D-Wave Quantum Inc. (QBTS) Stock Drop On Monday: Reasons And Analysis

Table of Contents

Market Sentiment and Overall Tech Stock Performance

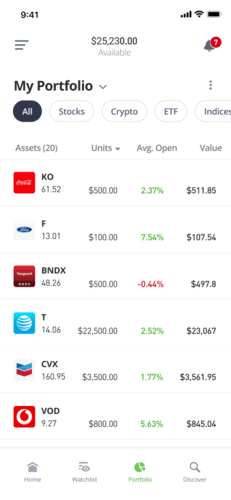

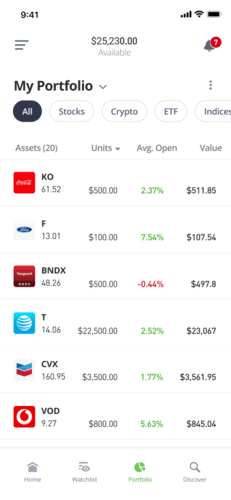

The recent downturn in QBTS stock isn't isolated; it reflects broader market trends impacting the technology sector. Negative sentiment surrounding tech stocks, fueled by macroeconomic factors, significantly influences QBTS's performance. This correlation is evident when comparing QBTS's stock movements with the NASDAQ Composite Index, a key benchmark for technology companies.

- Negative sentiment surrounding the tech sector: Concerns about high inflation, rising interest rates, and potential recessionary pressures have led to a general sell-off in growth stocks, including those in the burgeoning quantum computing field. Investors are shifting towards more conservative investments, impacting the valuation of riskier assets like QBTS.

- Correlation between QBTS stock and the NASDAQ index: A strong negative correlation exists between QBTS and the NASDAQ, suggesting that the overall market sentiment significantly impacts QBTS's price. A decline in the NASDAQ often leads to a corresponding drop in QBTS.

- Impact of interest rate hikes and inflation on growth stocks: Increased interest rates make borrowing more expensive, reducing the attractiveness of growth stocks like QBTS, which typically have higher valuations based on future earnings potential. High inflation further erodes the purchasing power of future earnings, impacting investor confidence.

For example, [link to relevant financial news source showing NASDAQ correlation with QBTS], illustrates the close relationship between QBTS's performance and the broader technology market.

Lack of Recent Positive Catalysts for QBTS Stock

The absence of significant positive news or announcements surrounding D-Wave Quantum has likely contributed to the stock price decline. Without fresh catalysts to bolster investor confidence, the stock becomes more vulnerable to negative market sentiment.

- No major contract wins or partnerships announced recently: Large-scale contract wins or strategic partnerships are crucial for demonstrating market traction and generating revenue for quantum computing companies. The absence of such announcements can lead to uncertainty among investors.

- Absence of positive regulatory developments: Regulatory changes and government support can significantly influence the quantum computing industry. The lack of positive regulatory news can dampen investor enthusiasm for QBTS.

- Limited progress updates on key technological milestones: Investors closely monitor technological advancements in the quantum computing space. A lack of substantial progress updates on key milestones can raise concerns about the company's long-term prospects. Furthermore, [link to D-Wave's latest financial report] reveals [insert relevant data from the report, e.g., revenue figures or R&D spending], which may have contributed to the negative market reaction.

Analyst Ratings and Price Target Adjustments

Analyst opinions play a substantial role in shaping investor perceptions and influencing stock prices. Downgrades or adjustments in price targets by financial analysts can trigger sell-offs.

- Review any downgrades or changes in price targets by financial analysts: Check reputable financial news sources for any recent analyst reports on QBTS. A negative outlook from key analysts can significantly impact investor sentiment.

- Analyze the rationale behind these adjustments: Understanding the reasoning behind analyst downgrades is crucial. Factors to consider include concerns about revenue growth, competition, or technological challenges.

