D-Wave Quantum Inc. (QBTS) Stock Plunge In 2025: Understanding The Decline

Table of Contents

Increased Competition in the Quantum Computing Sector

The quantum computing market, once a relatively niche area, has exploded with activity. The race to develop commercially viable quantum computers has attracted substantial investment, leading to a surge in competitors offering alternative technologies. This fierce “quantum computing competition” directly impacted D-Wave's position and investor confidence in QBTS stock. Key competitors, leveraging technologies such as superconducting qubits and trapped ions, have made significant strides.

- Increased investment in competing quantum technologies: Companies like IBM, Google, and Rigetti Computing have secured billions in funding, allowing them to accelerate research and development, pushing the boundaries of quantum computing capabilities.

- Development of superior quantum algorithms and applications by competitors: Rivals have developed algorithms better suited to solve real-world problems, potentially overshadowing D-Wave's quantum annealing approach. This advancement in "rival quantum technologies" eroded D-Wave's perceived advantage.

- Announcements of breakthroughs by competitors impacting investor sentiment: Regular announcements of qubit count milestones and successful applications by competitors created negative sentiment toward D-Wave's slower progress, impacting the QBTS stock price negatively.

This intensified competition for market share significantly eroded investor confidence in D-Wave's long-term prospects, contributing substantially to the decline in QBTS stock.

Missed Market Expectations and Technological Roadblocks

D-Wave's progress, while noteworthy, failed to meet the ambitious projections many investors had placed upon it. This disparity between expectation and reality directly impacted the QBTS stock price. Several technological hurdles hampered D-Wave's ability to deliver on its promises, further dampening investor enthusiasm. The limitations of "quantum annealing," D-Wave's core technology, became increasingly apparent.

- Failure to meet projected milestones in terms of qubit count or performance: D-Wave struggled to increase its qubit count and improve the performance of its existing systems at the pace anticipated by the market.

- Difficulty in scaling the technology to meet real-world application demands: Scaling quantum annealing technology to handle complex, real-world problems proved more challenging than initially predicted, hindering commercial applications.

- Challenges in demonstrating clear commercial viability of D-Wave's technology: The lack of compelling, commercially successful applications using D-Wave's technology raised questions about its practical value, ultimately impacting "D-Wave technology limitations" and its stock.

This gap between promised advancements and actual achievements fueled skepticism, driving down the QBTS stock price.

Financial Performance and Investor Sentiment

D-Wave's hypothetical 2025 financial reports revealed a troubling picture: slower-than-expected revenue growth, coupled with escalating operational costs. This negatively impacted profitability and, consequently, investor sentiment. The relationship between these "QBTS financial reports" and the stock price plunge is undeniable.

- Lower than anticipated revenue figures: Revenue failed to meet market projections, indicating a lack of strong commercial traction for D-Wave's technology.

- Increased operational costs: The high cost of research, development, and maintaining cutting-edge quantum computing infrastructure put a strain on the company's finances.

- Negative or declining profit margins: The combination of lower revenue and increasing costs resulted in negative or declining profit margins, a major red flag for investors.

This negative financial news created a sell-off, further accelerating the decline in QBTS stock.

Macroeconomic Factors and Market Volatility

The decline in QBTS stock wasn't solely attributable to internal factors. Broader macroeconomic conditions also played a significant role. The overall market volatility and a shift towards risk aversion among investors created a perfect storm.

- A general downturn in the technology sector: A broader correction in the tech market negatively impacted even well-performing companies, further depressing the QBTS stock price.

- Increased interest rates impacting investor appetite for riskier assets: Rising interest rates made less risky investments more attractive, causing investors to withdraw from potentially higher-risk ventures like quantum computing stocks.

- Geopolitical events creating market instability: Global uncertainty and geopolitical tensions contributed to a general sense of risk aversion in the market, impacting investor confidence in riskier assets like QBTS.

These "macroeconomic factors" exacerbated the already challenging situation for D-Wave, significantly contributing to the QBTS stock plunge.

Conclusion: Navigating the Future of D-Wave Quantum Inc. (QBTS) Stock

The hypothetical 2025 QBTS stock plunge stemmed from a confluence of factors: heightened competition, unmet expectations, weak financial performance, and unfavorable macroeconomic conditions. Understanding these interconnected elements is crucial for investors evaluating D-Wave’s future. While the long-term potential of quantum computing remains significant, the path forward for D-Wave and its stock is uncertain. To make informed investment decisions, it’s essential to “stay informed on QBTS stock” and “monitor the quantum computing market” closely. Conduct thorough research on D-Wave's future prospects, technological advancements, and competitive landscape before making any investment choices. Understanding the intricacies of "quantum computing stock" requires diligent research and careful consideration of the risks involved.

