D-Wave Quantum (QBTS) Stock Price Decline In 2025: A Comprehensive Overview

Table of Contents

H2: Macroeconomic Factors Influencing QBTS Stock Performance in 2025

The performance of even the most promising tech stocks, like QBTS, is heavily influenced by broader economic trends. A downturn in the overall market can significantly impact investor sentiment and funding for risky, high-growth ventures.

H3: Global Economic Slowdown and its Impact on Tech Investments

A global economic slowdown, potentially triggered by a recession, could dramatically affect QBTS's stock price.

- Reduced Investor Risk Appetite: During economic uncertainty, investors tend to move towards safer, more established investments, pulling funds away from high-growth, high-risk sectors like quantum computing. This decreased risk appetite directly translates to lower valuations for stocks like QBTS.

- Decreased Funding for Emerging Technologies: Quantum computing is still in its nascent stages. Reduced venture capital funding and a tightening of credit markets could severely hamper D-Wave's growth and development, impacting its stock price negatively.

- Market Volatility: A global economic slowdown often increases market volatility. This volatility can lead to sharp and unpredictable swings in stock prices, potentially pushing QBTS's stock price down significantly, even in the absence of company-specific negative news. Understanding this market volatility is crucial for investors.

H3: Rising Interest Rates and Their Effect on QBTS Valuation

Rising interest rates pose a significant challenge to growth stocks, including QBTS.

- Increased Discount Rate: Higher interest rates increase the discount rate used to calculate the present value of future earnings. This directly reduces the valuation of companies like D-Wave, which are heavily reliant on future revenue streams.

- Valuation Multiples Compression: Higher interest rates typically lead to a compression of valuation multiples (like the price-to-earnings ratio), further depressing the stock price of growth companies with high valuations. Investors become more cautious about investing in companies with uncertain future profits when they can earn higher returns on safer, fixed-income securities.

- Capital Allocation Challenges: Higher borrowing costs can make it more expensive for D-Wave to pursue capital-intensive research and development efforts, potentially slowing down its progress and impacting investor confidence.

H2: Company-Specific Challenges Contributing to the QBTS Stock Price Decline

Beyond macroeconomic factors, several company-specific challenges could contribute to a QBTS stock price decline in 2025.

H3: Competition in the Quantum Computing Market

The quantum computing landscape is becoming increasingly competitive. Companies like IBM, Google, and IonQ are all making significant advancements, potentially putting pressure on D-Wave's market share.

- Disruptive Technologies: The emergence of new, potentially more efficient quantum computing technologies could render D-Wave's current offerings less competitive.

- Market Share Erosion: Intense competition could lead to a decline in D-Wave's market share, reducing its revenue growth potential and negatively impacting its stock price. Maintaining a competitive advantage will be critical for QBTS's success.

H3: D-Wave's Technology Adoption and Revenue Generation

D-Wave's success hinges on its ability to commercialize its technology and generate sustainable revenue streams.

- Commercialization Challenges: The transition from research and development to successful commercial applications can be challenging, and delays or setbacks could impact investor confidence.

- Revenue Growth: Slow revenue growth or a failure to achieve projected revenue targets could trigger a sell-off in QBTS stock. Analyzing revenue growth will be key to understanding future performance.

- Market Penetration: Successfully penetrating target markets and securing substantial contracts will be crucial for D-Wave's long-term viability and positive stock performance.

H3: Management Decisions and Investor Confidence

Poor management decisions or a lack of transparency can erode investor confidence and negatively impact the stock price.

- Investor Relations: Effective communication and transparency with investors are crucial for maintaining confidence. Any perceived lack of transparency or communication could hurt investor sentiment.

- Corporate Governance: Sound corporate governance practices are essential for building trust with investors. Issues related to corporate governance could raise concerns and negatively affect the stock price.

- Strategic Shifts: Unexpected or poorly-executed strategic shifts could raise doubts about the company's direction and future potential.