- Consider the impact of differing analyst opinions on investor confidence: The divergence of analyst opinions underscores the uncertainty surrounding QBTS's future performance. Conflicting views can cause investor hesitation.

For instance, [link to a financial news article reporting on analyst rating changes for QBTS] highlights the impact of analyst opinions on the stock's recent performance.

Speculation and Short Selling Activity

Market speculation and short selling can significantly amplify price fluctuations in volatile stocks like QBTS. Increased short interest suggests a bearish outlook among some investors.

- Analyze short interest data for QBTS: Data on short interest provides insights into the level of bearish sentiment. High short interest indicates a substantial number of investors betting against the stock.

- Discuss potential implications of increased short selling pressure: Increased short selling pressure can exacerbate price declines as short sellers seek to profit from further price drops.

- Explain how market speculation can amplify price fluctuations: Speculative trading can create artificial price volatility, making it challenging for fundamental investors to assess QBTS's true value. [Link to a source showing QBTS short interest data] can provide context to this aspect.

Understanding the Quantum Computing Investment Landscape

Investing in quantum computing companies carries inherent risks. The industry is still in its early stages, making it highly speculative. Early-stage companies face challenges in scaling operations, securing funding, and achieving profitability. The sector's volatile nature underscores the need for thorough due diligence before investing.

Conclusion

The D-Wave Quantum Inc. (QBTS) stock drop on Monday resulted from a confluence of factors: negative market sentiment impacting the broader tech sector, a lack of recent positive catalysts for QBTS, adjustments in analyst ratings and price targets, and potentially increased short selling activity. Understanding these interconnected factors is crucial for investors considering QBTS stock. Conduct thorough due diligence before investing in QBTS stock and stay informed about D-Wave Quantum Inc. (QBTS) developments to navigate the complexities of this promising but volatile sector. Remember to consider the broader market conditions and the inherent risks associated with investing in quantum computing stocks like QBTS.

Featured Posts

-

Xronia Provlimata Stoys Sidirodromoys Mia Vathyteri Matia Stin Katastasi

May 20, 2025

Xronia Provlimata Stoys Sidirodromoys Mia Vathyteri Matia Stin Katastasi

May 20, 2025 -

First Food Shipments To Gaza In Months After Israeli Decision

May 20, 2025

First Food Shipments To Gaza In Months After Israeli Decision

May 20, 2025 -

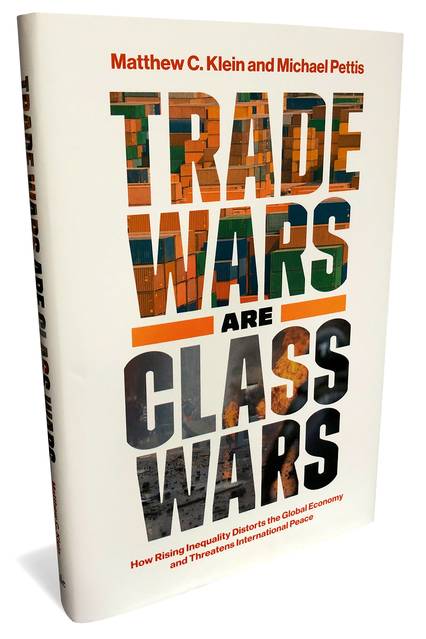

How Trade Wars Affected Porsches Attempt To Combine Ferrari And Mercedes Attributes

May 20, 2025

How Trade Wars Affected Porsches Attempt To Combine Ferrari And Mercedes Attributes

May 20, 2025 -

2025 D Wave Quantum Qbts Stock Dip Factors Contributing To The Fall

May 20, 2025

2025 D Wave Quantum Qbts Stock Dip Factors Contributing To The Fall

May 20, 2025 -

Up To 60 Off Hugo Boss Perfumes Amazons Spring 2025 Sale

May 20, 2025

Up To 60 Off Hugo Boss Perfumes Amazons Spring 2025 Sale

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025