Decoding The Bank Of Canada Pause: Insights From Financial Experts

Table of Contents

The Bank of Canada's Rationale Behind the Pause

The Bank of Canada's official statement regarding the pause cited a need to assess the cumulative impact of previous interest rate increases on inflation and economic growth. While inflation remains a concern, the central bank acknowledged signs of slowing economic activity and a cooling housing market. Their decision was likely influenced by a complex interplay of economic indicators.

- Current Inflation Rate and its Trajectory: While still above the Bank of Canada's 2% target, inflation has shown signs of moderating in recent months. The rate of increase is slowing, suggesting the previous interest rate hikes are having their intended effect.

- Unemployment Figures and Labor Market Trends: The Canadian labor market remains relatively strong, but there are indications of softening, with some sectors experiencing slower job growth. This suggests potential easing of inflationary pressures due to reduced demand.

- Recent GDP Growth or Contraction: Recent GDP figures indicate slower growth than previously anticipated, reflecting the impact of higher interest rates on consumer spending and business investment.

- Potential Risks and Uncertainties in the Economy: Global economic uncertainty, geopolitical risks, and potential supply chain disruptions remain significant factors influencing the Bank of Canada's decision-making process.

Expert Opinions on the Bank of Canada Pause

Financial experts offer varied interpretations of the Bank of Canada pause, reflecting the complexities of the current economic climate.

- Expert 1's View: Economist David Rosenberg believes the pause is a necessary tactical retreat, highlighting the risk of over-tightening monetary policy and triggering a deeper recession. He suggests a prolonged period of observation is needed before further interest rate adjustments.

- Expert 2's Analysis: Analyst Jennifer Lee anticipates further interest rate hikes later in the year, arguing that inflation remains stubbornly high and requires more aggressive action to reach the Bank of Canada's target. She predicts a potential increase of 25 basis points by the end of 2024.

- Expert 3's Opinion: Financial expert Mark Carney cautions against the risks of a premature pause, emphasizing the importance of sustained efforts to curb inflation. He stresses the need for vigilance and data-driven decision-making moving forward.

Implications of the Bank of Canada Pause for Consumers

The Bank of Canada pause will have a multifaceted impact on Canadian consumers, affecting borrowing costs, saving strategies, and the housing market.

- Potential Changes in Mortgage Rates: While a pause doesn't automatically translate to lower mortgage rates, it might prevent further increases. Existing borrowers may see some stability, and those considering a new mortgage may find slightly more favorable terms.

- Impact on Personal Loan Interest Rates: Interest rates on personal loans are likely to remain relatively stable in the short term, reflecting the current pause. However, future rate adjustments by the Bank of Canada could influence lending costs.

- Influence on Savings Account Interest Rates: Savings account interest rates may not immediately increase, as banks may maintain current levels to maintain profit margins. However, future rate adjustments could positively impact savings yields.

- Predicted Changes in Housing Prices: The pause might provide some relief to the housing market, potentially slowing further price declines. However, overall market trends will depend on various factors, including supply and demand dynamics.

Looking Ahead: Future Predictions and Potential Scenarios Following the Bank of Canada Pause

Several scenarios could unfold following the Bank of Canada pause, each with distinct economic consequences.

- Scenario 1: Continued Rate Hikes: If inflation remains stubbornly high, the Bank of Canada could resume raising interest rates, potentially impacting borrowing costs and slowing economic growth further.

- Scenario 2: Prolonged Pause: A prolonged pause might indicate a more cautious approach, allowing the Bank of Canada to assess the impact of previous rate hikes and observe economic data more closely. This could lead to a period of economic stabilization.

- Scenario 3: Potential Rate Cuts: If economic conditions worsen significantly, the Bank of Canada may consider cutting interest rates to stimulate growth, which could boost consumer spending and potentially lead to higher inflation again.

Understanding the Bank of Canada Pause and its Long-Term Effects

The Bank of Canada's pause on interest rate hikes is a significant development with far-reaching implications for the Canadian economy and individual consumers. The decision reflects a complex interplay of economic factors, and expert opinions vary regarding its long-term consequences. While the pause offers some short-term relief, navigating the evolving interest rate landscape requires careful monitoring and informed decision-making. Stay updated on the Bank of Canada's decisions and consult with a financial advisor to navigate the evolving interest rate landscape effectively and manage your finances in light of the Bank of Canada pause and fluctuating interest rates.

