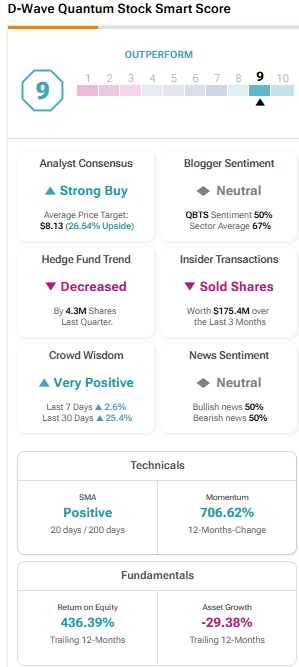

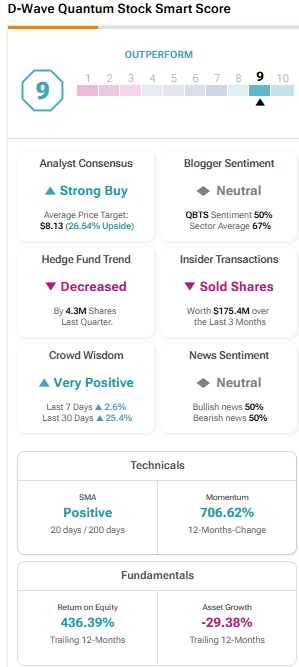

D-Wave Quantum (QBTS) Stock Slumps: Kerrisdale Capital's Valuation Concerns

Table of Contents

Kerrisdale Capital's Key Arguments Against D-Wave Quantum's Valuation

Kerrisdale Capital's report outlines several key concerns regarding D-Wave Quantum's valuation, casting doubt on the company's current market capitalization and future prospects. Let's examine their central arguments:

Overvalued Market Capitalization

Kerrisdale Capital argues that QBTS's market capitalization is significantly inflated compared to its current revenue and projected future earnings. Their analysis suggests a substantial disconnect between the company's valuation and its tangible achievements in the quantum computing market.

- Significant gap between market cap and revenue: Kerrisdale points to a disparity between QBTS's market capitalization and its relatively modest revenue stream, suggesting a substantial overvaluation. Specific figures from their report should be included here, properly cited. (e.g., "Kerrisdale estimates a market capitalization X times higher than the company's current annual revenue, citing [Source]").

- Unrealistic revenue projections: The report criticizes D-Wave's projected future revenue as overly optimistic and lacking a robust foundation. They argue that the projected growth rates are not supported by current market trends or the competitive landscape.

- Lack of substantial commercial success: Kerrisdale highlights the limited number of commercially successful applications of D-Wave's quantum annealing technology, questioning the market's acceptance of its current technological offerings.

Keywords: Market capitalization, overvaluation, revenue projections, financial analysis, QBTS valuation.

Concerns Regarding Technological Advancement and Market Competition

Kerrisdale expresses skepticism about D-Wave's technological claims and its competitive position within the rapidly evolving quantum computing industry.

- Technological limitations: The report questions the applicability and scalability of D-Wave's quantum annealing approach compared to other emerging quantum computing technologies, such as gate-based quantum computers.

- Intense competition: Kerrisdale points to the growing number of competitors in the quantum computing field, suggesting that D-Wave faces significant challenges in maintaining its market share. This includes mentioning key competitors like IBM, Google, and IonQ.

- Market acceptance: The report highlights concerns about the widespread adoption of D-Wave's technology by major industries, suggesting that the market may not fully embrace its current offerings.

Keywords: Quantum computing technology, market competition, technological advancement, competitive landscape, QBTS technology.

Analysis of D-Wave's Business Model and Revenue Streams

Kerrisdale's report critically examines D-Wave's business model, raising concerns about its long-term financial sustainability.

- Dependence on limited revenue streams: The report points to D-Wave's reliance on a relatively small number of revenue streams, making the company vulnerable to market fluctuations and changes in customer demand.

- Unsustainable revenue growth: The analysis casts doubt on the sustainability of D-Wave's current revenue growth trajectory, suggesting that the company may struggle to achieve its projected financial targets.

- High operating costs: Kerrisdale may highlight high research and development costs, potentially impacting profitability and long-term financial health.

