Credit Suisse Whistleblower Case: $150 Million Settlement Imminent

Table of Contents

The Allegations at the Heart of the Case

The Credit Suisse whistleblower case centers around serious allegations of financial misconduct. While specifics remain partially sealed due to ongoing legal proceedings, the accusations reportedly involve a range of illegal activities. This Credit Suisse scandal allegedly includes, but is not limited to, facilitating money laundering, aiding in tax evasion schemes, and potentially engaging in fraudulent activities that violated numerous regulatory standards.

- Specific accusations:

- Facilitating the movement of illicit funds through shell corporations.

- Ignoring or failing to report suspicious transactions, thereby violating anti-money laundering regulations.

- Engaging in practices that aided clients in evading taxes on a large scale.

- Potentially misrepresenting financial information to investors and regulatory bodies.

The identity of the whistleblower remains largely confidential, protected under whistleblower protection laws. However, it's understood they held a significant role within Credit Suisse, providing them with first-hand knowledge of the alleged illegal activities. This Credit Suisse scandal underscores the crucial role of internal controls and compliance programs in preventing financial crime.

The Whistleblower's Role and Protection

The whistleblower's actions in reporting the alleged misconduct are crucial to this case. Their bravery in coming forward highlights the importance of whistleblower protection laws designed to safeguard individuals who expose illegal activities within their organizations. These laws vary across jurisdictions but generally aim to prevent retaliation and ensure confidentiality.

- Steps taken by the whistleblower:

- Internal reporting to compliance departments within Credit Suisse.

- External reporting to relevant regulatory authorities.

- Seeking legal counsel to navigate the complexities of reporting and protection.

However, whistleblowers often face significant risks, including:

- Retaliation: Job loss, demotion, harassment, and even threats of violence are unfortunately common experiences for whistleblowers.

- Reputational damage: Whistleblowers can face social stigma and damage to their professional reputation.

- Legal challenges: Navigating the legal process can be complex and resource-intensive.

This Credit Suisse whistleblower case sets a vital precedent for financial industry whistleblowers and strengthens the argument for enhanced protections and easier reporting mechanisms.

The Potential $150 Million Settlement

The proposed $150 million settlement represents a substantial financial commitment for Credit Suisse. This substantial financial settlement reflects the severity of the alleged misconduct and the potential legal ramifications the bank faces. The implications are far-reaching:

-

Financial consequences: The settlement itself represents a considerable cost, potentially impacting profits and shareholder value. Further legal action, civil lawsuits, and regulatory fines could add to this financial burden.

-

Reputational damage: The negative publicity surrounding this Credit Suisse scandal significantly harms the bank's reputation, potentially leading to decreased client trust and investment.

-

Potential future legal actions: This settlement may not be the end of the legal battles. Further investigations and lawsuits by affected parties, including regulatory bodies, remain a possibility.

-

Potential future implications:

- Increased regulatory scrutiny.

- Damage to investor confidence.

- Difficulty attracting and retaining talent.

Implications for the Financial Industry and Future Regulations

The Credit Suisse whistleblower case will undoubtedly have a significant impact on the financial industry and future regulations. This case could serve as a catalyst for much-needed reforms:

-

Increased scrutiny of financial institutions: Regulatory bodies will likely increase their oversight and enforcement of compliance programs within banks and other financial institutions.

-

Changes in internal compliance programs: Banks will likely need to strengthen their internal controls and compliance mechanisms to mitigate future risks and prevent similar scandals.

-

Potential changes to whistleblower protection laws: This case highlights the need for robust whistleblower protection laws to encourage reporting and protect individuals who expose illegal activities.

-

Potential regulatory changes:

- Strengthened anti-money laundering regulations.

- Increased penalties for regulatory violations.

- Improved whistleblower protection mechanisms.

Conclusion:

The potential $150 million settlement in the Credit Suisse whistleblower case represents a significant development, underscoring the gravity of the alleged misconduct and the crucial role of whistleblower protection. The implications are far-reaching, impacting not only Credit Suisse but the broader financial industry and future regulations. This Credit Suisse whistleblower settlement highlights the need for enhanced compliance programs, stronger regulatory oversight, and robust protection for individuals who expose financial crime. Stay updated on the latest developments in this crucial Credit Suisse whistleblower case and learn more about whistleblower protection laws by following [link to relevant resource/news outlet]. The future of Credit Suisse whistleblowing and similar cases depends on the industry's response to these critical issues.

