Dasani Bottled Water: Why The UK Market Is Untapped

Table of Contents

Limited Brand Awareness and Marketing in the UK

Dasani's underperformance in the UK stems, in part, from insufficient brand awareness and a lack of impactful marketing campaigns. Compared to its competitors, Dasani's marketing efforts have been relatively muted, resulting in limited brand recall and recognition among UK consumers.

Weak Brand Recognition

- Under-utilized Marketing Channels: Dasani has underutilized key marketing channels, including social media engagement, influencer marketing, and impactful television advertising. Competitors effectively leverage these platforms to build brand loyalty and drive sales.

- Lack of Memorable Campaigns: Dasani has lacked memorable and consistent branding campaigns that resonate with UK consumers. Successful competitors often have long-running campaigns that build brand familiarity and positive associations.

A targeted, multi-channel marketing campaign, emphasizing the unique selling points of Dasani, is crucial to improve brand recall. This could include a refreshed brand image, engaging social media content, and strategic partnerships with influential figures in the UK.

Market Positioning

Dasani's current market positioning in the UK is unclear. A more defined strategy is needed to compete effectively.

- Comparison with Competitors: Competitors like Volvic often position themselves in the premium segment, while others, such as Highland Spring, focus on a natural, source-driven image. Dasani's positioning needs to be more distinct.

- Potential for Repositioning: Dasani could successfully reposition itself by highlighting its purity, sustainable sourcing practices, or affordability, depending on the chosen target market.

By identifying a clear niche and crafting compelling messaging, Dasani can fill a gap in the market and appeal to a specific segment of UK consumers.

Competition and Market Saturation

The UK bottled water market is highly competitive and saturated, presenting significant challenges for new entrants and underperforming brands.

Dominant Competitors

The UK bottled water market is dominated by several key players:

- Major Competitors: Buxton, Highland Spring, Volvic, and others hold significant market share, built on years of established branding and extensive distribution networks. These brands benefit from strong brand recognition and consumer loyalty.

Dasani needs a robust differentiation strategy to compete effectively against these established brands. This could involve focusing on a unique selling proposition, such as superior taste, specific mineral content, or eco-friendly packaging.

Price Sensitivity

UK consumers exhibit varying degrees of price sensitivity towards bottled water.

- Competitor Pricing Strategies: Competitors employ a range of pricing strategies, from premium pricing to competitive everyday pricing.

- Dasani's Potential Price Points: Dasani needs to analyze the optimal price point that balances profitability with market penetration. This requires a careful study of consumer preferences and competitor pricing within different market segments.

Understanding the price sensitivity of target demographics and offering competitive pricing while simultaneously highlighting the value proposition of Dasani is crucial for market success.

Distribution and Accessibility

Effective distribution and accessibility are critical for success in the highly competitive UK bottled water market. Dasani currently faces challenges in both areas.

Retail Presence

Dasani's retail distribution network in the UK requires significant improvement.

- Distribution Gaps: Dasani is underrepresented in many key retail locations, limiting consumer access to the product. This needs to be addressed through strategic partnerships with major retailers.

- Areas of Underrepresentation: A detailed analysis of retail distribution gaps is necessary to identify areas requiring immediate attention.

Expanding partnerships with supermarkets, convenience stores, and online retailers is crucial for increasing Dasani's visibility and accessibility.

Supply Chain

A highly efficient and cost-effective supply chain is essential for profitability in the bottled water industry.

- Potential Improvements: Optimizing logistics, warehousing, and transportation can significantly reduce costs and improve efficiency. This may involve exploring alternative routes and storage solutions.

- Relationship between Supply Chain and Profitability: An efficient supply chain directly impacts profitability by reducing costs and improving speed to market.

Investing in a streamlined supply chain is key to reducing costs and ensuring consistent product availability.

Conclusion

The UK bottled water market represents a significant, yet untapped, opportunity for Dasani. However, overcoming challenges related to brand awareness, competitive positioning, distribution, and pricing is crucial for achieving substantial market share. A comprehensive, multi-faceted marketing strategy, coupled with improvements in distribution and retail presence, is essential to compete effectively. Dasani needs to define its unique selling proposition, target specific consumer segments, and build strong brand recognition to make a meaningful impact on this lucrative market.

Call to Action: Unlock the untapped potential of the UK market with a strategic investment in Dasani bottled water. Invest in a robust marketing campaign, enhance distribution networks, optimize pricing strategies, and build a strong brand identity to capture significant market share in this thriving sector.

