CoreWeave (CRWV): A Contrarian View From Jim Cramer On AI Infrastructure

Table of Contents

CoreWeave's Business Model and Competitive Advantage

GPU-Focused Cloud Computing

CoreWeave distinguishes itself by providing cloud computing resources heavily optimized for Graphics Processing Units (GPUs), the workhorses of modern artificial intelligence. This focus sets it apart from general-purpose cloud providers like AWS, Azure, and Google Cloud. Their infrastructure is built to handle the immense computational demands of AI training and inference.

- High-Performance GPUs: CoreWeave utilizes cutting-edge NVIDIA H100 and other high-performance GPUs, offering unparalleled processing power for complex AI workloads.

- Scalability and Flexibility: Their platform offers scalable resources, allowing clients to adjust their computing needs on demand, ensuring cost-efficiency and flexibility.

- Superior Performance: The specialized architecture and optimized software stack result in faster training times and more efficient inference, providing a competitive edge.

Targeting the AI Boom

CoreWeave is strategically positioned to benefit significantly from the burgeoning AI market. The demand for specialized cloud computing resources to support AI development and deployment is exploding, creating a massive opportunity for companies like CoreWeave.

- Key Customer Segments: CoreWeave serves a diverse range of clients, including AI startups, large technology corporations, and research institutions, all with significant AI computing needs.

- Addressing Specific Needs: Their tailored solutions address the unique challenges faced by AI developers, offering the necessary computational power, scalability, and specialized software tools.

- Growth Trajectory: The continued growth of AI across various sectors indicates a promising future for CoreWeave's specialized services.

