D-Wave Quantum (NYSE: QBTS) Stock Dive: Analyzing Kerrisdale Capital's Critique

Table of Contents

Kerrisdale Capital's Key Accusations Against D-Wave Quantum

Kerrisdale Capital's short report on D-Wave Quantum leveled several serious accusations, casting doubt on the company's prospects and sparking a significant drop in QBTS stock. These accusations can be broadly categorized into concerns about revenue and market potential, technological advancements, and financial health.

Overstated Revenue and Market Potential

Kerrisdale's report alleges that D-Wave has significantly overstated its revenue projections and the overall market potential for its quantum annealing approach. The report questions the company's ability to achieve its ambitious revenue targets, citing a lack of substantial, recurring revenue streams and limited customer adoption.

- Specific Claims: Kerrisdale highlighted discrepancies between D-Wave's projected revenue growth and its actual performance, pointing to a significant gap between expectations and reality. They also questioned the validity of D-Wave's market size estimations for quantum annealing, suggesting a much smaller addressable market than claimed.

- Competitor Comparison: The report compared D-Wave's projections to those of competitors in the quantum computing space, suggesting that D-Wave's claims were overly optimistic compared to more conservative estimates from other players in the gate-based quantum computing field.

- Market Size Analysis: Kerrisdale presented its own analysis of the market for quantum annealing, concluding that the total addressable market is significantly smaller than D-Wave's projections, potentially impacting the company's long-term revenue potential. This analysis included data on current market adoption and future growth forecasts based on independent research.

Questionable Technological Advancements

Kerrisdale's report also questioned the pace and significance of D-Wave's technological advancements, suggesting that its quantum annealing technology faces inherent limitations that restrict its practical applications. The report highlighted the technological gap between D-Wave's approach and other quantum computing technologies like gate-based quantum computers.

- Technological Limitations: The report pointed to specific technological limitations of quantum annealing, such as its difficulty in tackling certain types of computational problems that are more easily addressed by other quantum computing architectures. Specific examples from the report were highlighted, and their implications for the potential use cases for D-Wave's technology were discussed.

- Comparison with Gate-Based Quantum Computers: Kerrisdale contrasted D-Wave's quantum annealing approach with the more widely accepted gate-based approach, highlighting the advantages and potential of the latter. This comparison aimed to showcase the limitations and potential obsolescence of the quantum annealing technology that D-Wave utilizes.

- Independent Verification: The report called for independent verification of D-Wave's claims regarding technological breakthroughs, arguing that the available evidence does not sufficiently support the company's assertions of significant advancements. The lack of third-party validation of D-Wave’s claims was presented as a significant risk factor for potential investors.

