Could These ETFs Profit From Uber's Autonomous Vehicle Technology?

Table of Contents

Uber's Autonomous Vehicle Ambitions and Market Potential

Uber's Advanced Technologies Group (ATG) is at the forefront of autonomous driving development. Their significant investment in research and development, coupled with strategic partnerships and acquisitions, positions them as a key player in the burgeoning robotaxi market. Understanding Uber's progress is crucial to identifying ETFs that could benefit from their success.

Uber's ATG (Advanced Technologies Group):

Uber's ATG is responsible for the company's self-driving car program. This division has invested heavily in developing the technology behind autonomous vehicles, including sensor technology, artificial intelligence (AI), and high-definition mapping. While they have faced challenges and setbacks, Uber's commitment to autonomous driving remains strong. Key partnerships and acquisitions within the ATG have bolstered their technology and broadened their reach.

- Market Size: The autonomous vehicle market is projected to experience explosive growth in the coming decades, with estimates reaching hundreds of billions of dollars. This represents a massive opportunity for investors.

- Competitive Landscape: Uber faces competition from other tech giants and established automakers. However, their existing ride-hailing infrastructure provides a significant advantage in deploying autonomous vehicles once the technology matures.

- Recent Milestones: Uber's ATG has achieved several notable milestones, such as successfully completing millions of autonomous miles in testing and securing permits to operate robotaxis in select cities. Keeping abreast of their progress is essential for investors.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Several ETFs offer exposure to companies involved in the development and deployment of autonomous vehicle technology. These can be broadly categorized into technology ETFs and transportation ETFs.

Technology ETFs:

These ETFs focus on technology companies contributing to the autonomous driving ecosystem, including those specializing in AI, sensor technology, mapping, and related fields.

- Example 1 (Hypothetical):

TECHV– This ETF invests in companies developing key components for self-driving cars, such as lidar sensors, AI algorithms, and high-precision mapping systems. Its investment strategy directly benefits from advances in autonomous driving technology. (Note: This is a hypothetical example. Conduct your own research to identify actual ETFs). - Example 2 (Hypothetical):

AIROB– This ETF focuses on artificial intelligence companies developing crucial software and algorithms for autonomous vehicles. Its performance is directly tied to the progress of AI in self-driving applications. (Note: This is a hypothetical example. Conduct your own research to identify actual ETFs).- Historical Performance: Analyze the ETF's historical performance data, considering factors like volatility and risk-adjusted returns.

- Risk Assessment: Evaluate the overall risk associated with investing in this ETF, considering factors such as market fluctuations and technological uncertainties.

Transportation ETFs:

Transportation ETFs provide exposure to companies within the transportation sector poised to benefit from the adoption of autonomous vehicles. This could include ride-hailing companies, traditional auto manufacturers adapting to the change, and logistics firms.

- Example 1 (Hypothetical):

TRANSX– This ETF invests in transportation companies likely to be significantly impacted by the adoption of autonomous vehicles, including ride-sharing services and logistics providers. (Note: This is a hypothetical example. Conduct your own research to identify actual ETFs). - Example 2 (Hypothetical):

AUTORO– This ETF focuses specifically on companies involved in the design, manufacture, and deployment of robotic taxis and autonomous delivery vehicles. (Note: This is a hypothetical example. Conduct your own research to identify actual ETFs).- Investment Strategy: Understanding the ETF's investment strategy is vital for determining its potential exposure to Uber's technology and the broader autonomous vehicle market.

- Performance and Risk: Thoroughly examine the ETF's historical performance, considering its volatility and risk profile.

Risks and Considerations When Investing in Autonomous Vehicle ETFs

While investing in autonomous vehicle ETFs presents significant opportunities, several risks must be considered.

Regulatory Uncertainty:

The regulatory landscape for autonomous vehicles is still evolving, creating uncertainty for investors.

- Regulatory Hurdles: Varying regulations across different jurisdictions can significantly impact the deployment of autonomous vehicles and the profitability of related companies.

- Delays and Setbacks: Regulatory hurdles and delays in obtaining necessary permits could negatively affect the performance of ETFs tied to autonomous vehicle technology.

Technological Challenges:

Developing fully autonomous vehicles is a complex undertaking with inherent technological challenges.

- Complexity of Self-Driving Technology: The technology is incredibly complex and requires overcoming numerous obstacles related to software, hardware, and safety.

- Unforeseen Technical Issues: Unexpected technical issues and delays in development could negatively impact the value of related investments.

Market Volatility:

The technology sector is known for its volatility. Investing in ETFs focused on autonomous vehicles carries significant market risk.

- Price Swings: The price of technology-related ETFs can fluctuate significantly based on various factors including market sentiment, technological advancements, and regulatory changes.

- Due Diligence: Thorough due diligence is essential before investing in any ETF to understand its potential risks and rewards.

