Copper Market Forecast: Tongling Highlights US Tariff Risks

Table of Contents

Tongling's Vulnerability to US Tariffs

Tongling's substantial copper exports to the US make it particularly vulnerable to the imposition of new tariffs. This vulnerability creates ripple effects throughout the global copper market and the broader Chinese economy.

Impact on Copper Production and Exports

- Reduced US Demand: US tariffs could significantly reduce demand for Tongling's copper products in the American market, impacting its export volume.

- Production Slowdown: Decreased demand could lead to a reduction in Tongling's copper production, potentially impacting its overall profitability and potentially leading to job losses within the company.

- Profitability Decline: The combination of reduced demand and potentially increased production costs due to tariffs could significantly reduce Tongling's profitability margins. A detailed analysis of Tongling's financial statements would be needed to accurately quantify the potential losses. For instance, a 10% decrease in US exports, coupled with a 5% increase in production costs, could translate to a substantial drop in annual revenue. Any public statements released by Tongling regarding the tariff situation should be closely monitored.

Ripple Effects on the Chinese Copper Industry

- Impact on Other Chinese Producers: If Tongling experiences significant losses, it could trigger a chain reaction within the Chinese copper industry, affecting other producers who rely on similar export markets.

- Retaliatory Measures: The Chinese government might implement retaliatory measures against US imports, further escalating trade tensions and affecting the global metal prices, impacting other commodities beyond copper.

- Overall Market Instability: The uncertainty surrounding tariffs could create instability in the Chinese copper market, making investment and long-term planning more challenging. Data on China's overall copper production and export volumes is critical to understanding the scale of the potential impact. A reduction in Chinese copper exports could lead to a global supply shortage and price increases.

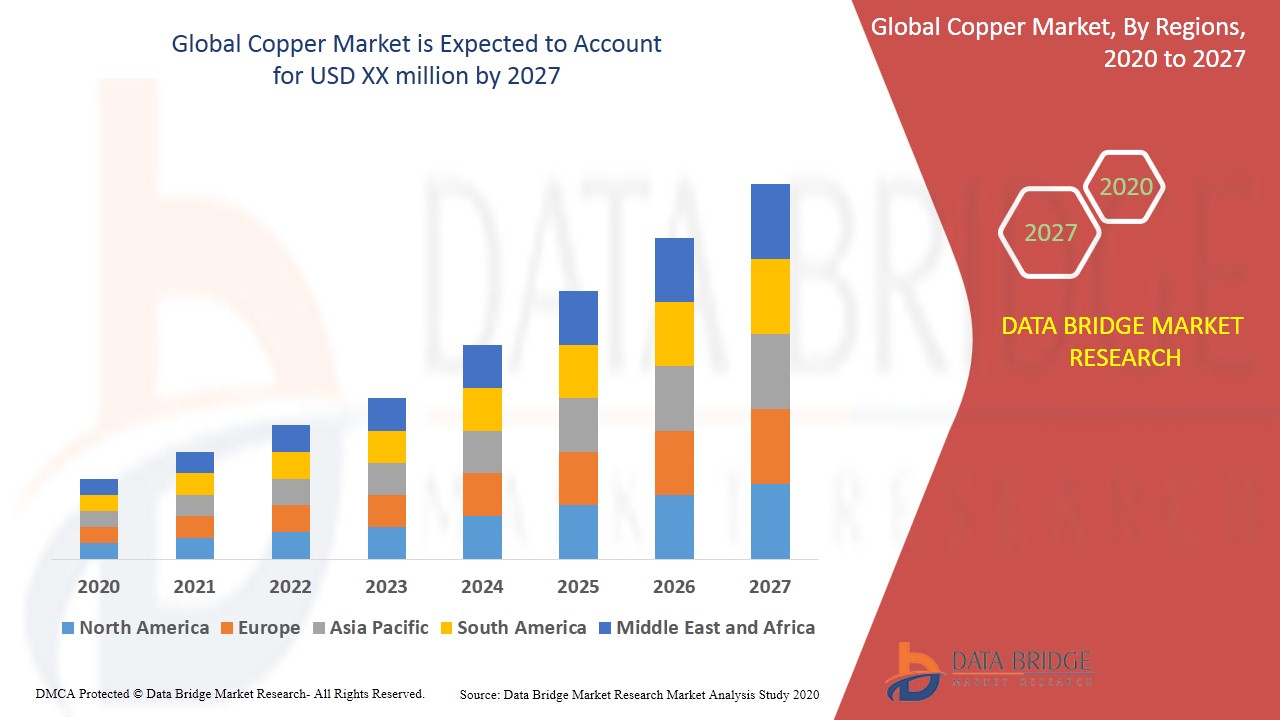

Global Copper Market Implications

The impact of US tariffs on Tongling extends far beyond China, influencing the entire global copper market and impacting copper prices.