Jim Cramer's Contrarian Opinion and its Implications

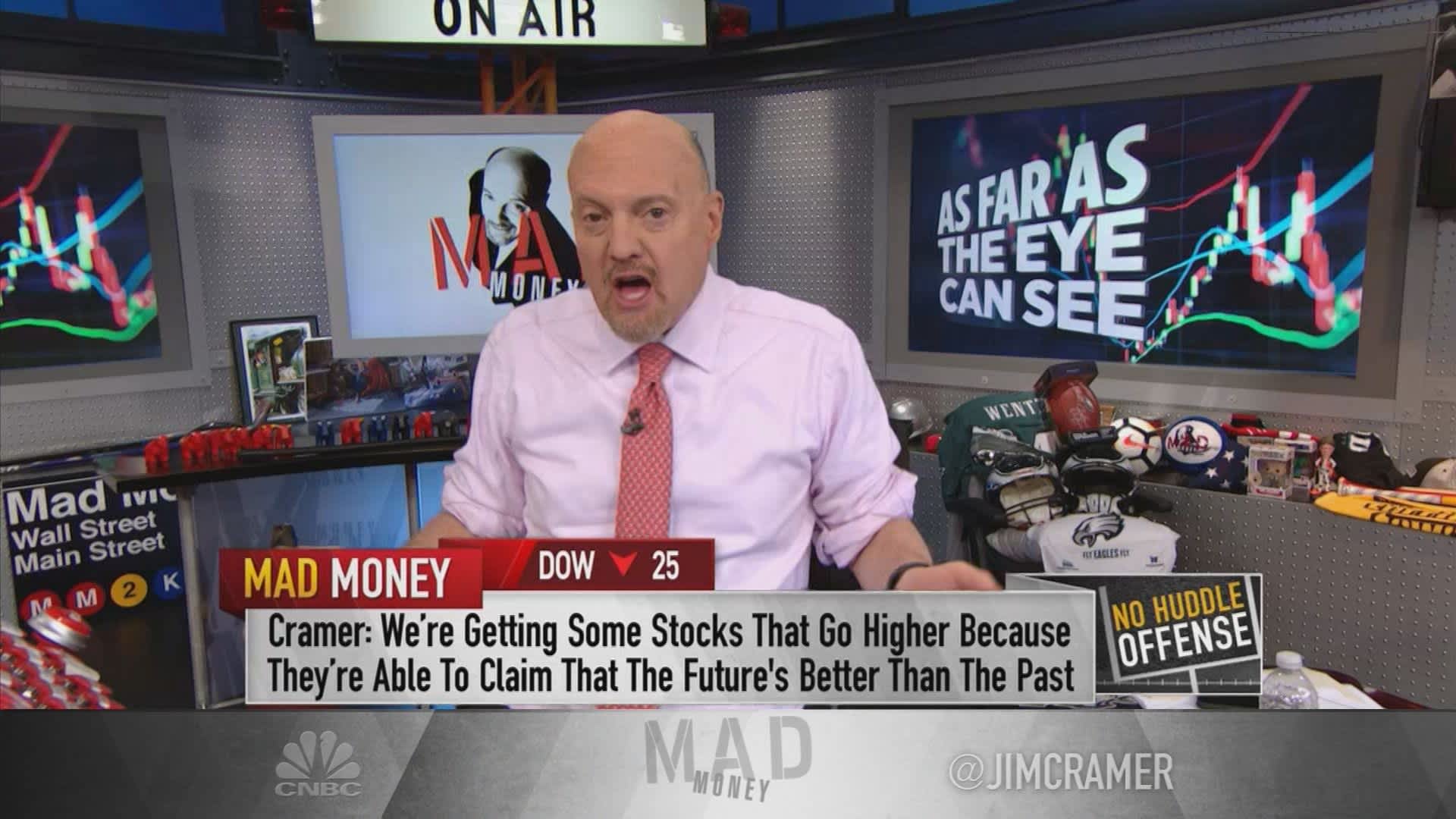

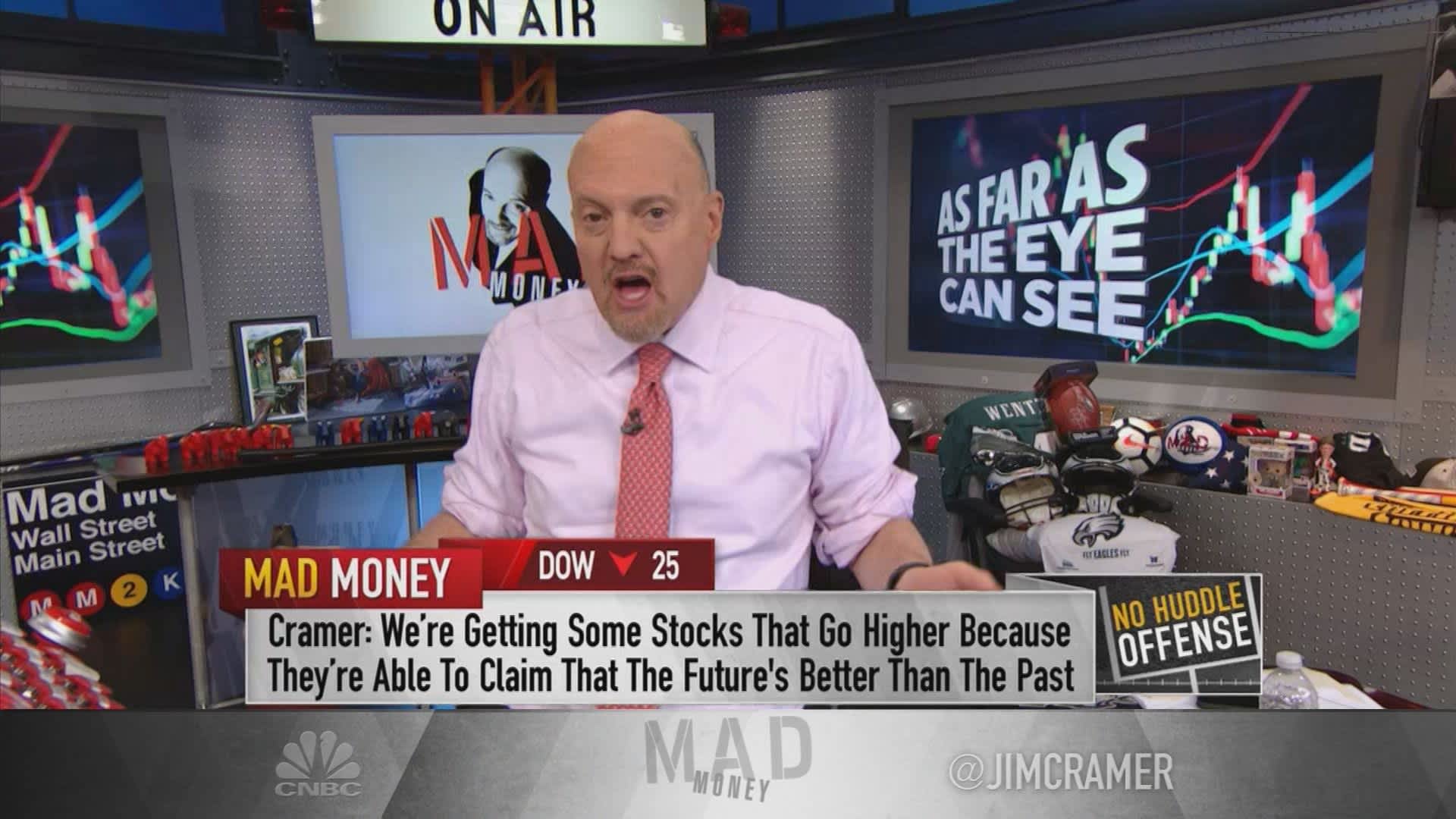

The Cramer Perspective

Jim Cramer's comments on CoreWeave have often been characterized as contrarian, varying from cautious optimism to more bullish pronouncements depending on the market conditions. Understanding the rationale behind his opinions is vital. He frequently highlights both the potential of the AI infrastructure market and the inherent volatility of investing in such a rapidly developing sector.

- Market Volatility: Cramer often emphasizes the significant price swings in CRWV stock, urging caution for risk-averse investors.

- Long-Term Potential: Despite acknowledging the risks, Cramer has also highlighted the potential for significant long-term growth within the AI infrastructure sector.

- Competitive Landscape: He often analyzes CoreWeave's positioning within the competitive landscape, weighing its strengths and potential vulnerabilities.

Analyzing the Contrarian View

Critically evaluating Cramer's pronouncements requires considering various factors beyond his pronouncements. A comprehensive analysis should include a detailed look at CoreWeave's financial performance, competitive landscape, and future growth projections.

- Market Valuation: Analyzing CoreWeave's market capitalization relative to its revenue and projected growth is essential to determine if the stock is overvalued or undervalued.

- Competitor Analysis: Comparing CoreWeave's offerings and capabilities to those of established cloud providers is crucial to assess its long-term viability.

- Future Growth Projections: Considering industry forecasts for AI infrastructure growth and CoreWeave's anticipated market share is key to evaluating its investment potential.

Risks and Opportunities in Investing in CoreWeave (CRWV)

Market Volatility and Risk Factors

Investing in high-growth technology companies, particularly in a volatile market like AI infrastructure, carries inherent risks. It’s vital to acknowledge these potential threats before investing in CoreWeave.

