David Rosenberg: Latest Labour Data Pleads For Bank Of Canada Rate Cuts

Table of Contents

David Rosenberg's Stance on the Canadian Economy

David Rosenberg is known for his often contrarian views and his insightful analysis of macroeconomic trends. He typically adopts a cautious approach, often emphasizing potential risks and downside scenarios. His perspectives are highly valued, even when they differ from the mainstream consensus.

- Recent Predictions: Rosenberg's recent predictions regarding Canadian economic growth have often leaned towards a more pessimistic outlook, highlighting potential headwinds facing the economy.

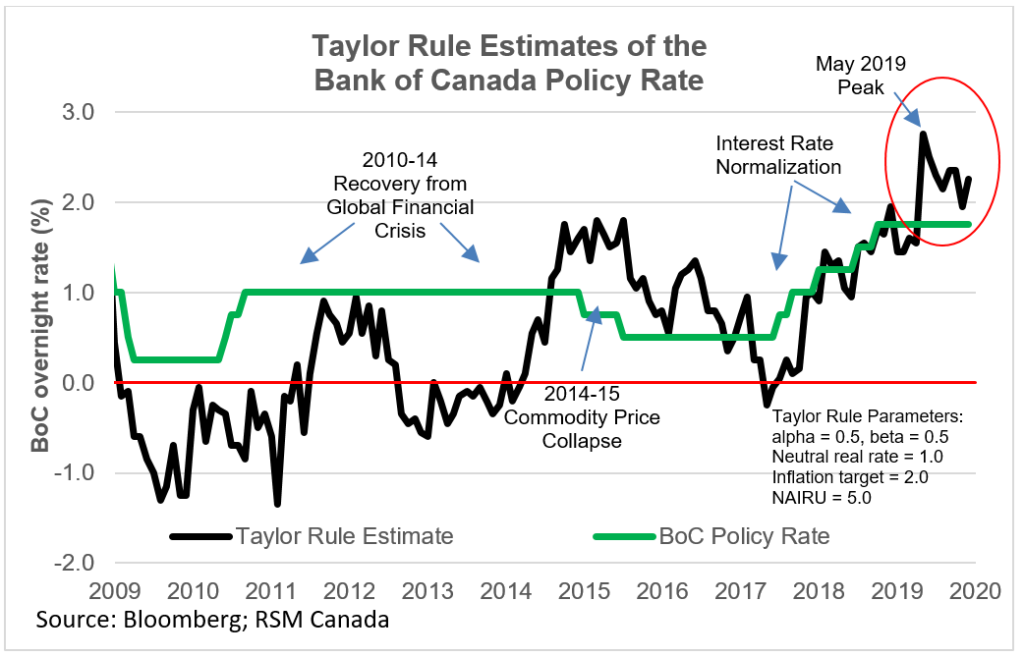

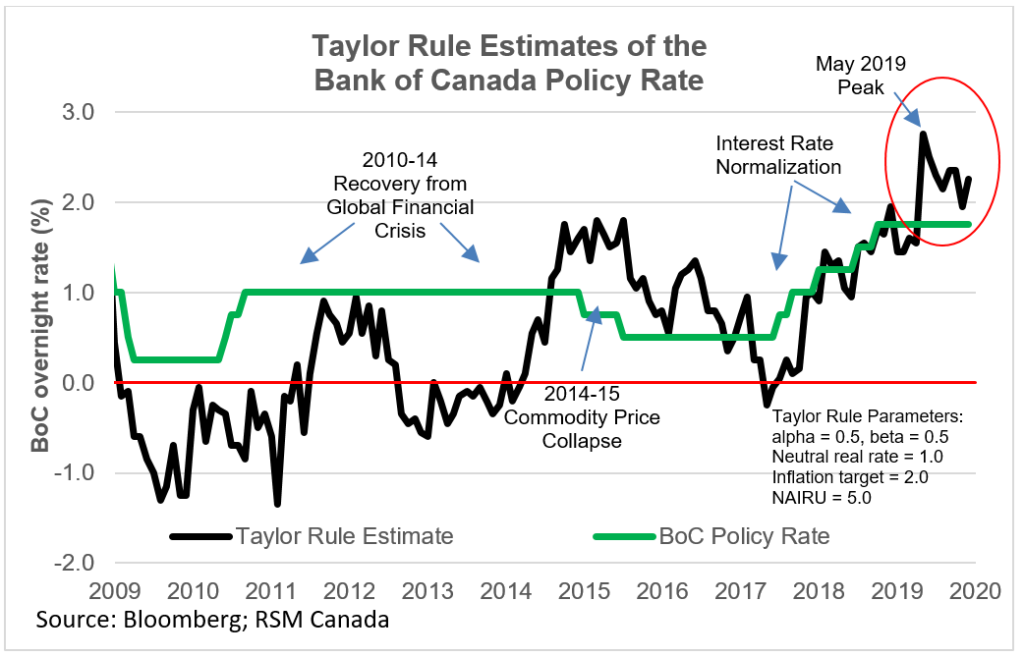

- Interest Rate Analysis: His approach to interest rate analysis typically focuses on the impact of monetary policy on inflation and employment, emphasizing the potential for unintended consequences.

