D-Wave Quantum (QBTS) Stock: Investment Potential And Risks

Table of Contents

Understanding D-Wave Quantum and its Technology

D-Wave Quantum is a leading player in the quantum computing industry, focusing on a specific type of quantum computing known as quantum annealing. Understanding this technology is crucial to assessing the investment potential of QBTS stock.

Quantum Annealing Explained

Unlike gate-based quantum computing, which utilizes qubits to perform universal computations, D-Wave's approach utilizes quantum annealing, a specialized form of adiabatic quantum computation. This method leverages the principles of quantum superposition and quantum entanglement to solve specific types of optimization problems far more efficiently than classical computers. Quantum annealing excels at finding the lowest energy state in a complex system, making it particularly well-suited for applications in logistics, materials science, and artificial intelligence. These optimization problems often involve finding the best solution from a vast number of possibilities, a task that can overwhelm even the most powerful classical computers.

D-Wave's Market Position and Competition

While D-Wave is a pioneer in the quantum annealing space, the quantum computing market is rapidly evolving with significant competition from industry giants like IBM, Google, and Rigetti. These companies are pursuing various quantum computing approaches, including gate-based quantum computing which offers greater versatility but faces significant technological challenges. D-Wave’s market share is substantial within the niche of quantum annealing, but the overall quantum computing market remains largely untapped. The company's success depends on maintaining its technological edge and expanding the applications of quantum annealing.

- Strengths: D-Wave boasts years of experience and a considerable installed base of quantum annealers, providing valuable data and experience in the field. They've also established key partnerships with prominent organizations.

- Weaknesses: The limited applicability of quantum annealing compared to gate-based quantum computing represents a key weakness. Its specialized nature restricts its applicability to specific types of problems.

- Key Partnerships: D-Wave collaborates with various organizations across diverse sectors, demonstrating the potential for real-world applications of its technology and providing valuable insights into practical challenges and opportunities.

- Technological Advancements: D-Wave consistently introduces advancements in its quantum annealing technology, constantly improving qubit count, coherence times, and overall system performance.

Analyzing the Investment Potential of QBTS Stock

The investment potential of QBTS stock is intrinsically linked to the future growth of the quantum computing market and D-Wave's ability to capture a significant share of that market.

Growth Prospects in Quantum Computing

The long-term growth potential of the quantum computing market is substantial, with projections forecasting significant expansion over the coming decades. As quantum computers become more powerful and accessible, their applications will extend beyond niche areas to transform numerous industries. This market expansion offers a compelling argument for the potential long-term returns of QBTS stock, provided D-Wave maintains its competitive position. However, the actual growth trajectory will depend heavily on the rate of technological advancement and market adoption.

Financial Performance and Valuation

Analyzing QBTS's financial statements – including revenue, earnings, and debt – is critical to understanding its valuation. As a relatively young company, D-Wave is not yet profitable, but its revenue growth is a key indicator to watch. Comparing QBTS's market capitalization and valuation metrics to other tech companies in similar developmental stages can offer a relative perspective, but direct comparisons are often difficult due to the unique nature of the quantum computing sector.

- Potential Catalysts: Successful deployment of D-Wave's systems in high-value applications, strategic partnerships, and technological breakthroughs could significantly boost QBTS stock price appreciation.

- Positive Impacts on Future Earnings: Wider adoption of quantum annealing in commercially viable applications and reduced development costs are key factors that could positively impact future earnings.

- Future Profitability: The transition from research and development to large-scale commercial deployment will be critical to achieving sustained profitability.

Assessing the Risks Associated with Investing in QBTS Stock

Investing in QBTS stock is inherently a high-risk, high-reward proposition. The quantum computing industry is still in its nascent stages, and significant uncertainties exist.

High-Risk, High-Reward Investment

Investing in QBTS stock should be considered a speculative investment. The company operates in a volatile market characterized by technological uncertainty, intense competition, and a long timeline before widespread commercial adoption. This makes QBTS stock unsuitable for risk-averse investors.

Technological and Competitive Risks

The quantum computing industry is fraught with technological challenges and intense competition. D-Wave faces the risk of technological disruption from competitors pursuing different quantum computing approaches. The long development timelines for quantum computing technology and the potential for slower-than-expected market adoption add further layers of risk.

- Technological Disruption: Breakthroughs in competing technologies could render quantum annealing less competitive.

- Slower-than-Expected Adoption: The widespread adoption of quantum computing may take longer than anticipated, impacting D-Wave's growth trajectory.

- Underperforming Financial Results: D-Wave needs to demonstrate consistent progress in its financial performance to justify the current valuation and attract further investment.

Conclusion

Investing in D-Wave Quantum (QBTS) stock presents a unique opportunity in the burgeoning quantum computing sector. The potential rewards are substantial, driven by the long-term growth prospects of the quantum computing market. However, this potential is coupled with considerable risks, including technological uncertainties, intense competition, and the inherent volatility of investing in a young, unproven technology company. The limited applicability of quantum annealing compared to more versatile approaches also presents a challenge. Thorough due diligence and a realistic assessment of your risk tolerance are absolutely essential before investing in QBTS stock. Remember, this information is for educational purposes only and should not be considered financial advice. Conduct your own thorough research before making any investment decisions regarding D-Wave Quantum (QBTS) or any other quantum computing stock.

