CoreWeave (CRWV) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Analyzing the Factors Contributing to CRWV's Stock Drop

Several factors likely converged to cause Thursday's dramatic CRWV stock market plunge. Understanding these interconnected elements is crucial for interpreting the situation and formulating future investment strategies.

Negative Investor Sentiment and Market Volatility

Thursday's broader market conditions played a significant role in CRWV's decline. The overall negative sentiment across the tech sector, particularly impacting AI-related companies, likely amplified the downward pressure on CRWV stock. Increased interest rates and concerns about a potential recession further exacerbated investor anxiety.

- Dow Jones Industrial Average closed down 300 points. (This is an example, replace with actual data)

- Negative sentiment towards AI stocks due to concerns over regulatory scrutiny and potential antitrust investigations.

- Increased interest rates impacting growth stocks like CRWV, making them less attractive compared to safer investments.

- Broader tech sell-off fueled by profit-taking after a period of strong performance in the sector.

Lack of Positive Catalysts and Recent Company News

The absence of positive catalysts and potentially disappointing news surrounding CoreWeave also contributed to the negative investor sentiment. While the company has generally performed well, a lack of significant announcements or perhaps missed expectations could have fueled selling pressure.

- Absence of major contract announcements with large enterprise clients.

- Potential concerns regarding future revenue growth, stemming from increased competition in the cloud computing and AI space.

- Analyst downgrades or price target reductions from leading financial institutions following a reassessment of CRWV's outlook.

- No significant positive news to counteract the prevailing negative market sentiment.

Technical Analysis and Trading Activity

Analyzing the CRWV stock chart reveals significant sell-offs and unusual trading activity on Thursday. High trading volume coupled with a break below key support levels indicate a considerable shift in investor sentiment.

- CRWV stock chart showed a dramatic price drop, exceeding X% within a single trading day. (Replace X with actual percentage)

- Trading volume on Thursday significantly surpassed average daily volume, indicating strong selling pressure.

- Potential for increased short selling activity, further driving down the stock price.

- Break below key support levels on the CRWV stock chart suggesting a possible continuation of the downward trend.

Long-Term Implications and Future Outlook for CRWV Stock

Assessing the sustainability of Thursday's decline requires a careful evaluation of CoreWeave's long-term fundamentals and its position within the broader market landscape.

Assessing the Sustainability of the Decline

Whether the decline is a temporary correction or signals a more significant shift in investor sentiment remains to be seen. CoreWeave's strong fundamentals in a high-growth sector should be considered. However, short-term market volatility and the impact of macroeconomic factors should not be ignored.

- CRWV's performance compared to competitors in the cloud computing and AI infrastructure market remains relatively strong. (Include comparative data)

- Long-term growth potential remains significant, given the increasing demand for AI and cloud-based solutions.

- Company's financial health and cash reserves should be assessed to determine resilience to short-term market pressures.

Strategies for Investors

Investors facing this situation need a measured approach, aligning their strategies with their individual risk tolerance and investment goals.

- Buy the dip strategy: For long-term investors with a high-risk tolerance, the decline could represent a buying opportunity.

- Hold strategy: Maintaining existing positions may be appropriate for investors confident in CRWV's long-term prospects.

- Sell strategy: Selling may be considered by investors with lower risk tolerance or those needing to secure profits.

Conclusion

Thursday's sharp decline in CoreWeave (CRWV) stock was likely a confluence of negative market sentiment, a lack of positive company-specific news, and significant technical selling pressure. While the short-term outlook remains uncertain, investors should carefully consider CRWV's long-term fundamentals and the potential for recovery within the broader growth of the AI and cloud computing sectors. Monitoring CRWV stock closely, staying updated on CoreWeave's announcements, and conducting thorough due diligence are crucial for making informed investment decisions. Continue to monitor CRWV stock and stay informed about developments affecting the company and the broader market before making any investment decisions. Conduct your own research and consult with a financial advisor before investing in CRWV stock or any other security.

Featured Posts

-

Cassis Blackcurrant From Berry To Bottle A Production Overview

May 22, 2025

Cassis Blackcurrant From Berry To Bottle A Production Overview

May 22, 2025 -

Nederlandse Huizenmarkt Verschillende Perspectieven Van Abn Amro En Geen Stijl

May 22, 2025

Nederlandse Huizenmarkt Verschillende Perspectieven Van Abn Amro En Geen Stijl

May 22, 2025 -

David Walliams Britains Got Talent Departure The Story

May 22, 2025

David Walliams Britains Got Talent Departure The Story

May 22, 2025 -

Sejarah Kesuksesan Liverpool Analisis Pelatih Yang Membawa The Reds Juara Liga Inggris

May 22, 2025

Sejarah Kesuksesan Liverpool Analisis Pelatih Yang Membawa The Reds Juara Liga Inggris

