Could You Be Due An HMRC Refund? A Simple Payslip Check

Table of Contents

Understanding Your Payslip: Key Components for an HMRC Refund Check

Understanding your payslip is crucial for identifying potential tax overpayments. A thorough payslip analysis can uncover discrepancies leading to a significant HMRC repayment. Here's what to look for:

-

Examine your gross pay (total earnings before deductions). This is your total income before any taxes or deductions are applied. It provides a baseline for comparing your tax deductions.

-

Carefully check your tax deductions (PAYE). PAYE (Pay As You Earn) is the tax deducted from your salary each month. Are they unusually high compared to previous pay periods or your expected tax liability based on your income and personal allowances? Significant variations warrant further investigation.

-

Review your National Insurance contributions. Ensure these are calculated correctly based on your earnings. Incorrect calculations can lead to unnecessary deductions and a potential tax refund.

-

Scrutinize your tax code. Your tax code dictates how much tax is deducted from your salary. An incorrect tax code, often resulting from a change in circumstances, is a very common reason for overpaying tax. Is your tax code (e.g., 1257L) the correct code for your current circumstances? You can check the correct code on the HMRC website.

-

Compare your net pay (take-home pay) to your expected amount. A significant difference between your expected net pay and what you actually receive might indicate an overpayment. Keep records of your expected income to compare easily.

Common Reasons for Overpaying Tax and Being Due an HMRC Refund

Several factors can contribute to overpaying tax and being eligible for an HMRC refund. Recognising these situations can help you proactively check your payslips:

-

Incorrect Tax Code: This is the most frequent cause of overpayment. A simple error in your tax code, whether entered by your employer or HMRC, can lead to significant overpayments over time.

-

Emergency Tax: If you've recently started a new job or experienced a change in employment circumstances, you might have been placed on emergency tax. This usually results in higher tax deductions than necessary, leading to a potential HMRC repayment.

-

Changes in Circumstances: Life events such as marriage, childbirth, or starting a pension plan can affect your tax code and allowances. Ensure your tax code reflects your current status to avoid overpaying. Notify HMRC of any changes promptly.

-

Unclaimed Tax Reliefs: Are you entitled to tax relief on certain expenses? Many individuals are unaware of tax reliefs available to them, such as those for childcare costs, pension contributions, or certain medical expenses. Claiming these reliefs can significantly reduce your tax liability and potentially lead to an HMRC tax refund.

Identifying Potential Errors on Your Payslip

Identifying errors on your payslip requires careful attention to detail. Here's how to spot potential problems:

-

Look for discrepancies between your payslip and your P60 (end-of-year tax statement). Your P60 summarises your earnings and tax deductions for the tax year. Any discrepancies between your payslips and your P60 are a red flag.

-

If you notice inconsistencies, keep detailed records of your payslips and any supporting documentation. This will be vital if you need to make a claim.

-

Consider contacting your employer's payroll department to address any discrepancies you've identified. They may be able to resolve the issue quickly and prevent further overpayment.

-

For complex situations, seeking professional advice from a tax advisor might be beneficial. They can guide you through the process and ensure you claim everything you are entitled to.

