CoreWeave (CRWV) Stock Price Action On Tuesday: An In-depth Look

Table of Contents

Pre-Market and Opening Bell Activity for CRWV

The pre-market for CRWV showed a slight upward trend, suggesting positive sentiment before the opening bell. The stock opened at [Insert Opening Price Here], a [Insert Percentage Change - e.g., 2%] increase compared to the previous day's closing price. Several factors may have contributed to this positive start:

- Positive Analyst Ratings: Any positive analyst reports released prior to market open could have influenced investor confidence.

- Industry News: Positive developments within the cloud computing sector or announcements from competitors could have had a ripple effect on CRWV's stock.

- Overall Market Sentiment: A generally positive market mood often spills over into individual stocks, particularly those in growth sectors.

We can visualize this pre-market and opening activity with a chart showing the price movement from the previous day's close to the opening bell. [Insert Chart Here]. Note the relatively high trading volume in the pre-market, indicating significant investor interest. This high CoreWeave pre-market trading volume is a key indicator to watch.

Intraday Price Swings and Volume Analysis for CoreWeave (CRWV)

Tuesday's trading session for CRWV was marked by considerable intraday volatility. The stock reached a high of [Insert High Price Here] and a low of [Insert Low Price Here], showcasing a significant price swing of [Calculate Percentage Change]. Analyzing the trading volume throughout the day reveals some interesting insights:

- High Volume Periods: Periods of high trading volume often coincided with significant price movements, suggesting that these fluctuations were driven by substantial buying or selling pressure.

- Low Volume Periods: Periods of low volume saw more muted price changes, indicating less intense trading activity.

- News Impact: Any news releases or announcements related to CoreWeave or the broader market during the day likely influenced these intraday price swings.

[Insert Chart Here] showing the intraday CRWV price and volume will clearly illustrate these fluctuations. The chart will help identify potential correlations between price movements and trading volume. This detailed CoreWeave intraday analysis helps understand market sentiment.

After-Hours Trading and Implications for CRWV Investors

After-hours trading for CRWV saw [Insert Percentage Change and Direction - e.g., a 1% decrease]. This post-market movement could be attributed to various factors:

- Late-Breaking News: Any news released after the market closed might have influenced investor sentiment and resulted in the after-hours price change.

- Delayed Reactions: Investors may have reacted to earlier events or news during the regular trading session after the market closed.

- Overall Market Conditions: The overall market's performance after hours also plays a role in determining the price movements of individual stocks.

Understanding CoreWeave after-hours trading is crucial for investors who want to anticipate the next day's opening price. The CRWV closing price after the post-market trading session is a significant data point for predicting future trends.

Comparing CRWV Performance to Market Benchmarks

Comparing CRWV's performance on Tuesday to relevant market indices like the Nasdaq and S&P 500 provides valuable context. If the Nasdaq and S&P 500 experienced [Insert Market Performance - e.g., a slight decline], and CRWV showed a more significant decline, it could indicate specific sector-related headwinds or investor sentiment against the stock. Conversely, outperformance could signify investor confidence in the company's prospects. This CoreWeave market performance comparison gives a clearer picture of the stock's strength relative to broader market trends.

Conclusion: Understanding CoreWeave (CRWV) Stock Price Action and Future Outlook

Tuesday's trading activity for CoreWeave (CRWV) highlighted significant volatility, driven by a combination of pre-market trends, intraday swings, and after-hours movements. The analysis of trading volume and comparison with market benchmarks helps contextualize these fluctuations. While this analysis offers insights into CRWV's recent performance, it's crucial to remember that predicting future price movements is inherently uncertain. Stay informed about CoreWeave (CRWV) stock price action and continue your own in-depth research to make informed investment choices. Remember to diversify your portfolio and always consult with a financial advisor before making any investment decisions related to CRWV stock or any other security.

