China's Steel Sector Contraction: Implications For Iron Ore Demand

Table of Contents

Declining Steel Production in China: A Deep Dive

The decline in China's steel production is a multifaceted issue with several contributing factors. Year-on-year comparisons reveal a significant drop in steel output, signaling a substantial shift in the industry.

- Government Regulations: Stringent environmental regulations aimed at curbing pollution and reducing overcapacity have significantly impacted steel production. The Chinese government's commitment to a greener economy has led to stricter emission standards and limitations on steel production capacity.

- Real Estate Market Slowdown: The cooling real estate market, a major consumer of steel, has further dampened demand. The decreased construction activity directly translates to lower steel consumption.

- Reduced Infrastructure Spending: While infrastructure projects remain a significant driver of steel demand, recent cuts in government spending on large-scale infrastructure projects have also contributed to the decline in steel production.

The consequences are stark. Data shows a consistent monthly trend of declining steel output. This contrasts sharply with the previous years of robust growth and highlights the gravity of the situation for the Chinese steel industry and global iron ore markets. The focus on capacity reduction is likely to continue impacting China steel production for the foreseeable future.

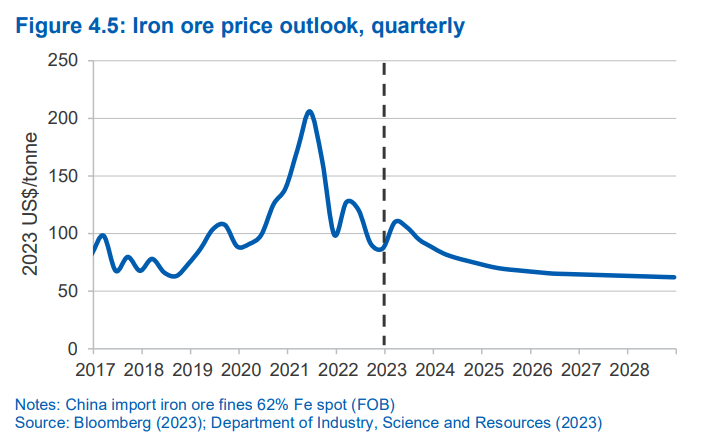

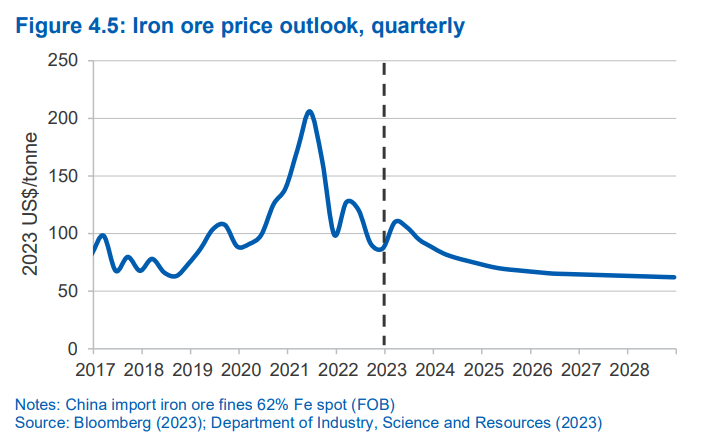

Impact on Iron Ore Imports and Prices

China's steel production and iron ore imports are intrinsically linked. The contraction in steel production directly translates to reduced demand for iron ore. This decreased demand has, unsurprisingly, impacted iron ore prices globally.

- Price Volatility: The iron ore market has experienced significant price volatility as major producers in Australia and Brazil grapple with reduced demand from China. Price fluctuations reflect the uncertainty surrounding future Chinese steel production.

- Supply Chain Adjustments: Australian and Brazilian iron ore producers are responding to the decreased demand by adjusting their production levels and exploring new markets. However, the overreliance on the Chinese market presents a significant challenge.

The resulting situation is a complex interplay of supply and demand, creating a dynamic and uncertain environment for businesses involved in the iron ore trade. The iron ore price remains highly sensitive to changes in China's steel output.

Shifting Dynamics in the Global Iron Ore Market

The implications of China's steel sector contraction extend beyond its borders, significantly influencing the global iron ore market.

- Increased Competition: The reduced demand from China increases competition among iron ore suppliers globally, putting pressure on prices and profit margins.

