Decoding Live Nation Entertainment (LYV): A Deep Dive Into Investment Strategies

Table of Contents

Understanding Live Nation Entertainment (LYV) and its Business Model

Live Nation Entertainment's (LYV) business model is multifaceted, encompassing three core pillars: Ticketmaster, concert promotion, and venue ownership. This vertical integration provides a significant competitive advantage.

- Key Revenue Streams:

- Ticket Sales: Ticketmaster, a wholly-owned subsidiary, holds a dominant position in the global ticketing market, generating substantial revenue from ticket sales across various events. This near-monopoly provides a significant and stable revenue stream for LYV stock.

- Concert Promotion Fees: Live Nation promotes thousands of concerts annually, earning fees from artists and event organizers. This segment is highly dependent on the success and popularity of the artists and the overall health of the live music industry.

- Venue Rentals and Operations: Owning and operating numerous venues worldwide provides additional revenue streams from rentals, concessions, and other venue-related services. This diversification reduces reliance on solely ticket sales and concert promotion fees.

- Sponsorship and Advertising Revenue: Live Nation leverages its vast reach and brand recognition to secure lucrative sponsorship deals and advertising contracts, further enhancing its profitability.

- Data Analytics and Artist Services: LYV utilizes data analytics to optimize its operations and offers various services to artists, enhancing their reach and generating additional income streams.

Live Nation's market position as a leading concert promoter and the undisputed leader in ticketing through Ticketmaster offers significant competitive advantages. The combined power of these two segments creates a powerful ecosystem benefiting both artists and fans. Keywords: Live Nation stock, LYV stock price, Ticketmaster, concert promoter.

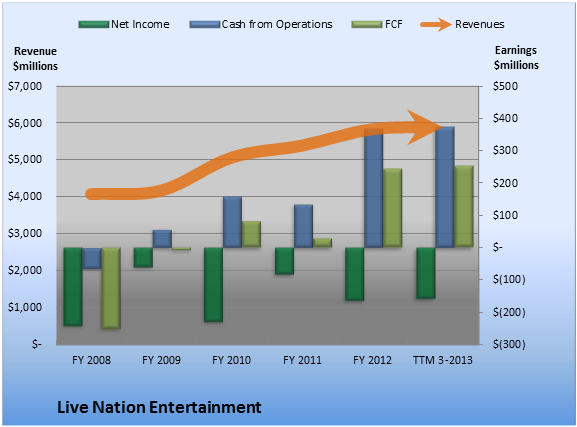

Analyzing Live Nation's Financial Performance and Growth Potential

Analyzing LYV's financial performance requires examining key metrics. While historical data provides valuable context, future projections are crucial for assessing growth potential. (Note: Actual charts and graphs would be included here in a published article, showing revenue growth, profitability, and debt levels over time).

- Factors Impacting Growth:

- Post-pandemic Recovery: The live entertainment industry experienced a significant downturn during the pandemic, but the post-pandemic recovery is a key driver of LYV's growth. Increased concert attendance and pent-up demand contribute significantly to revenue growth.

- Technological Advancements: Digital ticketing, virtual concerts, and data-driven marketing strategies are enhancing efficiency and expanding revenue opportunities.

- Market Expansion: Live Nation continues to expand into new markets and demographics, tapping into previously untapped potential for growth.

- Strategic Acquisitions and Partnerships: Acquisitions and strategic partnerships enhance market share and provide access to new technologies and resources.

Keywords: LYV financial statements, Live Nation revenue, LYV earnings, Live Nation stock forecast.

Assessing the Risks Associated with Investing in Live Nation (LYV)

Investing in LYV, like any investment, carries inherent risks. It's crucial to understand these before making any investment decisions.

-

Macroeconomic Factors: Recessions, inflation, and changes in consumer spending patterns directly impact discretionary spending on entertainment, posing a substantial risk to LYV's performance.

-

Industry-Specific Risks: Competition from other live entertainment companies, artist cancellations, and security concerns at events can all negatively impact revenue and profitability.

