand potential interest rates without affecting your credit.

- Full Application: A hard inquiry that appears on your credit report; multiple hard inquiries can negatively impact your credit score.

Tips for Getting the Best Personal Loan Interest Rates

Finally, let's examine strategies to optimize your chances of securing the most favorable interest rates.

Improve Your Credit Score

A higher credit score is your greatest asset.

- Improve Your Score: Pay bills on time, reduce your outstanding debt, and monitor your credit report regularly. (Include links to reputable credit score improvement resources).

Shop Around and Compare

Don't settle for the first offer you receive.

- Compare Offers: Compare interest rates, fees, and terms from multiple lenders to find the best deal. This will save you money in the long run.

Negotiate with Lenders

Don't be afraid to negotiate!

- Negotiate: If you have a strong credit score, a large down payment, or other positive factors, you might be able to negotiate a lower interest rate.

Conclusion

Checking today's personal loan interest rates is essential for securing the best loan terms and minimizing borrowing costs. By understanding the factors influencing interest rates, utilizing online comparison tools, and employing smart negotiation strategies, you can significantly improve your chances of obtaining a loan with a low interest rate. Start your search for the best personal loan interest rates today! Use our resources and tips to find the perfect loan that fits your financial needs. Don't delay – check today's personal loan interest rates and secure your financial future.

Featured Posts

-

Delayed But Significant Analyzing Chicagos Recent Crime Reduction

May 28, 2025

Delayed But Significant Analyzing Chicagos Recent Crime Reduction

May 28, 2025 -

Man Utd News 50m Stars House Sale Hints At Exit

May 28, 2025

Man Utd News 50m Stars House Sale Hints At Exit

May 28, 2025 -

Blake Livelys Lawyer Responds To Ryan Reynolds And Taylor Swift Subpoena

May 28, 2025

Blake Livelys Lawyer Responds To Ryan Reynolds And Taylor Swift Subpoena

May 28, 2025 -

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025 -

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025

Latest Posts

-

De Laatste Dagen Van Het Derde Rijk Een Analyse Van Bert Natters Concentratiekamproman

May 31, 2025

De Laatste Dagen Van Het Derde Rijk Een Analyse Van Bert Natters Concentratiekamproman

May 31, 2025 -

A Talajnedvesseg Kritikus Szerepe Az Alfoeldi Noevenytermesztesben Strategiak A Termeshozam Noevelesere

May 31, 2025

A Talajnedvesseg Kritikus Szerepe Az Alfoeldi Noevenytermesztesben Strategiak A Termeshozam Noevelesere

May 31, 2025 -

Recensie Bert Natters Concentratiekamproman Groots Dodelijk Vermoeiend En Indrukwekkend

May 31, 2025

Recensie Bert Natters Concentratiekamproman Groots Dodelijk Vermoeiend En Indrukwekkend

May 31, 2025 -

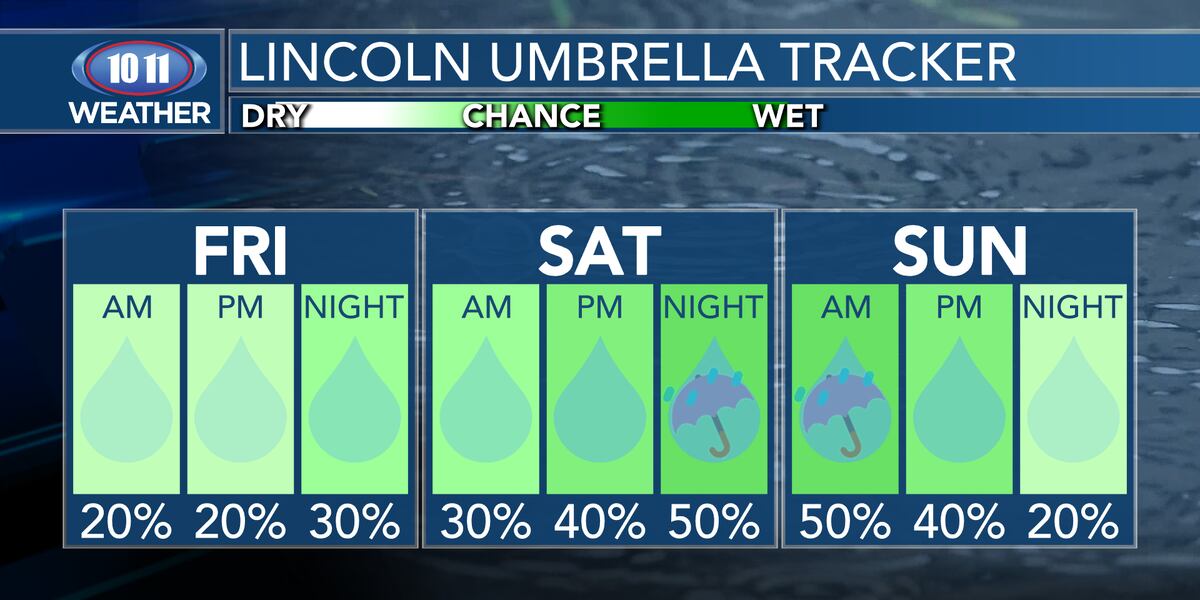

Seattle Rain Forecast Soggy Conditions To Last Into The Weekend

May 31, 2025

Seattle Rain Forecast Soggy Conditions To Last Into The Weekend

May 31, 2025 -

Weather Forecast Warning Heavy Snow And Strong Winds Tuesday

May 31, 2025

Weather Forecast Warning Heavy Snow And Strong Winds Tuesday

May 31, 2025