Chime's Upcoming IPO: Examining The Financial Performance Of A Digital Banking Leader

Table of Contents

Revenue Growth and Key Revenue Streams of Chime

Chime's primary revenue sources are crucial to understanding its financial health. The company generates income primarily through interchange fees, overdraft fees (though this is a smaller component), and increasingly, subscription services. Analyzing the growth trajectory of these streams reveals much about Chime's overall financial strength.

-

Interchange fee revenue analysis: Interchange fees, earned when Chime customers use their debit cards for purchases, form a significant portion of Chime's revenue. The growth of this revenue stream is directly tied to the increase in Chime's customer base and transaction volume. A detailed analysis of this growth, comparing it to previous years and to industry benchmarks, would be essential for any investor. (Illustrative chart/graph would go here showing year-over-year growth of interchange fees.)

-

Growth of subscription services: Chime's push into subscription services, like premium features and credit-building products, represents a strategic move to diversify revenue streams and increase average revenue per user (ARPU). The success of this strategy is a key indicator of future profitability. (Illustrative chart/graph would go here showing growth of subscription revenue over time.)

-

Impact of regulatory changes on revenue: The financial services industry is heavily regulated. Changes in regulations, particularly those impacting interchange fees or overdraft practices, can significantly affect Chime's revenue. It is critical to assess the potential impact of future regulatory changes.

-

Comparison to competitors' revenue models: Comparing Chime's revenue model to its competitors, such as other neobanks like Robinhood or Current, provides valuable context. Analyzing differences in revenue streams and their relative contributions offers insights into Chime's competitive positioning. Keywords: Chime revenue, Chime revenue model, neobank revenue, digital banking revenue, interchange fees, subscription revenue.

Customer Acquisition and Retention Strategies of Chime

Chime's success is also driven by its ability to attract and retain customers. Its customer acquisition tactics employ a multi-pronged approach, focusing on:

-

Marketing spend and ROI: Chime utilizes targeted digital marketing campaigns, focusing on social media and online advertising, to reach its target demographic. Understanding the return on investment (ROI) of these marketing efforts is vital to assess the efficiency of customer acquisition.

-

Customer demographics and segmentation: Chime’s target demographic is primarily younger, tech-savvy individuals often underserved by traditional banks. Understanding the specific needs and preferences of this segment allows Chime to tailor its products and marketing.

-

Strategies for reducing customer churn: Customer retention is paramount. Analyzing Chime's churn rate and strategies to improve it, such as enhanced customer service and loyalty programs, are critical for long-term success.

-

Customer satisfaction metrics: Measuring customer satisfaction (CSAT) scores and Net Promoter Scores (NPS) provides crucial insights into customer loyalty and overall brand perception. Keywords: Chime customer acquisition, Chime customer retention, neobank customer growth, digital banking customer base, customer loyalty, churn rate.

Profitability and Financial Health of Chime

Profitability is a critical aspect of Chime's financial health. While Chime has demonstrated substantial growth, its path to profitability needs careful examination.

-

Net income and profit margin trends: Analyzing Chime's net income and profit margins over time reveals whether the company is moving towards profitability or not. Trends in these metrics are crucial for evaluating the investment opportunity. (Illustrative chart/graph would go here displaying net income and profit margins over time.)

-

Operating expenses and cost structure: A detailed examination of Chime's operating expenses, including technology costs, marketing expenses, and salaries, provides insights into its cost efficiency.

-

Debt levels and financial leverage: Assessing Chime's debt levels and financial leverage indicates its financial risk profile. High debt levels can be a cause for concern.

-

Analysis of cash flow: Analyzing Chime's cash flow statement is essential to understand its ability to generate cash and meet its financial obligations. Keywords: Chime profitability, Chime financial health, neobank profitability, digital banking profitability, financial ratios, financial risk.

Competitive Landscape and Chime's Position

Chime operates in a competitive landscape. Understanding its competitive advantages and disadvantages within the neobanking sector is key.

-

Market share analysis: Assessing Chime's market share relative to its competitors helps determine its market position and growth potential.

-

Competitive differentiation: Identifying Chime's unique selling propositions (USPs), such as its fee-free model or its focus on financial inclusion, is crucial for understanding its competitive edge.

-

Growth opportunities and challenges: Analyzing the opportunities for future growth, such as expansion into new markets or the introduction of new financial products, while also assessing potential challenges like increased competition or regulatory hurdles, provides a holistic perspective.

-

Impact of technological advancements: The neobanking sector is rapidly evolving. The impact of technological advancements, such as AI and blockchain, on Chime's competitive positioning needs careful consideration. Keywords: Chime competitors, neobank competition, digital banking competition, competitive advantage, market share, market outlook.

Conclusion:

Chime's upcoming IPO presents a compelling opportunity within the dynamic digital banking sector. While the company exhibits robust customer growth and innovative offerings, a comprehensive analysis of its revenue streams, profitability, and competitive positioning is vital for evaluating its long-term potential. Investors should undertake thorough due diligence, considering the information presented here and conducting further research before making any investment decisions regarding the Chime IPO. Understanding the financial performance of Chime is key to making an informed decision about investing in this exciting digital banking leader. Therefore, further research into Chime's financial performance is highly recommended before any investment.

