Chime IPO: A Deep Dive Into Revenue And Digital Banking Disruption

Table of Contents

Chime's Revenue Streams: A Detailed Look

Chime's success hinges on a diversified revenue model, moving beyond traditional banking fee structures. Let's break down the key components:

Fee-Based Revenue

While Chime is known for its fee-free checking accounts, some revenue is generated from specific services. While a detailed breakdown of all fees is not publicly available prior to the IPO, potential fee sources could include:

- Overdraft fees (if applicable): Though Chime actively promotes its "SpotMe" feature designed to mitigate overdrafts, overdraft fees, if applied in specific circumstances, contribute to revenue. Further information on the application and frequency of such fees will be crucial in assessing this revenue stream.

- International transfer fees: Transactions involving international money transfers may incur fees, contributing to Chime's revenue generation. The exact fee structure for these services needs further clarity.

- Other potential fees: Depending on future product offerings, additional fees may be introduced for specific services.

Subscription Revenue

Chime's premium subscription offerings, like Chime Plus and Chime Premium, are a significant contributor to its revenue growth. These subscriptions offer enhanced features and benefits attracting customers willing to pay for added convenience and financial tools.

- Features and benefits: Premium accounts often include features like higher interest rates on savings accounts, early direct deposit access, and international money transfer options. These added benefits attract customers seeking a more comprehensive financial management experience.

- Subscriber growth: The growth trajectory of premium subscribers directly impacts Chime's revenue. Analyzing the rate of subscription growth is key to understanding the sustainability of this revenue stream.

- Competitive pricing: Chime's pricing needs to be competitive within the marketplace. Understanding their pricing strategy in relation to other digital banks offering similar premium services is essential for predicting future revenue potential.

Interest Income

Chime earns interest income from customer deposits, a traditional banking revenue source. However, Chime's approach to investing these deposits may differ from traditional banks.

- Investment strategy: Chime's investment strategy and risk tolerance will directly impact its interest income. A conservative strategy might yield lower returns but reduce risk.

- Regulatory environment: Regulatory changes impacting interest rates and banking regulations will significantly influence Chime's ability to generate interest income.

- Sustainability: The long-term sustainability of interest income as a major revenue stream will depend on prevailing interest rates and competition within the digital banking space.

Chime's Disruptive Impact on Traditional Banking

Chime's success stems from its innovative approach to financial services, challenging established banking norms.

Technology and Innovation

Chime leverages technology to create a seamless and user-friendly experience. Its mobile-first approach is a key differentiator:

- Mobile-first strategy: Chime's mobile-first approach simplifies user interaction, fosters engagement, and reduces reliance on physical branches, a significant cost advantage over traditional banks.

- AI and Machine Learning: The incorporation of AI and machine learning allows for personalized financial management tools, enhancing customer experience and operational efficiency.

- Financial inclusion: Chime actively works towards promoting financial inclusion by providing banking services to underserved communities.

Challenging Traditional Banking Models

Chime's operational model directly challenges traditional banking's high overhead costs.

- Reduced overhead: The absence of extensive branch networks significantly reduces overhead costs compared to brick-and-mortar banks.

- Competitive pricing: Chime offers competitive pricing strategies, attracting customers seeking value for their money.

- Customer acquisition costs: Chime's approach to customer acquisition through digital marketing and a seamless mobile experience potentially leads to lower costs compared to traditional banks' branch-based acquisition strategies.

Future Growth Potential

Chime's future growth hinges on its ability to expand its product offerings and maintain its competitive edge.

- New financial services: Expansion into areas like lending, investment products, and other financial services will broaden Chime's revenue streams and market reach.

- Competitive landscape: Analyzing the competitive landscape, including existing digital banks and the potential entry of new players, is crucial to understanding Chime's future opportunities and threats.

- Market share projections: Predicting Chime's future market share involves analyzing its growth strategy, competitive advantages, and the overall growth of the digital banking sector.

The Chime IPO: Investor Considerations

Potential investors must carefully weigh the potential rewards against the inherent risks associated with the Chime IPO.

Valuation and Investment Risks

The valuation of Chime at the time of its IPO is a crucial factor for investors. Several risks need to be considered:

- Economic downturns: Economic downturns can significantly impact Chime's performance, affecting customer spending, loan defaults, and overall revenue.

- Key metrics: Investors need to monitor key metrics like customer acquisition cost, customer churn rate, net promoter score (NPS), and revenue diversification to assess the health of the company.

- Competitive threats: The competitive landscape in digital banking is dynamic. The emergence of new competitors or innovative technologies could threaten Chime's market share.

Market Outlook and Potential Returns

The future of digital banking is promising, indicating potential for significant returns. However, this requires a balanced perspective:

- Digital banking growth: The projected growth of the digital banking sector suggests a positive outlook for Chime's long-term prospects.

- Long-term sustainability: Chime's long-term sustainability depends on its ability to adapt to evolving customer needs, maintain its competitive advantage, and navigate regulatory changes.

- Risk and reward: Investing in the Chime IPO presents a balance of risks and potential rewards. Careful research and due diligence are crucial before any investment decisions.

Conclusion

The Chime IPO represents a pivotal moment in the digital banking revolution. By analyzing Chime's revenue streams, its disruptive business model, and the inherent investment risks, we’ve developed a clearer understanding of this influential fintech company. While the Chime IPO holds exciting potential, thorough due diligence and a comprehensive understanding of the market are vital before investing. Stay informed about the latest Chime IPO developments and the evolving landscape of digital banking to make informed decisions.

