China Tariffs: Trump's Policy To Remain Until 2025, Analysts Predict

Table of Contents

The Political Landscape: Why Removal is Unlikely Before 2025

Removing the China tariffs is far from a simple task, entangled in a complex web of political realities and strategic considerations. The Biden administration, despite its stated preference for a more collaborative approach with China, faces significant hurdles in fully reversing Trump's protectionist policies. The political complexities are multifaceted:

- Domestic political pressure from protectionist groups: Powerful lobbying groups representing specific industries that benefited from the tariffs exert considerable pressure on the administration to maintain them. These groups often frame the tariffs as crucial for protecting American jobs and industries.

- Concerns over national security and intellectual property theft: The tariffs serve as a tool to address concerns about China's unfair trade practices, including intellectual property theft and the potential for reliance on China for critical goods to compromise national security. This resonates strongly with a significant segment of the US population and lawmakers.

- Use of tariffs as a bargaining chip in ongoing trade negotiations: The administration may strategically retain the threat of tariffs or their imposition as leverage in future negotiations with China on issues like market access and technology transfer.

- Specific industries benefiting from tariffs: Sectors like agriculture and steel have experienced positive impacts from the tariffs, making their removal politically contentious. These industries wield considerable influence and lobby fiercely against any policy changes that could negatively impact their bottom line. The resulting political pressure makes complete tariff removal a highly challenging proposition. This complex interplay of US-China relations, protectionism, and the Biden administration's strategic considerations strongly suggests the tariffs will remain in place for the foreseeable future.

Economic Implications of Continued China Tariffs

The continued presence of China tariffs carries significant economic implications, potentially impacting inflation, consumer prices, and specific economic sectors in profound ways. The economic consequences could include:

- Increased costs for businesses importing goods from China: Businesses face higher import costs, leading to reduced profit margins or the need to increase prices for consumers. This impacts the competitiveness of US businesses both domestically and internationally.

- Potential for retaliatory tariffs from China: China has historically responded to US tariffs with its own retaliatory measures, creating a cycle of escalating trade tensions that further disrupt global trade and negatively impact US exporters.

- Impact on supply chains and global trade: The tariffs disrupt global supply chains, causing delays, increased costs, and uncertainty for businesses worldwide. This instability makes long-term economic planning and investment more challenging.

- Effects on consumer spending and economic growth: Higher prices for imported goods, due to tariffs, can lead to decreased consumer spending and potentially slower economic growth. This creates a ripple effect throughout the economy. The overall economic impact of continued China tariffs remains a significant concern, especially regarding inflation and supply chain disruptions.

The Impact on Specific Industries: Winners and Losers

The impact of China tariffs is not uniform across all industries. Some sectors have benefited, while others have faced significant hardship. Analyzing the winners and losers is crucial for understanding the overall economic impact:

- Specific examples of industries negatively impacted: Manufacturing, particularly industries reliant on Chinese components or supply chains, has experienced significant challenges. Retail sectors, also heavily reliant on imports, have faced increased costs, forcing some to adjust prices or reduce profit margins.

- Specific examples of industries benefiting: Certain agricultural sectors, for instance, have seen increased domestic demand due to the tariffs, leading to higher prices and increased profitability.

- Discussion on job creation and losses in relation to tariffs: While some sectors have seen job creation due to increased domestic production, many jobs have been lost in industries struggling to compete with higher import costs. The net effect on job creation and job losses varies significantly across different sectors, highlighting the complexity of the issue. The effect on manufacturing, agriculture, and retail showcases how unevenly the impact of China tariffs is distributed.

Alternative Trade Policies and Future Prospects: Beyond China Tariffs

While the persistence of China tariffs until 2025 appears likely, exploring alternative trade policies and strategies is crucial for navigating the complexities of the US-China trade relationship. Alternatives could include:

- Discussion of potential trade agreements or negotiations: Refocusing efforts on negotiating new trade agreements that address concerns about unfair trade practices while promoting greater collaboration could offer a more sustainable long-term solution.

- Focus on diversification of supply chains and reducing reliance on China: Shifting sourcing to other countries, while challenging, can mitigate the risks associated with over-reliance on any single nation for crucial goods and components. This supply chain diversification is a key aspect of reducing future vulnerability.

- Mention strategies to address concerns regarding intellectual property: Implementing stronger intellectual property rights protection mechanisms, both domestically and through international collaborations, is vital for fostering a fairer and more balanced trade environment. This directly addresses a major driver behind the imposition of China tariffs.

Conclusion: The Long Shadow of China Tariffs and What Lies Ahead

The prediction of China tariffs remaining in place until 2025 is not merely an economic forecast; it’s a reflection of the deeply intertwined political and economic complexities of the US-China relationship. The implications are far-reaching, impacting industries, consumers, and the global economy. The political landscape makes complete removal unlikely in the short term, while the economic consequences necessitate a deeper examination of alternative trade policies. The lack of a simple solution underscores the intricate nature of this challenge.

