CoreWeave (CRWV) Stock Down On Thursday: What Investors Need To Know

Table of Contents

Understanding CoreWeave's Business Model and Recent Performance

CoreWeave is a rapidly growing player in the cloud computing industry, specializing in providing high-performance computing infrastructure, particularly geared towards the burgeoning artificial intelligence (AI) market. Their focus on providing powerful, scalable solutions for AI workloads has positioned them for significant growth in a sector experiencing explosive demand. However, recent performance leading up to Thursday’s drop presents a more nuanced picture. While revenue growth has been impressive, profitability remains a key focus area for the company.

Recent announcements and news surrounding CoreWeave have also played a role. For instance, [insert any specific recent news, partnerships or announcements here, linking to reliable sources]. This information needs to be contextualized to its impact on the stock price.

- Revenue figures for the last quarter: [Insert actual figures and a comparison to previous quarters if available. Source the information.]

- Key partnerships and clients: [List key partnerships and clients, highlighting their significance. Source the information.]

- Market share compared to competitors: [Provide estimates of market share and comparison to key competitors like AWS, Google Cloud, Azure, etc. Source the information.]

- Growth projections and potential: [Discuss analyst growth projections and the overall potential for CoreWeave in the long term. Source the information.]

Analyzing the Factors Contributing to Thursday's Stock Drop

Thursday's significant drop in CRWV stock price can be attributed to a confluence of factors, ranging from broader market trends to company-specific news and shifting investor sentiment.

Broader Market Trends

The overall market environment played a significant role. The tech sector, as a whole, has experienced a downturn in recent months, influenced by factors such as rising interest rates, increased market volatility, and concerns about a potential recession. This broader tech stock downturn certainly impacted investor confidence in growth stocks like CoreWeave. The rise in interest rates also makes borrowing more expensive, potentially impacting CoreWeave's expansion plans and profitability.

- Market Volatility Index (VIX): [Insert data about the VIX on Thursday to illustrate market volatility.]

- Interest Rate Hikes: [Mention the recent interest rate hikes by the Federal Reserve and their impact on the tech sector.]

Company-Specific News

While no major negative news directly from CoreWeave was released on Thursday, [mention any relevant rumors, speculation, or indirect news impacting the company's perception, citing sources]. Absence of positive news in a generally negative market sentiment may have also contributed to the sell-off.

- CRWV Press Releases: [Check for any press releases issued in the days leading up to Thursday's drop.]

- Earnings Report (if applicable): [Analyze any recent earnings reports for potential hints at upcoming challenges.]

Analyst Ratings and Price Target Changes

Changes in analyst ratings and price targets can significantly influence investor sentiment. Any downgrades or reductions in price targets by prominent analysts could have contributed to the selling pressure.

- Analyst Ratings: [Cite specific examples of analyst rating changes, if available, and their justifications.]

- Price Target Adjustments: [Mention any significant downward revisions of price targets by analysts and their reasoning.]

Investor Sentiment and Trading Volume

Unusual trading activity, such as increased short selling or a significant shift in investor sentiment, can amplify downward pressure on a stock. Examining trading volume on Thursday can provide insights into the extent of selling pressure.

- Trading Volume: [Compare Thursday's trading volume to the average daily volume to identify unusual activity.]

- Short Interest: [If available, mention the short interest data for CRWV to understand the extent of bearish bets.]

How to Approach CoreWeave (CRWV) Stock After the Drop

The drop in CRWV stock presents both risks and opportunities for investors. The approach should depend on individual investment goals, risk tolerance, and time horizon.

Long-Term Investment Perspective

For long-term investors with a high risk tolerance, the drop could be seen as a potential buying opportunity. CoreWeave operates in a rapidly growing sector, and its long-term prospects remain promising. However, thorough due diligence and understanding the company's fundamentals are essential before making any investment decisions.

- Long-term growth potential: [Reiterate the long-term potential of the AI cloud computing market and CoreWeave's position within it.]

- Competitive landscape analysis: [Analyze CoreWeave's competitive advantages and disadvantages compared to industry giants.]

Short-Term Trading Strategies

Short-term trading strategies should be approached with caution. The volatility of CRWV stock makes it a risky proposition for short-term traders. Day trading or swing trading requires significant expertise and risk management skills.

- Risk Management: [Emphasize the importance of setting stop-loss orders and limiting potential losses.]

- Technical Analysis: [Mention the use of technical indicators to identify potential entry and exit points, while acknowledging the limitations of this approach.]

