Choosing Your Place In The Sun: Factors To Consider When Buying Overseas Property

Table of Contents

Budget and Financing Your Overseas Property Purchase

Before you start browsing idyllic villas and beachfront condos, you need a solid financial plan. Purchasing overseas property involves more than just the purchase price. Understanding your budget and securing financing are crucial first steps.

Determine Your Budget

Clearly defining your financial limits is paramount. This includes not only the purchase price of the overseas property but also:

- Legal Fees: Expect to pay for legal representation, especially when dealing with international property transactions.

- Taxes: Research property taxes, stamp duty, and any other applicable taxes in your chosen location. These can vary significantly between countries.

- Ongoing Maintenance Costs: Factor in regular maintenance, repairs, and potential unforeseen expenses. This includes everything from landscaping to plumbing repairs.

- Exchange Rates: Fluctuations in currency exchange rates can significantly impact your overall costs. Factor in potential losses or gains depending on your home currency and the currency of your chosen property location.

- Insurance: Obtain quotes for property insurance to protect your investment against damage or loss.

Explore various financing options:

- Cash Purchase: If you have the funds, a cash purchase can often simplify the process and potentially secure a better price.

- Mortgages: Research international mortgage options and compare interest rates and terms offered by different lenders. Be aware that securing a mortgage for overseas property can be more complex than domestic mortgages.

- Combination: A combination of cash and a mortgage might be a suitable option for many buyers.

Securing Financing for Overseas Property

Securing financing for overseas property often requires more extensive documentation and a stronger credit history.

- Mortgage Options: Research lenders specializing in international mortgages. They will be familiar with the intricacies of financing overseas property.

- Interest Rates: Compare interest rates and loan terms carefully. Rates for foreign buyers might be higher than for domestic buyers.

- Documentation: Prepare for a thorough application process, including providing extensive financial documentation and proof of income.

- Restrictions: Be aware of any restrictions or limitations placed on foreign buyers in your chosen location. Some countries might have stricter regulations than others.

Location, Location, Location: Researching Your Ideal Overseas Property Destination

The location of your overseas property is a crucial decision influencing your lifestyle, investment potential, and future enjoyment.

Lifestyle Considerations

Consider your desired lifestyle:

- Beachfront Living: Enjoy the sun, sand, and sea, but expect higher property prices and potential susceptibility to weather damage.

- Mountain Retreat: Embrace tranquility and stunning scenery, but be mindful of accessibility and potential harsh weather conditions.

- Bustling City Center: Enjoy vibrant city life, easy access to amenities, but expect higher property prices and potentially less tranquility.

Also consider:

- Proximity to Amenities: How close are you to shops, restaurants, hospitals, and transportation links?

- Healthcare Facilities: Ensure access to quality healthcare services, especially important if you plan to live there for extended periods.

- Local Culture and Community: Research the local culture and community to ensure it aligns with your preferences.

Legal and Regulatory Framework

Navigating the legal aspects of buying overseas property is critical:

- Property Laws and Regulations: Familiarize yourself with the specific property laws and regulations of your target country.

- Real Estate Lawyer: Seek advice from a reputable local real estate lawyer specializing in international property transactions. They can navigate the legal complexities and protect your interests.

- Tax Implications: Understand potential tax implications, including property taxes, capital gains tax, and inheritance tax.

- Residency Requirements: Research any residency requirements associated with owning property in that country.

Due Diligence: Protecting Your Investment in Overseas Property

Thorough due diligence is vital to protect your investment.

Thorough Property Inspection

Never skip this essential step:

- Qualified Surveyor: Hire a qualified and independent surveyor to conduct a comprehensive inspection of the property. They will identify any structural issues or potential problems.

- Permits and Licenses: Verify that all necessary permits and licenses are in order.

- Property Title and Ownership History: Ensure a clear and verifiable title, free from any encumbrances or disputes.

Working with Reputable Professionals

Working with experienced and trusted professionals is paramount:

- Real Estate Agents: Choose agents with a proven track record and extensive knowledge of the local market.

- Lawyers and Surveyors: Obtain references and check their credentials carefully before engaging their services.

- Avoid Rushing: Don't rush the process. Take your time to conduct thorough research and due diligence.

Ongoing Costs and Responsibilities of Overseas Property Ownership

Owning overseas property comes with ongoing costs and responsibilities:

Maintenance and Repairs

Budget for ongoing expenses:

- Regular Maintenance: Plan for regular maintenance tasks like landscaping, pool cleaning, and appliance servicing.

- Repairs: Budget for unexpected repairs and potential major maintenance issues.

- Property Manager: Consider hiring a local property manager to oversee maintenance and handle tenant issues (if renting out).

Understanding Local Taxes and Regulations

Stay informed about local regulations:

- Property Taxes: Understand the specific property tax rates and payment schedules.

- Capital Gains Tax: Research the capital gains tax implications if you decide to sell your property.

- Other Regulations: Familiarize yourself with any other relevant regulations that may affect your property ownership.