Featured Posts

-

How Elon Musk Made His Billions A Deep Dive Into His Financial Success

May 09, 2025

How Elon Musk Made His Billions A Deep Dive Into His Financial Success

May 09, 2025 -

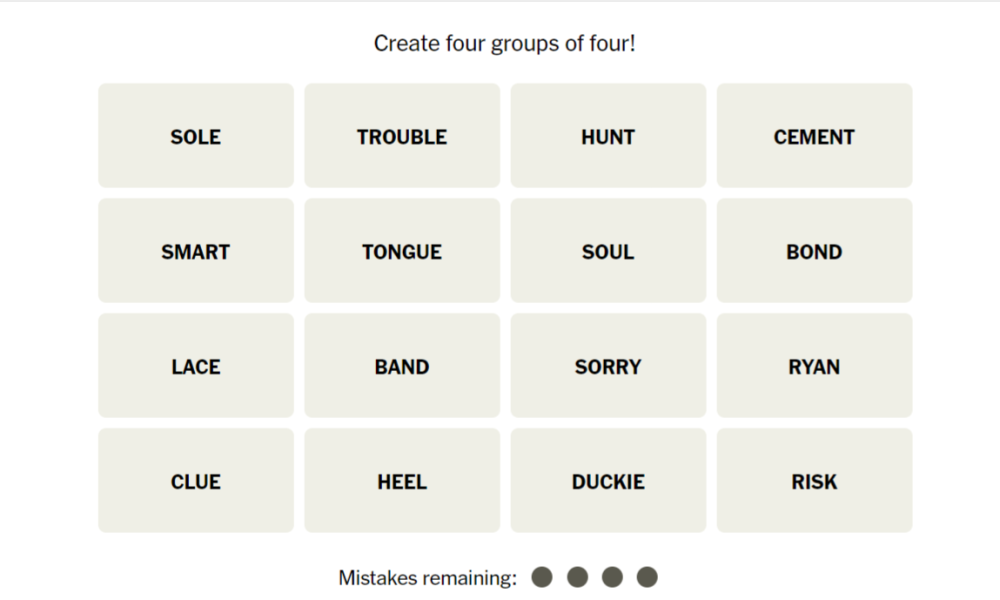

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For The Saturday Crossword

May 09, 2025

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For The Saturday Crossword

May 09, 2025 -