Diversification and Risk Management

Regardless of investment strategy, diversification and risk management are paramount. Never put all your eggs in one basket. A well-diversified portfolio can mitigate risk and protect your investment.

- Portfolio diversification: [Encourage readers to spread their investments across different asset classes.]

- Risk tolerance assessment: [Suggest readers assess their own risk tolerance before making any investment decisions.]

Conclusion

The decline in CoreWeave (CRWV) stock on Thursday was a result of a combination of broader market conditions, potential company-specific concerns, and shifting investor sentiment. Understanding the company's fundamentals, analyzing market conditions, and carefully assessing your own risk tolerance are crucial before investing in CRWV stock or any other stock. While the drop presents potential opportunities for long-term investors, it also highlights the inherent risks involved. Conduct thorough research, consult a financial advisor if needed, and make informed decisions regarding your CoreWeave (CRWV) stock investment. Invest wisely.

Featured Posts

-

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025 -

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025 -

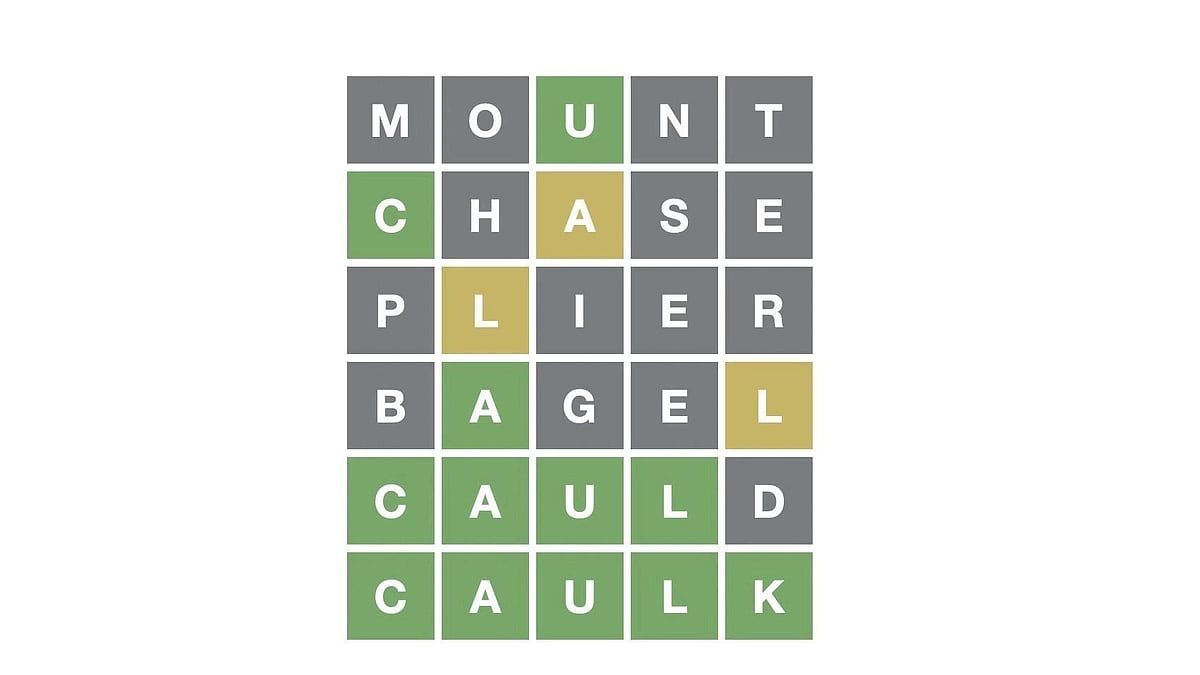

Wordle 367 March 17th Hints Clues And The Solution

May 22, 2025

Wordle 367 March 17th Hints Clues And The Solution

May 22, 2025 -

Where To Buy High Quality Cassis Blackcurrant

May 22, 2025

Where To Buy High Quality Cassis Blackcurrant

May 22, 2025 -

Risicos Van Goedkope Arbeidsmigranten Voor Voedingsbedrijven Analyse Abn Amro

May 22, 2025

Risicos Van Goedkope Arbeidsmigranten Voor Voedingsbedrijven Analyse Abn Amro

May 22, 2025

Latest Posts

-

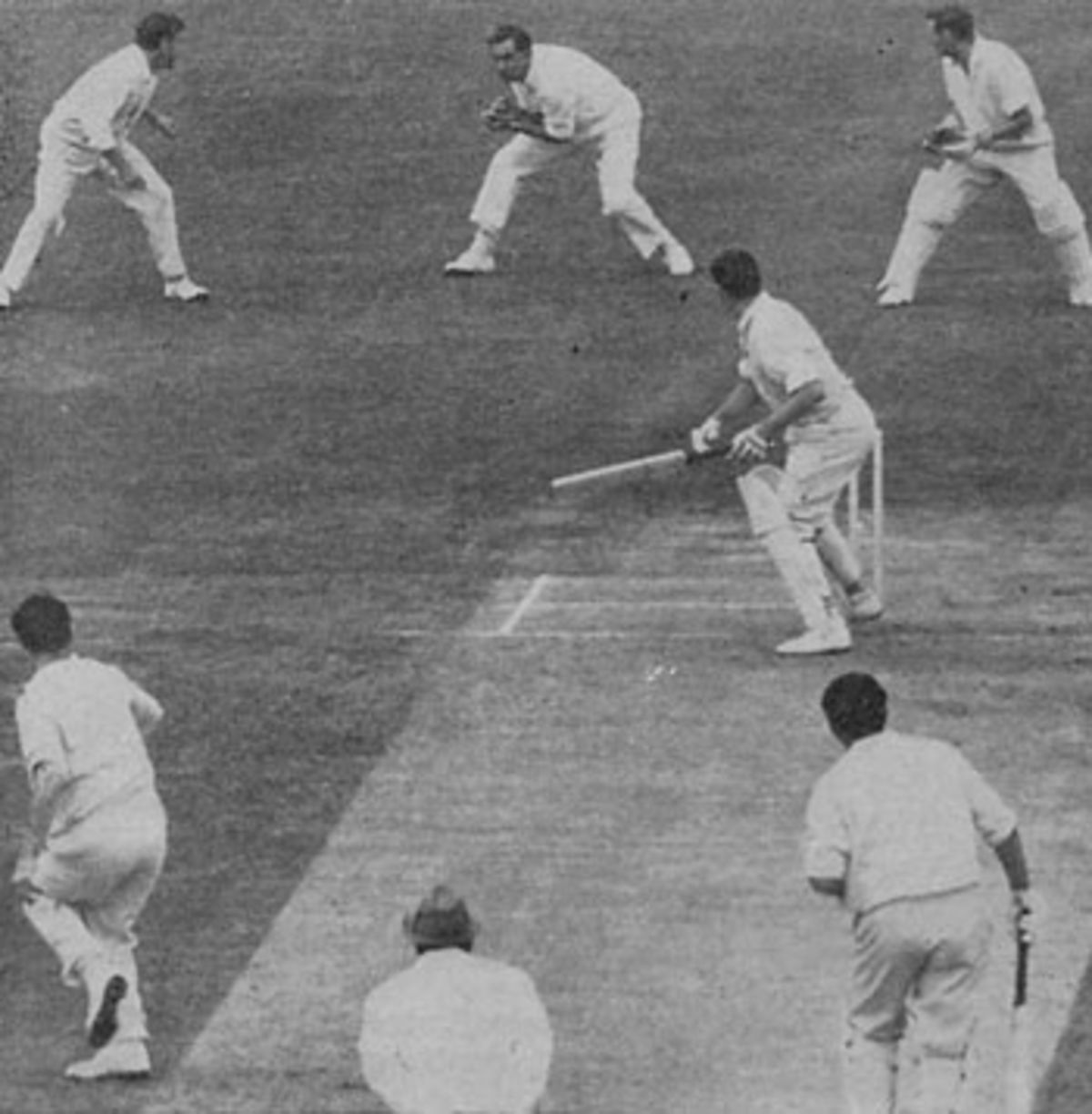

Zimbabwes Muzarabani Eyes 100 Test Wickets

May 23, 2025

Zimbabwes Muzarabani Eyes 100 Test Wickets

May 23, 2025 -

One Off Test Englands Team Selection Against Zimbabwe

May 23, 2025

One Off Test Englands Team Selection Against Zimbabwe

May 23, 2025 -

Muzarabanis 100 Test Wicket Target A Realistic Dream

May 23, 2025

Muzarabanis 100 Test Wicket Target A Realistic Dream

May 23, 2025 -

Englands Test Squad Revealed Zimbabwe Match

May 23, 2025

Englands Test Squad Revealed Zimbabwe Match

May 23, 2025 -

Englands Xi For Zimbabwe Test Revealed

May 23, 2025

Englands Xi For Zimbabwe Test Revealed

May 23, 2025