May 22, 2025 -

Beenie Mans New York Takeover Is It A Streaming Event

May 22, 2025

Beenie Mans New York Takeover Is It A Streaming Event

May 22, 2025

Latest Posts

-

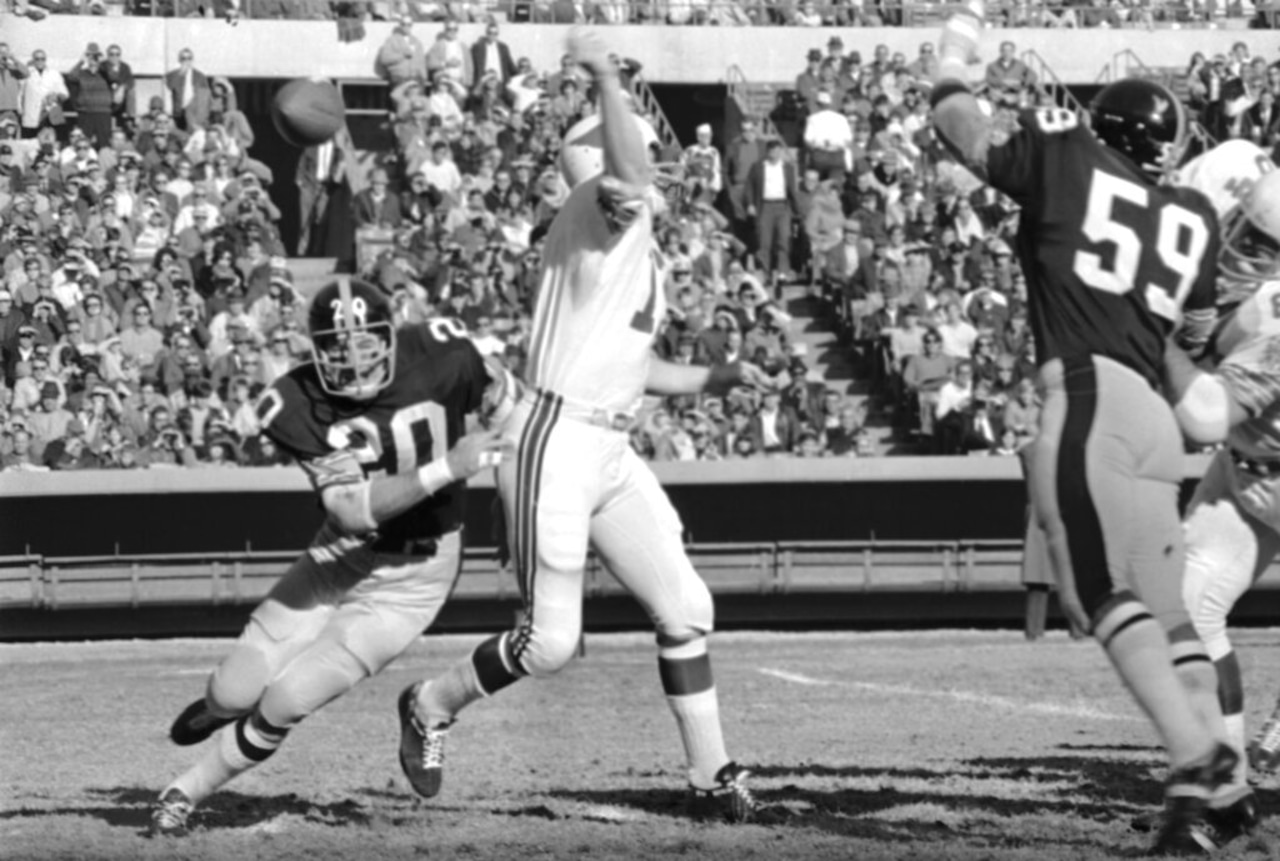

Ray Seals Pittsburgh Steelers Legend Dead At 59

May 22, 2025

Ray Seals Pittsburgh Steelers Legend Dead At 59

May 22, 2025 -

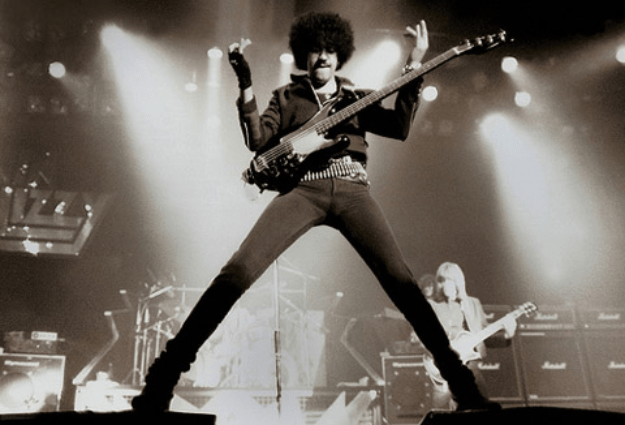

Remembering Adam Ramey Vocalist Of Dropout Kings Passes Away

May 22, 2025

Remembering Adam Ramey Vocalist Of Dropout Kings Passes Away

May 22, 2025 -

Remembering Band Name S Frontman A Celebration Of His Life And Music At 32

May 22, 2025

Remembering Band Name S Frontman A Celebration Of His Life And Music At 32

May 22, 2025 -

Tragedy Strikes Popular Rock Band Loses Frontman At 32

May 22, 2025

Tragedy Strikes Popular Rock Band Loses Frontman At 32

May 22, 2025 -

Rock Icon Dead At 32 A Legacy Cut Short

May 22, 2025

Rock Icon Dead At 32 A Legacy Cut Short

May 22, 2025