Featured Posts

-

Stream Captain America Brave New World A Guide To Online Viewing Options

May 14, 2025

Stream Captain America Brave New World A Guide To Online Viewing Options

May 14, 2025 -

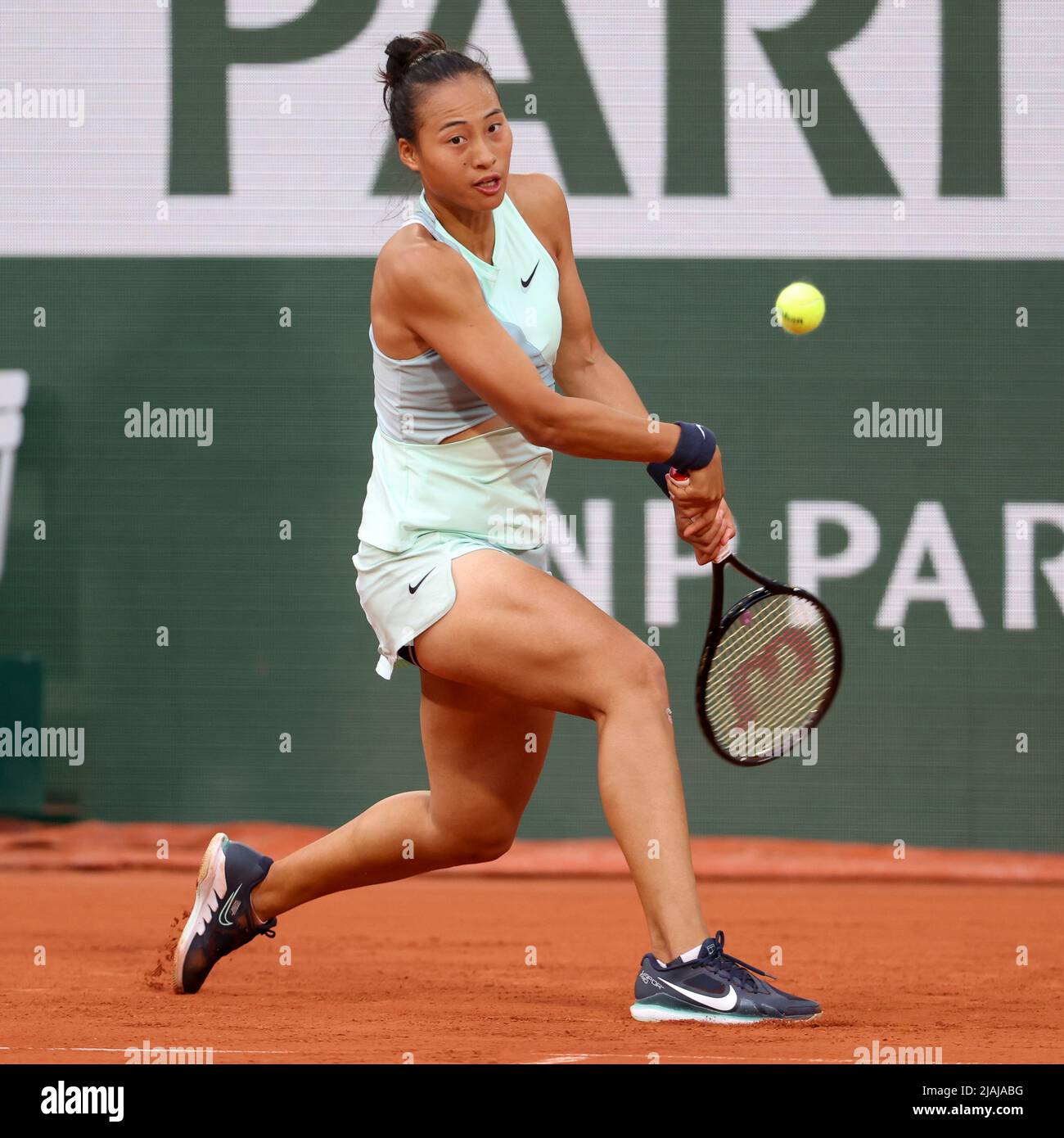

Zheng Qinwen Out Of Madrid Open After Potapova Upset

May 14, 2025

Zheng Qinwen Out Of Madrid Open After Potapova Upset

May 14, 2025 -

Paolinis Dubai Run Ends In Loss To Sabalenka

May 14, 2025

Paolinis Dubai Run Ends In Loss To Sabalenka

May 14, 2025 -

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025 -

Sunderlands Bellingham Chelseas Top Target Ahead Of Man Utd

May 14, 2025

Sunderlands Bellingham Chelseas Top Target Ahead Of Man Utd

May 14, 2025

Latest Posts

-

Gde Kupiti Novakove Patike Od 1 500 Evra

May 14, 2025

Gde Kupiti Novakove Patike Od 1 500 Evra

May 14, 2025 -

Luksuzne Patike Novaka Okovi A Da Li Vrede 1 500 Evra

May 14, 2025

Luksuzne Patike Novaka Okovi A Da Li Vrede 1 500 Evra

May 14, 2025 -

Patike Novaka Okovi A 1 500 Evra Tsena Diza N I Karakteristike

May 14, 2025

Patike Novaka Okovi A 1 500 Evra Tsena Diza N I Karakteristike

May 14, 2025 -

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025 -

Novakove Patike Od 1 500 Evra Luksuzni Modeli I Gde Ikh Kupiti

May 14, 2025

Novakove Patike Od 1 500 Evra Luksuzni Modeli I Gde Ikh Kupiti

May 14, 2025