Check Today's Personal Loan Interest Rates And Apply

Table of Contents

Understanding Today's Personal Loan Interest Rates

Securing a favorable interest rate on your personal loan is key to managing your finances effectively. Understanding the factors that influence these rates is the first step towards achieving your financial goals.

Factors Affecting Interest Rates

Several factors contribute to the personal loan interest rates you'll be offered. It's important to understand these to better navigate the loan application process.

-

Credit Score: Your credit score is a significant factor. A higher credit score (700 or above is generally considered good) typically translates to lower interest rates. Improving your credit score before applying is highly beneficial. Consider checking your credit report for errors and working to improve your credit history.

-

Loan Amount: Larger loan amounts may come with slightly higher personal loan interest rates. Lenders perceive a higher risk with larger sums.

-

Loan Term: The length of your loan term impacts your monthly payments and overall interest paid. Shorter loan terms (e.g., 12 months) usually mean higher monthly payments but lower overall interest paid. Longer terms (e.g., 60 months) mean lower monthly payments but higher overall interest paid over the life of the loan.

-

Interest Rate Type: You'll typically encounter two types: fixed and variable interest rates. Fixed rates remain constant throughout the loan term, providing predictability. Variable rates fluctuate based on market conditions, potentially leading to changes in your monthly payments.

-

Lender Type: Different lenders—banks, credit unions, and online lenders—often have varying personal loan interest rates. Comparing offers from multiple lenders is essential to finding the most competitive rate. Credit unions often offer slightly lower rates than banks due to their member-focused structure.

Where to Check Current Rates

Finding the best personal loan interest rates requires diligent research. Here are some reliable resources:

-

Online Comparison Websites: Many websites aggregate personal loan offers from various lenders, allowing you to compare rates easily. These can save you valuable time in your search for the best rates.

-

Individual Lender Websites: Visit the websites of banks and credit unions directly to see their current rates and loan options. Look for detailed information on APR (Annual Percentage Rate), fees, and repayment terms.

-

Financial Advisors: A financial advisor can provide personalized recommendations based on your financial situation and goals. They can help you navigate the complexities of loan options and find the best fit for your needs.

Remember to always verify information from online resources with official lender sources. Be wary of hidden fees and fine print.

Types of Personal Loans and Their Interest Rates

Understanding different loan types and their associated interest rates is crucial for making an informed decision.

Secured vs. Unsecured Personal Loans

The type of personal loan significantly impacts the interest rate.

-

Secured Loans: These loans require collateral (e.g., a car, savings account, or other asset) to secure the loan. Because the lender has less risk, secured loans typically offer lower personal loan interest rates.

-

Unsecured Loans: These loans don't require collateral. The higher risk for the lender translates to higher interest rates compared to secured loans.

Other Loan Types

Various personal loans cater to different financial needs. Each type typically carries its own interest rate range.

-

Debt Consolidation Loans: These loans are designed to consolidate multiple high-interest debts into a single, more manageable payment. Interest rates vary depending on your creditworthiness and the lender.

-

Home Equity Loans: These loans use your home's equity as collateral, often resulting in lower interest rates than unsecured personal loans. However, it's crucial to understand the risks involved, as defaulting on the loan could lead to foreclosure.

-

Payday Loans: These are short-term, high-interest loans that should be avoided unless absolutely necessary. Their extremely high interest rates can create a debt trap.

Consider the purpose of your loan and choose the type that best suits your needs. Carefully review the terms and conditions before applying.

How to Apply for a Personal Loan with Favorable Interest Rates

Securing a low interest rate involves proactive steps to improve your creditworthiness and shop around for the best offers.

Improve Your Credit Score

A strong credit score is your best ally when applying for a loan.

-

Pay Bills on Time: Consistent on-time payments are crucial for building a good credit history. Late payments can significantly damage your credit score.

-

Keep Credit Utilization Low: Maintain a low credit utilization ratio (the amount of credit you use compared to your total available credit). Aim for less than 30% utilization.

-

Check Your Credit Report Regularly: Monitor your credit report for errors and address any inaccuracies promptly. You're entitled to a free credit report annually from each of the three major credit bureaus.

Shop Around and Compare Offers

Don't settle for the first offer you receive.

-

Compare Interest Rates, Fees, and Terms: Carefully compare all aspects of different loan offers, not just the interest rate. Hidden fees can significantly impact the overall cost.

-

Use Online Comparison Tools: Utilize online tools to streamline the comparison process and easily identify the best offers.

Prepare Necessary Documents

Gather all required documentation beforehand to expedite the application process.

- Necessary Documents: Typically, lenders will require income verification (pay stubs or tax returns), bank statements, and government-issued identification.

Pre-qualifying for a loan will not affect your credit score, allowing you to compare offers without impacting your creditworthiness.