Featured Posts

-

Cote D Ivoire Le Diletta Gigantesque Navire Arrive Au Port D Abidjan

May 20, 2025

Cote D Ivoire Le Diletta Gigantesque Navire Arrive Au Port D Abidjan

May 20, 2025 -

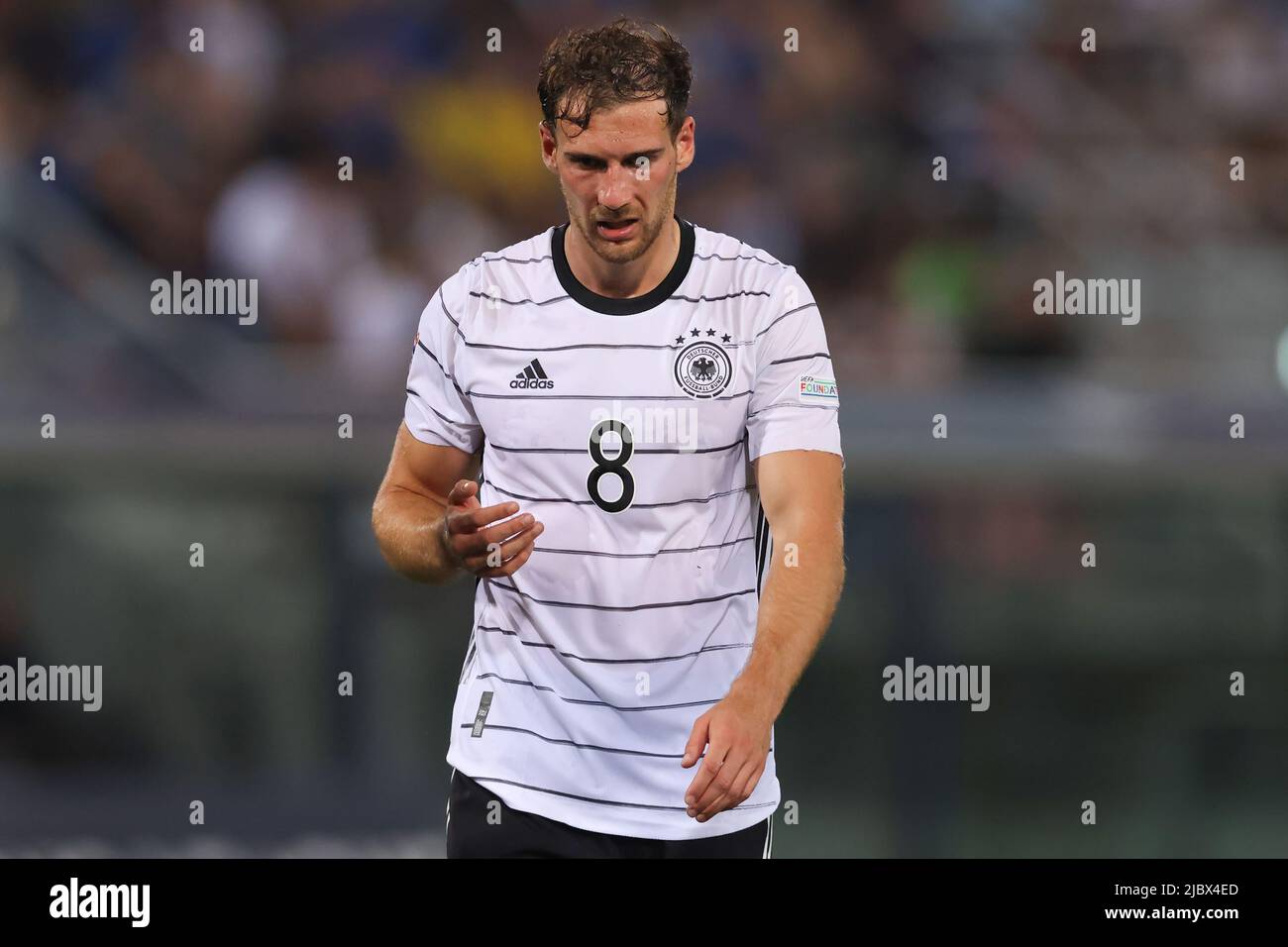

Goretzkas Nations League Call Up Nagelsmanns Team Announcement

May 20, 2025

Goretzkas Nations League Call Up Nagelsmanns Team Announcement

May 20, 2025 -

The Detective Genius Of Agatha Christies Poirot An Analysis

May 20, 2025

The Detective Genius Of Agatha Christies Poirot An Analysis

May 20, 2025 -

Protecting Your Rights Big Bear Ai Bbai Investors And The June 10 2025 Deadline

May 20, 2025

Protecting Your Rights Big Bear Ai Bbai Investors And The June 10 2025 Deadline

May 20, 2025 -

Australia Us Missile Test Chinas Concerns And The Strategic Implications

May 20, 2025

Australia Us Missile Test Chinas Concerns And The Strategic Implications

May 20, 2025

Latest Posts

-

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025