- Impact on Other Steel-Producing Nations: Steel-producing nations globally are feeling the effects of decreased demand and price competition. This necessitates adaptation and diversification of markets and products.

- Rise of Electric Arc Furnaces: The growing adoption of electric arc furnaces (EAFs) in steel production, which use scrap metal instead of iron ore, presents both a challenge and an opportunity for the iron ore market. This shift in steelmaking technology could further reduce demand for iron ore in the long term.

These shifts highlight the need for both iron ore producers and steelmakers to adapt to a changing global landscape and reassess their strategies for long-term sustainability.

Future Outlook and Potential for Recovery

Predicting the future of China's steel sector and its impact on iron ore demand requires careful consideration. While a complete recovery is anticipated eventually, the timeline remains uncertain.

- Government Stimulus: Government stimulus packages aimed at boosting infrastructure projects could potentially revive steel demand. However, the scale and timing of any such initiatives remain unclear.

- Long-Term Implications: The long-term implications for the iron ore market are complex. Factors such as global economic growth, technological advancements in steelmaking, and environmental regulations will all play a crucial role.

The China steel industry forecast is crucial for understanding the future of iron ore demand forecast. While opportunities exist for businesses that can adapt and innovate, careful planning and risk management are essential for navigating the uncertainties ahead.

Conclusion: Navigating the Uncertainties of China's Steel Sector Contraction and Iron Ore Demand

China's steel sector contraction presents a significant challenge for the global iron ore market. The decline in steel production directly impacts iron ore demand, leading to price volatility and increased competition among suppliers. While a full recovery is anticipated, navigating the uncertainties requires close monitoring of the situation, proactive adaptation, and diversification strategies. Understanding the intricacies of China's steel sector outlook and its effect on iron ore market analysis is crucial for businesses involved in the steel and iron ore industries. For further insights, we recommend exploring recent reports from industry analysts and government publications on China steel sector contraction and its broader economic impact. Continuously researching the implications for your business is key to navigating this evolving landscape.