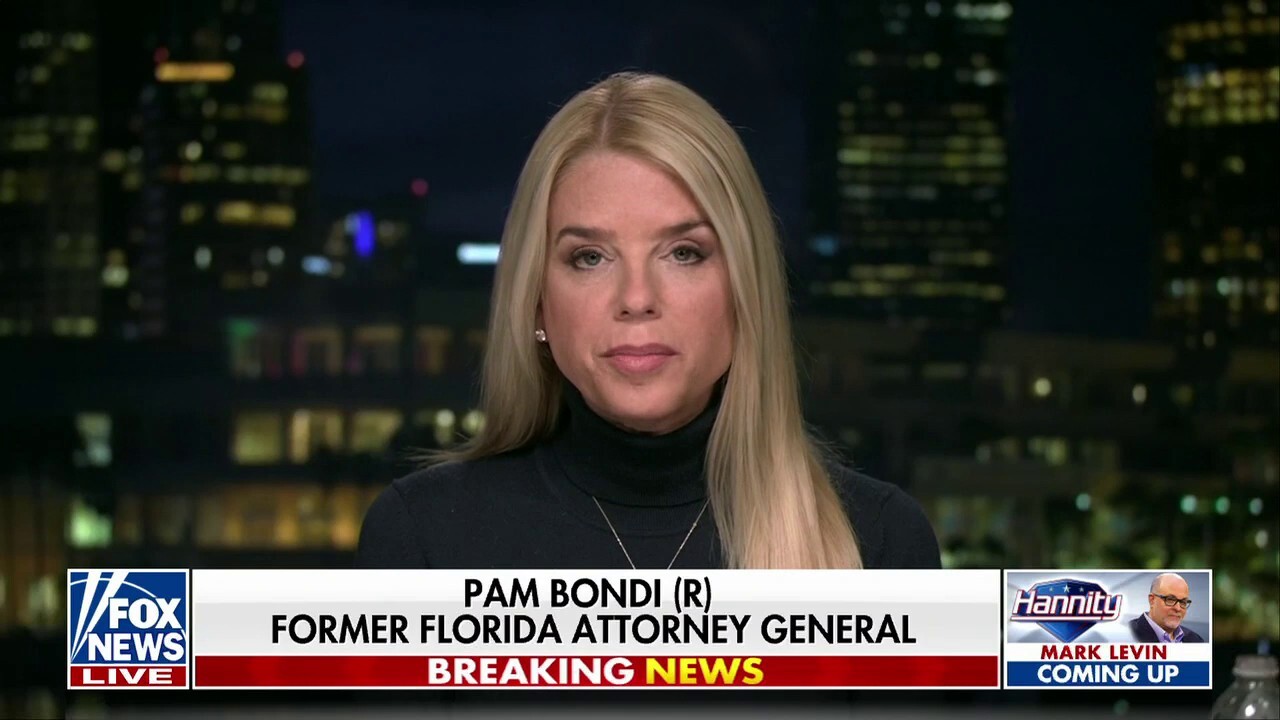

Pam Bondi Announces Record Breaking Fentanyl Seizure

May 09, 2025

Pam Bondi Announces Record Breaking Fentanyl Seizure

May 09, 2025 -

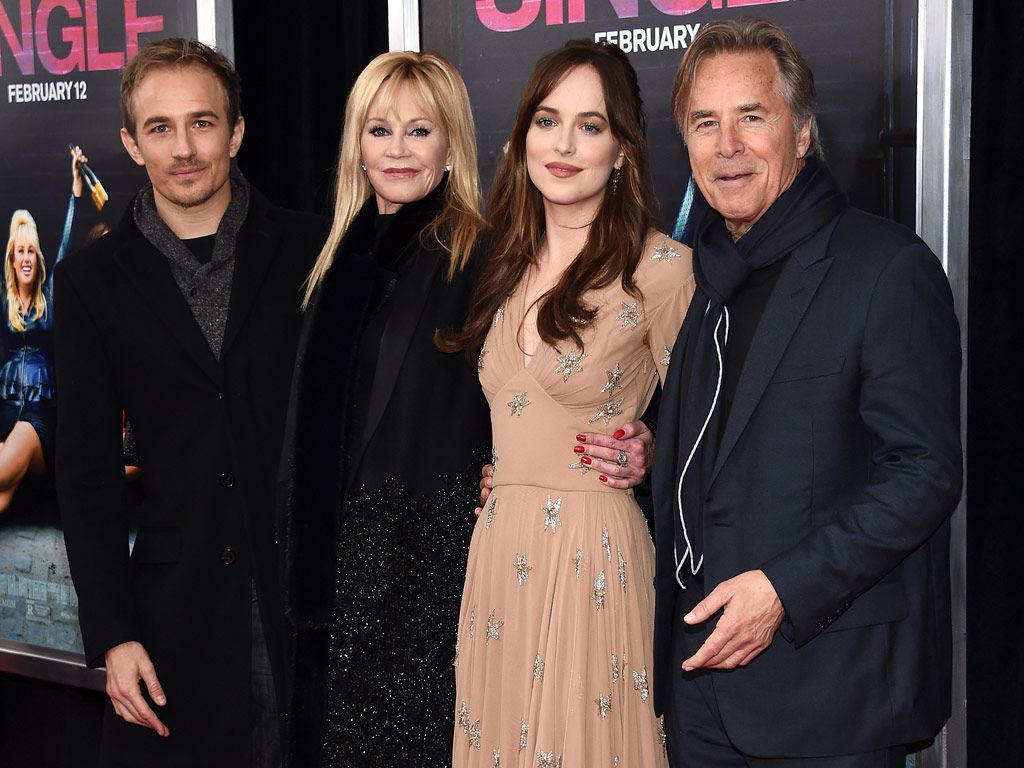

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025 -

Eintracht Frankfurt At Bayern Munich Form Team News And Prediction

May 09, 2025

Eintracht Frankfurt At Bayern Munich Form Team News And Prediction

May 09, 2025