Claim Your HMRC Refund: A Payslip Check Could Reveal Unpaid Money

Table of Contents

Understanding Your Payslip: Deciphering the Details

Before you can identify potential errors leading to an HMRC refund, you need to understand what your payslip shows. A thorough payslip check requires familiarity with key elements.

Key elements to look for:

Understanding the components of your payslip is crucial for a successful HMRC refund claim. Key areas to focus on include:

- Gross Pay: Your total earnings before any deductions.

- Net Pay: Your take-home pay after all deductions.

- Taxable Pay: The amount of your income subject to income tax.

- Tax Deducted: The amount of income tax withheld from your pay.

- National Insurance Contributions (NICs): Your contributions to the National Insurance system.

- Student Loan Repayments: If applicable, the amount deducted for student loan repayments.

- Pension Contributions: The amount contributed to your pension scheme.

Common Errors in Payslip Calculations:

Employers, while generally diligent, can sometimes make mistakes when calculating tax and NI contributions. Common errors include:

- Incorrect tax code application.

- Inaccurate calculation of taxable pay.

- Errors in National Insurance contribution calculations.

- Incorrect deduction of student loan repayments.

Using Online Payslip Portals:

Many employers now provide online access to payslips. These portals offer convenience and easy access to your payslip history. However, remember to always access these portals through secure channels and be mindful of data privacy. Check your employer's security protocols before accessing your payslips online.

Common Reasons for HMRC Underpayments

Several factors can lead to an HMRC underpayment, often revealed through a careful payslip check.

Incorrect Tax Code:

An incorrect tax code is a frequent reason for underpayment or overpayment of tax. Your tax code dictates how much income tax is deducted from your earnings. A wrong tax code can result in either too much or too little tax being taken.

- Example: Using the wrong tax code can lead to significant underpayment over several months or years.

- Verification: Check your tax code on the HMRC website using your National Insurance number. [Link to HMRC Tax Code Checker]

Errors in National Insurance Contributions:

Mistakes in calculating your National Insurance contributions can also lead to unpaid money. This is less common than tax code errors but equally important to check.

- Example: Incorrect classification of employment could lead to underpayment of NICs.

Missed Tax Reliefs and Allowances:

Several tax reliefs and allowances can reduce your taxable income, potentially leading to a larger HMRC refund if not applied correctly.

- Marriage Allowance: Allows transfer of a portion of your personal allowance to your spouse.

- Child Benefit: A payment to help with the cost of raising children.

- Working Tax Credit/Child Tax Credit: Tax credits for low to middle-income families.

Failing to claim these can lead to overpayment of tax. Ensure your payslip reflects all applicable tax reliefs and allowances.

How to Claim Your HMRC Refund

Once you've identified a potential error on your payslip, you can start the claim process.

Gathering Necessary Documentation:

Before contacting HMRC, gather the necessary documents to support your claim. This typically includes:

- Relevant payslips showing the discrepancies.

- Your P60 (end-of-year tax statement).

- Any supporting documentation related to tax reliefs or allowances claimed.

Contacting HMRC:

Contact HMRC to initiate your refund claim. You can contact them through:

- Online: Use the HMRC online service. [Link to HMRC online services]

- Phone: Call the HMRC helpline. [Link to HMRC helpline details]

- Post: Send your claim by post (ensure you keep a copy for your records). [Link to HMRC postal address]

Understanding the Timeline:

HMRC processing times can vary. Be patient and allow sufficient time for your claim to be processed. HMRC aims to process most claims within a specific timeframe.

Seeking Professional Help with Your HMRC Refund Claim

While many HMRC refund claims are straightforward, some cases might require professional assistance.

When to Seek Assistance:

Consider professional help if:

- You have complex tax affairs.

- You're dealing with multiple years of underpayment.

- You're unsure about the best course of action.

Finding Reputable Tax Professionals:

Seek recommendations or use online resources to find qualified and trustworthy tax advisors.

Secure Your HMRC Refund Today

This article highlighted the importance of regularly checking your payslips for potential errors that could lead to unpaid money. We've covered identifying common reasons for underpayments, understanding the details on your payslip, and the process of claiming your HMRC refund. Don't delay! Claim your HMRC refund today by reviewing your payslips and contacting HMRC. Proactive financial management, including regular payslip checks, helps ensure you receive all the money you're entitled to. Reclaiming unpaid money is a legitimate process – take control of your finances and secure your HMRC refund.

Featured Posts

-

Agatha Christie Back From The Dead In A Groundbreaking Bbc Series

May 20, 2025

Agatha Christie Back From The Dead In A Groundbreaking Bbc Series

May 20, 2025 -

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025 -

Port Autonome D Abidjan 28 33 Millions De Tonnes Traitees En 2022

May 20, 2025

Port Autonome D Abidjan 28 33 Millions De Tonnes Traitees En 2022

May 20, 2025 -

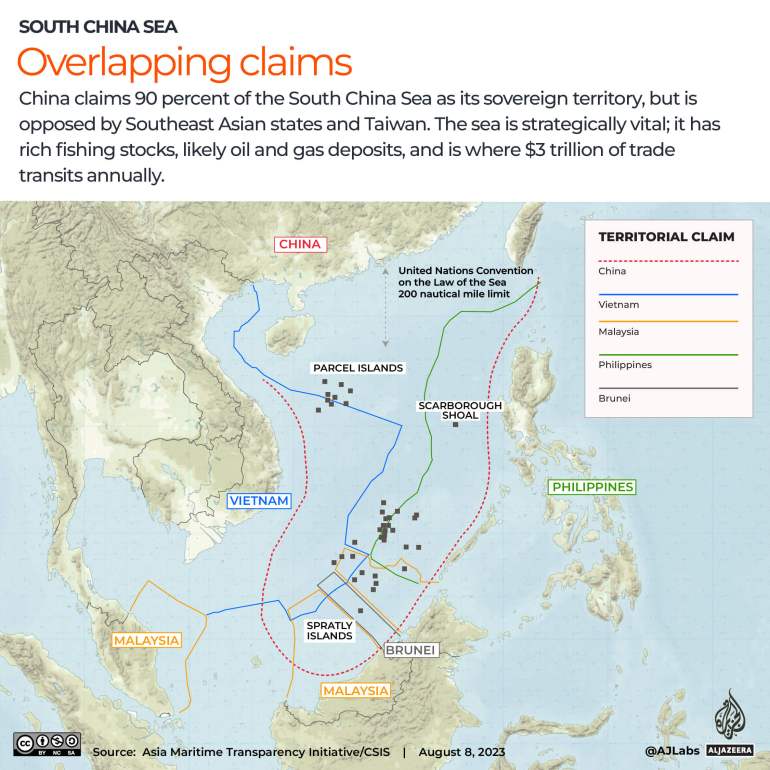

South China Sea Chinas Reaction To Philippine Missile System

May 20, 2025

South China Sea Chinas Reaction To Philippine Missile System

May 20, 2025 -

Cameroun Macron S Engage Contre Un Troisieme Mandat Et Un Referendum

May 20, 2025

Cameroun Macron S Engage Contre Un Troisieme Mandat Et Un Referendum

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025