Clinton Vs. The Budget: A Retrospective On Veto Threats And The 1%

Table of Contents

Clinton's Budget Battles: A Contextual Overview

The 1990s saw a complex economic climate. The country grappled with a significant national deficit, inherited from previous administrations, fueling intense debates about fiscal policy and the need for deficit reduction. Clinton, inheriting this challenge, proposed budgets aimed at controlling spending and stimulating economic growth. His approach clashed sharply with the Republican-controlled Congress, particularly after the Republicans won control of both houses in the 1994 midterm elections. Key players like Newt Gingrich spearheaded a conservative agenda that often directly contradicted Clinton's proposals.

- Key Budget Proposals during Clinton's Presidency:

- The 1993 Budget Reconciliation Act, which included tax increases on higher earners to fund deficit reduction.

- Subsequent budget proposals that focused on targeted spending cuts and continued efforts to rein in the deficit.

- Ideological Differences: The central conflict stemmed from fundamental disagreements about the role of government in the economy. Clinton favored government investment in infrastructure and social programs, while Republicans prioritized tax cuts and deregulation. These opposing viewpoints fueled intense budget battles that dominated the political landscape.

The Strategic Use of Veto Power: A Tool for Negotiation

Clinton skillfully employed the threat, and occasionally the execution, of a veto as a powerful negotiating tool. He understood that the veto could force compromises and shape the final legislation. This strategic approach allowed him to influence the direction of fiscal policy, even when facing a hostile Congress.

- Specific Examples of Veto Threats and Vetoes: Clinton famously threatened to veto numerous budget bills that he deemed too extreme or harmful to his policy goals. In some instances, he followed through, forcing Congress to negotiate. These high-stakes showdowns highlighted the importance of presidential power in budgetary decisions.

- Political Calculations: Clinton's decisions were carefully calculated, weighing public opinion, potential political fallout, and the needs of his party. He skillfully navigated the complexities of partisan politics to achieve his objectives.

- Budgetary Items Targeted by Veto Threats: Many veto threats focused on specific spending cuts that Clinton believed would disproportionately harm vulnerable populations or undermine vital social programs. Conversely, he also vetoed bills he felt were fiscally irresponsible or gave undue tax breaks to the wealthy.

The Impact on the 1%: Tax Increases and Spending Cuts

Clinton's budget strategies significantly impacted the wealthiest Americans (the 1%). The 1993 Budget Reconciliation Act, for example, included tax increases on high-income earners. While spending cuts were a key component of many budget proposals, their impact on programs predominantly benefiting the wealthy was relatively limited compared to the effects on the tax code.

- Tax Increases on High-Income Earners: These increases, while controversial, generated significant revenue that contributed to deficit reduction efforts.

- Arguments For and Against Clinton's Approach: Supporters argued that the tax increases on the wealthy were necessary to address the deficit and invest in crucial social programs. Critics contended that they hindered economic growth and discouraged investment.

- Income Inequality During Clinton's Presidency: While income inequality remained a persistent challenge during Clinton's time in office, his fiscal policies, particularly the tax increases on the 1%, are part of the ongoing debate concerning their impact on this trend.

Long-Term Consequences of Clinton's Fiscal Policies

Clinton's budget decisions had lasting consequences for the national debt and the economy. His administration successfully reduced the deficit, leading to a period of sustained economic growth. However, the impact on income inequality and the debate surrounding the efficacy of his approach continue to resonate today.

- Effects on the National Debt and Economy: Clinton's policies contributed to a significant reduction in the national debt, a considerable achievement. This positive economic environment also contributed to a period of economic prosperity.

- Legacy on Subsequent Administrations: Clinton's emphasis on fiscal responsibility and deficit reduction influenced subsequent administrations, although the specific approaches differed.

- Ongoing Debate About Effectiveness: The long-term effects of Clinton's fiscal policies remain a subject of ongoing discussion and analysis. Debates often center on the relative importance of deficit reduction vs. investment in social programs.

- Lasting Impact on Income Inequality and Economic Growth: The extent to which Clinton's budget decisions contributed to or mitigated income inequality is still debated. The economic growth of the era is generally considered a positive outcome, although the distribution of that growth remains a point of contention.

Conclusion

Clinton's presidency saw significant budget battles, shaped by his strategic use of veto threats. His fiscal policies, while aimed at deficit reduction, also had a notable impact on the 1%, primarily through tax increases on high-income earners. The long-term consequences, including the reduction of the national debt and the ongoing debate about income inequality, remain relevant for understanding modern fiscal policy debates. Understanding Clinton's approach to the budget and his strategic use of veto power remains crucial for analyzing modern fiscal policy debates. Continue exploring the complexities of this pivotal era by researching relevant historical archives and engaging further in the discussion of Clinton's legacy on the 1% and the national budget.