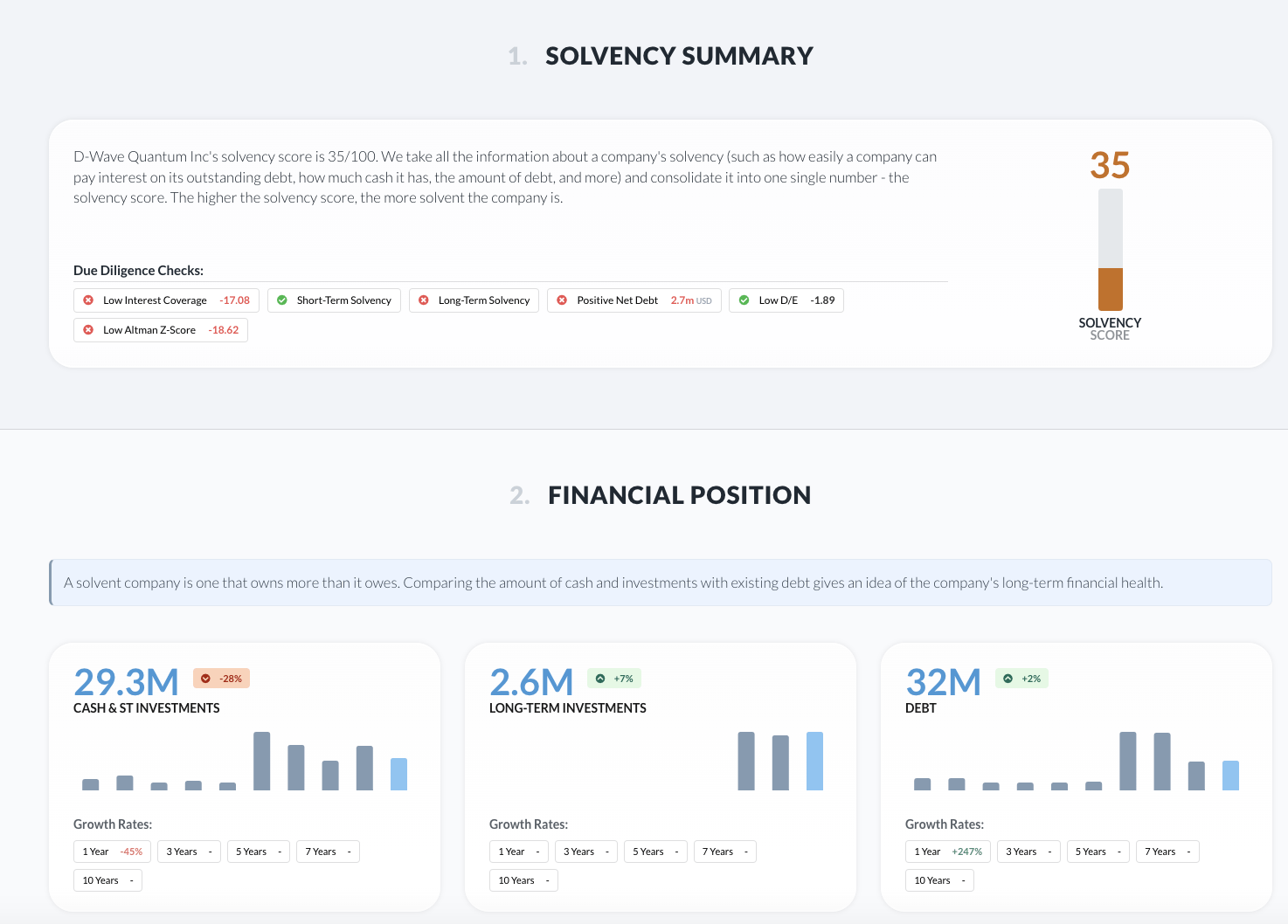

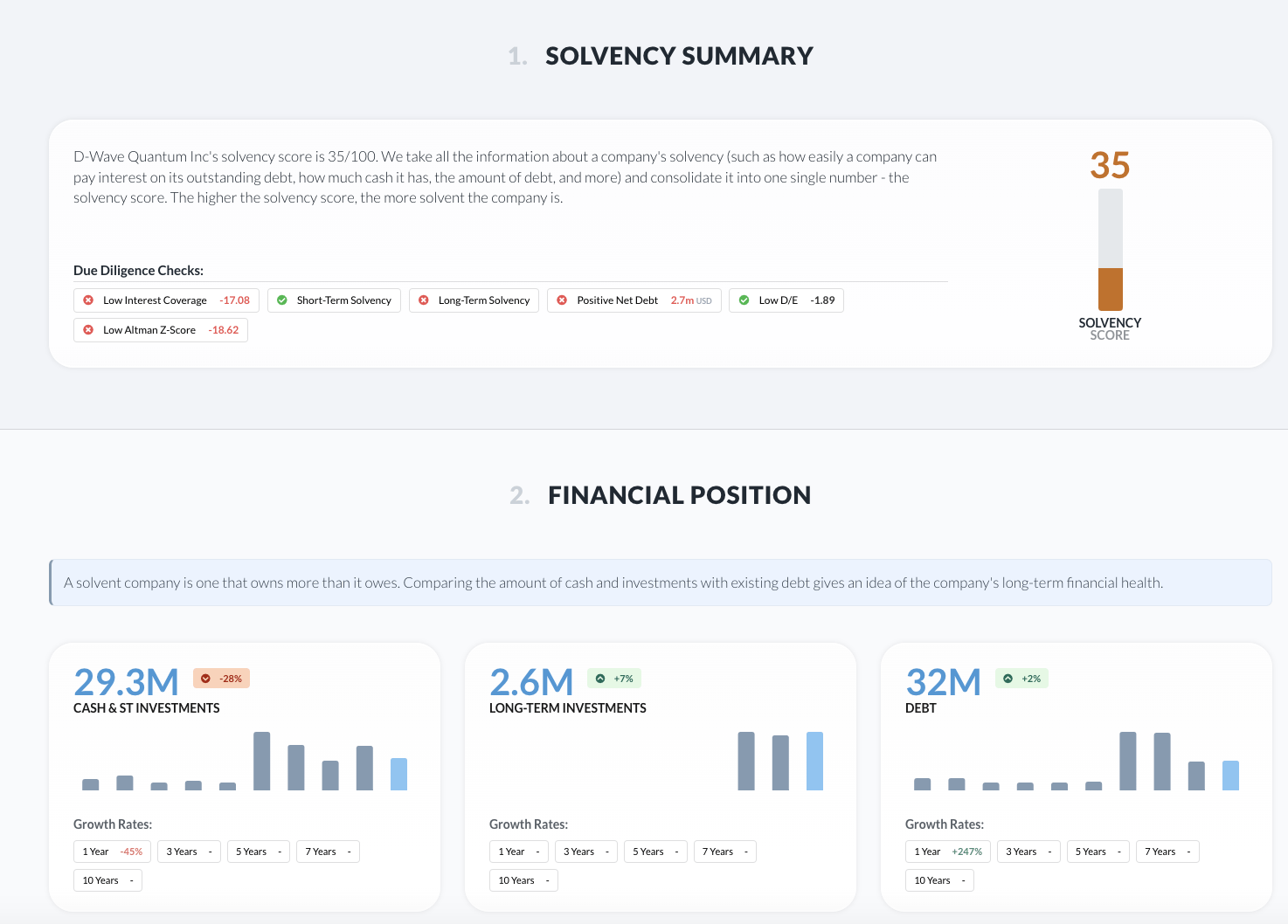

Concerns about Financial Health and Sustainability

Kerrisdale raised serious concerns about D-Wave's long-term financial sustainability, citing its high cash burn rate and reliance on external funding. The report suggested that D-Wave's current business model is not financially viable in the long run and that the company may struggle to secure future funding rounds.

