CoreWeave's (CRWV) Thursday Stock Rally: A Detailed Analysis

Table of Contents

1. Main Points: Deconstructing the CoreWeave (CRWV) Stock Rally

H2: Market Sentiment and Investor Confidence

The overall market sentiment on Thursday played a role in CRWV's positive performance. While a broader positive trend in the tech sector might have contributed, specific factors related to CoreWeave itself were likely more influential. The cloud computing sector, and particularly companies focused on AI infrastructure like CoreWeave, has experienced significant investor interest recently due to the rapid growth of artificial intelligence applications. This positive sentiment toward the sector likely boosted investor confidence in CRWV.

Several factors further fueled positive investor sentiment:

- Positive analyst ratings or upgrades: Any recent upgrades from prominent financial analysts would have significantly impacted CRWV's stock price. Positive outlook reports often translate to increased buying pressure.

- Increased institutional investment: Large institutional investors often signal confidence in a company by increasing their holdings. News of significant institutional investment in CRWV would likely contribute to a stock price surge.

- Positive media coverage: Favorable articles and news reports highlighting CoreWeave's technology, partnerships, or growth potential could have positively influenced investor sentiment. Positive press can drive increased interest and demand.

- Successful product launches or partnerships: Announcements of new products, successful partnerships, or significant contract wins would create positive momentum, influencing the stock price positively.

H2: Technical Analysis of CRWV Stock Performance

A technical analysis of CRWV's stock chart on Thursday reveals key indicators that contributed to the rally. Examining the price action leading up to and including the surge provides further insight.

- Breakout from a previous resistance level: A decisive break above a key resistance level – a price point that had previously capped price increases – often signals increased bullish momentum and attracts further buying.

- Increased trading volume: A significant increase in trading volume accompanying the price increase confirms the strength of the move and indicates strong investor participation. High volume breakouts are usually more sustainable.

- Positive RSI or MACD readings: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can signal overbought or oversold conditions. Positive readings suggest further upward potential.

- Analysis of candlestick patterns: Specific candlestick patterns, such as bullish engulfing patterns or hammer candles, can provide additional confirmation of the bullish trend and contribute to investor confidence.

H2: Fundamental Analysis: Assessing CoreWeave's (CRWV) Business Performance

Beyond market sentiment and technical analysis, CoreWeave's fundamental business performance provides a crucial perspective on the stock rally. The company's strong positioning in the rapidly expanding AI infrastructure market is a key driver of investor interest.

- Recent earnings reports and future projections: Strong earnings reports exceeding expectations and positive future projections instill confidence in the company's growth trajectory. Positive financial news directly impacts stock prices.

- Contract wins and strategic partnerships: Securing major contracts and forging strategic partnerships with leading technology companies demonstrates the strength of CoreWeave's technology and market position. Significant partnerships often boost a company's credibility and market reach.

- Expansion of data center infrastructure: Investing in and expanding data center infrastructure signals CoreWeave's commitment to scaling its operations to meet growing demand in the AI space. This is a positive indicator for long-term growth.

- Competitive advantages in the AI cloud space: CoreWeave's unique technology, specialized infrastructure, or strategic advantages compared to competitors are key drivers of its long-term potential. A strong competitive edge often translates into a higher stock valuation.

3. Conclusion: CoreWeave (CRWV) Stock Rally: Takeaways and Future Outlook

CoreWeave's (CRWV) Thursday stock rally resulted from a confluence of factors: positive market sentiment, strong technical indicators, and a robust fundamental business outlook. The company's position in the booming AI cloud computing market and positive news regarding its performance played a vital role. However, investors should approach this rally with a balanced perspective, considering that short-term volatility is inherent in the stock market. Further research is vital to assess the sustainability of this surge.

Understanding the dynamics behind CoreWeave's (CRWV) stock performance requires a comprehensive analysis of market sentiment, technical indicators, and fundamental business factors. Further research into CRWV and the AI cloud computing market is crucial for making informed investment decisions regarding this exciting company. Keep a close eye on CRWV's future announcements and financial reports to continue assessing its potential.

Featured Posts

-

Latest Matthew Stafford Update A Wake Up Call For Steelers Qb Plans

May 22, 2025

Latest Matthew Stafford Update A Wake Up Call For Steelers Qb Plans

May 22, 2025 -

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025 -

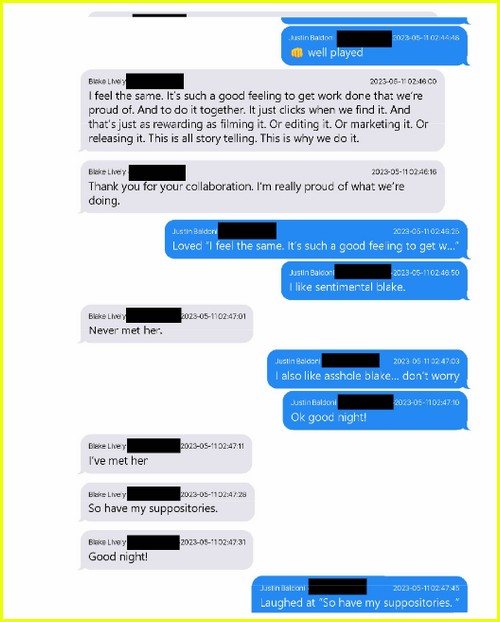

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025 -

Blake Lively And Taylor Swift Friendship Under Pressure Following Subpoena News

May 22, 2025

Blake Lively And Taylor Swift Friendship Under Pressure Following Subpoena News

May 22, 2025 -

Mysterious Red Light Flashes In France What Was It

May 22, 2025

Mysterious Red Light Flashes In France What Was It

May 22, 2025

Latest Posts

-

James Wiltshires 10 Years At The Border Mail Reflections On A Career

May 23, 2025

James Wiltshires 10 Years At The Border Mail Reflections On A Career

May 23, 2025 -

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025 -

The Tour De Frances 2027 Grand Depart Edinburghs Historic Cycling Event

May 23, 2025

The Tour De Frances 2027 Grand Depart Edinburghs Historic Cycling Event

May 23, 2025 -

The Tour De Frances Uk Return Edinburghs 2027 Grand Depart

May 23, 2025

The Tour De Frances Uk Return Edinburghs 2027 Grand Depart

May 23, 2025 -

2027 Tour De France A Scottish Grand Depart From Edinburgh

May 23, 2025

2027 Tour De France A Scottish Grand Depart From Edinburgh

May 23, 2025