Core Inflation Surge Forces Bank Of Canada Into Difficult Position

Table of Contents

The Core Inflation Problem: Understanding the Numbers

Understanding core inflation is crucial to grasping the Bank of Canada's predicament. Core inflation, unlike headline inflation (which includes volatile items like food and energy), focuses on the persistent underlying price pressures within the economy. It's a more accurate indicator of long-term inflationary trends and is therefore a key metric for the Bank of Canada's monetary policy decisions. This persistent inflation is concerning because it indicates broader inflationary pressures embedded within the economy.

Recent data from Statistics Canada reveals a troubling trend. For instance, [insert specific recent data on core inflation rates in Canada, citing the source]. This increase represents a significant challenge, exceeding the Bank of Canada's target range. Several factors contribute to this core inflation surge:

- Supply chain disruptions: Lingering global supply chain bottlenecks continue to exert upward pressure on prices for various goods.

- Strong consumer demand: Robust consumer spending, fueled by pent-up demand and government stimulus, continues to drive prices higher.

- Wage pressures: Rising wages, while beneficial for workers, contribute to increased costs for businesses, which are often passed on to consumers in the form of higher prices. This can create a wage-price spiral, further exacerbating inflation.

The Bank of Canada's Response: A Tightrope Walk

The Bank of Canada's current monetary policy stance involves actively combating inflation through interest rate hikes. Past interest rate increases [mention specific rate hikes and dates], aimed at cooling down the economy and reducing inflationary pressures, have had a [describe the observed impact – e.g., mixed success]. While some slowdown in economic growth has been observed, core inflation remains stubbornly high.

Potential future policy actions include:

- Further interest rate increases: The Bank of Canada may opt for additional interest rate hikes to further curb demand and bring inflation closer to its target. However, the magnitude and timing of such hikes will be carefully considered to avoid triggering a sharp economic downturn.

- Quantitative tightening: This involves reducing the Bank of Canada's balance sheet by allowing government bonds to mature without reinvestment. This reduces the money supply, helping to control inflation.

The Risks of Aggressive Rate Hikes

Aggressively raising interest rates carries substantial risks for the Canadian economy:

- Increased unemployment: Higher borrowing costs can lead to reduced business investment and hiring, resulting in job losses.

- Housing market slowdown: Increased mortgage rates can significantly dampen the housing market, potentially leading to a price correction and impacting consumer wealth.

- Reduced consumer spending: Higher interest rates reduce disposable income, leading to decreased consumer spending and potentially a broader economic slowdown.

The Risks of Insufficient Rate Hikes

Conversely, failing to raise interest rates sufficiently also presents considerable risks:

- Entrenchment of inflation: Allowing inflation to persist could lead to it becoming ingrained in the economy, making it harder to control in the long run and creating higher inflation expectations.

- Wage-price spiral: If inflation expectations rise, workers may demand higher wages to compensate for the loss of purchasing power. This, in turn, leads businesses to raise prices further, creating a self-perpetuating cycle.

- Loss of central bank credibility: If the Bank of Canada is perceived as failing to effectively manage inflation, it could erode public trust in its ability to maintain price stability.

The Outlook for the Canadian Economy

Forecasts for the Canadian economy vary. Some predict a “soft landing,” where inflation gradually decreases without a significant economic contraction. Others foresee a recession, triggered by the Bank of Canada's efforts to control inflation. The uncertainty stems from several factors, including:

- Global economic conditions: Global factors, such as the war in Ukraine and ongoing supply chain disruptions, add significant uncertainty.

- Consumer behavior: Consumer spending patterns are difficult to predict accurately and will play a key role in the economic outlook.

- Effectiveness of monetary policy: The lag effect of monetary policy makes it difficult to precisely gauge the impact of interest rate changes on the economy.

Conclusion:

The Bank of Canada faces a complex challenge in navigating the current surge in core inflation. The delicate balance between taming rising prices and avoiding a recession requires astute policymaking. The path ahead remains highly uncertain, and the Canadian economy's future trajectory depends significantly on several interconnected factors. Stay informed about the evolving situation by regularly reviewing updates on core inflation and the Bank of Canada's monetary policy decisions. Understanding the dynamics of core inflation and its impact on interest rates is crucial for navigating the current economic climate.

Featured Posts

-

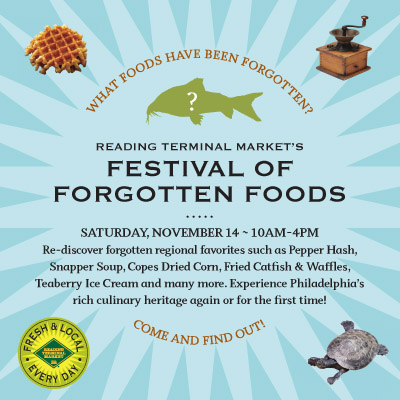

The Manhattan Forgotten Foods Festival A Taste Of The Unusual

May 22, 2025

The Manhattan Forgotten Foods Festival A Taste Of The Unusual

May 22, 2025 -

Two Loose Cows In Lancaster County Park Search Update

May 22, 2025

Two Loose Cows In Lancaster County Park Search Update

May 22, 2025 -

Manhattan Forgotten Foods Festival Preserving Culinary Traditions Through Rare Ingredients

May 22, 2025

Manhattan Forgotten Foods Festival Preserving Culinary Traditions Through Rare Ingredients

May 22, 2025 -

Cau Ma Da Du An Trong Diem Noi Lien Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Du An Trong Diem Noi Lien Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025 -

Wtt Chennai 2024 Arunas Unexpected Tournament Departure

May 22, 2025

Wtt Chennai 2024 Arunas Unexpected Tournament Departure

May 22, 2025

Latest Posts

-

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025 -

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025 -

Tractor Trailer Carrying Produce Overturns On I 83

May 22, 2025

Tractor Trailer Carrying Produce Overturns On I 83

May 22, 2025 -

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025 -

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025