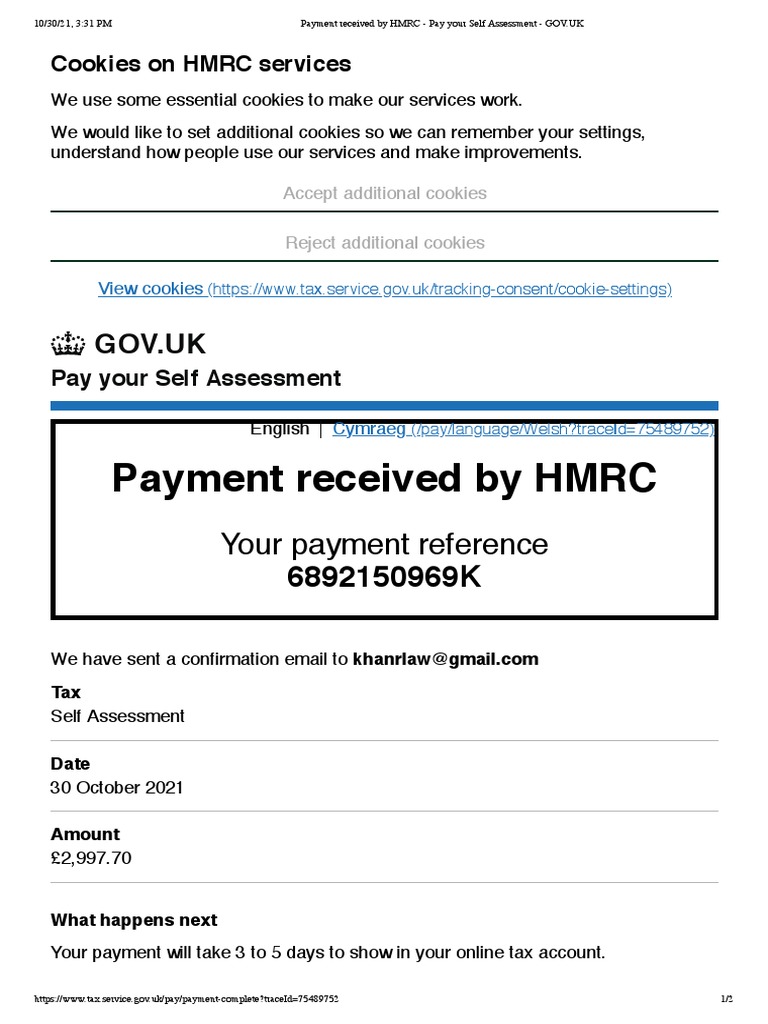

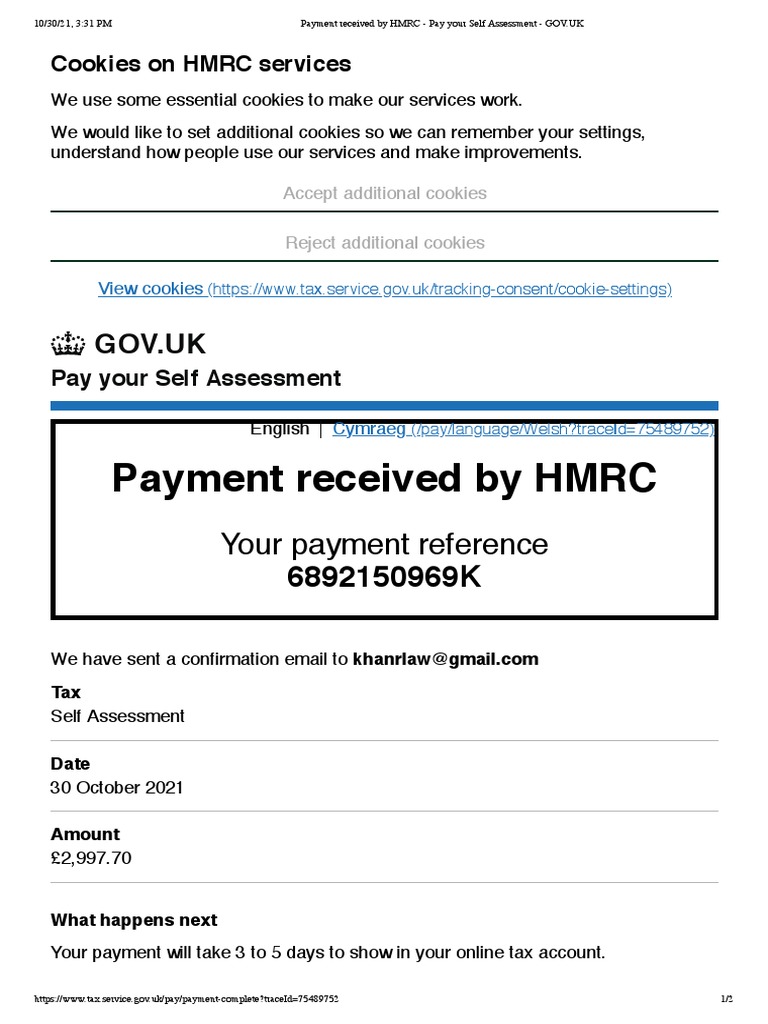

Claiming Your HMRC Refund: A Step-by-Step Guide

Once you've identified a potential overpayment, here's how to claim your HMRC refund:

-

Gather all necessary documentation: This includes your payslips, P60, and any other relevant documents supporting your claim.

-

Access the HMRC online services through the Government Gateway. You'll need your Government Gateway User ID and password to access your online account.

-

Navigate to the relevant section for tax repayments or tax returns. The specific section will depend on the nature of your claim.

-

Complete the online form accurately and thoroughly. Ensure all information is correct and consistent with your supporting documentation.

-

Submit your claim and wait for HMRC to process it. This can take several weeks, so be patient. HMRC will contact you with the outcome of your claim.

Conclusion: Reclaim Your HMRC Refund Today!

Regularly checking your payslip for potential errors is a simple yet effective way to safeguard your finances. By carefully reviewing your tax deductions and comparing them to your circumstances, you might discover you're due a significant HMRC refund. Don't let money go unclaimed! Follow the steps outlined above to check your payslips and claim any HMRC refund you're entitled to. Take control of your finances and ensure you're not overpaying tax. Start your payslip check today and reclaim what's rightfully yours!

Featured Posts

-

