DAX Rally: Can It Withstand A Wall Street Comeback?

Table of Contents

H2: The Drivers of the Recent DAX Rally

The robust performance of the DAX isn't arbitrary; several key factors have fueled this impressive rally. Understanding these drivers is crucial for assessing the sustainability of the current market trend.

-

Stronger-than-expected German economic data: Recent economic indicators from Germany have surprised analysts with their resilience. Data points such as industrial production and consumer confidence have exceeded expectations, suggesting a more robust economic recovery than initially predicted. This positive data has bolstered investor confidence in the German market.

-

Positive corporate earnings reports from German companies: Many DAX-listed companies have reported strong earnings, exceeding analyst forecasts. This demonstrates the underlying health and profitability of the German corporate sector, attracting further investment.

-

Easing concerns about the energy crisis in Europe: While the energy crisis remains a concern, recent efforts by the European Union and individual nations to diversify energy sources and reduce dependence on Russian gas have eased some anxieties. This reduction in uncertainty has positively impacted investor sentiment.

-

Investor sentiment shifting towards European markets: As investors seek diversification and potentially higher returns, some are shifting their focus from the US market to European markets, including Germany. This influx of capital is contributing to the DAX rally.

These positive factors, however, aren't without potential weaknesses. The ongoing war in Ukraine, lingering inflation, and potential future energy price shocks could still significantly impact the German economy and, consequently, the DAX. Careful monitoring of these factors is essential for any investor. The DAX performance is intrinsically linked to the health of the German economy and the broader European markets; therefore, a comprehensive understanding of these factors is crucial for accurate DAX performance analysis.

H2: The Potential for a Wall Street Comeback

The US economy, after a period of volatility, displays signs of potential recovery. However, several factors remain crucial to its trajectory.

-

Key Economic Indicators: Inflation, though declining, remains above the Federal Reserve's target. Interest rates are elevated, impacting borrowing costs for businesses and consumers. Unemployment figures, while relatively low, are closely watched for any signs of weakening.

-

Catalysts for a Wall Street Rally: A sustained decline in inflation, positive revisions to corporate earnings, and a shift towards a more accommodative monetary policy from the Federal Reserve could all contribute to a Wall Street rally.

-

Risks to a Wall Street Comeback: Geopolitical uncertainty, particularly concerning the war in Ukraine and its impact on global supply chains, poses a significant risk. Persistent inflation could force the Federal Reserve to maintain a restrictive monetary policy, potentially stifling economic growth. Recessionary fears continue to linger, posing a threat to investor confidence.

The interplay between these factors will significantly determine whether Wall Street experiences a sustained recovery, impacting the global economic outlook.

H3: The Impact of a Wall Street Comeback on the DAX

A robust Wall Street comeback could significantly impact the DAX.

-

Capital Flows: Investors might shift capital from European markets, including Germany, back to the US in search of potentially higher returns. This capital outflow could negatively affect the DAX's performance.

-

Market Correlation: The DAX and the US stock market exhibit some correlation, meaning that a positive trend in one market often influences the other, though not always to the same degree. A strong Wall Street performance could initially boost investor sentiment, but sustained strength in the US could attract significant capital away from Europe.

-

Investor Sentiment and Risk Appetite: A Wall Street rally might alter global investor sentiment, potentially shifting risk appetite away from perceived higher-risk markets like Europe towards the perceived stability of the US market.

The correlation between the DAX and Wall Street isn't absolute, and other factors will influence the DAX's performance. However, understanding the potential for capital flows and shifts in investor sentiment is vital for navigating the complexities of the global market.

H2: Analyzing the Sustainability of the DAX Rally

Assessing the long-term prospects of the DAX rally requires considering several potential challenges:

-

Geopolitical Risks: The ongoing war in Ukraine, tensions between China and Taiwan, and other geopolitical uncertainties create instability and could negatively impact investor confidence and investment flows.

-

Persistent Inflation and Rising Interest Rates: High inflation and rising interest rates could dampen economic growth in Germany and Europe, impacting corporate earnings and investor sentiment.

-

Supply Chain Disruptions: Global supply chain disruptions could continue to affect German industries, impacting profitability and growth.

Considering these challenges, multiple scenarios are possible for the DAX. A strong Wall Street recovery could lead to capital outflow from Europe, potentially hindering the DAX rally. Conversely, if the US economy underperforms, the DAX might continue its positive trajectory, provided other factors remain supportive. Long-term investment in the DAX requires careful consideration of these various possibilities.

3. Conclusion: The Future of the DAX Rally in the Face of Wall Street

The current DAX rally is driven by positive economic data, strong corporate earnings, easing energy concerns, and shifting investor sentiment. However, the potential for a Wall Street comeback poses a significant challenge. A Wall Street resurgence could attract capital away from European markets, potentially slowing or reversing the DAX's upward momentum. The sustainability of the DAX rally hinges on the continued strength of the German economy, easing geopolitical risks, and the overall global economic outlook. Whether the DAX can withstand a Wall Street comeback depends on a complex interplay of factors, making continuous monitoring and analysis crucial.

To stay informed about the DAX rally and its interaction with the US market, subscribe to our newsletter, follow reputable financial news sources, and conduct further research on DAX investments and the global economic outlook. For deeper dives into DAX performance analysis and Wall Street predictions, consult our recommended resources (link to resources). Stay informed and make informed decisions about your DAX investments.

Featured Posts

-

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja Sopimukseen

May 25, 2025

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja Sopimukseen

May 25, 2025 -

Annie Kilners Account Of Events Following Kyle Walkers Night Out

May 25, 2025

Annie Kilners Account Of Events Following Kyle Walkers Night Out

May 25, 2025 -

Pletojant Elektromobiliu Tinkla Porsche Atidaro Nauja Ikrovimo Stoti

May 25, 2025

Pletojant Elektromobiliu Tinkla Porsche Atidaro Nauja Ikrovimo Stoti

May 25, 2025 -

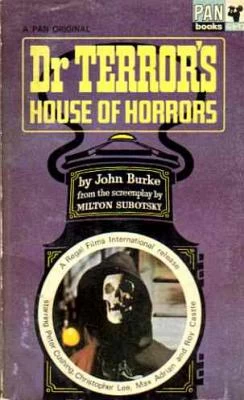

Plan Your Fright A Comprehensive Guide To Dr Terrors House Of Horrors

May 25, 2025

Plan Your Fright A Comprehensive Guide To Dr Terrors House Of Horrors

May 25, 2025 -

George Russells Crucial Decision Solving Mercedes Key Flaw

May 25, 2025

George Russells Crucial Decision Solving Mercedes Key Flaw

May 25, 2025