Featured Posts

-

Royal Albert Hall Fallout Who Drummer Addresses Dismissal

May 23, 2025

Royal Albert Hall Fallout Who Drummer Addresses Dismissal

May 23, 2025 -

Mutlq Alnar Ela Mwzfy Sfart Alahtlal Srkhat Alhryt Lflstyn

May 23, 2025

Mutlq Alnar Ela Mwzfy Sfart Alahtlal Srkhat Alhryt Lflstyn

May 23, 2025 -

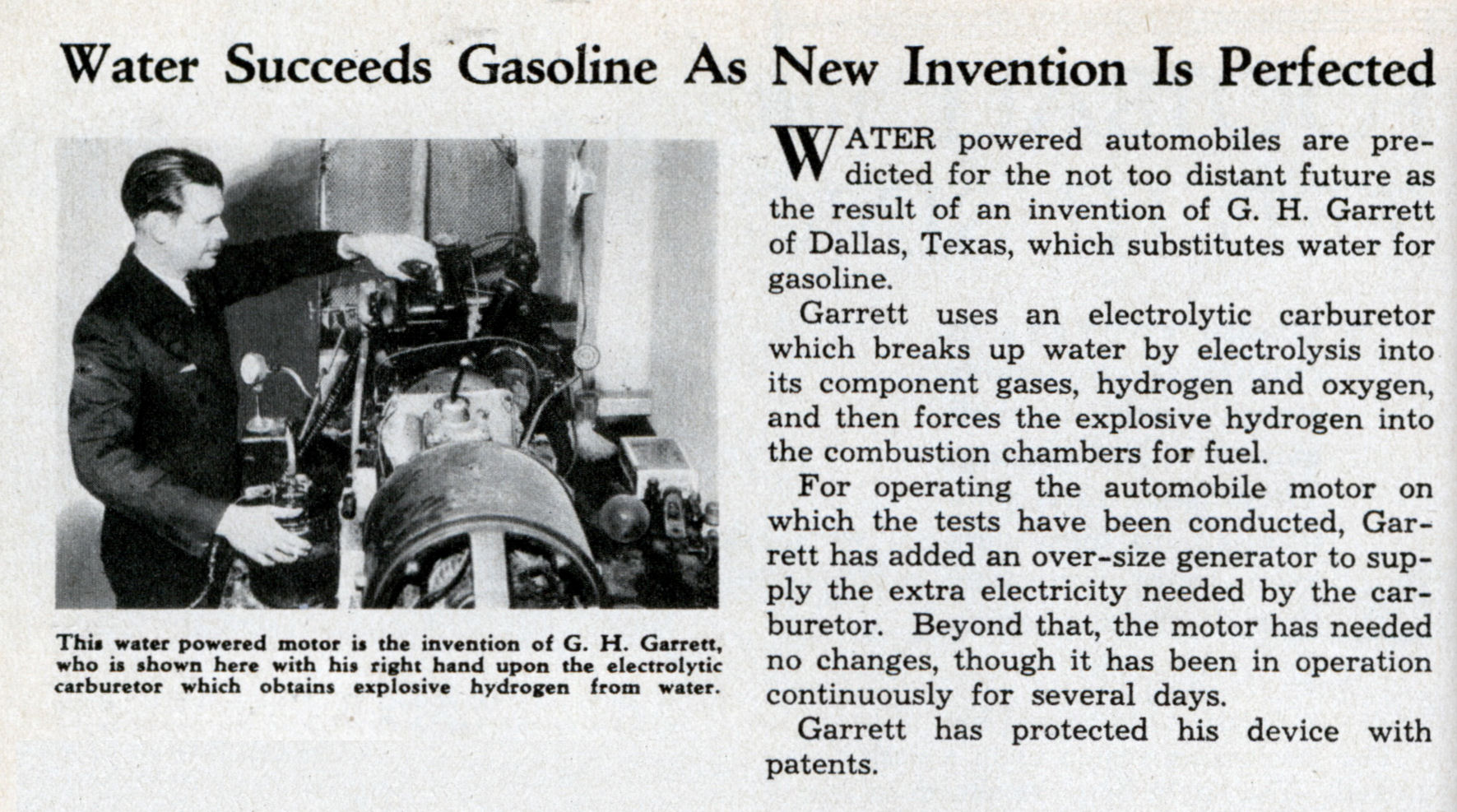

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025 -

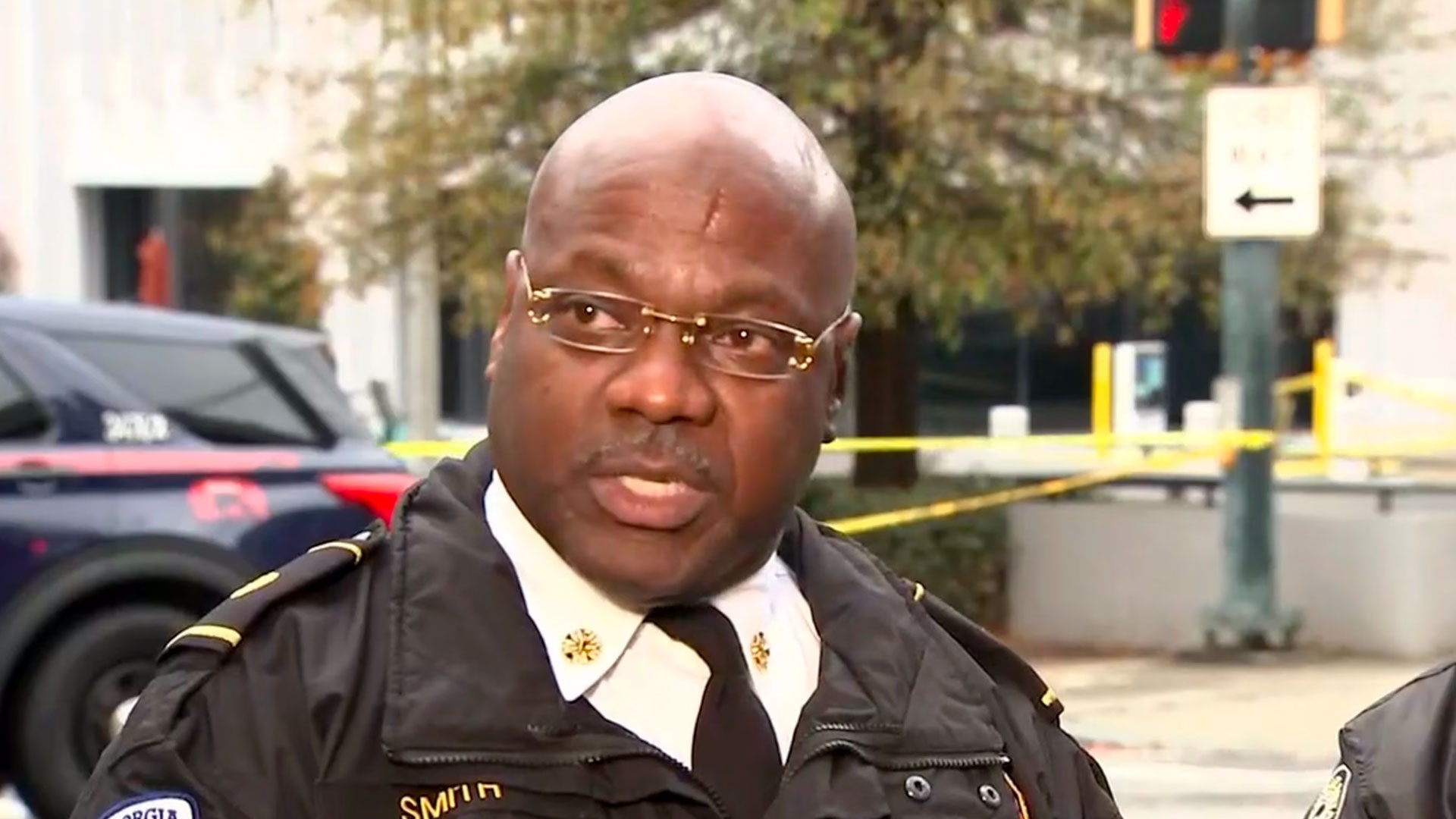

Israeli Embassy Staffers Killed In Washington D C Shooting

May 23, 2025

Israeli Embassy Staffers Killed In Washington D C Shooting

May 23, 2025 -

Daco Valerie Rodriguez Erazo En Nuevo Rol Como Secretaria

May 23, 2025

Daco Valerie Rodriguez Erazo En Nuevo Rol Como Secretaria

May 23, 2025

Latest Posts

-

Podcast Production Revolutionized Ai And The Analysis Of Repetitive Scatological Data

May 23, 2025

Podcast Production Revolutionized Ai And The Analysis Of Repetitive Scatological Data