Conclusion

Choosing your perfect place in the sun, your ideal piece of overseas property, requires careful planning and thorough research. By meticulously considering your budget, location preferences, legal aspects, and ongoing responsibilities, you can significantly increase your chances of a successful and enjoyable investment. Remember to engage reputable professionals and conduct thorough due diligence at every stage. Don't hesitate to seek expert advice before making this significant purchase. Start your journey towards owning your dream overseas property today! Begin your search for the perfect overseas property now!

Featured Posts

-

Polskie Preselekcje Eurowizji Analiza Najwiekszych Rozczarowan

May 19, 2025

Polskie Preselekcje Eurowizji Analiza Najwiekszych Rozczarowan

May 19, 2025 -

Radio 2 Elige La Mejor Cancion De Eurovision Siglo Xxi

May 19, 2025

Radio 2 Elige La Mejor Cancion De Eurovision Siglo Xxi

May 19, 2025 -

Analysis Broadcoms V Mware Acquisition And The 1 050 Price Hike For At And T

May 19, 2025

Analysis Broadcoms V Mware Acquisition And The 1 050 Price Hike For At And T

May 19, 2025 -

Sovereign Bond Market Developments A Swissquote Bank Analysis

May 19, 2025

Sovereign Bond Market Developments A Swissquote Bank Analysis

May 19, 2025 -

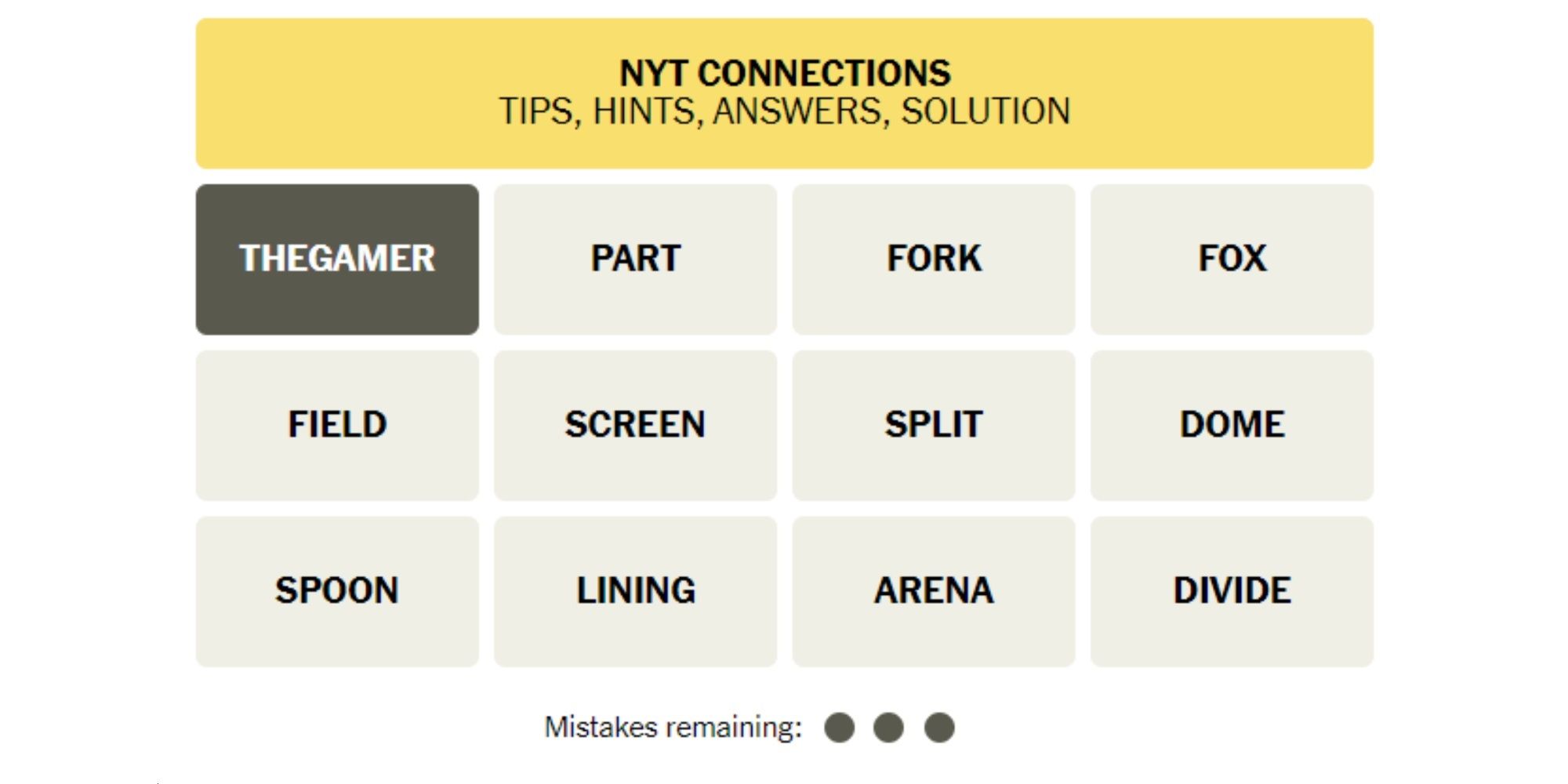

April 11th Nyt Connections Puzzle Hints And Solutions 670

May 19, 2025

April 11th Nyt Connections Puzzle Hints And Solutions 670

May 19, 2025