- Financial Statement Analysis: The report analyzed D-Wave's financial statements, highlighting its significant operating losses and the growing gap between revenue and expenses. Specific data points and ratios were used to illustrate D-Wave's precarious financial situation.

- Cash Burn Rate: The high cash burn rate was identified as a major concern, implying that D-Wave needs continuous infusions of capital to sustain its operations. The report explored various scenarios surrounding the acquisition of this funding and the chances of D-Wave achieving profitability.

- Funding Sources and Future Rounds: The report questioned D-Wave's ability to secure sufficient future funding, particularly given the negative sentiment created by the report itself. This analysis included predictions based on recent funding rounds in the quantum computing space.

D-Wave Quantum's Response and Counterarguments

D-Wave Quantum has responded to Kerrisdale Capital's report, refuting several of its key claims. The company's response primarily focused on defending its revenue projections, highlighting ongoing technological advancements, and emphasizing its strong customer relationships and pipeline. However, the effectiveness of D-Wave’s response in addressing the concerns surrounding its financial health and long-term viability remains a subject of debate. Specific quotes from D-Wave's press releases and statements were included to provide context and balance to the analysis.

Impact on the Quantum Computing Market and Investor Sentiment

The controversy surrounding D-Wave and Kerrisdale Capital has had a significant impact on the quantum computing market and investor sentiment. The sharp drop in QBTS stock price reflects a broader concern about the viability of quantum annealing technology and the overall risk associated with investing in early-stage quantum computing companies.

- Investor Confidence: The incident has shaken investor confidence in quantum computing stocks, leading to a reassessment of valuations and investment strategies across the sector. This concern extends to not only D-Wave but also its competitors in the space.

- Future Funding and Development: The controversy may make it more challenging for quantum computing companies to secure future funding, slowing down innovation and development in the field.

- Role of Short-Selling: The event highlights the significant influence that short-selling can have on market perception and the valuation of technology companies, particularly in emerging sectors. The impact of such actions needs to be taken into account when evaluating information from sources with a vested interest in the decline of certain stocks.

Conclusion

Kerrisdale Capital's critical report on D-Wave Quantum (QBTS) has raised serious questions about the company's revenue projections, technological advancements, and financial sustainability. While D-Wave has issued a response, the controversy has significantly impacted QBTS stock price and investor sentiment within the broader quantum computing market. This situation emphasizes the importance of thorough due diligence before investing in early-stage technology companies. While quantum computing holds immense long-term potential, significant risks remain, and careful evaluation is necessary. Before investing in D-Wave Quantum or any other quantum computing stock, conduct your own in-depth research and understand the inherent risks involved. Further research into D-Wave Quantum and similar companies is crucial for informed investment decisions in this volatile, yet promising, sector.

Featured Posts

-

Mkhalfat Malyt Khtyrt Mjls Alnwab Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025

Mkhalfat Malyt Khtyrt Mjls Alnwab Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025 -

Taiwan Turns To Lng Addressing Energy Needs After Nuclear Shutdown

May 21, 2025

Taiwan Turns To Lng Addressing Energy Needs After Nuclear Shutdown

May 21, 2025 -

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025 -

Press Conference Announcement Wtts New Competitive Framework

May 21, 2025

Press Conference Announcement Wtts New Competitive Framework

May 21, 2025 -

Burke Guilty Navy Officer Convicted In Job Exchange Bribery Scandal

May 21, 2025

Burke Guilty Navy Officer Convicted In Job Exchange Bribery Scandal

May 21, 2025

Latest Posts

-

Watercolor Play Script Review Realism And Potential Explored

May 22, 2025

Watercolor Play Script Review Realism And Potential Explored

May 22, 2025 -

Honest Review A Young Playwrights Watercolor Inspired Script

May 22, 2025

Honest Review A Young Playwrights Watercolor Inspired Script

May 22, 2025 -

The Key To The Bruins Success Espns Insight Into Their Critical Offseason Decisions

May 22, 2025

The Key To The Bruins Success Espns Insight Into Their Critical Offseason Decisions

May 22, 2025 -

Watercolor Script Review A Promising New Playwright

May 22, 2025

Watercolor Script Review A Promising New Playwright

May 22, 2025 -

Bruins Offseason Espn Reveals Key Decisions Shaping The Franchises Future

May 22, 2025

Bruins Offseason Espn Reveals Key Decisions Shaping The Franchises Future

May 22, 2025