- Publications and Interviews: His views are frequently shared through his publications at Rosenberg Research and various media appearances, providing a consistent stream of commentary on the Canadian economy and monetary policy.

Analysis of the Latest Labour Market Data

The latest Canadian employment figures paint a complex picture. While some indicators might suggest strength, others reveal underlying weaknesses that support Rosenberg's concerns.

- Specific Data Points: The unemployment rate, job creation numbers, and participation rate all provide crucial pieces of the puzzle. For example, while the headline unemployment rate might appear low, a closer look might reveal a decline in the participation rate indicating hidden unemployment. Job creation numbers need to be analyzed by sector for context.

- Comparisons: Comparing these figures to previous months and years is essential to gauge the underlying trends. A slowdown in job growth compared to previous years, for instance, could signal weakening economic momentum.

- Unexpected Trends: Analyzing unexpected trends or anomalies within the data is critical. For instance, a sharp decline in employment within a specific sector might indicate emerging economic vulnerabilities.

Key Indicators Suggesting a Need for Rate Cuts (According to Rosenberg)

Rosenberg likely points to several key labour market indicators to bolster his argument for rate cuts.

- Wage Growth and Inflation: He might argue that slower-than-expected wage growth indicates lessening inflationary pressures, reducing the urgency for the Bank of Canada to maintain restrictive monetary policy.

- Sectoral Employment Trends: A deeper dive into sectoral data might reveal weaknesses in key economic sectors, suggesting a broader slowdown requiring intervention.

- Signs of Economic Slowdown: The labour market often acts as a lagging indicator. Slowing job growth or rising unemployment can signal that the broader economy is already experiencing a slowdown, necessitating proactive measures.

Rosenberg's Argument for Bank of Canada Intervention

Based on his interpretation of the labour market data, Rosenberg likely advocates for Bank of Canada rate cuts to mitigate the risk of a deeper economic downturn.

- Labour Market Data and Inflation: He might argue that the current labour market data doesn't justify the current level of interest rates, suggesting that maintaining them risks a significant economic contraction.

- Risks of Maintaining Current Rates: He would likely highlight the potential negative consequences of overly tight monetary policy, including increased unemployment and reduced economic growth.

- Alternative Monetary Policy Actions: He may suggest alternative monetary policy actions beyond simple interest rate cuts, perhaps advocating for targeted interventions to support specific sectors or regions.

Counterarguments and Opposing Viewpoints

Not all economists agree with Rosenberg's assessment. Counterarguments to his position frequently highlight different interpretations of the same data.

- Arguments Against Rate Cuts: Some may argue that inflation remains a persistent threat, requiring the Bank of Canada to maintain a hawkish stance to avoid a wage-price spiral.

- Other Economists' Perspectives: Other analysts might focus on different aspects of the economic data, emphasizing factors that support continuing the current monetary policy or even suggesting further rate hikes.

- Risks of Rate Cuts: Critics might warn of potential risks associated with rate cuts, such as fueling inflation or creating asset bubbles.

Conclusion: The Implications of Rosenberg's Analysis on Bank of Canada Rate Cuts

David Rosenberg's analysis, based on his interpretation of the latest Canadian labour market data, suggests a compelling case for Bank of Canada rate cuts to mitigate the risk of a deeper economic slowdown. His focus on potential inflationary pressures and the need for proactive monetary policy highlights the complexities of navigating the current economic climate. Key takeaways emphasize the need to carefully consider various indicators within the labour market and their implications for future economic growth and inflation.

Stay updated on David Rosenberg's insights regarding Bank of Canada rate cuts to better understand the evolving dynamics of the Canadian economy and monetary policy decisions. Learn more about the impact of labour data on Bank of Canada policy decisions by following reputable financial news sources and economic commentary. Understanding the potential implications of Bank of Canada rate cuts is crucial for making informed financial decisions.

Featured Posts

-

Receta Aragonesa De 3 Ingredientes Un Sabor Del Pasado

May 31, 2025

Receta Aragonesa De 3 Ingredientes Un Sabor Del Pasado

May 31, 2025 -

Recetas De Crepes Salados 8 Ideas Para Tu Merienda O Cena

May 31, 2025

Recetas De Crepes Salados 8 Ideas Para Tu Merienda O Cena

May 31, 2025 -

Der Drohende Verlust Des Bodensees Ein Argument Fuer Klimaschutz

May 31, 2025

Der Drohende Verlust Des Bodensees Ein Argument Fuer Klimaschutz

May 31, 2025 -

How The Canadian Red Cross Is Assisting Manitoba Wildfire Evacuees

May 31, 2025

How The Canadian Red Cross Is Assisting Manitoba Wildfire Evacuees

May 31, 2025 -

Fentanyl Toxicity Confirmed In Princes Autopsy March 26th Report

May 31, 2025

Fentanyl Toxicity Confirmed In Princes Autopsy March 26th Report

May 31, 2025