DAX Surge: Will A Wall Street Rebound Dampen The Celebrations?

Table of Contents

Factors Driving the Recent DAX Surge

Several factors have contributed to the recent impressive performance of the DAX index. Understanding these drivers is crucial for predicting its future trajectory.

Positive Economic Indicators in Germany

Germany's economy has shown signs of resilience, bolstering the DAX. Several key indicators point towards a positive outlook:

- Stronger-than-expected GDP growth: Recent data suggests that the German economy is growing at a faster rate than initially projected, injecting confidence into the market. This positive economic momentum directly impacts the DAX index performance.

- Improved manufacturing data: The manufacturing sector, a vital component of the German economy, has shown signs of recovery, contributing to the overall positive sentiment reflected in the DAX.

- Increased consumer spending: Rising consumer confidence and increased spending indicate a healthy domestic market, further supporting the DAX's upward trend. This reflects positive investor sentiment regarding the future of the German economy.

Analyzing the impact of these positive German economic indicators on the DAX index performance and investor confidence is essential for understanding the current market situation. The improved economic outlook directly translates to higher valuations for German companies listed on the DAX.

Global Economic Optimism (Despite Inflation)

Despite persistent inflationary pressures, a degree of global economic optimism has fueled the DAX's rise. This optimism stems from several factors:

- Easing inflation concerns in some regions: While inflation remains a global concern, easing pressures in certain key economies have reduced some investor anxieties. This decreased uncertainty has positively impacted the DAX.

- Positive corporate earnings reports: Strong corporate earnings reports from both German and international companies have boosted investor confidence and fueled further investment in the DAX.

- Increased investor appetite for risk: As inflation concerns ease, investors are showing a greater willingness to take on risk, leading to increased investment in equities, including the DAX. This increased risk appetite is a key driver of the DAX's upward trajectory.

How global economic sentiment, despite ongoing inflationary pressures, fuels the DAX's upward trajectory is a critical aspect of understanding the current market dynamics. The interplay between global and regional economic factors significantly impacts investor behavior and the DAX's performance.

Performance of Key DAX Companies

The strong performance of several key DAX companies across various sectors has significantly contributed to the overall index surge.

- Strong performance of leading German companies across various sectors: Companies in the automotive, technology, and industrial sectors have shown particularly strong performances, driving the DAX upward.

- Impact of specific company announcements and earnings: Positive news and strong earnings reports from individual companies have had a ripple effect, boosting the overall DAX index.

Highlighting the contribution of individual DAX companies to the overall index surge, focusing on sectors and specific examples, provides a granular understanding of the forces at play. Analyzing the performance of individual companies allows for a more nuanced interpretation of the DAX's movement.

Potential Impact of a Wall Street Rebound

A potential rebound on Wall Street could significantly impact the DAX, given the interconnectedness of global financial markets.

Correlation between DAX and Wall Street

The DAX and US stock markets exhibit a degree of correlation, meaning that movements in one market often influence the other.

- Explain the historical correlation between the DAX and US stock markets: Historical data reveals a significant correlation, indicating that positive movements on Wall Street tend to be followed by positive movements on the DAX, and vice versa.

- Discuss the interconnectedness of global financial markets: Global financial markets are intricately linked. Events in one market often trigger ripple effects across the globe.

Analyzing the degree to which a Wall Street rebound could influence the DAX's performance, considering historical data and current market dynamics, is crucial for predicting future movements. The strength of the correlation, however, can fluctuate depending on various economic and geopolitical factors.

Potential for Capital Flows

A Wall Street rebound could lead to capital flows shifting from European markets, including the DAX, back to the US.

- Discuss the possibility of investors shifting capital from European markets (including the DAX) back to Wall Street if a significant rebound occurs: Investors often seek higher returns, and a strong Wall Street rebound might incentivize capital reallocation.

- Analyze the potential impact of interest rate differentials between the US and Europe: Interest rate differentials between the US and Europe can influence capital flows, potentially impacting the DAX.

Discussing the movement of capital between Wall Street and the DAX, and how this affects investor sentiment and market volatility, is critical for understanding the potential consequences of a Wall Street rebound. The flow of capital is a significant factor influencing market dynamics.

Impact on Investor Sentiment

A Wall Street rebound could significantly influence investor sentiment towards the DAX.

- Explain how a Wall Street rebound could affect investor confidence in the DAX: A strong US market might divert investor attention and capital away from the DAX.

- Discuss the potential for a shift in risk appetite among investors: A shift in investor risk appetite, driven by a Wall Street rebound, could lead to decreased investment in the DAX.

Analyzing the psychological impact of a US market recovery on investor behavior concerning the DAX index is crucial for understanding the potential for a market correction. Investor sentiment is a powerful driver of market movements.

Predicting Future DAX Performance

Predicting the future performance of the DAX requires careful analysis of various factors, including market volatility and expert opinions.

Analyzing Market Volatility

Market volatility plays a significant role in determining the DAX's future trajectory.

- Discuss the current level of market volatility and its potential impact on the DAX: High volatility creates uncertainty and can lead to sharp price swings.

- Explore potential risks and uncertainties that could affect future DAX performance: Geopolitical events, economic downturns, and unexpected company announcements can all impact the DAX.

Examining market volatility indicators and their relationship to DAX forecasts and investor uncertainty is crucial for developing a realistic outlook. Understanding volatility is key to effective investment strategy.

Expert Opinions and Forecasts

Financial analysts offer diverse perspectives on the future DAX performance.

- Summarize expert opinions and forecasts regarding future DAX performance: Collect and summarize opinions from reputable sources, highlighting different viewpoints.