-

External Factors: Geopolitical instability, pandemics, and unexpected events can significantly disrupt the live entertainment industry and create unforeseen challenges for LYV.

-

Key Risks:

- Economic Downturns: Economic downturns significantly reduce consumer spending on entertainment, impacting ticket sales and overall revenue.

- Competition: Competition from other concert promoters and ticketing platforms presents a significant challenge to LYV's market dominance.

- Regulatory Changes: Antitrust concerns and regulatory changes could impact LYV's operations and profitability.

- Event Dependence: Live Nation's revenue is heavily dependent on the success and attendance of large-scale events; cancellations due to unforeseen circumstances can significantly impact profitability.

Keywords: LYV risk assessment, Live Nation competition, Live Nation investment risks.

Developing Effective Investment Strategies for Live Nation (LYV)

Developing a robust investment strategy for LYV requires considering various approaches and risk tolerance.

-

Investment Approaches:

- Long-Term Investing: A buy-and-hold strategy focusing on long-term growth is suitable for investors with a higher risk tolerance and a longer time horizon.

- Short-Term Trading: Short-term trading based on market fluctuations requires close monitoring and a higher risk tolerance. This approach is not suitable for all investors.

- Value Investing: Identifying undervalued LYV stock and holding for long-term appreciation.

- Growth Investing: Focusing on companies with high growth potential, expecting significant returns in the future.

-

Diversification Strategies: Diversification across multiple asset classes is crucial to mitigate risk. Don't put all your eggs in one basket!

-

Investment Tools: Consider options such as dollar-cost averaging (DCA) to mitigate risk and maximize returns over time. Dividend reinvestment plans (DRIPs) can provide additional returns.

Keywords: LYV investment strategy, Live Nation long-term investment, Live Nation stock trading.

Conclusion

Investing in Live Nation Entertainment (LYV) offers a compelling opportunity to participate in the growth of the live entertainment industry. However, understanding its business model, financial performance, and the inherent risks is paramount. Thorough due diligence, a well-defined investment plan, and careful consideration of your risk tolerance are essential. By meticulously analyzing the factors discussed above, you can make informed decisions regarding your Live Nation Entertainment (LYV) investment. Start your research today and decode the potential of LYV for your investment goals!

Featured Posts

-

Sinners A Louisiana Horror Movie Coming Soon To Theaters

May 29, 2025

Sinners A Louisiana Horror Movie Coming Soon To Theaters

May 29, 2025 -

Zaragoza Recibe Reconocimiento Europeo Por Su Patrimonio Cultural

May 29, 2025

Zaragoza Recibe Reconocimiento Europeo Por Su Patrimonio Cultural

May 29, 2025 -

El Arquero Sorprendente Descifrando El Exito De Mamardashvili

May 29, 2025

El Arquero Sorprendente Descifrando El Exito De Mamardashvili

May 29, 2025 -

Book Your Luxurious 30 Minute Bubble Bath At Lush In Nyc 75

May 29, 2025

Book Your Luxurious 30 Minute Bubble Bath At Lush In Nyc 75

May 29, 2025 -

Is Mamardashvili Meeting Expectations Westerveld Weighs In

May 29, 2025

Is Mamardashvili Meeting Expectations Westerveld Weighs In

May 29, 2025

Latest Posts

-

Are Landlords Exploiting Las Fire Victims A Look At Rising Rental Costs

May 31, 2025

Are Landlords Exploiting Las Fire Victims A Look At Rising Rental Costs

May 31, 2025 -

Podcast Rethinking Your Approach To Personal Finance

May 31, 2025

Podcast Rethinking Your Approach To Personal Finance

May 31, 2025 -

Tracking The Markets Dow S And P 500 May 30 2024 Updates

May 31, 2025

Tracking The Markets Dow S And P 500 May 30 2024 Updates

May 31, 2025 -

Increased Rent In Los Angeles After Recent Fires A Growing Concern

May 31, 2025

Increased Rent In Los Angeles After Recent Fires A Growing Concern

May 31, 2025 -

Podcast Forget Everything You Know About Money

May 31, 2025

Podcast Forget Everything You Know About Money

May 31, 2025