- Competition: Intense competition from established cloud providers and emerging players presents a significant challenge to CoreWeave's market share.

- GPU Dependency: CoreWeave's reliance on NVIDIA GPUs exposes it to potential supply chain disruptions and price fluctuations.

- Economic Downturn: A broader economic slowdown could significantly impact demand for AI-related cloud computing services.

Potential for High Returns

Despite the inherent risks, the potential for substantial returns in the AI infrastructure sector is undeniable. CoreWeave’s innovative strategies and strategic market positioning offer significant upside.

- Market Expansion: The AI market is expanding rapidly across various sectors, creating a substantial growth opportunity for CoreWeave.

- Increasing Demand: The escalating demand for specialized AI computing resources will likely fuel continued growth for CoreWeave.

- Innovative Strategies: CoreWeave's ongoing innovation and strategic partnerships can solidify its position as a leader in AI infrastructure.

Conclusion: CoreWeave (CRWV) – A Calculated Risk in the AI Infrastructure Landscape?

Jim Cramer's contrarian perspective on CoreWeave highlights the complexities and potential rewards within the AI infrastructure market. While the company presents significant opportunities, understanding the inherent risks – including market volatility and intense competition – is critical. Factors such as CoreWeave's dependence on specific GPU manufacturers and the impact of a potential economic downturn must be thoroughly considered. Before investing in CoreWeave (CRWV) or any AI infrastructure stock, conduct thorough due diligence. Analyze the company's financial performance, competitive landscape, and future growth projections, and consider both the bullish and bearish arguments before making any investment decisions. Remember, understanding the nuances of the AI infrastructure market and carefully weighing the risks is crucial to making informed investment choices in companies like CoreWeave.