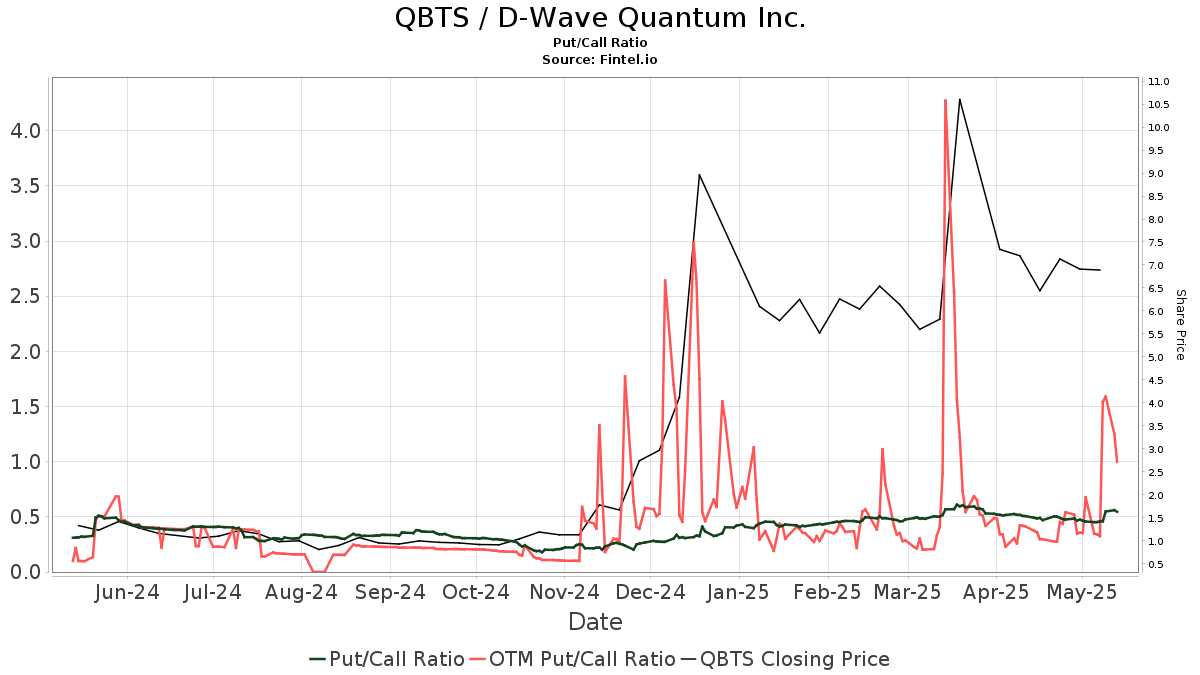

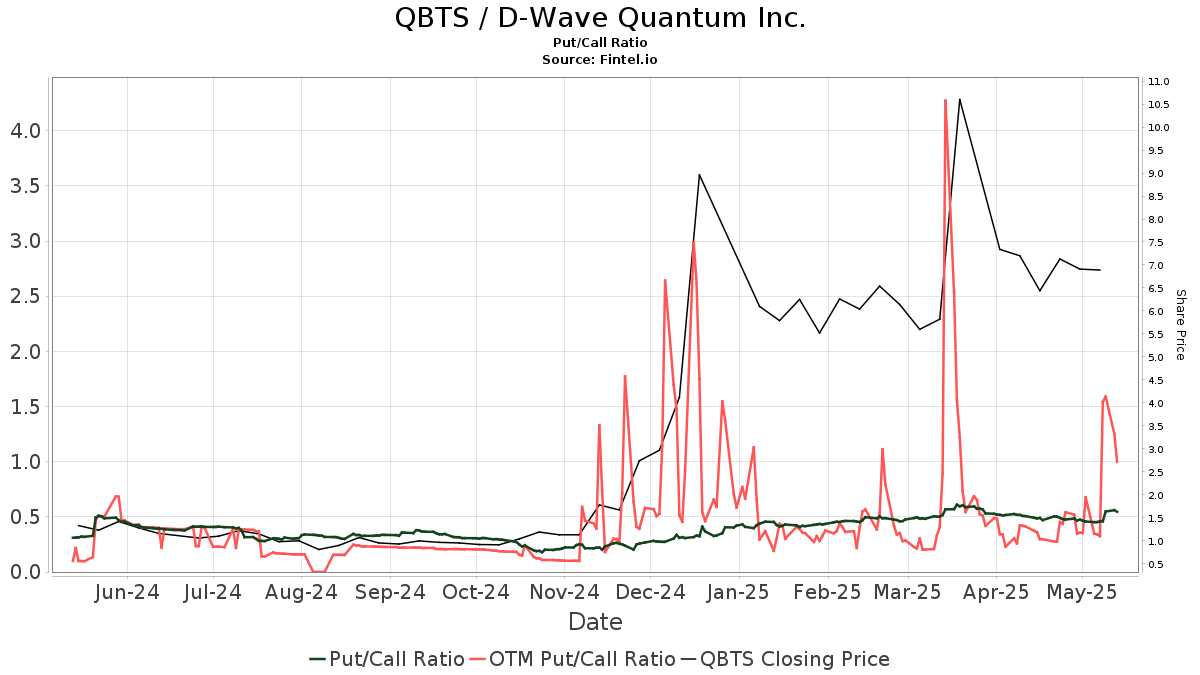

H2: Analyzing the QBTS Stock Price Decline: Technical and Fundamental Factors

Understanding both technical and fundamental factors is essential for a complete analysis.

H3: Technical Analysis of QBTS Stock Chart Patterns

Technical analysis involves studying past stock price movements to predict future trends.

- Support and Resistance Levels: Identifying key support and resistance levels can help anticipate potential price reversals or breakouts.

- Moving Averages: Tracking moving averages can reveal the overall trend (bullish or bearish) of the QBTS stock price.

- RSI (Relative Strength Index): RSI helps gauge the momentum of the stock price and identify potential overbought or oversold conditions.

H3: Fundamental Analysis of QBTS Financial Statements

Fundamental analysis involves examining a company's financial health to assess its intrinsic value.

- Earnings Per Share (EPS): EPS indicates profitability on a per-share basis. Consistent growth in EPS is generally a positive indicator.

- Price-to-Earnings Ratio (P/E): The P/E ratio compares a company's stock price to its earnings per share, helping assess valuation.

- Return on Equity (ROE): ROE measures a company's profitability relative to its shareholder equity. A high ROE usually suggests effective management of assets.

3. Conclusion

A potential D-Wave Quantum (QBTS) stock price decline in 2025 could be attributed to a confluence of factors. Macroeconomic headwinds, such as a global economic slowdown and rising interest rates, could significantly impact investor sentiment and funding for the quantum computing sector. Simultaneously, company-specific challenges, including intense competition, difficulties in commercializing technology, and the need for robust revenue generation, could further exacerbate the situation. Analyzing both technical and fundamental aspects of QBTS's performance is crucial for informed decision-making.

Key Takeaways: Investors should carefully consider the interplay between macroeconomic conditions and D-Wave's specific progress in commercializing its technology and achieving sustainable revenue growth before making any investment decisions. Understanding the competitive landscape and the potential impact of rising interest rates is also crucial.

Call to Action: Before investing in D-Wave Quantum (QBTS) or any other quantum computing stock, conduct thorough due diligence, considering the factors discussed in this article. Monitor the macroeconomic environment, assess D-Wave's progress in commercializing its technology, and carefully analyze its financial statements and competitive position to make informed investment decisions regarding D-Wave Quantum (QBTS) stock and the future of quantum computing investments.

