D-Wave Quantum (QBTS): Reasons Behind The Significant Stock Drop In 2025

Table of Contents

Market-Wide Downturn and Tech Sector Correction

The dramatic fall in D-Wave Quantum's stock price wasn't solely attributable to company-specific issues. A significant contributing factor was the broader economic climate and the subsequent correction within the technology sector.

Broader Economic Factors

A potential recession or economic slowdown in 2025 significantly impacted high-growth tech stocks like QBTS. This downturn created a ripple effect across the financial markets:

- Decreased investor appetite for riskier investments during economic uncertainty: Investors, fearing losses, shifted away from speculative investments, including those in the relatively nascent quantum computing field. The perceived risk associated with early-stage technology companies like D-Wave increased considerably.

- Shift in investor focus towards more stable, established companies: In times of economic uncertainty, investors often gravitate towards safer, more established companies with a proven track record of profitability and stability. This led to a flight of capital away from riskier growth stocks, including QBTS.

- Increased interest rates impacting valuations of growth stocks: Rising interest rates typically lead to decreased valuations of growth stocks, as investors demand higher returns to compensate for the increased risk. This macroeconomic factor further contributed to the decline in QBTS stock price.

Tech Sector Specific Headwinds

Beyond the broader economic downturn, the technology sector itself faced specific headwinds in 2025. The overall negative sentiment towards the tech industry contributed to the QBTS stock drop:

- Negative investor sentiment towards the broader technology sector: A general sense of overvaluation and concerns about future growth in certain tech sub-sectors created a negative ripple effect across the board.

- Concerns about overvaluation of tech companies: Many tech companies had experienced significant growth in previous years, leading to concerns about potential overvaluation. This concern was amplified during an economic downturn.

- Competition from other emerging technologies: The rapid advancement of other emerging technologies, such as advanced AI and improved classical computing, diverted investor attention and capital away from quantum computing, creating further pressure on QBTS.

D-Wave Quantum's Specific Challenges

While the broader market conditions played a significant role, D-Wave Quantum faced its own set of specific challenges that exacerbated the stock price decline.

Slower-than-Expected Revenue Growth

D-Wave's financial performance in 2025 fell short of expectations, contributing significantly to the drop in its stock price. This underperformance stemmed from several factors:

- Comparison of actual revenue to projected revenue figures: A significant gap between projected and actual revenue figures signaled a failure to meet market expectations, directly impacting investor confidence.

- Analysis of factors contributing to slow revenue growth (e.g., market adoption, competition): Slow market adoption of quantum computing solutions and increased competition hindered D-Wave's ability to secure contracts and generate revenue.

- Discussion of any delays in product development or deployment: Potential delays in product development or deployment further contributed to the revenue shortfall, undermining investor faith in the company's ability to execute its strategy.

Increased Competition in the Quantum Computing Space

The quantum computing landscape is becoming increasingly competitive. The emergence of new players and advancements from established companies put pressure on D-Wave's market position:

- Overview of key competitors in the quantum computing market: The rise of competitors with different technological approaches intensified the competition for market share and funding.

- Analysis of competitor advantages and strategies: Competitors' advantages, whether in terms of technology, market reach, or funding, put significant pressure on D-Wave's market position.

- Impact of competitor innovations on D-Wave's market position: Innovative breakthroughs by competitors further eroded D-Wave's market share and potential for future growth.

Challenges in Scaling and Commercialization

D-Wave also faced significant hurdles in scaling its operations and successfully commercializing its quantum technology:

- Discussion of technical challenges in scaling quantum computers: The inherent technical complexities of scaling quantum computers presented significant challenges to D-Wave's growth plans.

- Challenges in attracting and retaining skilled workforce: The highly specialized nature of quantum computing made attracting and retaining a skilled workforce a significant challenge, impacting development and deployment capabilities.

- Obstacles in integrating quantum solutions into existing business processes: Difficulties in integrating quantum solutions into existing business processes limited the adoption rate and consequently, revenue generation.

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock price in 2025 resulted from a complex interplay of factors. A broader market downturn impacting the technology sector, coupled with D-Wave's specific challenges in revenue growth, increased competition, and the inherent difficulties in scaling and commercializing quantum computing technologies, all contributed to the decline. These factors highlighted the inherent risks associated with investing in early-stage quantum computing companies.

