CoreWeave Initial Public Offering: $40 Listing Price Announced

Table of Contents

CoreWeave's Business Model and Market Position

CoreWeave's success is built on a foundation of innovative technology and strategic positioning within the booming cloud computing and artificial intelligence (AI) sectors.

Dominating the AI Infrastructure Landscape

CoreWeave's specialized infrastructure, built for high-performance computing, positions it as a key beneficiary of the exploding AI market. They provide cloud computing services meticulously optimized for AI workloads, including machine learning and deep learning applications. This focus gives them a significant competitive edge.

- Focus on GPU-accelerated computing: CoreWeave leverages the power of Graphics Processing Units (GPUs) to deliver unparalleled performance for AI training and inference. This is crucial for the demanding computational needs of modern AI algorithms.

- Strategic partnerships with leading AI companies: CoreWeave has forged strong partnerships with key players in the AI industry, providing them with access to cutting-edge infrastructure and expertise. This network further solidifies their position in the market.

- High growth potential within the expanding AI sector: The global AI market is experiencing exponential growth, and CoreWeave is ideally positioned to capture a substantial share of this expanding market. This offers investors significant long-term growth potential.

Competitive Advantages and Scalability

CoreWeave's success isn't just about providing powerful computing; it's about doing it efficiently and sustainably. Their technological edge and scalability are key differentiators.

- Efficient and cost-effective data center operations: CoreWeave’s data centers are designed for optimal energy efficiency, reducing operational costs and minimizing environmental impact. This allows them to offer competitive pricing to their clients.

- Advanced cooling technologies for optimal performance: Innovative cooling solutions ensure that their servers operate at peak performance, preventing overheating and maximizing uptime. This reliability is crucial for AI workloads which are often computationally intensive.

- Superior network connectivity and low latency: CoreWeave provides high-bandwidth, low-latency network connectivity, ensuring rapid data transfer and minimal delays. This is essential for the real-time processing often required in AI applications.

The $40 Listing Price: Analysis and Implications

The $40 listing price for the CoreWeave IPO is a significant data point, offering insights into market expectations and investor sentiment.

Valuation and Investor Sentiment

The $40 per share price reflects a strong valuation, driven by CoreWeave's impressive growth trajectory and the high demand for AI infrastructure.

- Comparison with other cloud computing IPOs: Compared to recent cloud computing IPOs, CoreWeave's valuation is competitive, reflecting its strong market position and growth potential. Analysts are comparing its potential to established players.

- Expected market capitalization post-IPO: The IPO is expected to result in a substantial market capitalization, solidifying CoreWeave's position as a major player in the cloud computing sector.

- Analyst predictions and ratings: Many financial analysts have issued positive ratings and price targets for CoreWeave, indicating a bullish outlook.

Risks and Opportunities for Investors

While the CoreWeave IPO presents substantial opportunities, investors should also be aware of potential risks.

- Potential for high growth in the long term: The long-term growth potential in the AI and cloud computing sectors is significant, offering investors the chance for substantial returns.

- Exposure to the rapidly evolving AI industry: Investing in CoreWeave provides exposure to the dynamic and rapidly evolving AI industry. This comes with both risks and rewards.

- Risks associated with a highly competitive market: The cloud computing market is highly competitive. CoreWeave faces competition from established players and new entrants.

The IPO Process and Timeline

Understanding the timeline and key players involved in the CoreWeave IPO is crucial for potential investors.

Key Dates and Milestones

The CoreWeave IPO process involves several key dates and milestones. Precise dates should be verified through official announcements.

- Official announcement date: The official announcement of the $40 listing price marked a key milestone in the IPO process.

- Expected trading start date: The official trading debut date will be widely publicized once confirmed.

- Lock-up period details: The lock-up period, during which early investors cannot sell their shares, will be detailed in the IPO prospectus.

Underwriters and Advisors

Several investment banks and advisors play key roles in the CoreWeave IPO.

- Lead underwriters and their roles: The lead underwriters are responsible for managing the offering and marketing the shares to investors. Their experience and reputation are vital to the IPO's success.

- Other key advisors and their expertise: A team of legal, financial, and other advisors provide expertise to guide CoreWeave through the complexities of the IPO process.

Conclusion

The CoreWeave IPO, with its $40 listing price, represents a significant opportunity within the rapidly expanding cloud computing and AI sectors. The company’s strong market position, technological advantages, and the immense growth potential of the AI sector make it an attractive investment opportunity. However, investors should carefully consider the associated risks, including the competitive landscape and market volatility, before making any investment decisions. Thorough due diligence is essential.

Call to Action: Stay informed about the CoreWeave Initial Public Offering and its progress. Research the CoreWeave investment opportunity thoroughly before investing. Consider consulting with a financial advisor to assess your risk tolerance and make an informed decision about investing in the CoreWeave IPO or other similar cloud computing and AI infrastructure investments.

Featured Posts

-

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson

May 22, 2025

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson

May 22, 2025 -

Market Reaction To Core Weave Crwv Stock On Tuesday Causes And Impacts

May 22, 2025

Market Reaction To Core Weave Crwv Stock On Tuesday Causes And Impacts

May 22, 2025 -

Vidmova Ukrayini Vid Nato Poglyad Z Yevropi Ta Potentsiyni Zagrozi

May 22, 2025

Vidmova Ukrayini Vid Nato Poglyad Z Yevropi Ta Potentsiyni Zagrozi

May 22, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

May 22, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

May 22, 2025 -

Dak Lak Phu Yen Chay Bo Hon 200km Hon 200 Nguoi Tham Gia

May 22, 2025

Dak Lak Phu Yen Chay Bo Hon 200km Hon 200 Nguoi Tham Gia

May 22, 2025

Latest Posts

-

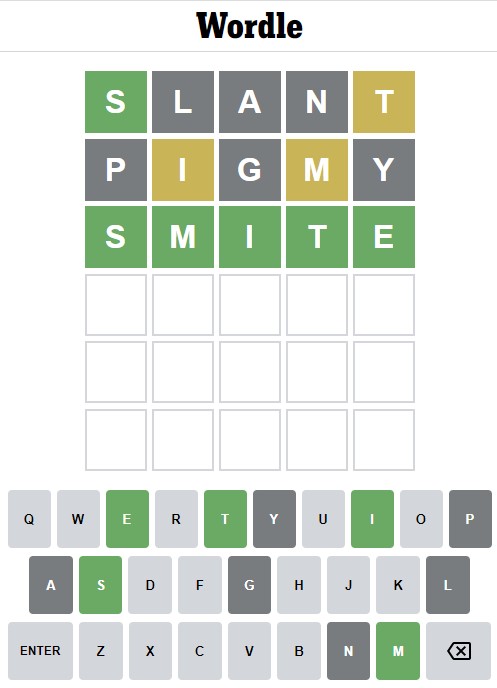

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025 -

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025 -

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025