CoreWeave (CRWV): Jim Cramer's Bold AI Infrastructure Bet

Table of Contents

CoreWeave's Business Model and Competitive Advantages

CoreWeave offers a unique approach to cloud computing specifically tailored for the demanding needs of AI workloads. Unlike general-purpose cloud providers, CoreWeave focuses on delivering highly optimized, scalable, and sustainable infrastructure built around powerful GPUs (Graphics Processing Units). This GPU-centric infrastructure is crucial for training and deploying sophisticated AI models.

- Sustainable Cloud Computing: CoreWeave distinguishes itself with a commitment to sustainability, utilizing energy-efficient hardware and practices to minimize its environmental footprint. This resonates with environmentally conscious investors and aligns with growing corporate sustainability initiatives.

- Key Differentiators: Compared to giants like AWS, Google Cloud, and Azure, CoreWeave offers a more specialized and potentially cost-effective solution for AI-focused companies. This specialization allows for greater customization and optimization of resources, potentially leading to faster model training times and lower operational costs.

- Technological Advantages: CoreWeave's expertise lies in its ability to efficiently manage and scale large GPU clusters, providing clients with unparalleled processing power. This technological prowess is a key driver of its competitive advantage.

- Strategic Partnerships: Strong partnerships with leading technology companies further enhance CoreWeave's market position and provide access to cutting-edge technologies and expanded customer reach. These collaborative efforts are essential for maintaining a competitive edge in the rapidly evolving AI landscape.

- Keywords: CoreWeave cloud computing, AI infrastructure, GPU computing, sustainable cloud, cloud computing competitors

Market Opportunity and Growth Potential in AI Infrastructure

The market for AI infrastructure services is experiencing explosive growth, fueled by the increasing adoption of artificial intelligence across various industries. High-performance computing (HPC) solutions, like those offered by CoreWeave, are essential for handling the complex computations required by advanced AI models.

- Exponential Market Growth: Market forecasts project significant growth in the AI infrastructure market over the next several years, indicating a substantial opportunity for companies like CoreWeave to capture significant market share.

- High Demand for HPC: The demand for high-performance computing resources is escalating rapidly, driven by the need to train ever-larger and more complex AI models. CoreWeave is well-positioned to benefit from this growing demand.

- CoreWeave's Market Penetration: CoreWeave's strategic focus on a niche market within AI infrastructure allows for focused growth and efficient resource allocation. Their ability to capture market share will depend heavily on their continued innovation and ability to meet the evolving needs of their clients.

- Keywords: AI infrastructure market, high-performance computing, market growth, AI cloud computing

Financial Performance and Investment Analysis of CRWV

Analyzing CRWV stock requires a thorough examination of CoreWeave's financial statements, including revenue growth, profitability margins, and overall financial health. A comparison with industry peers is essential to understand CoreWeave's valuation and competitive standing.

- Revenue Growth & Profitability: Investors should carefully scrutinize CoreWeave's revenue streams, profitability, and its ability to manage costs effectively. Sustained revenue growth and increasing profitability are key indicators of a healthy and growing company.

- Valuation & Peer Comparison: Comparing CoreWeave's valuation metrics (such as Price-to-Earnings ratio) to those of its competitors provides context for its stock price and potential for future appreciation.

- Financial Risks & Uncertainties: Investing in CRWV carries inherent risks. These include the volatility of the technology sector, competition from established players, and potential economic downturns that could affect demand for AI services.

- Long-Term vs. Short-Term Investment: Investors should consider their own investment horizon and risk tolerance when evaluating CRWV. A long-term perspective might be more appropriate given the growth potential of the AI infrastructure market.

- Keywords: CRWV stock, CoreWeave financials, investment analysis, stock valuation, risk assessment

Jim Cramer's Recommendation and Expert Opinions

Jim Cramer's bullish stance on CoreWeave warrants careful consideration, but it shouldn't be the sole factor in your investment decision. It's crucial to review the opinions of other analysts and experts, considering their track records and potential biases.