Featured Posts

-

La Chanson De Louane Pour L Eurovision 2024 Details Et Analyse

May 20, 2025

La Chanson De Louane Pour L Eurovision 2024 Details Et Analyse

May 20, 2025 -

Systeme D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025

Systeme D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025 -

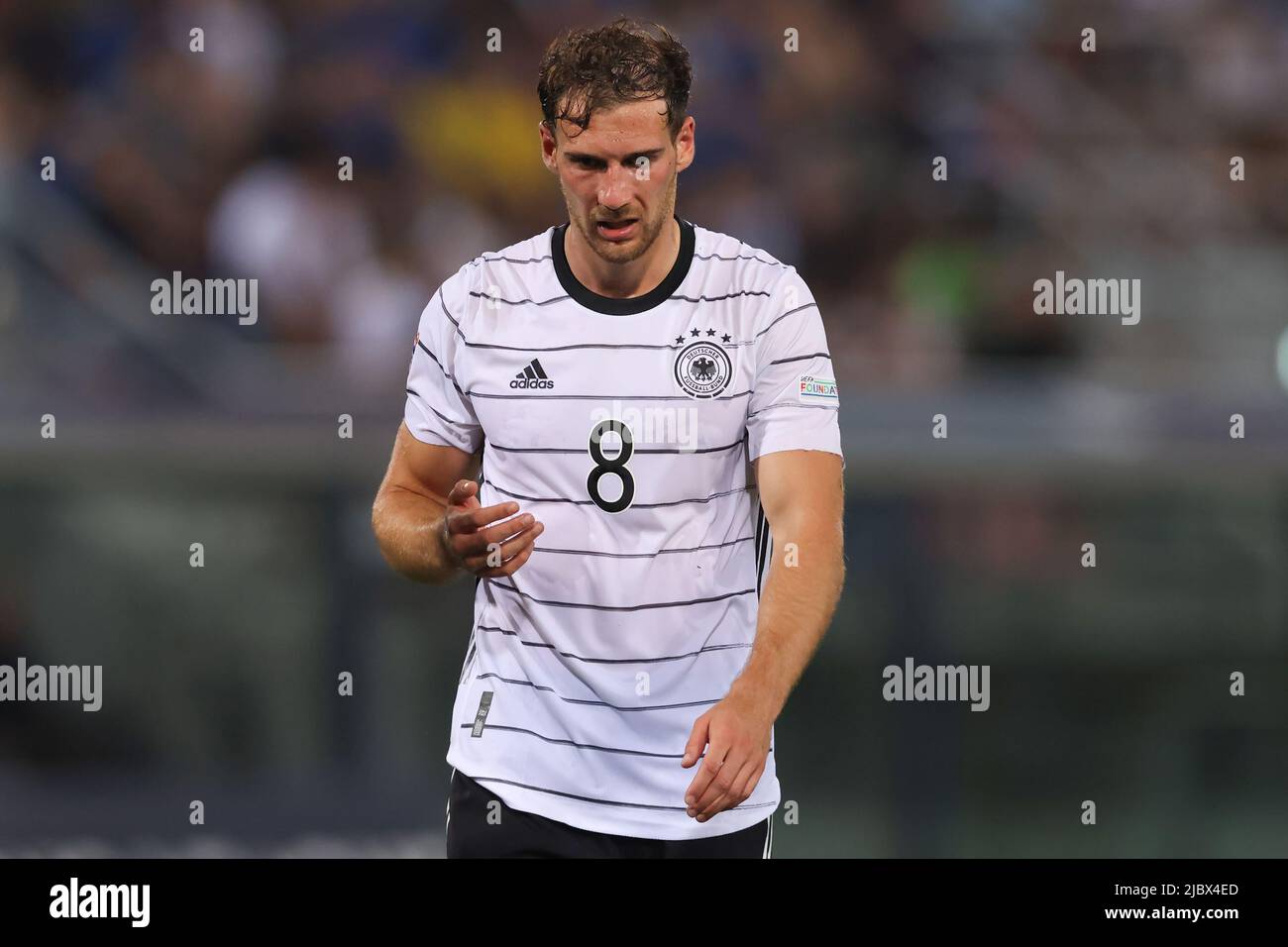

Goretzkas Nations League Call Up Nagelsmanns Team Announcement

May 20, 2025

Goretzkas Nations League Call Up Nagelsmanns Team Announcement

May 20, 2025 -

March 13 Nyt Mini Crossword Answers

May 20, 2025

March 13 Nyt Mini Crossword Answers

May 20, 2025 -

Jennifer Lawrence Sem A Barriga De Gravida Desmentindo Rumores De Segundo Filho

May 20, 2025

Jennifer Lawrence Sem A Barriga De Gravida Desmentindo Rumores De Segundo Filho

May 20, 2025

Latest Posts

-

Benjamin Kaellman Kasvu Ja Maalinteko Huuhkajissa

May 20, 2025

Benjamin Kaellman Kasvu Ja Maalinteko Huuhkajissa

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellman Tuo Maalintekovoimaa

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellman Tuo Maalintekovoimaa

May 20, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025 -

Benjamin Kaellman Kehitys Ja Potentiaali Huuhkajissa

May 20, 2025

Benjamin Kaellman Kehitys Ja Potentiaali Huuhkajissa

May 20, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta Huuhkajiin

May 20, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta Huuhkajiin

May 20, 2025