China's CMOC's $581 Million Lumina Gold Acquisition: Details And Implications

Table of Contents

Deal Details and Financial Aspects of the CMOC Lumina Gold Acquisition

The acquisition of Lumina Gold by CMOC represents a substantial investment in the gold mining sector. The deal, finalized in [Insert Date of Finalization, if available], saw CMOC acquire all outstanding shares of Lumina Gold. While the exact price per share fluctuated slightly during the acquisition period, the total deal value settled at approximately $581 million USD. This significant financial commitment underscores CMOC's serious intent to expand its footprint in the gold mining industry.

The transaction involved a complex structure, likely using a combination of cash and potentially stock options, although the exact payment structure remains subject to official filings and announcements. Securing financing for such a large acquisition required significant financial planning and likely involved several key players. [Insert names of key financial advisors and legal counsel involved, if available]. Regulatory approvals from relevant Canadian and potentially Chinese authorities were necessary to complete the transaction.

- Acquisition price per share: [Insert Price per Share, if available]

- Total deal value in USD: Approximately $581 million

- Payment structure: [Insert Payment Structure Details, if available. E.g., Primarily cash, with a small percentage in CMOC stock]

- Financing sources: [Insert Financing Source Details, if available. E.g., A combination of internal reserves and external debt financing]

- Key regulatory approvals required: Canadian regulatory bodies (e.g., TSX Venture Exchange), and possibly Chinese regulatory bodies.

Strategic Rationale Behind CMOC's Lumina Gold Purchase

CMOC's acquisition of Lumina Gold serves multiple strategic objectives. Firstly, it grants CMOC access to Lumina Gold's high-quality gold assets, which are strategically located and possess significant exploration potential. This acquisition represents a significant diversification strategy for CMOC, moving beyond its existing portfolio of molybdenum and other base metal mining interests. The move positions CMOC as a more significant player in the global gold market.

The acquisition also provides potential synergies. CMOC's established operational expertise and global network can be leveraged to enhance Lumina Gold's operational efficiency and potentially reduce production costs. This integration promises improved resource extraction and better profitability for the combined entity.

- Access to Lumina Gold's high-quality gold assets: This includes [Mention specific mines and their characteristics. E.g., the advanced-stage projects with significant gold reserves].

- Diversification of CMOC's portfolio: Reducing reliance on molybdenum and other base metals, thus mitigating market risk.

- Strengthening CMOC's global presence: Expanding into a new geographic region and gaining access to new markets.

- Potential cost savings and operational efficiencies: Leveraging CMOC’s expertise to optimize Lumina Gold's operations.

Lumina Gold's Assets and Production Potential

Lumina Gold's portfolio includes several key gold projects, primarily located in [Mention the geographical location of mines]. These projects boast significant estimated gold reserves and resources, with considerable potential for future production growth. [Insert specific details about Lumina Gold's key gold projects including their estimated reserves, resources, and production potential]. The proximity of these mines to existing infrastructure minimizes logistical challenges and contributes to the overall cost-effectiveness of the operation.

- Specific gold projects owned by Lumina Gold: [List key projects with brief descriptions]

- Estimated gold reserves and resources: [Provide estimates from Lumina Gold’s reports, if available]

- Production forecasts for the acquired assets: [Provide production estimates, sourced from credible financial reports]

- Location of mines and access to infrastructure: [Describe geographic location and proximity to key infrastructure]

Impact on the Global Gold Market and Industry

The CMOC-Lumina Gold acquisition will undoubtedly have several ramifications for the global gold market and the mining industry as a whole. While the immediate impact on gold prices might be relatively minor, the long-term implications are worth considering. Increased competition, especially from a large state-backed player like CMOC, might stimulate further consolidation in the gold mining sector. Other mining companies may be compelled to pursue similar acquisition strategies to remain competitive.

The acquisition's impact on the Canadian mining industry is multifaceted. While the loss of an independent Canadian gold producer is noteworthy, the injection of significant capital from CMOC may also stimulate further investment and exploration activities in Canada. However, regulatory scrutiny and potential adjustments to foreign investment policies in Canada should be considered.

- Potential impact on gold prices: [Analyze potential short-term and long-term effects on prices]

- Increased competition in the gold mining sector: [Discuss the potential for a more competitive gold market]

- Potential for further mergers and acquisitions: [Analyze the likely increase in M&A activity in the industry]

- Influence on Canadian mining investment and regulations: [Assess the implications for Canadian mining policies]

Risks and Challenges for CMOC Post-Acquisition

Despite the significant opportunities, CMOC faces several challenges following the Lumina Gold acquisition. Integrating two companies with different operational cultures and management styles is a complex undertaking and requires careful planning and execution. Furthermore, geopolitical risks in the regions where Lumina Gold operates should be carefully considered and proactively addressed. Unexpected operational challenges, cost overruns, and project delays remain potential risks. Fluctuations in gold prices also pose a significant financial risk.

- Integration challenges: [Discuss potential cultural and operational integration challenges]

- Geopolitical risks: [Analyze potential political and social instability in operating regions]

- Potential for cost overruns and project delays: [Address the risks associated with large-scale mining projects]

- Fluctuations in gold prices: [Explain the impact of price volatility on profitability]

Conclusion

CMOC's $581 million acquisition of Lumina Gold represents a significant strategic move, reshaping the global mining landscape. This CMOC Lumina Gold acquisition provides CMOC with access to valuable gold assets, strengthens its international presence, and diversifies its portfolio. However, successful integration of Lumina Gold's operations and effective mitigation of potential risks will be crucial to the long-term success of this ambitious undertaking. Careful analysis of this China Molybdenum strategic move, alongside monitoring future developments, is crucial for anyone invested in or interested in the global gold market and the mining industry. Stay updated on this gold acquisition and its far-reaching consequences.

