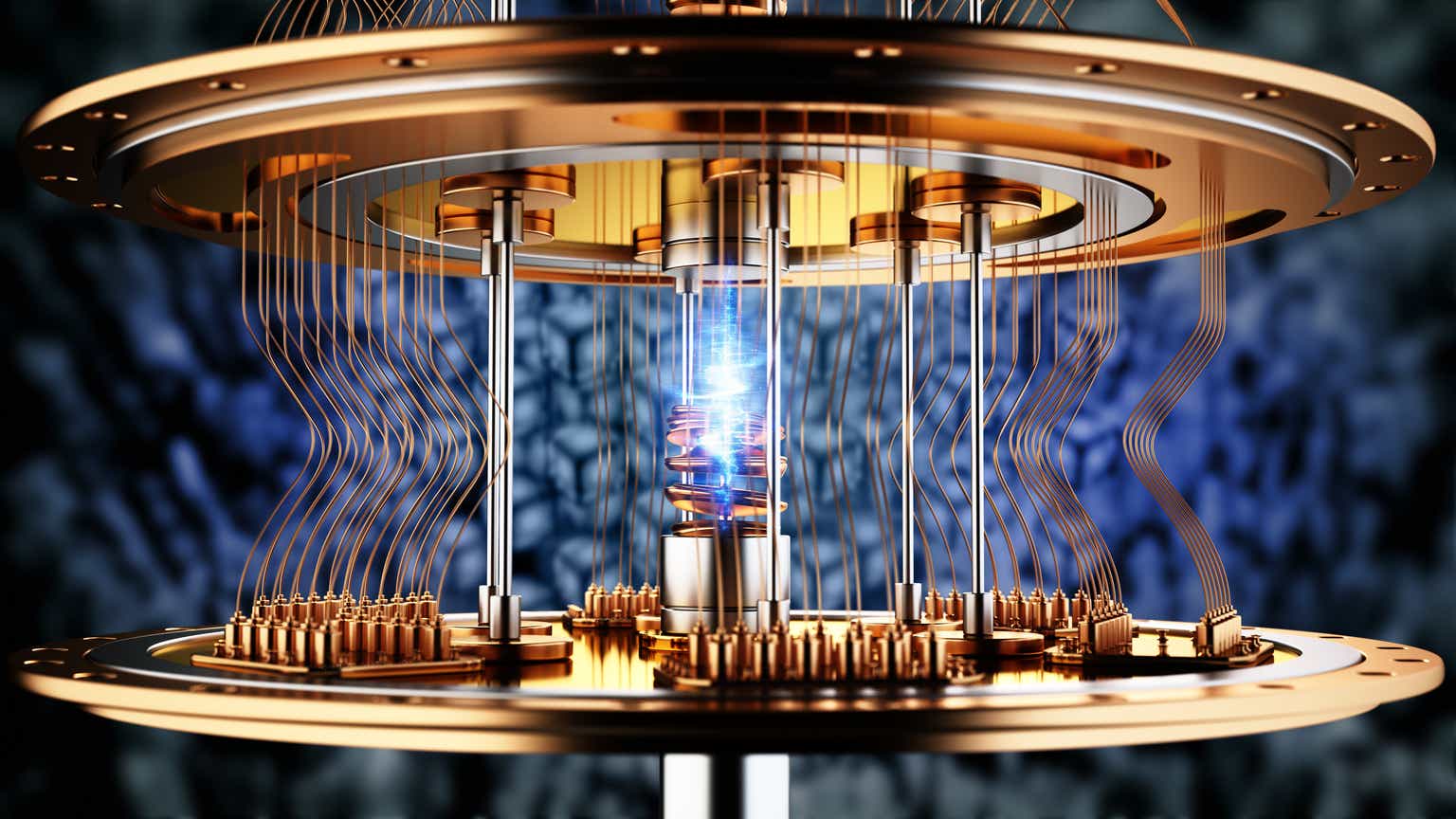

D-Wave Quantum Inc. (QBTS) Stock Market Activity: A Comprehensive Analysis

Table of Contents

QBTS Stock Performance Overview

Analyzing QBTS stock requires examining its price movements, historical trends, and market capitalization. Understanding these aspects provides a crucial foundation for any investment decision.

Keywords: QBTS Stock Price, QBTS Stock Chart, Historical Performance, Stock Volatility, Market Capitalization

-

Recent Price Movements: [Insert current QBTS stock price and recent high/low points here. Include percentage changes over various timeframes – e.g., daily, weekly, monthly]. Observe the average daily trading volume to gauge market interest and liquidity. High volume often indicates significant investor activity.