- Cramer's Rationale: Understanding the specific reasons behind Cramer's positive outlook on CoreWeave is crucial for a comprehensive assessment. His reasoning should be weighed against other market analyses.

- Analyst Ratings & Expert Opinions: Consulting various financial news sources and analyst reports will provide a broader perspective on CoreWeave's investment prospects. Consider the consensus view and any significant divergence in opinions.

- Conflict of Interest & Bias: Always be aware of potential conflicts of interest or biases that might influence expert opinions. Independent analysis is crucial for forming an unbiased view.

- Keywords: Jim Cramer CoreWeave, analyst ratings, expert opinions, investment recommendations

Conclusion: CoreWeave (CRWV): A Promising, Yet Risky, Investment in AI Infrastructure

CoreWeave presents a compelling investment opportunity within the rapidly expanding AI infrastructure market. Its unique business model, focus on sustainability, and technological advantages offer significant potential for growth. However, investing in CRWV is not without risk. The competitive landscape is intense, and the company's financial performance will be a crucial determinant of its long-term success. Jim Cramer's endorsement is noteworthy, but investors should conduct their own thorough due diligence, considering both the potential rewards and the inherent risks. Before making any investment decisions, conduct further research, consult with a financial advisor, and carefully evaluate your own risk tolerance. Consider diversifying your portfolio to mitigate risk. Ultimately, the decision to invest in CoreWeave or other AI infrastructure companies rests on your own comprehensive analysis and investment strategy. Is CoreWeave the right AI infrastructure investment for you? *Keywords: CoreWeave investment, AI infrastructure investing, CRWV stock analysis, invest in CoreWeave

Featured Posts

-

Moncoutant Sur Sevre Et Clisson Evolution Et Diversification Economique

May 22, 2025

Moncoutant Sur Sevre Et Clisson Evolution Et Diversification Economique

May 22, 2025 -

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025 -

How To Survive A Screen Free Week With Kids

May 22, 2025

How To Survive A Screen Free Week With Kids

May 22, 2025 -

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025 -

Prediksi Juara Premier League 2024 2025 Akankah Liverpool Menang

May 22, 2025

Prediksi Juara Premier League 2024 2025 Akankah Liverpool Menang

May 22, 2025

Latest Posts

-

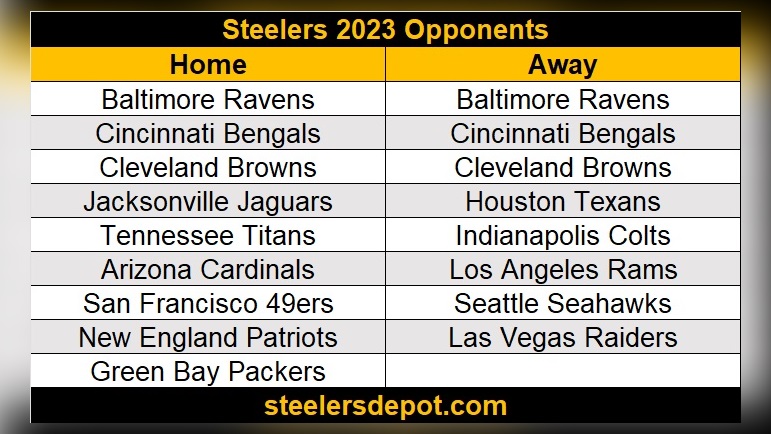

Analyzing The Pittsburgh Steelers 2024 Schedule Key Takeaways

May 22, 2025

Analyzing The Pittsburgh Steelers 2024 Schedule Key Takeaways

May 22, 2025 -

Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025

Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025 -

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025 -

Steelers Nfl Draft Plans The Case For A New Quarterback

May 22, 2025

Steelers Nfl Draft Plans The Case For A New Quarterback

May 22, 2025 -

Pittsburgh Steelers Insider Explains Pickens Trade Decision

May 22, 2025

Pittsburgh Steelers Insider Explains Pickens Trade Decision

May 22, 2025