Fluctuations in Copper Prices

- Price Increases: Supply chain disruptions caused by reduced Chinese copper exports could lead to a decrease in the global supply of copper, potentially driving up copper prices.

- Price Decreases (Short-Term): A short-term price decrease is possible if the reduced demand from the US market outweighs the supply constraints, although this is less likely given the importance of the US market.

- Speculative Trading: Speculative trading activity driven by the uncertainty surrounding tariffs could exacerbate price fluctuations, leading to increased volatility in the commodity market. Historical data from the London Metal Exchange (LME) can provide insights into the relationship between trade policy and copper price volatility. Charts illustrating different tariff scenarios and their potential effects on copper prices are crucial for assessing risk.

Shifting Supply Chains and Trade Dynamics

- Diversification of Supply Chains: Companies may seek alternative copper suppliers outside of China to mitigate the risk associated with US tariffs, leading to a reshuffling of the global copper trade landscape.

- Increased Competition: This shift could create opportunities for copper producers in other countries, such as Chile, Peru, and Zambia, to increase their market share. An analysis of the relative competitiveness of these countries would be crucial in predicting the extent of the supply chain shifts.

- New Trade Routes: Trade routes may shift as companies seek to avoid US tariffs, leading to increased transportation costs and potentially new logistical challenges.

Strategic Responses and Mitigation Strategies

Navigating these challenges requires proactive strategies from both Tongling and other global copper producers.

Tongling's Adaptability and Response

- Market Diversification: Tongling could mitigate the impact of US tariffs by diversifying its export markets, reducing its reliance on the US.

- Cost-Cutting Measures: Implementing cost-cutting measures and optimizing its production processes could help improve profitability even with reduced demand.

- Lobbying Efforts: Engaging in lobbying efforts to influence trade policy could potentially lead to a more favorable outcome for the company. Any public statements or actions taken by Tongling to address the challenges must be considered.

Opportunities for Other Copper Producers

- Increased Market Share: The disruption caused by US tariffs on Tongling presents opportunities for copper producers in other countries to capture increased market share, particularly in the US market.

- Investment Opportunities: The uncertainty in the market could create investment opportunities for companies willing to take on the risk and capitalize on the shifting global dynamics. Identifying specific regions and companies that are likely to benefit is crucial for strategic investors.

Conclusion

The potential impact of US tariffs on Tongling and the broader copper market is significant and multifaceted. The forecast highlights potential price volatility, disruptions to global supply chains, and strategic responses from industry players. The situation necessitates careful monitoring and proactive adaptation by all stakeholders. The interplay between US trade policy, China's copper industry, and global commodity markets creates a complex and dynamic environment.

Call to Action: Stay informed on the evolving copper market forecast and the impact of US tariffs on Tongling and the global copper industry. Subscribe to our newsletter for regular updates on copper prices, market analysis, and strategic insights. Understanding these dynamic factors is crucial for navigating the complexities of the global copper market and making informed decisions within this volatile sector.