Keywords: Business model, revenue streams, revenue projections, financial sustainability, QBTS revenue.

The Impact of Short Selling on QBTS Stock Price

Kerrisdale Capital holds a short position in QBTS stock, meaning they profit from a decline in its price. This inherent conflict of interest must be acknowledged when interpreting their analysis.

- Short selling mechanics: Understanding that short selling involves borrowing and selling shares, hoping to buy them back later at a lower price, is crucial to interpreting their motivations.

- Potential for bias: While Kerrisdale's analysis is thorough, it's essential to acknowledge the potential for bias inherent in their short position. Readers should consider this when evaluating the report's conclusions.

- Market impact: The report's publication likely contributed to the increased volatility in QBTS's stock price.

Keywords: Short selling, short position, stock price volatility, QBTS stock price.

Counterarguments and Considerations

While Kerrisdale Capital's report presents a compelling case, it's vital to consider counterarguments and alternative perspectives. [Insert any counterarguments or supporting data for D-Wave here, citing reputable sources]. This section should present a balanced view, acknowledging both criticisms and potential opportunities. Maintain objectivity and acknowledge limitations in available data.

Conclusion: Navigating the D-Wave Quantum (QBTS) Stock Situation

Kerrisdale Capital's report raises significant concerns about D-Wave Quantum's valuation, focusing on its market capitalization, technological advancements, business model, and revenue streams. Their short position in QBTS stock necessitates a careful consideration of potential biases. While their arguments are substantial, it is crucial to consider alternative viewpoints and conduct thorough independent research before making any investment decisions related to D-Wave Quantum (QBTS) stock. The quantum computing sector remains dynamic and rapidly evolving, and understanding the various analyses and perspectives is critical before investing in QBTS stock. Stay informed about further developments in the quantum computing sector and the QBTS stock performance to make the most informed decision. Remember to always conduct your own due diligence before investing in D-Wave Quantum (QBTS) stock or any other security.

Featured Posts

-

Vanja Mijatovic Razlozi Za Promenu Imena

May 21, 2025

Vanja Mijatovic Razlozi Za Promenu Imena

May 21, 2025 -

Domaca Kancelaria Vs Firemna Kancelaria Kde Je Lepsie Pracovat

May 21, 2025

Domaca Kancelaria Vs Firemna Kancelaria Kde Je Lepsie Pracovat

May 21, 2025 -

New Womens Tag Team Champions Emerge On Wwe Monday Night Raw

May 21, 2025

New Womens Tag Team Champions Emerge On Wwe Monday Night Raw

May 21, 2025 -

Vanja Mijatovic Demantira Glasine O Razvodu Zbog Tezine

May 21, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Zbog Tezine

May 21, 2025 -

Energy Transition In Taiwan The Shift To Lng Following Nuclear Reactor Closure

May 21, 2025

Energy Transition In Taiwan The Shift To Lng Following Nuclear Reactor Closure

May 21, 2025

Latest Posts

-

Barry Ward Interview I Look Like A Cop To Casting Directors

May 22, 2025

Barry Ward Interview I Look Like A Cop To Casting Directors

May 22, 2025 -

Michael Bay And Sydney Sweeney To Star In Outrun Movie Adaptation

May 22, 2025

Michael Bay And Sydney Sweeney To Star In Outrun Movie Adaptation

May 22, 2025 -

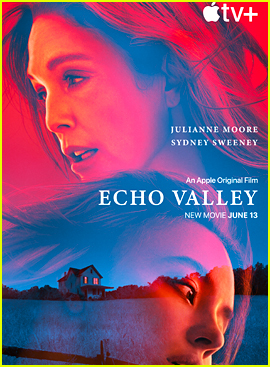

Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller

May 22, 2025

Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller

May 22, 2025 -

New Thriller Echo Valley Images Featuring Sydney Sweeney And Julianne Moore Released

May 22, 2025

New Thriller Echo Valley Images Featuring Sydney Sweeney And Julianne Moore Released

May 22, 2025 -

Barry Ward Why He Keeps Getting Cast As A Cop

May 22, 2025

Barry Ward Why He Keeps Getting Cast As A Cop

May 22, 2025