Featured Posts

-

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 23, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 23, 2025 -

Pazartesi Dizileri 17 Subat Tv Programi

Apr 23, 2025

Pazartesi Dizileri 17 Subat Tv Programi

Apr 23, 2025 -

Aaron Judges Triple Power Surge Yankees Smash Team Home Run Record

Apr 23, 2025

Aaron Judges Triple Power Surge Yankees Smash Team Home Run Record

Apr 23, 2025 -

Program Tv Ramadan 2025 Pilihan Terbaik Untuk Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025

Program Tv Ramadan 2025 Pilihan Terbaik Untuk Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025 -

Adeyemi Der Bvb Profi Zeigt Klasse Auf Und Neben Dem Platz

Apr 23, 2025

Adeyemi Der Bvb Profi Zeigt Klasse Auf Und Neben Dem Platz

Apr 23, 2025

Latest Posts

-

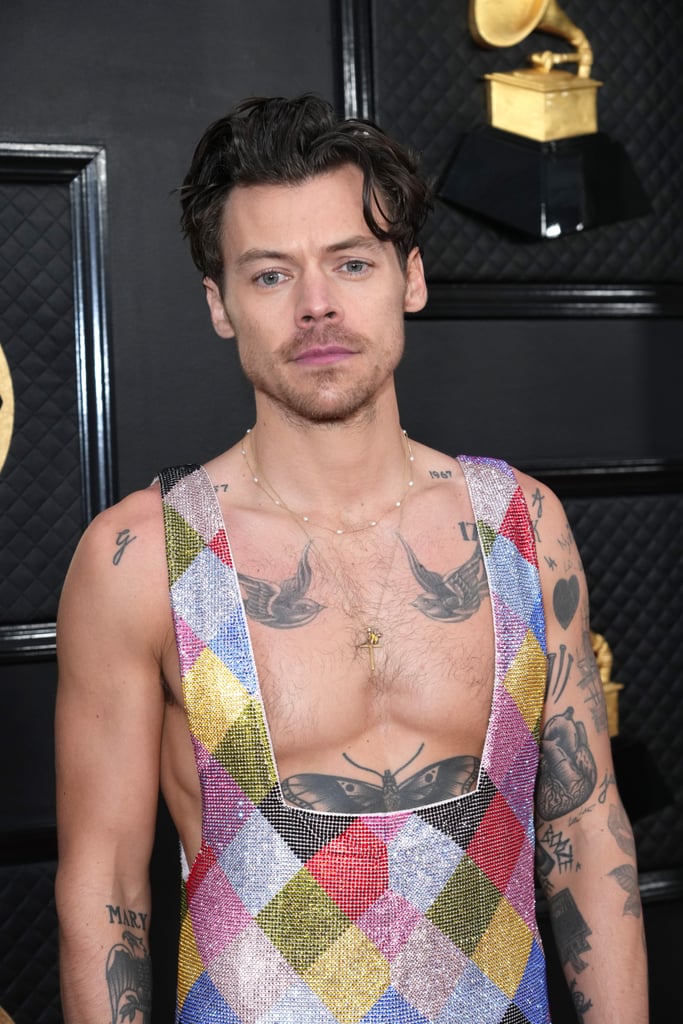

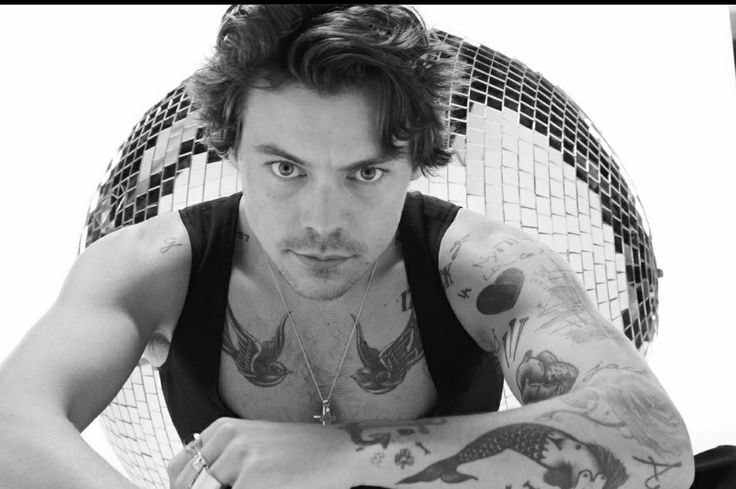

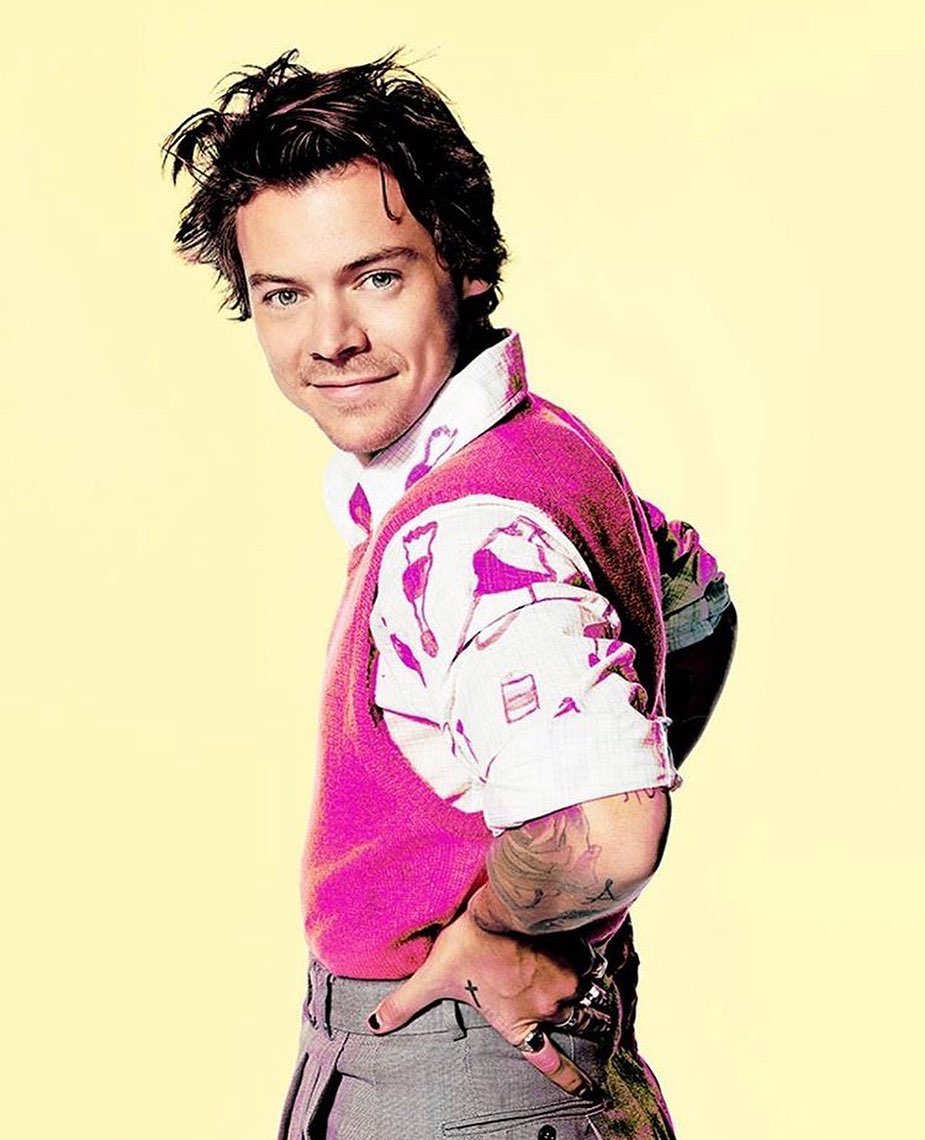

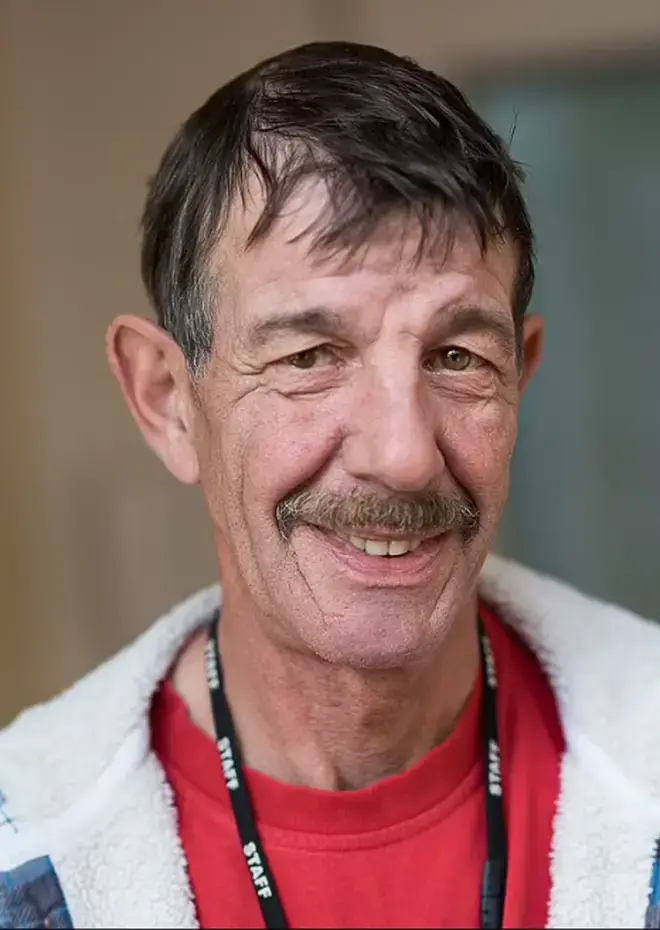

Snls Impression Of Harry Styles The Singers Disappointed Response

May 10, 2025

Snls Impression Of Harry Styles The Singers Disappointed Response

May 10, 2025 -

Harry Styles Responds To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Responds To A Hilariously Bad Snl Impression

May 10, 2025 -

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025 -

The Snl Impression Harry Styles Couldnt Stand His Reaction

May 10, 2025

The Snl Impression Harry Styles Couldnt Stand His Reaction

May 10, 2025 -

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025