-

Historical Performance: [Include a chart visualizing QBTS stock performance over the past year or longer. Clearly label the axes and highlight significant trends, such as periods of high volatility or sustained growth/decline. Mention any major events that significantly impacted the stock price during this period].

-

Market Capitalization: [State QBTS's current market capitalization. Explain what this metric represents and its implications for investors. A larger market cap typically indicates a more established company, but it's not the only factor to consider].

Factors Influencing QBTS Stock Price

Several intertwined factors influence the QBTS stock price. These factors range from technological advancements to broader market sentiment.

Keywords: Quantum Computing Technology, Industry Competition, Financial Performance, Regulatory Landscape, Market Sentiment

-

Technological Advancements: D-Wave's progress in developing and releasing new quantum computing hardware and software directly impacts investor confidence. Announcements of improved qubit performance, enhanced algorithms, or successful partnerships can lead to positive stock price reactions. Conversely, setbacks or delays can negatively affect the QBTS stock price.

-

Industry Competition: The quantum computing industry is highly competitive. The success of competitors, advancements in alternative quantum computing technologies, and the overall pace of industry development will significantly affect QBTS's market share and valuation.

-

Financial Performance: D-Wave's financial reports – including revenue, expenses, profitability, and debt levels – are closely scrutinized by investors. Strong financial performance, indicating consistent growth and profitability, will typically boost the QBTS stock price. Conversely, financial losses or missed targets can trigger negative market sentiment.

-

Regulatory Landscape: Government policies and regulations regarding quantum computing technology can have a profound impact. Favorable regulations that encourage research, development, and adoption of quantum computing can positively affect QBTS's stock price.

-

Market Sentiment: The overall market's perception of the quantum computing sector and D-Wave’s potential within it significantly influences the QBTS stock price. Positive news stories, industry endorsements, and increased investor interest generally lead to higher prices.

Risk Assessment for QBTS Investment

Investing in QBTS involves inherent risks. A thorough risk assessment is paramount before making any investment decision.

Keywords: Investment Risk, Volatility Risk, Market Risk, Technological Risk, Financial Risk

-

Volatility Risk: QBTS stock price is likely to be highly volatile due to the nascent nature of the quantum computing industry. Market sentiment can change rapidly, leading to significant price swings.

-

Technological Risk: The development of quantum computing technology is complex and faces significant technical challenges. Delays or failures in achieving key technological milestones can negatively affect QBTS’s stock performance.

-

Financial Risk: D-Wave's financial health and its ability to secure funding for research and development are crucial. Any concerns regarding the company’s financial stability can impact investor confidence.

-

Market Risk: Broader macroeconomic factors, such as economic downturns or changes in investor risk appetite, can also affect QBTS stock price.

-

Regulatory Risk: Changes in government regulations or policies could impact D-Wave’s operations and profitability, influencing the QBTS stock price.

Future Outlook and Investment Strategies for QBTS

The future of D-Wave and the quantum computing sector holds significant potential, although it’s important to approach with realistic expectations.

Keywords: Future Growth Potential, Investment Strategy, Long-Term Investment, Short-Term Trading, Portfolio Diversification

-

Growth Potential: The long-term growth potential for D-Wave and the quantum computing industry is substantial, driven by potential applications across various sectors. However, realizing this potential depends on technological advancements, market adoption, and successful competition.

-

Investment Strategies: Investors with a higher risk tolerance and a long-term perspective may see QBTS as a potentially rewarding investment. Short-term trading in QBTS stock carries significant risk due to its volatility. A diversified investment portfolio is recommended to mitigate overall risk.

-

Informed Decision-Making: Before investing in QBTS, thoroughly research the company’s financial performance, technological progress, competitive landscape, and market outlook. Consult with a financial advisor to assess your risk tolerance and develop an appropriate investment strategy.

Conclusion

This analysis provides a comprehensive overview of D-Wave Quantum Inc. (QBTS) stock market activity, encompassing its historical performance, influencing factors, risk assessment, and future outlook. Understanding these elements is vital for investors considering exposure to this promising but volatile sector. Before making any investment decisions concerning D-Wave Quantum (QBTS) stock, thorough research and consideration of your personal risk tolerance are crucial. Continue your research on QBTS stock and the quantum computing market to make informed investment choices.