Featured Posts

-

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025 -

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

May 22, 2025

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

May 22, 2025 -

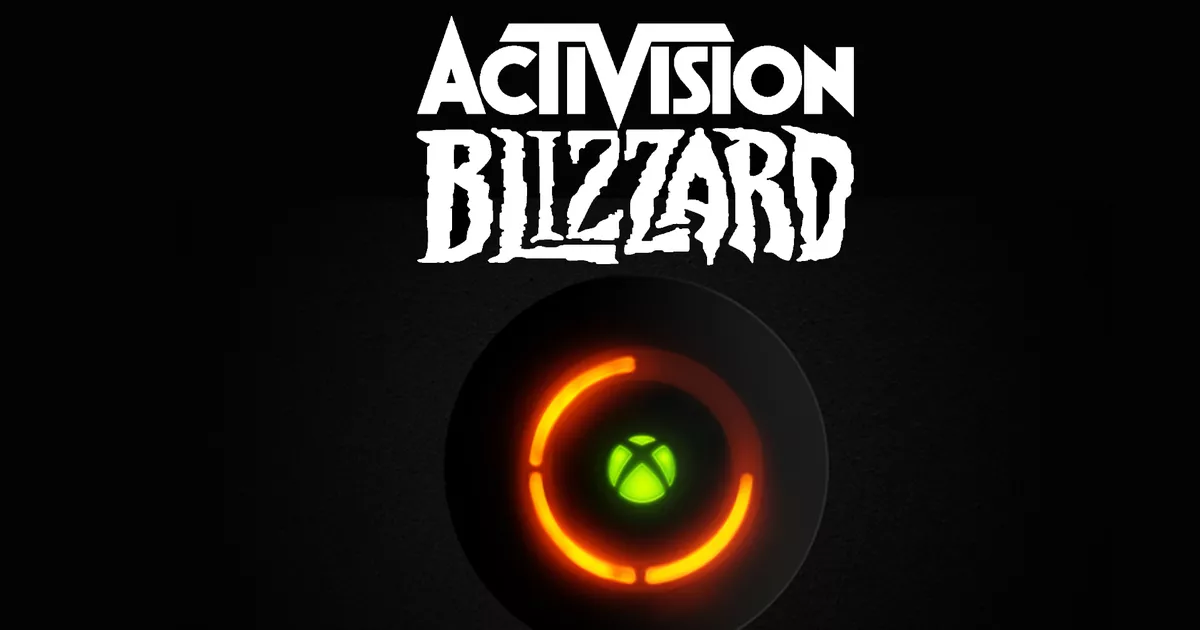

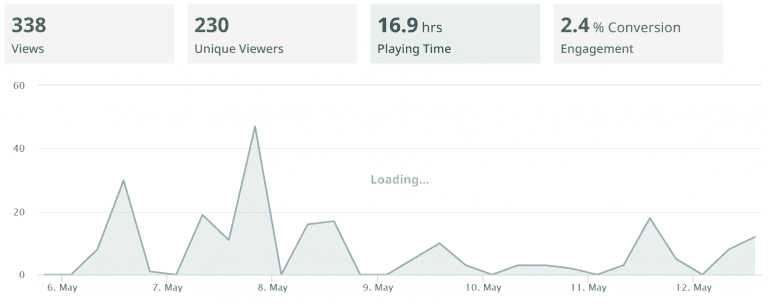

The Messy Truth How Streamer Monetization Affects The Viewer Experience

May 22, 2025

The Messy Truth How Streamer Monetization Affects The Viewer Experience

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Strategies

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Strategies

May 22, 2025 -

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025

Latest Posts

-

Analyzing The Karate Kid Fighting Techniques And Philosophical Insights

May 23, 2025

Analyzing The Karate Kid Fighting Techniques And Philosophical Insights

May 23, 2025 -

The Karate Kid A Deeper Dive Into The Characters And Themes

May 23, 2025

The Karate Kid A Deeper Dive Into The Characters And Themes

May 23, 2025 -

Big Rig Rock Report 3 12 And Laser 101 7 Technical Deep Dive

May 23, 2025

Big Rig Rock Report 3 12 And Laser 101 7 Technical Deep Dive

May 23, 2025 -

The Karate Kids Impact How A Movie Shaped A Generation

May 23, 2025

The Karate Kids Impact How A Movie Shaped A Generation

May 23, 2025 -

The Karate Kid Exploring The Films Enduring Popularity

May 23, 2025

The Karate Kid Exploring The Films Enduring Popularity

May 23, 2025