Featured Posts

-

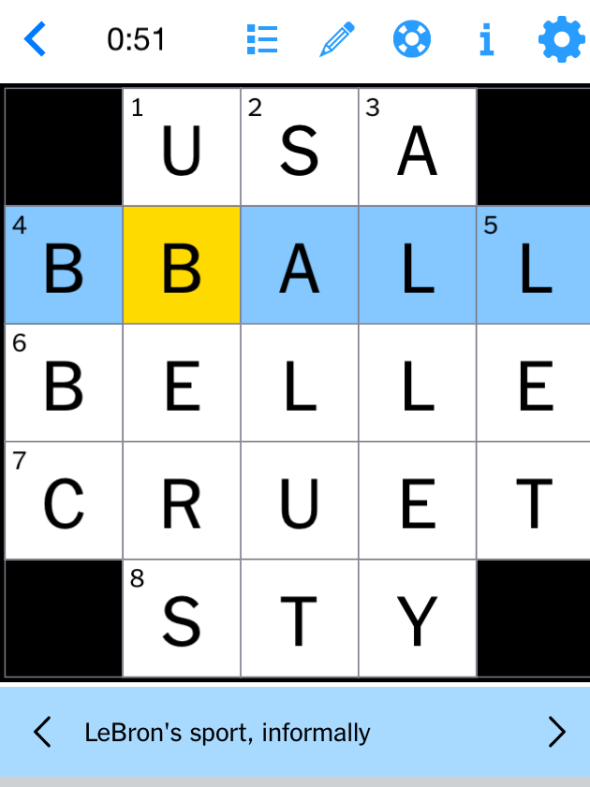

Nyt Mini Crossword March 26 2025 Complete Answers

May 21, 2025

Nyt Mini Crossword March 26 2025 Complete Answers

May 21, 2025 -

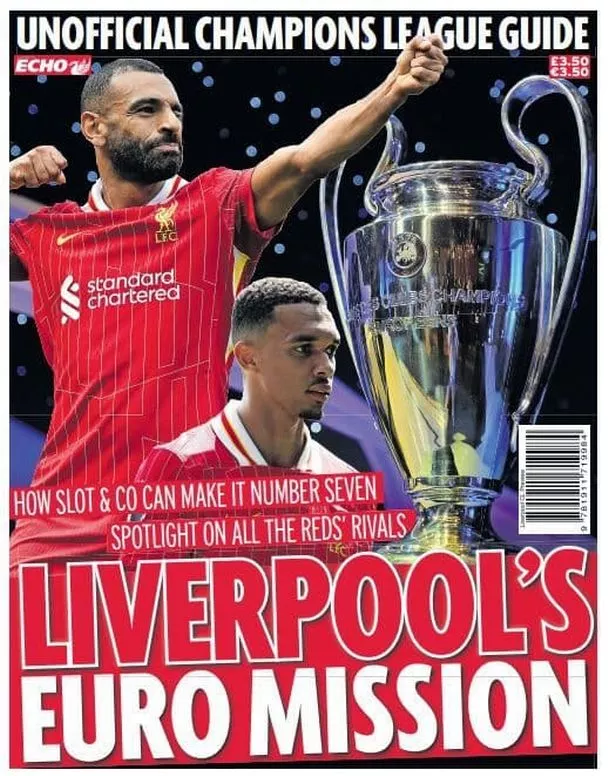

Liverpool Dan 10 Tahun Sejarah Juara Premier League

May 21, 2025

Liverpool Dan 10 Tahun Sejarah Juara Premier League

May 21, 2025 -

Get The Dexter Original Sin Steelbook Blu Ray Your Guide To Dexter New Blood

May 21, 2025

Get The Dexter Original Sin Steelbook Blu Ray Your Guide To Dexter New Blood

May 21, 2025 -

Is This Ai Quantum Computing Stock A Good Buy Right Now

May 21, 2025

Is This Ai Quantum Computing Stock A Good Buy Right Now

May 21, 2025 -

Top Gbr News Best Grocery Buys Lucky 2000 Quarter And Doge Poll Update

May 21, 2025

Top Gbr News Best Grocery Buys Lucky 2000 Quarter And Doge Poll Update

May 21, 2025

Latest Posts

-

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025 -

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025 -

The Klopp Revolution Transforming Liverpool Fc A Detailed Analysis

May 22, 2025

The Klopp Revolution Transforming Liverpool Fc A Detailed Analysis

May 22, 2025 -

Klopps Liverpool Return Confirmed Before Final Match

May 22, 2025

Klopps Liverpool Return Confirmed Before Final Match

May 22, 2025 -

David Walliams Slams Simon Cowell Amid Britains Got Talent Dispute

May 22, 2025

David Walliams Slams Simon Cowell Amid Britains Got Talent Dispute

May 22, 2025