Featured Posts

-

Hunter Bidens Recordings A Deeper Look At Joe Bidens Mental Fitness

May 21, 2025

Hunter Bidens Recordings A Deeper Look At Joe Bidens Mental Fitness

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025 -

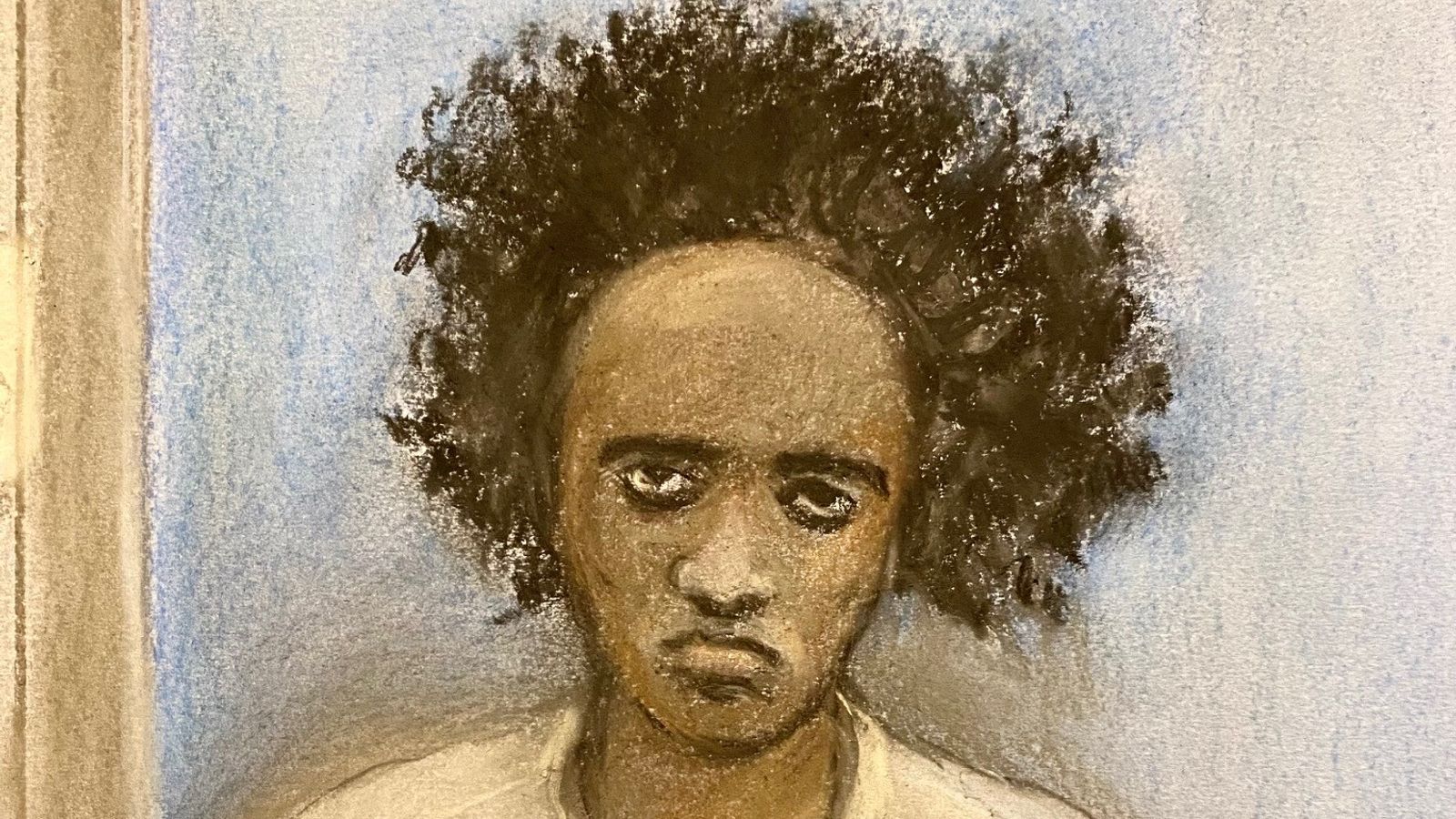

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 21, 2025

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 21, 2025 -

Abn Amro Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025

Abn Amro Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025 -

William Goodges Record Breaking Australian Foot Journey

May 21, 2025

William Goodges Record Breaking Australian Foot Journey

May 21, 2025

Latest Posts

-

Is This The End David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025 -

Little Britain Cancelled In 2020 Gen Zs Unexpected Obsession Explained

May 22, 2025

Little Britain Cancelled In 2020 Gen Zs Unexpected Obsession Explained

May 22, 2025 -

Real Madrid Manager Search Klopps Agent Responds To Transfer Rumors

May 22, 2025

Real Madrid Manager Search Klopps Agent Responds To Transfer Rumors

May 22, 2025 -

Klopps Agent Addresses Real Madrid Links What Was Said

May 22, 2025

Klopps Agent Addresses Real Madrid Links What Was Said

May 22, 2025 -

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025