Featured Posts

-

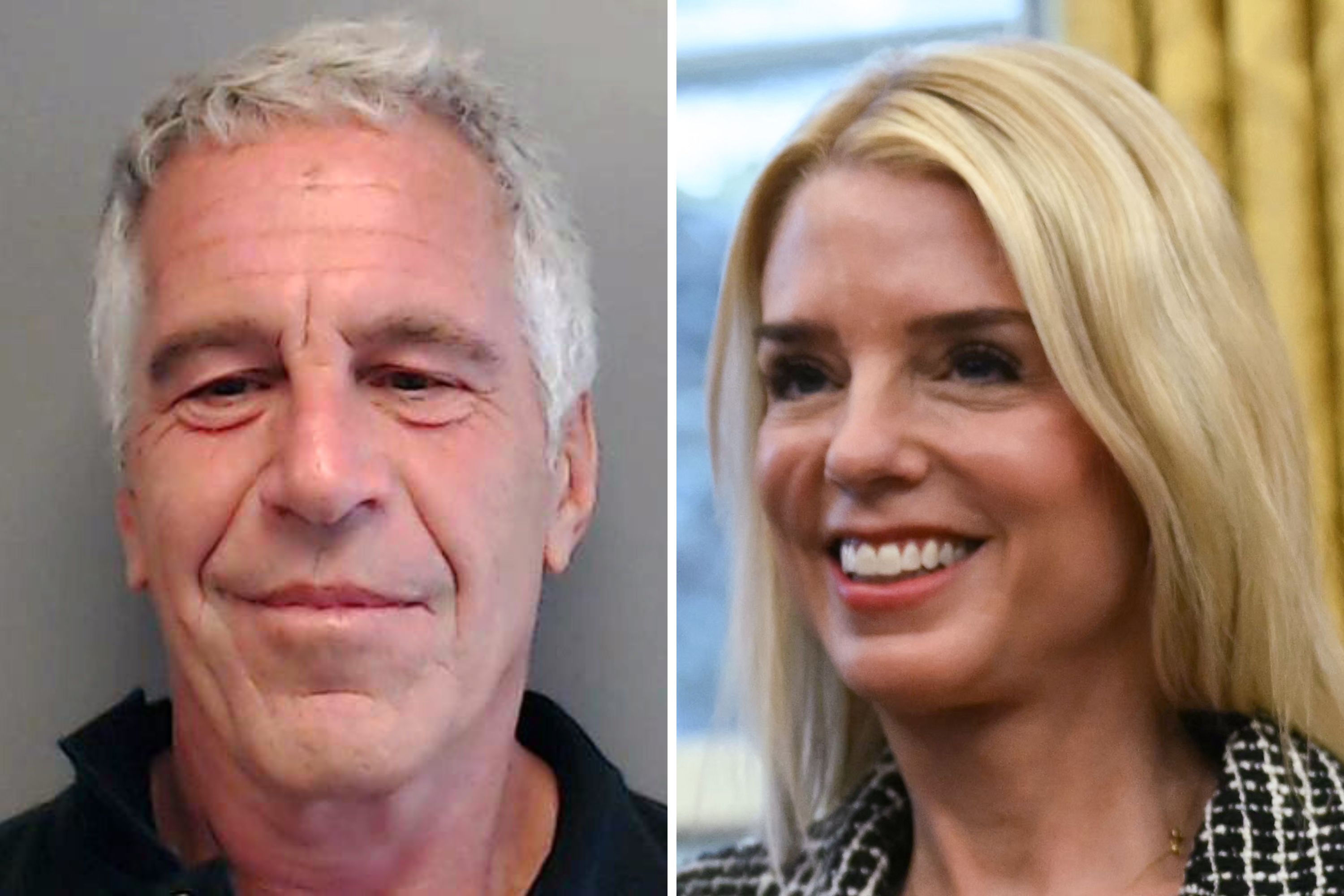

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025 -

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025 -

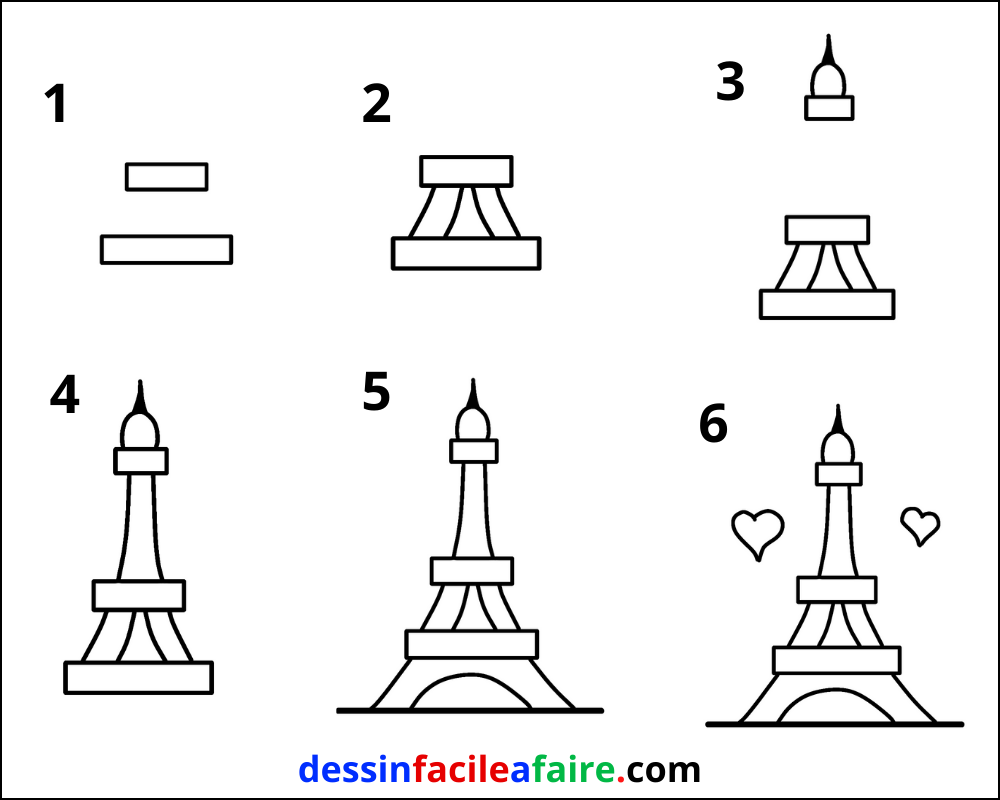

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 10, 2025

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 10, 2025 -

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025 -

Nigeria Fuel Market A Deep Dive Into The Roles Of Dangote And Nnpc

May 10, 2025

Nigeria Fuel Market A Deep Dive Into The Roles Of Dangote And Nnpc

May 10, 2025