Featured Posts

-

Nonna A Charming Old Fashioned Comedy

May 14, 2025

Nonna A Charming Old Fashioned Comedy

May 14, 2025 -

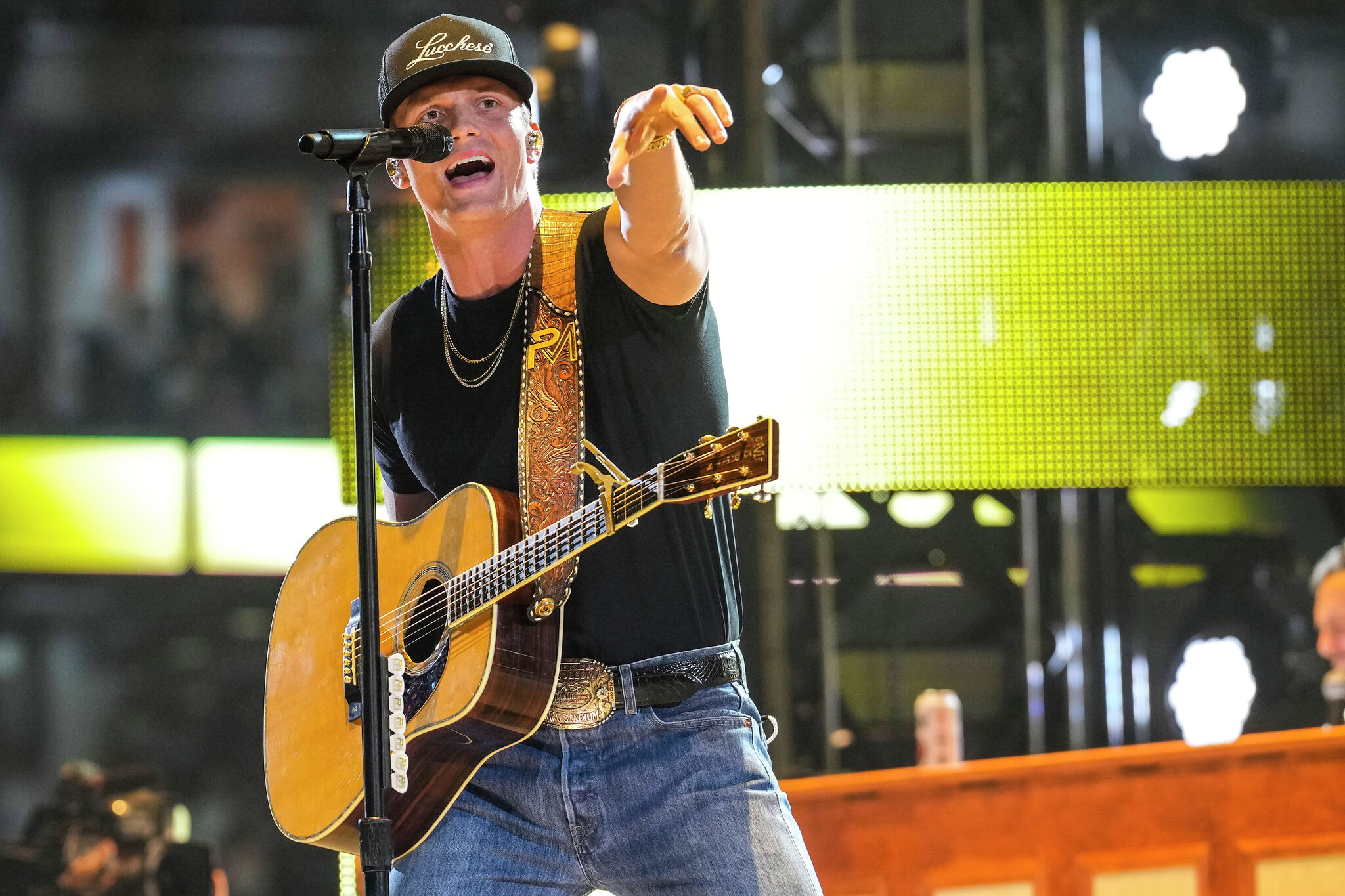

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025 -

Khto Predstavit Ukrayinu Na Yevrobachenni 2024 Data Mistse Provedennya Ta Uchasniki

May 14, 2025

Khto Predstavit Ukrayinu Na Yevrobachenni 2024 Data Mistse Provedennya Ta Uchasniki

May 14, 2025 -

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025 -

Gk Barrys Honest Account Navigating Loose Women And Finding Unexpected Help

May 14, 2025

Gk Barrys Honest Account Navigating Loose Women And Finding Unexpected Help

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025 -

Wynonna And Ashley Judd Open Up About Family Life In Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family Life In Docuseries

May 14, 2025 -

The Judd Family A Docuseries Exploring Their Complex Legacy

May 14, 2025

The Judd Family A Docuseries Exploring Their Complex Legacy

May 14, 2025 -

Untold Stories Wynonna And Ashley Judd Open Up About Their Family

May 14, 2025

Untold Stories Wynonna And Ashley Judd Open Up About Their Family

May 14, 2025 -

Judd Sisters Docuseries Uncovering Family History And Heartache

May 14, 2025

Judd Sisters Docuseries Uncovering Family History And Heartache

May 14, 2025