Conclusion

Investing in ETFs that could benefit from Uber's autonomous vehicle technology presents a compelling opportunity to participate in a potentially transformative industry. By carefully considering ETFs focusing on technology and transportation, investors can diversify their portfolios and potentially capture significant long-term growth. However, it is crucial to understand the associated risks, including regulatory uncertainty, technological challenges, and market volatility. Explore ETFs focused on autonomous vehicle technology, and diversify your portfolio with autonomous vehicle ETFs to learn more about investing in the future of transportation. Remember to conduct thorough research and consider your personal risk tolerance before making any investment decisions.

Featured Posts

-

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Cap Dau

May 17, 2025

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Cap Dau

May 17, 2025 -

Analyzing The Knicks Landry Shamet Situation Options And Implications

May 17, 2025

Analyzing The Knicks Landry Shamet Situation Options And Implications

May 17, 2025 -

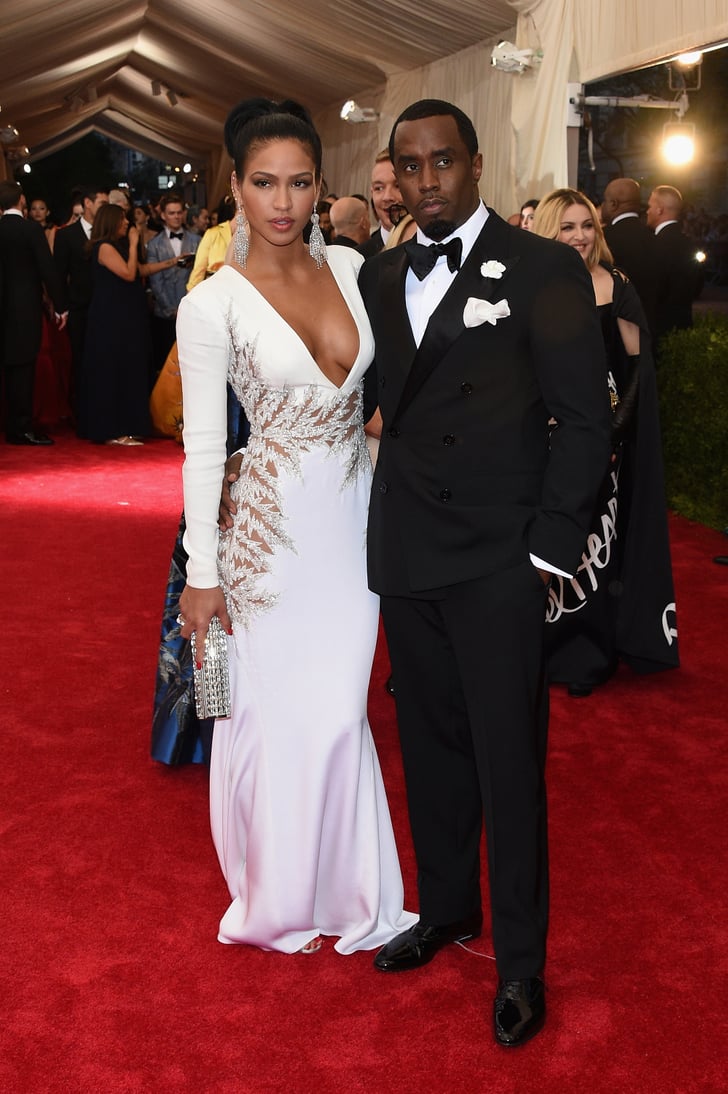

Diddy Trial A Deep Dive Into Cassie Venturas Cross Examination

May 17, 2025

Diddy Trial A Deep Dive Into Cassie Venturas Cross Examination

May 17, 2025 -

14 0 Blowout Mariners Dominant First Inning Secures Win Over Miami

May 17, 2025

14 0 Blowout Mariners Dominant First Inning Secures Win Over Miami

May 17, 2025 -

Uber And Waymo Robo Taxi Rides Now Available In Austin

May 17, 2025

Uber And Waymo Robo Taxi Rides Now Available In Austin

May 17, 2025

Latest Posts

-

Will Jalen Brunsons Absence Affect Next Weeks Cm Punk Vs Seth Rollins Raw Bout

May 17, 2025

Will Jalen Brunsons Absence Affect Next Weeks Cm Punk Vs Seth Rollins Raw Bout

May 17, 2025 -

Jalen Brunsons Displeasure Will He Miss Cm Punk Vs Seth Rollins On Raw

May 17, 2025

Jalen Brunsons Displeasure Will He Miss Cm Punk Vs Seth Rollins On Raw

May 17, 2025 -

Zhittya Ta Spadschina Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025

Zhittya Ta Spadschina Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025 -

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025 -

Donald Tramp Ta Yogo Mati Biografiya Meri Enn Maklaud

May 17, 2025

Donald Tramp Ta Yogo Mati Biografiya Meri Enn Maklaud

May 17, 2025