- Include different perspectives on potential upward and downward trends: Acknowledge the inherent uncertainty in market forecasting.

Including forecasts and opinions from financial analysts regarding the future outlook for the DAX index, considering the potential impact of a Wall Street rebound, provides a comprehensive perspective on potential future scenarios. It is important to consider multiple perspectives when making investment decisions.

Conclusion

The recent DAX surge is a multifaceted event driven by a confluence of factors, including positive economic indicators within Germany and broader global economic optimism. However, the possibility of a Wall Street rebound introduces a crucial variable that could significantly impact the DAX's future trajectory. The inherent correlation between the DAX and Wall Street, coupled with potential shifts in capital flows and investor sentiment, will be pivotal in determining the DAX's future direction.

Call to Action: Stay informed about the latest developments in both the German and US markets to make well-informed investment decisions concerning the DAX. Continuously monitor the DAX index and its relationship with Wall Street for a clearer understanding of potential market fluctuations. A thorough understanding of the interplay between the DAX and Wall Street is vital for navigating the intricacies of the global financial market. Keep monitoring the DAX forecast and adjust your investment strategy accordingly.

Featured Posts

-

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025 -

Debolezza Bancaria E Borsa Italiana L Influenza Della Fed

May 25, 2025

Debolezza Bancaria E Borsa Italiana L Influenza Della Fed

May 25, 2025 -

Zivot Penzionera U Luksuzu Milioni I Luksuzne Vile

May 25, 2025

Zivot Penzionera U Luksuzu Milioni I Luksuzne Vile

May 25, 2025 -

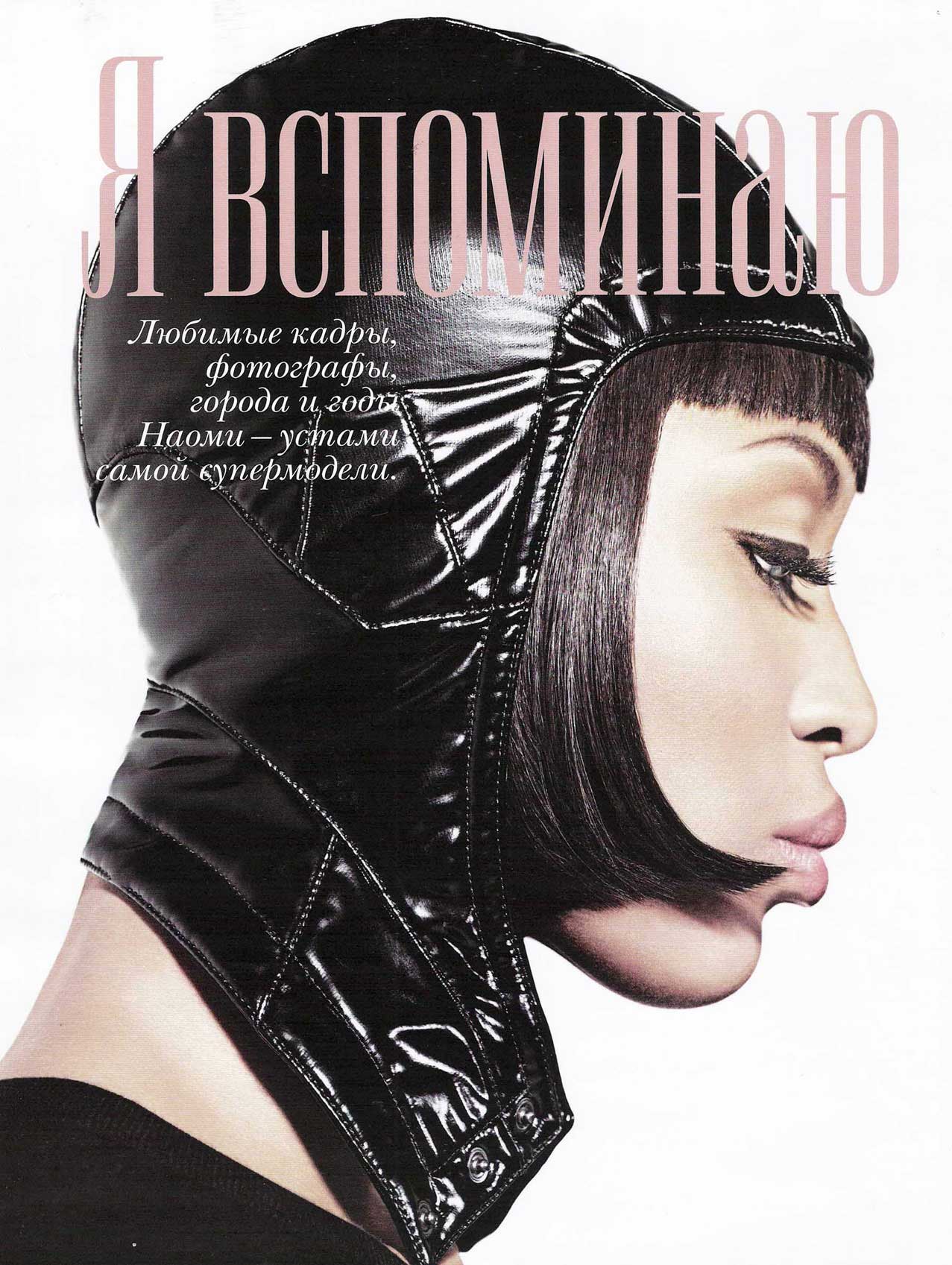

Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025

Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025 -

8 Stock Market Rally On Euronext Amsterdam Following Us Tariff News

May 25, 2025

8 Stock Market Rally On Euronext Amsterdam Following Us Tariff News

May 25, 2025