May 23, 2025 -

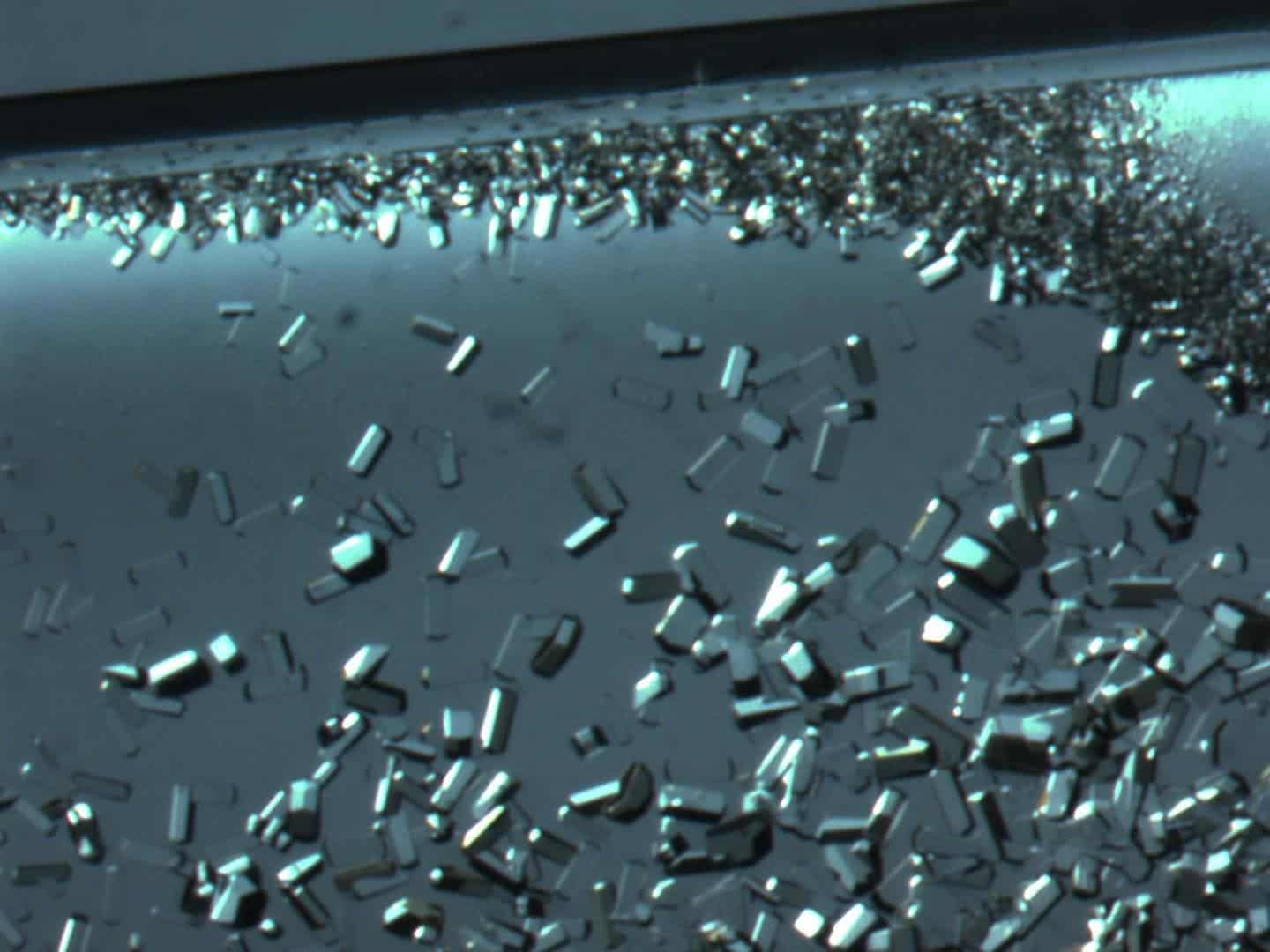

Space Crystals A Novel Approach To Pharmaceutical Innovation

May 23, 2025

Space Crystals A Novel Approach To Pharmaceutical Innovation

May 23, 2025 -

From Scatological Data To Podcast Gold The Power Of Ai

May 23, 2025

From Scatological Data To Podcast Gold The Power Of Ai

May 23, 2025 -

Exploring The Use Of Orbital Space Crystals In Drug Creation

May 23, 2025

Exploring The Use Of Orbital Space Crystals In Drug Creation

May 23, 2025 -

Improving Drug Development With Orbital Space Crystals A Promising Approach

May 23, 2025

Improving Drug Development With Orbital Space Crystals A Promising Approach

May 23, 2025