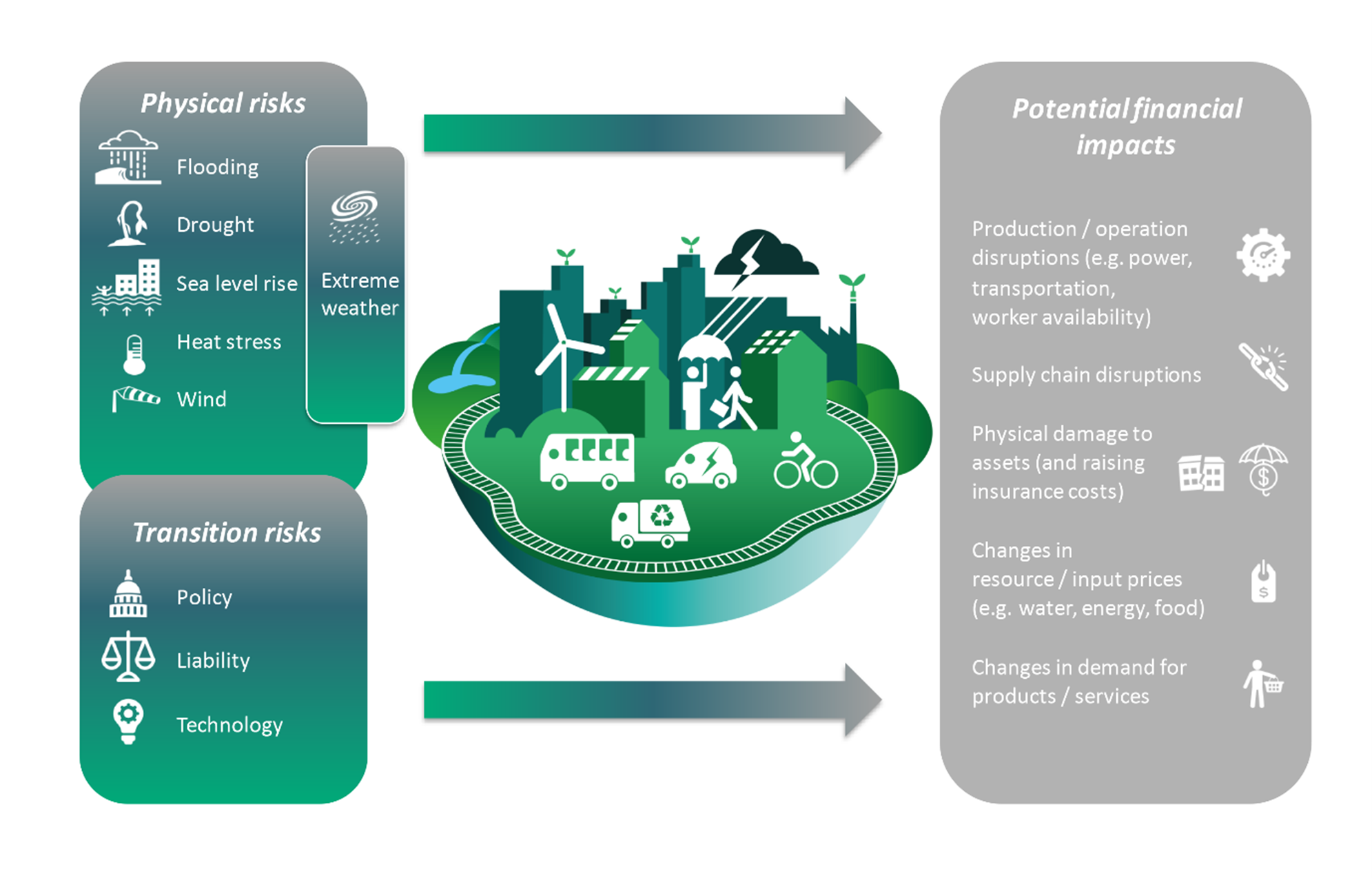

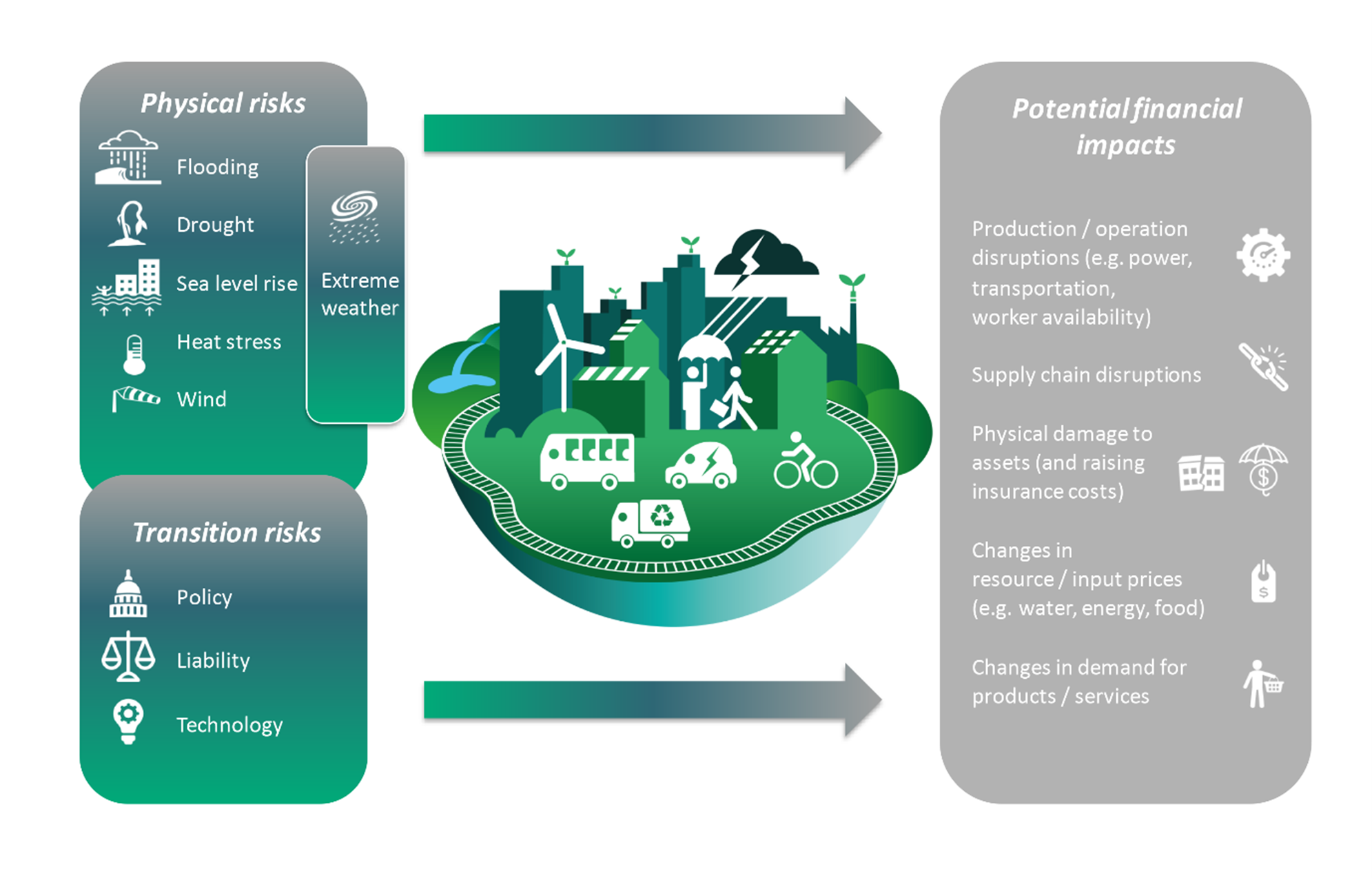

Climate-Related Risks: Their Impact On Your Ability To Secure A Home Loan

Table of Contents

Increased Flood Risk and Home Loan Approval

Properties in flood-prone areas face significantly higher insurance premiums and increased difficulty in securing a mortgage. Lenders carefully assess flood risk, using maps and data from sources like FEMA (Federal Emergency Management Agency) in the US, or equivalent organizations in other countries. This flood risk assessment is a critical part of the mortgage underwriting process.

- Lenders assess flood risk using maps and data from FEMA (or equivalent in other countries). These maps delineate floodplains and identify areas with varying levels of flood risk. The higher the risk, the more stringent the lender's requirements.

- Higher flood risk often translates to higher interest rates or loan denial. Lenders perceive a greater financial risk in lending on properties with a high probability of flooding, leading to penalties for borrowers.

- Flood insurance is usually mandatory for properties in high-risk zones, adding to the overall cost. This added expense can make the home less affordable and further complicate the mortgage application.

- The rising frequency and severity of flooding due to climate change are exacerbating this issue. More frequent and intense rainfall events are increasing the likelihood of flooding in areas previously considered low-risk, making it harder to obtain financing. Climate change impact on mortgages is becoming increasingly relevant.