Featured Posts

-

A Champions Vision Bringing Professional Boxing Back To Reno

May 16, 2025

A Champions Vision Bringing Professional Boxing Back To Reno

May 16, 2025 -

The Common Weakness Among Top Nba Championship Aspirants

May 16, 2025

The Common Weakness Among Top Nba Championship Aspirants

May 16, 2025 -

New York Knicks Playoff Race Brunsons Return A Game Changer

May 16, 2025

New York Knicks Playoff Race Brunsons Return A Game Changer

May 16, 2025 -

Elon Musks Twitter Name Change Fuels Gork Meme Coin Rally

May 16, 2025

Elon Musks Twitter Name Change Fuels Gork Meme Coin Rally

May 16, 2025 -

Paddy Pimblett Ufc 314 And The Liverpool Fc Connection

May 16, 2025

Paddy Pimblett Ufc 314 And The Liverpool Fc Connection

May 16, 2025

Latest Posts

-

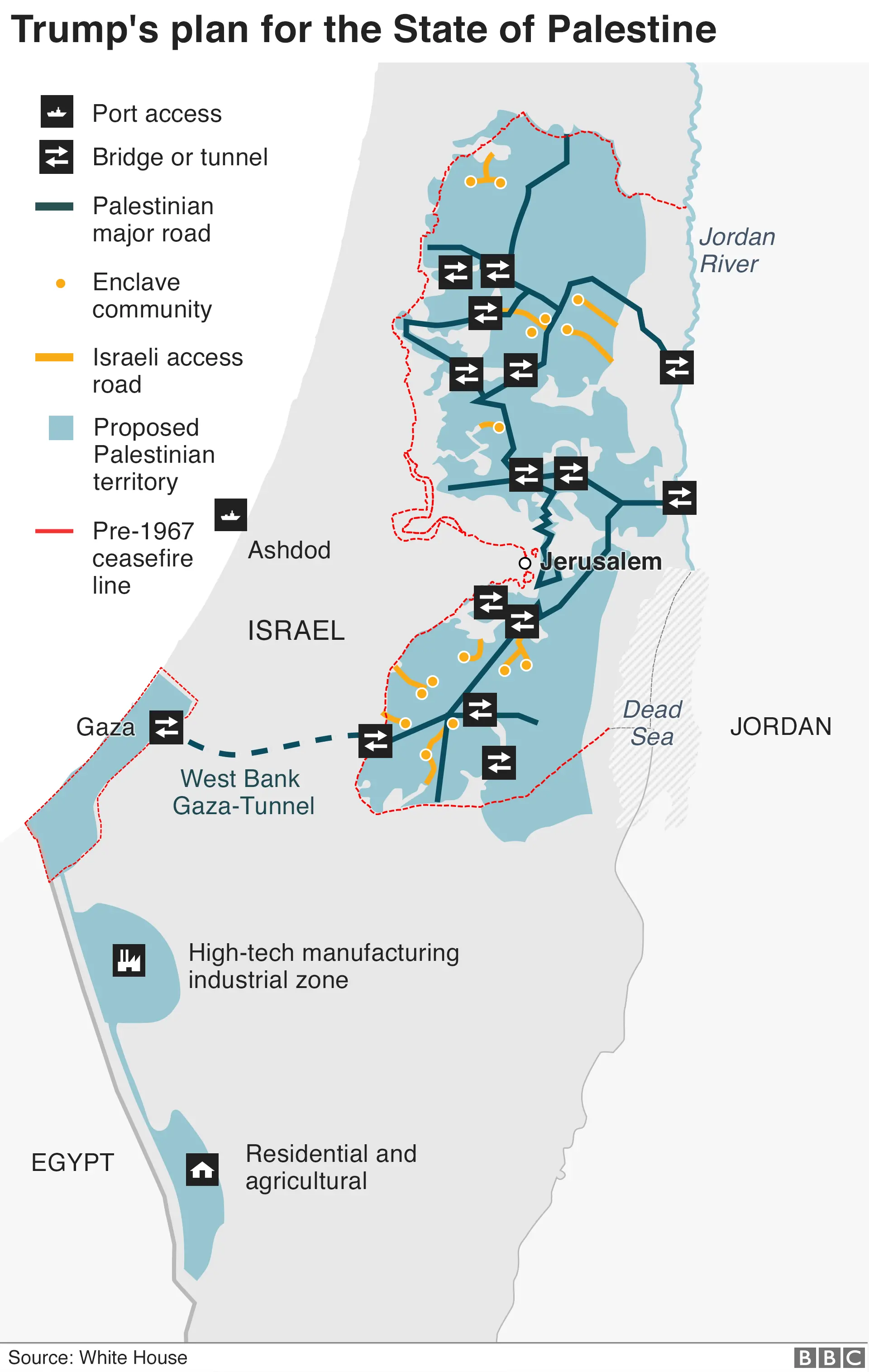

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025 -

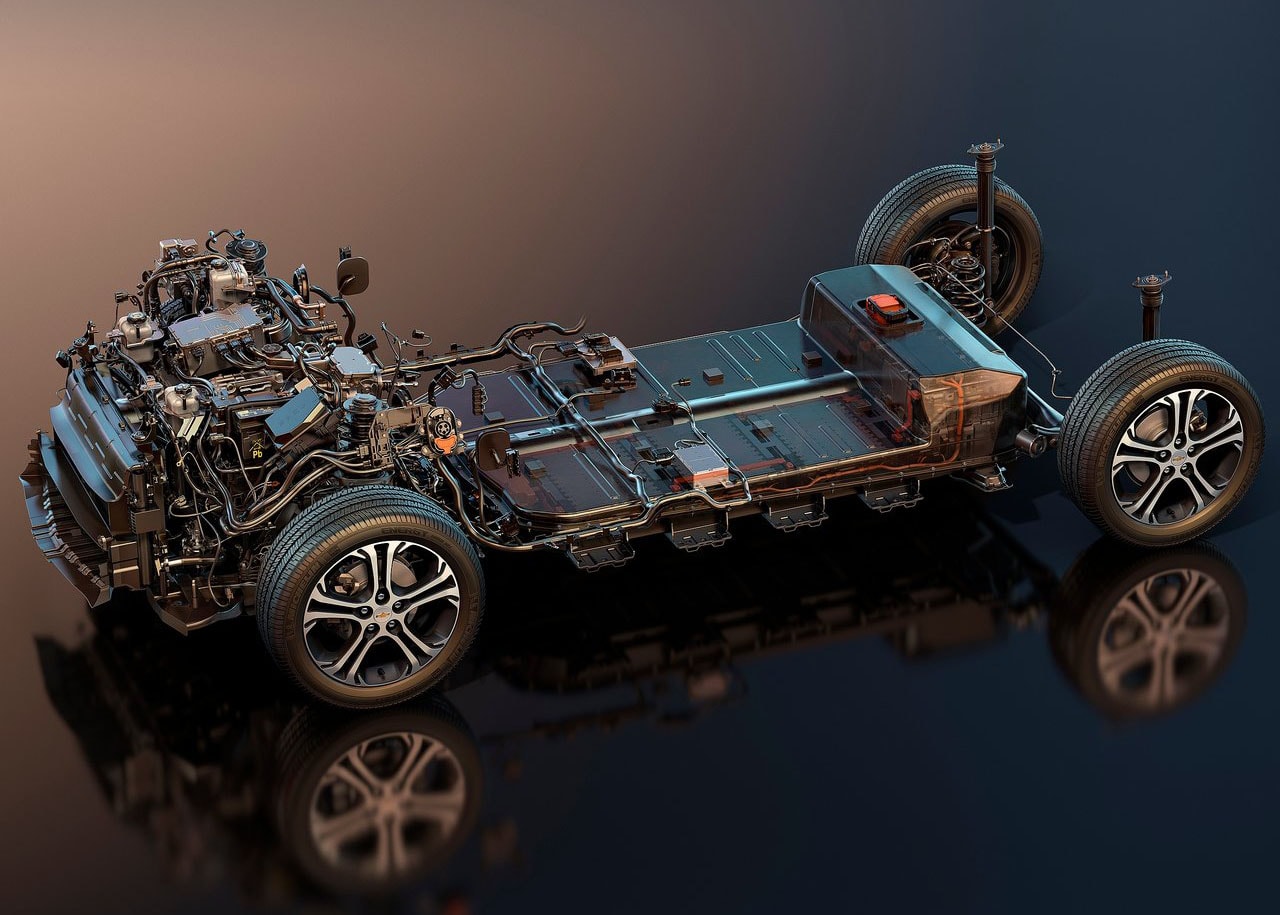

Rising Phone Battery Replacement Costs A Direct Result Of Trump Tariffs

May 17, 2025

Rising Phone Battery Replacement Costs A Direct Result Of Trump Tariffs

May 17, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 17, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 17, 2025 -

President Trumps Middle East Journey May 15 2025 A Retrospective

May 17, 2025

President Trumps Middle East Journey May 15 2025 A Retrospective

May 17, 2025 -

How Trump Tariffs Increased The Cost Of Replacing My Phone Battery

May 17, 2025

How Trump Tariffs Increased The Cost Of Replacing My Phone Battery

May 17, 2025