Conclusion

Checking today's personal loan interest rates is a crucial step in securing the most affordable financing. By understanding the factors influencing interest rates, comparing offers from different lenders, and improving your creditworthiness, you can significantly increase your chances of obtaining a loan with favorable terms. Don't delay—start comparing personal loan interest rates today and find the best loan option to meet your financial needs. Apply now for the best rates available!

Featured Posts

-

Arsenal News Arteta U Turn On 76m Striker Eyes 60m Mbappe Style Star

May 28, 2025

Arsenal News Arteta U Turn On 76m Striker Eyes 60m Mbappe Style Star

May 28, 2025 -

Nadals Last Roland Garros Sabalenkas Dominant Performance

May 28, 2025

Nadals Last Roland Garros Sabalenkas Dominant Performance

May 28, 2025 -

Prediksi Cuaca Akurat Jawa Timur Hujan Berlanjut 24 Maret

May 28, 2025

Prediksi Cuaca Akurat Jawa Timur Hujan Berlanjut 24 Maret

May 28, 2025 -

Best Direct Lender Payday Loans For Bad Credit Understanding Guaranteed Approval

May 28, 2025

Best Direct Lender Payday Loans For Bad Credit Understanding Guaranteed Approval

May 28, 2025 -

American Music Awards 2025 Jennifer Lopez As Host

May 28, 2025

American Music Awards 2025 Jennifer Lopez As Host

May 28, 2025

Latest Posts

-

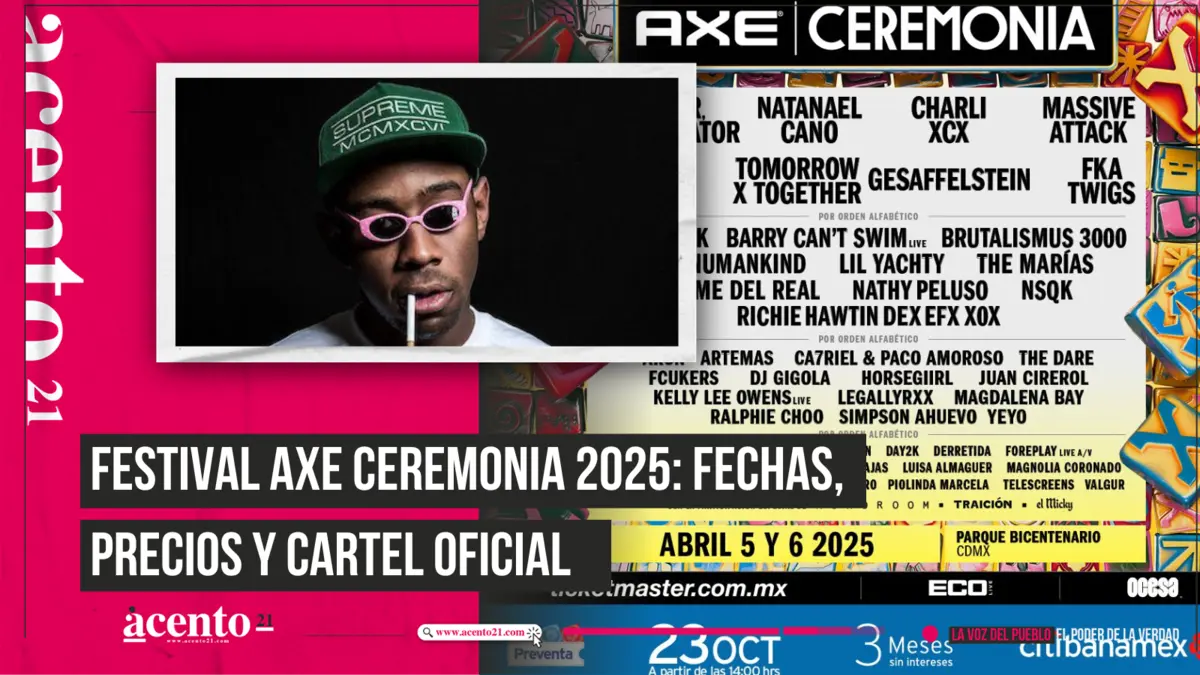

Reembolso Boletos Axe Ceremonia 2025 Ticketmaster Proceso Paso A Paso

May 30, 2025

Reembolso Boletos Axe Ceremonia 2025 Ticketmaster Proceso Paso A Paso

May 30, 2025 -

Festival Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025

Festival Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025 -

Solicitar Reembolso Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025

Solicitar Reembolso Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025 -

Preventa Entradas Bad Bunny Conciertos Madrid Y Barcelona Ticketmaster And Live Nation

May 30, 2025

Preventa Entradas Bad Bunny Conciertos Madrid Y Barcelona Ticketmaster And Live Nation

May 30, 2025 -

Bad Bunny En Madrid Y Barcelona Preventa De Entradas Ticketmaster Y Live Nation

May 30, 2025

Bad Bunny En Madrid Y Barcelona Preventa De Entradas Ticketmaster Y Live Nation

May 30, 2025