Wildfire Risk and its Impact on Mortgage Applications

Similar to flood risk, properties located in wildfire-prone areas face challenges in securing home loans. Lenders carefully consider the proximity to wildfires and the history of fires in the area when conducting their wildfire risk assessment.

- Lenders consider the proximity to wildfires and the history of fires in the area. Areas with a recent history of significant wildfires are deemed higher risk.

- Increased insurance premiums and potential for property damage increase lending risk. The cost of fire insurance in high-risk areas can be substantial, impacting affordability and lender willingness to approve a loan.

- Home improvements for fire resistance can positively influence loan approval. Investing in fire-resistant roofing materials, landscaping, and other protective measures can demonstrate a commitment to mitigating risk and potentially improve your chances of mortgage approval.

- The increasing wildfire risk due to climate change and drought is a growing concern for lenders. Drier conditions and hotter temperatures are fueling more intense and frequent wildfires, increasing the risk for lenders and impacting mortgage underwriting.

Extreme Weather Events and Property Value

Extreme weather events, including heat waves, hurricanes, severe thunderstorms, and other climate-related disasters, can significantly affect property values and, consequently, mortgage approvals. The long-term effects of climate change on property value are a major consideration for lenders.

- Damage from extreme weather can decrease property value, affecting the loan-to-value ratio. This can make it more difficult to secure a loan, or require a larger down payment.

- Lenders may require higher down payments or stricter terms for properties in high-risk areas. This is a direct response to the increased perceived risk associated with extreme weather events.

- The long-term effects of climate change on property value are a significant consideration. Lenders are increasingly factoring in the potential for future damage and decreased property value when assessing mortgage applications.

- The increasing frequency and intensity of extreme weather events are driving this trend. More frequent and severe storms are creating a greater need for lenders to assess climate-related risks.

Proactive Steps to Mitigate Climate-Related Risks

Homebuyers can take several proactive steps to improve their chances of securing a home loan in a climate-changing world. Climate risk mitigation is becoming increasingly important.

- Conduct thorough due diligence on the property's climate risk. Research the property's flood and wildfire risk, as well as its vulnerability to other extreme weather events.

- Invest in property improvements to increase resilience against climate risks. Upgrading your roof, installing fire-resistant landscaping, or making other improvements can demonstrate a commitment to mitigating risk.

- Secure adequate insurance coverage. Make sure you have comprehensive insurance coverage that adequately protects you from potential climate-related damage.

- Shop around for lenders who understand climate risks. Some lenders are more proactive than others in assessing and addressing climate-related risks.

Conclusion

Climate change is significantly influencing the home loan market. Understanding the increased risks associated with floods, wildfires, and extreme weather events is crucial for anyone seeking a mortgage. By proactively addressing climate-related risks and working with a lender who understands these issues, you can significantly improve your chances of securing a home loan and making a sound investment. Remember to thoroughly assess the climate risks associated with any property before applying for a home loan, and don't hesitate to ask your lender about their policies regarding climate-related risks to ensure a smooth process. Secure your dream home by understanding the impact of climate-related risks on your mortgage application.

Featured Posts

-

Half Dome Wins Abn Group Victoria Pitch A New Era Of Digital Marketing

May 21, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era Of Digital Marketing

May 21, 2025 -

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 21, 2025

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 21, 2025 -

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 21, 2025

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 21, 2025 -

Michael Bays Outrun Film Sydney Sweeney Confirmed For Lead Role

May 21, 2025

Michael Bays Outrun Film Sydney Sweeney Confirmed For Lead Role

May 21, 2025 -

Love Monster In Relationships Impact And Solutions

May 21, 2025

Love Monster In Relationships Impact And Solutions

May 21, 2025

Latest Posts

-

Determined Germany Faces Italy In World Cup Quarterfinals

May 21, 2025

Determined Germany Faces Italy In World Cup Quarterfinals

May 21, 2025 -

Ftv Lives A Hell Of A Run A Retrospective Analysis

May 21, 2025

Ftv Lives A Hell Of A Run A Retrospective Analysis

May 21, 2025 -

Finding Strength In Challenges A Practical Guide To Resilience

May 21, 2025

Finding Strength In Challenges A Practical Guide To Resilience

May 21, 2025 -

Overcoming Adversity Developing Resilience For Improved Mental Health

May 21, 2025

Overcoming Adversity Developing Resilience For Improved Mental Health

May 21, 2025 -

Analyzing Ftv Lives A Hell Of A Run Success And Challenges

May 21, 2025

Analyzing Ftv Lives A Hell Of A Run Success And Challenges

May 21, 2025