Featured Posts

-

Delayed Mammogram Leads To Tina Knowles Breast Cancer Diagnosis A Wake Up Call

Apr 23, 2025

Delayed Mammogram Leads To Tina Knowles Breast Cancer Diagnosis A Wake Up Call

Apr 23, 2025 -

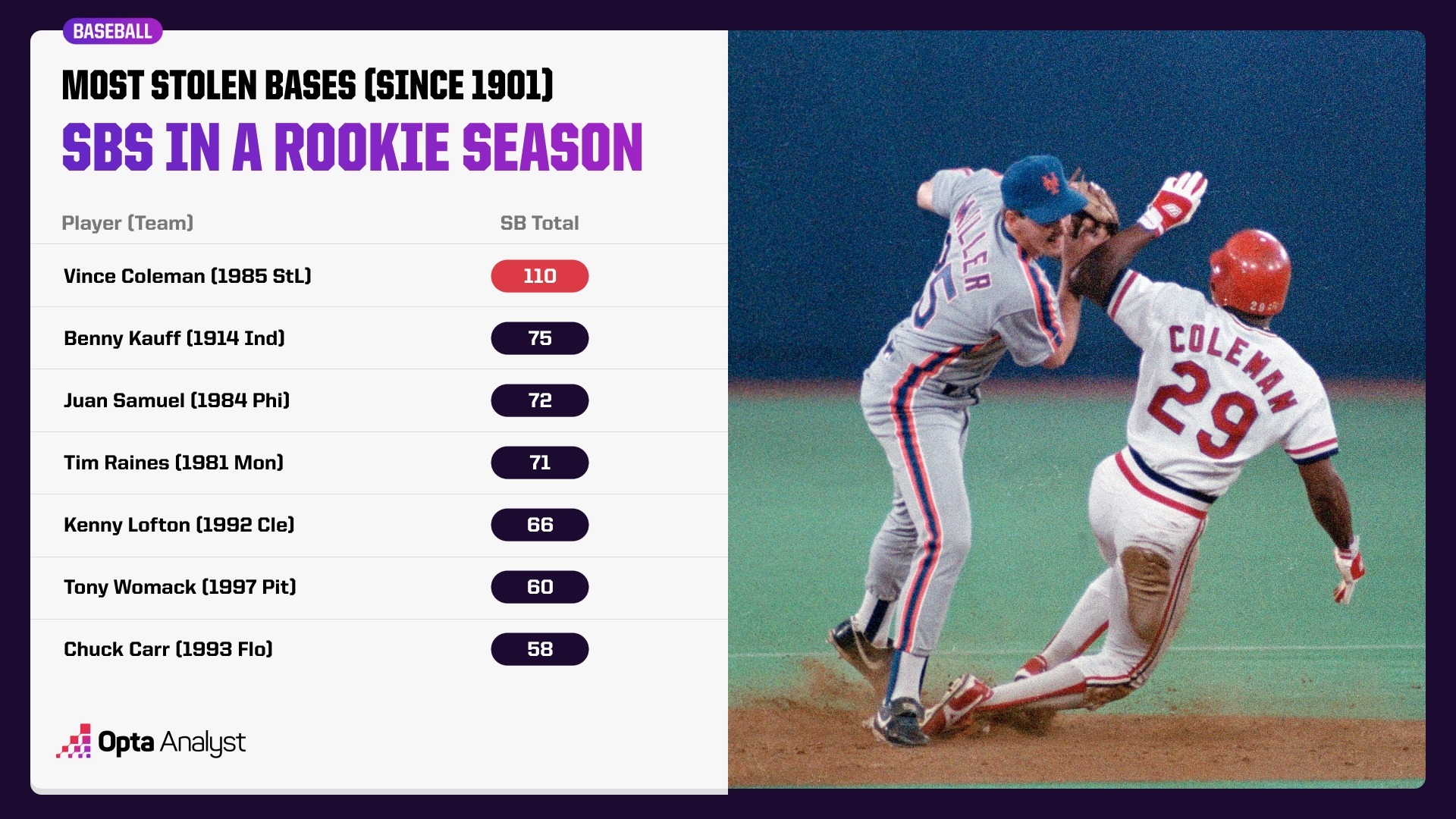

Record Nine Stolen Bases Power Brewers Rout Of As

Apr 23, 2025

Record Nine Stolen Bases Power Brewers Rout Of As

Apr 23, 2025 -

17 Subat Pazartesi Tv De Bu Aksamki Diziler

Apr 23, 2025

17 Subat Pazartesi Tv De Bu Aksamki Diziler

Apr 23, 2025 -

Report Hegseth Says Leaks Targeting Trumps Political Goals

Apr 23, 2025

Report Hegseth Says Leaks Targeting Trumps Political Goals

Apr 23, 2025 -

Economic Data And The Trump Administration A Discrepancy