Michael Schumachers Comeback Red Bulls Ignored Advice And A Pointless Pursuit

May 20, 2025

Michael Schumachers Comeback Red Bulls Ignored Advice And A Pointless Pursuit

May 20, 2025 -

Formula 1 Hamiltonin Ferrarin Sopimus Analyysi Epaeonnistumisesta

May 20, 2025

Formula 1 Hamiltonin Ferrarin Sopimus Analyysi Epaeonnistumisesta

May 20, 2025 -

Chinas Fury The U S Missile System Causing International Tensions

May 20, 2025

Chinas Fury The U S Missile System Causing International Tensions

May 20, 2025 -

Zakat Odnoy Ery Rassvet Drugoy Novaya Sharapova V Rossiyskom Tennise

May 20, 2025

Zakat Odnoy Ery Rassvet Drugoy Novaya Sharapova V Rossiyskom Tennise

May 20, 2025 -

Nea Stoixeia Rixnoyn Fos Se Ypothesi Tampoy Oi Fonoi

May 20, 2025

Nea Stoixeia Rixnoyn Fos Se Ypothesi Tampoy Oi Fonoi

May 20, 2025

Latest Posts

-

Ferraris Pre Imola Statement On Charles Leclercs Situation

May 20, 2025

Ferraris Pre Imola Statement On Charles Leclercs Situation

May 20, 2025 -

Tea Break Tensions Hamilton And Ferrari Clash At Miami Gp

May 20, 2025

Tea Break Tensions Hamilton And Ferrari Clash At Miami Gp

May 20, 2025 -

Imola Gp Ferrari Issues Official Statement On Leclerc

May 20, 2025

Imola Gp Ferrari Issues Official Statement On Leclerc

May 20, 2025 -

Ferrari And Leclerc Imola Press Conference Statement

May 20, 2025

Ferrari And Leclerc Imola Press Conference Statement

May 20, 2025 -

Formula 1 Hamiltonin Ferrarin Sopimus Analyysi Epaeonnistumisesta

May 20, 2025

Formula 1 Hamiltonin Ferrarin Sopimus Analyysi Epaeonnistumisesta

May 20, 2025