Featured Posts

-

The David Walliams Britains Got Talent Controversy Explained

May 22, 2025

The David Walliams Britains Got Talent Controversy Explained

May 22, 2025 -

5 Circuits Velo Pour Explorer La Loire Nantes Et Son Estuaire

May 22, 2025

5 Circuits Velo Pour Explorer La Loire Nantes Et Son Estuaire

May 22, 2025 -

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025 -

Duong Cao Toc Dong Nai Vung Tau Du Kien Thong Xe 2 9

May 22, 2025

Duong Cao Toc Dong Nai Vung Tau Du Kien Thong Xe 2 9

May 22, 2025 -

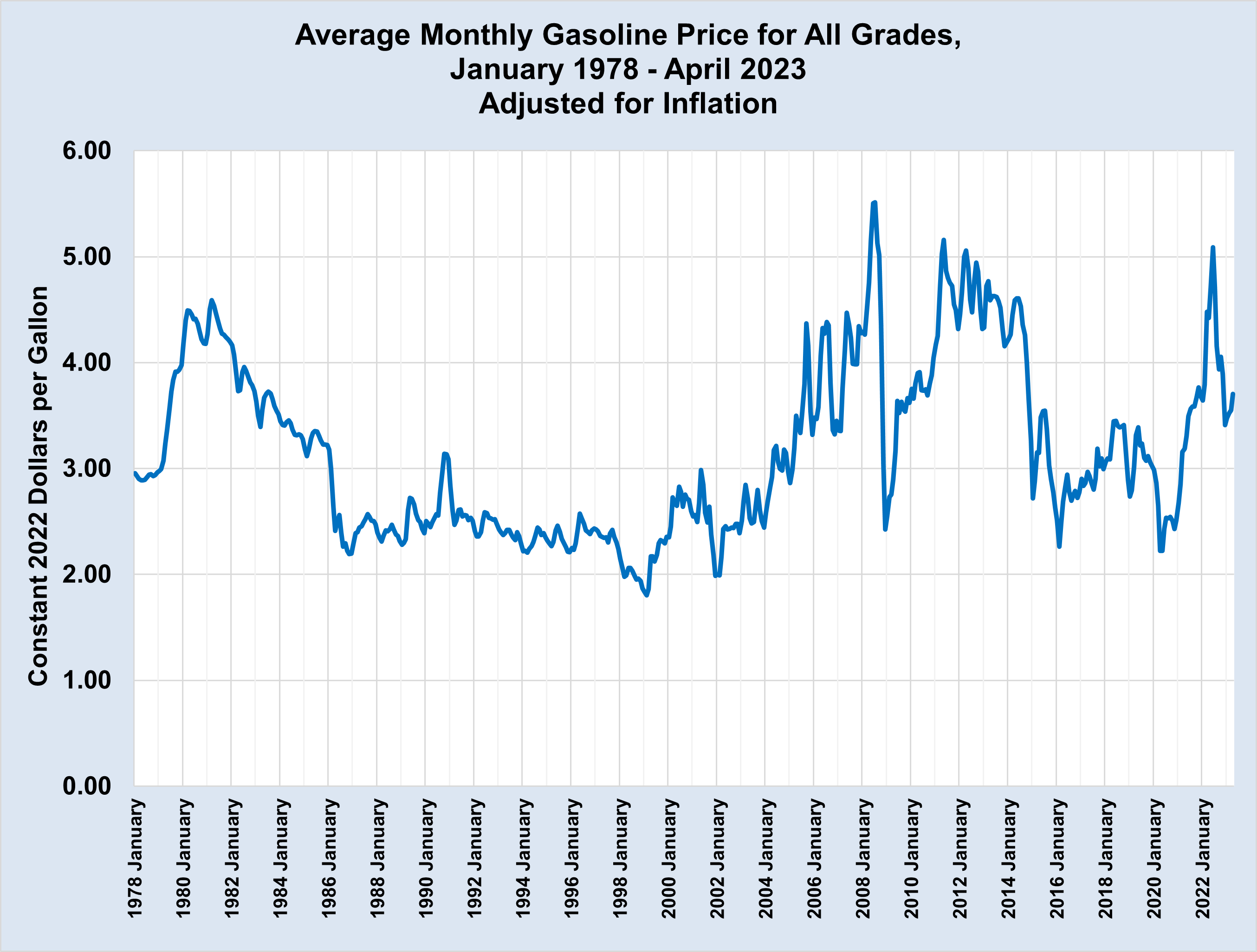

Average Gas Price Increase Up Nearly 20 Cents A Gallon

May 22, 2025

Average Gas Price Increase Up Nearly 20 Cents A Gallon

May 22, 2025

Latest Posts

-

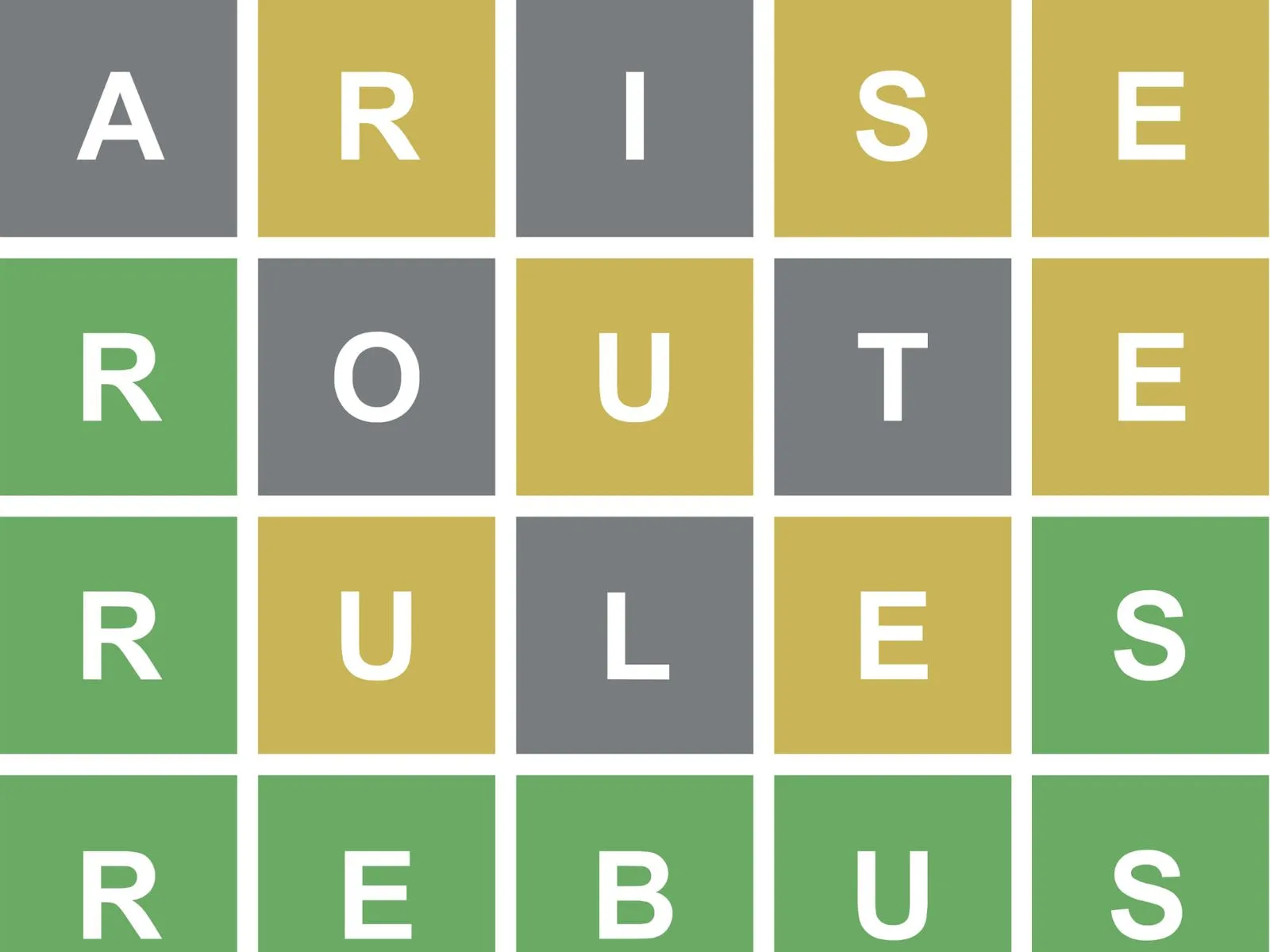

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025 -

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025 -

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025 -

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025