Featured Posts

-

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025 -

Live Stock Market Updates Dow Futures Gold Prices And Fed Rate Hikes

Apr 23, 2025

Live Stock Market Updates Dow Futures Gold Prices And Fed Rate Hikes

Apr 23, 2025 -

Dodgers Roberts Admits Crucial Hit Altered World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits Crucial Hit Altered World Series Outcome

Apr 23, 2025 -

Thdyth Asear Alktakyt Msr Alathnyn 14 Abryl 2025

Apr 23, 2025

Thdyth Asear Alktakyt Msr Alathnyn 14 Abryl 2025

Apr 23, 2025 -

Thlyl Ser Aldhhb Alywm Balsaght Bed Alankhfad

Apr 23, 2025

Thlyl Ser Aldhhb Alywm Balsaght Bed Alankhfad

Apr 23, 2025

Latest Posts

-

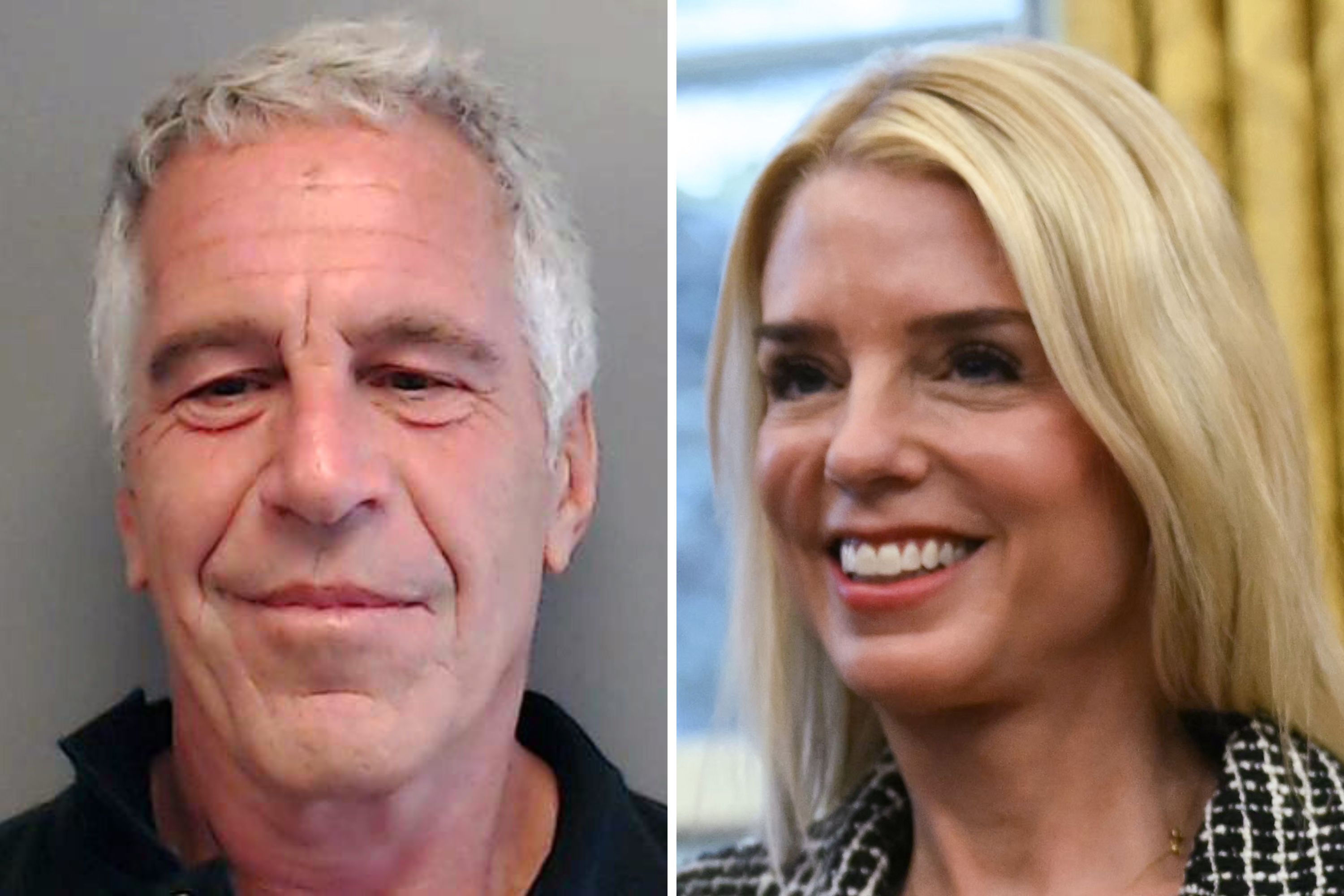

Analysis Of Ag Pam Bondis Decision A Public Vote On Epstein Files

May 10, 2025

Analysis Of Ag Pam Bondis Decision A Public Vote On Epstein Files

May 10, 2025 -

Attorney Generals Prop Understanding The Fentanyl Demonstration

May 10, 2025

Attorney Generals Prop Understanding The Fentanyl Demonstration

May 10, 2025 -

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025 -

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

High Potential The Finale That Impressed Abc

May 10, 2025

High Potential The Finale That Impressed Abc

May 10, 2025