To navigate this complex situation, staying informed about developments in US-China trade relations and the ongoing impact of China tariffs is essential. We encourage readers to seek further information from reputable sources, such as the US Trade Representative's office and economic research institutions, for in-depth analysis and up-to-date information on the evolving impact of China tariffs and related trade policies.

Featured Posts

-

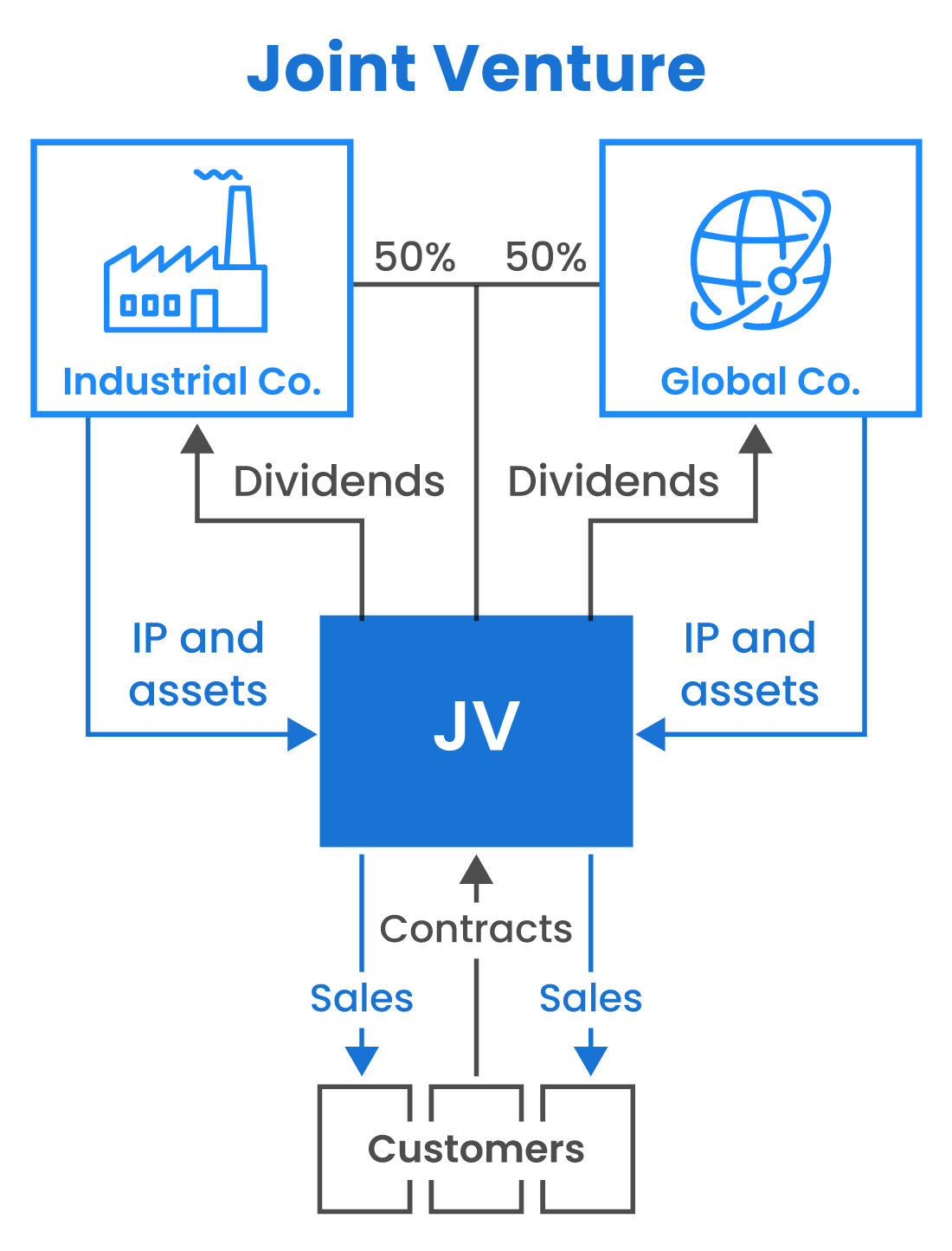

Destino Ranchs Next Gen Omnichannel Media Infrastructure A Joint Venture By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025

Destino Ranchs Next Gen Omnichannel Media Infrastructure A Joint Venture By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025 -

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025 -

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025 -

Best Bitcoin Casinos 2025 Your Guide To High Roller Crypto Gambling

May 18, 2025

Best Bitcoin Casinos 2025 Your Guide To High Roller Crypto Gambling

May 18, 2025 -

Booing Bears Claim Victory This Weeks You Toon Caption Contest Winner

May 18, 2025

Booing Bears Claim Victory This Weeks You Toon Caption Contest Winner

May 18, 2025