Understanding this complex interplay is crucial for investors navigating the volatile world of quantum computing stocks. Further research into D-Wave Quantum (QBTS) and the broader quantum computing market is recommended before making any investment decisions in D-Wave Quantum or similar companies. Stay informed about future developments in D-Wave Quantum and the broader quantum computing landscape to make informed investment choices in this dynamic and potentially lucrative sector.

Featured Posts

-

Solve The Nyt Mini Crossword Answers For March 24 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 24 2025

May 20, 2025 -

Cours D Ecriture D Agatha Christie Propulse Par L Ia

May 20, 2025

Cours D Ecriture D Agatha Christie Propulse Par L Ia

May 20, 2025 -

Suki Waterhouses Surface Tour Behind The Scenes In North America

May 20, 2025

Suki Waterhouses Surface Tour Behind The Scenes In North America

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025 -

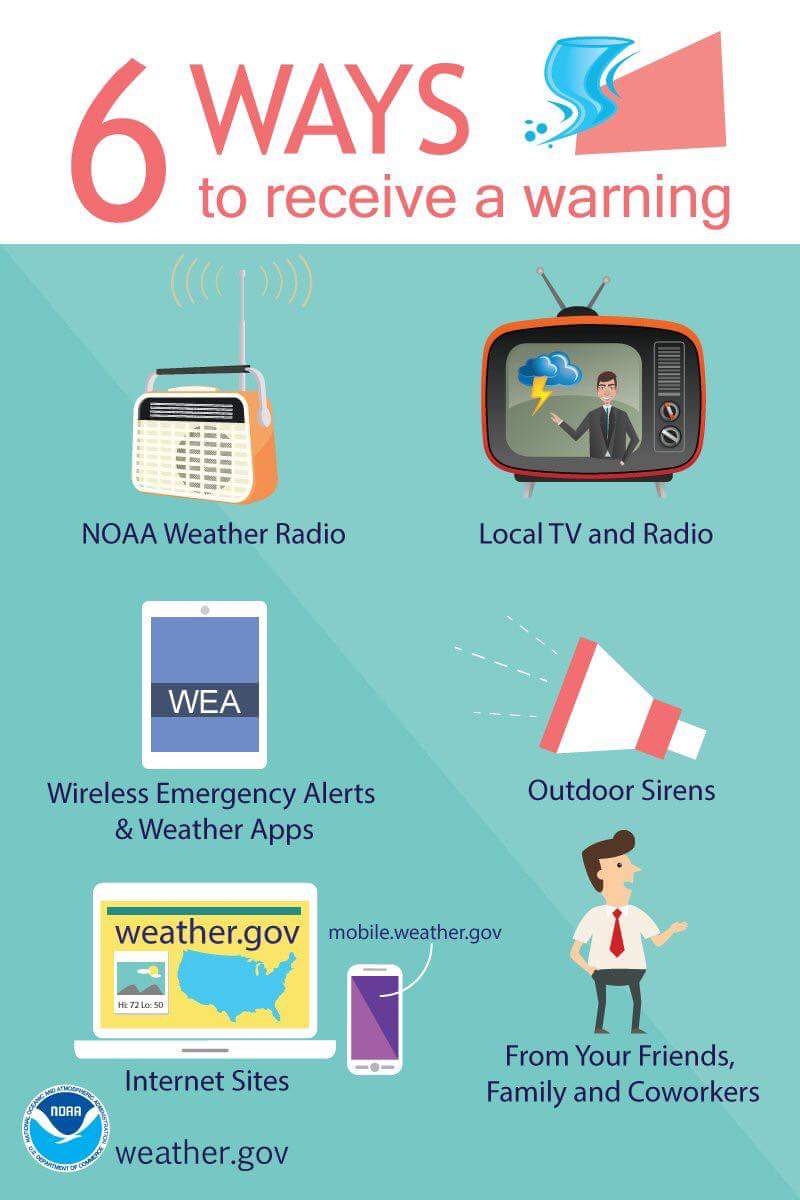

Staying Safe During Winter Weather School Delays And Emergency Preparedness

May 20, 2025

Staying Safe During Winter Weather School Delays And Emergency Preparedness

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025