Apr 23, 2025

Economic Data And The Trump Administration A Discrepancy

Apr 23, 2025

Latest Posts

-

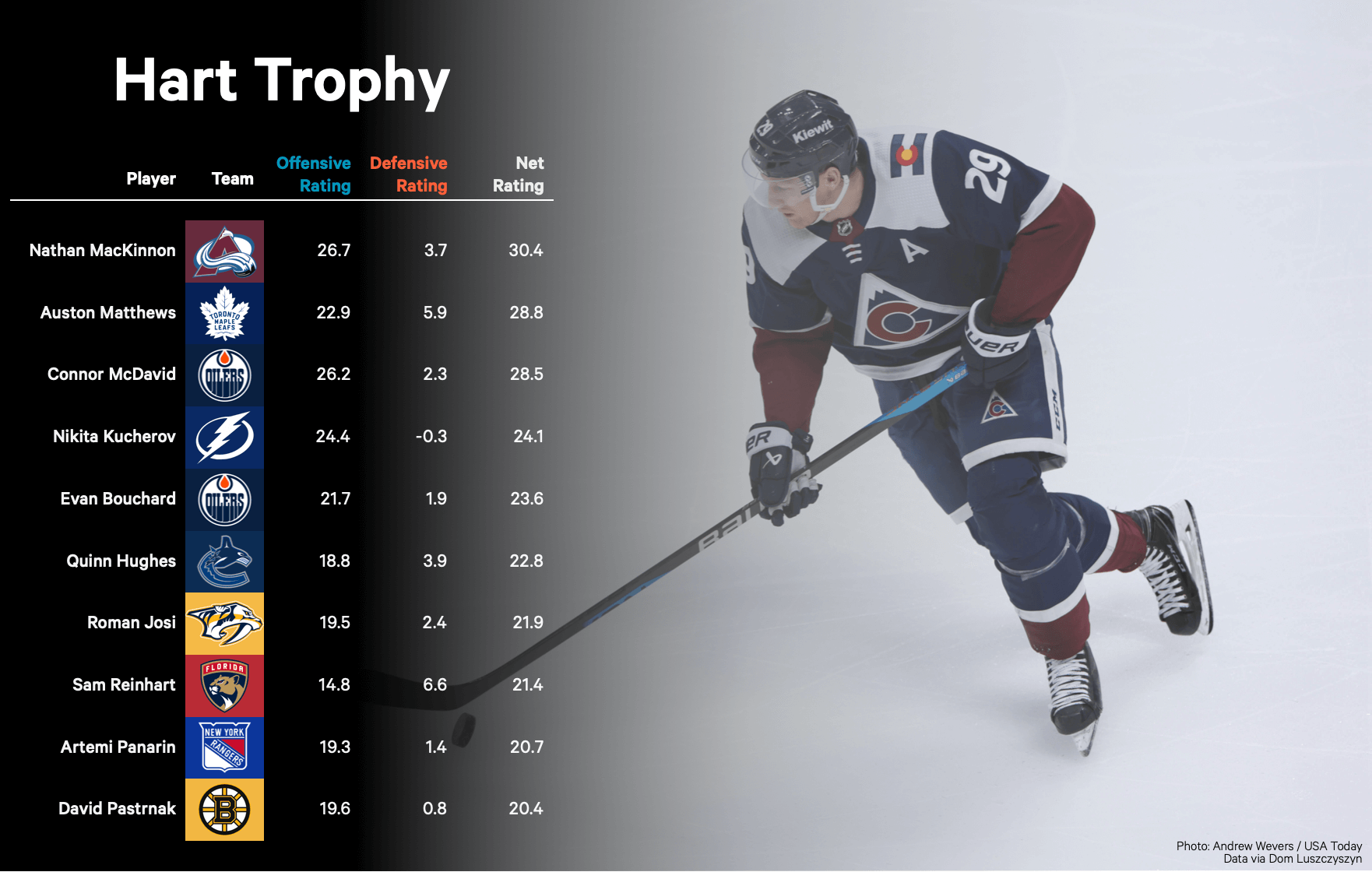

Three Stars Shine Draisaitl Hellebuyck And Kucherov In Hart Trophy Race

May 10, 2025

Three Stars Shine Draisaitl Hellebuyck And Kucherov In Hart Trophy Race

May 10, 2025 -

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025 -

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 10, 2025 -

2025 Nhl Trade Deadline Impact On Playoff Races

May 10, 2025

2025 Nhl Trade Deadline Impact On Playoff Races

May 10, 2025 -

Nhl 2025 Trade Deadline Playoff Contender Predictions

May 10, 2025

Nhl 2025 Trade Deadline Playoff Contender Predictions

May 10, 2025