Definity's $3.3 Billion Acquisition Of Travelers Canada: A Closer Look

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

Definity's acquisition of Travelers Canada's Canadian P&C operations carries a hefty price tag of $3.3 billion. While the exact breakdown of payment methods (cash, stock, or a combination) may not be publicly available in full detail at this time, the sheer scale of the transaction underscores Definity's commitment to expanding its presence in the Canadian insurance market. Contingent considerations, dependent on future performance metrics, may also play a role in the final acquisition cost. Further details are expected to emerge as the deal progresses through regulatory approvals.

Impact on Definity's Portfolio

This acquisition significantly bolsters Definity's position within the Canadian insurance market. The key benefits for Definity include:

- Increased market share in Canada: The addition of Travelers Canada's substantial customer base instantly elevates Definity's market share, making it a dominant player.

- Enhanced product diversification: Travelers Canada brings a diverse portfolio of insurance products, allowing Definity to offer a more comprehensive suite of solutions to its expanded customer base. This diversification reduces reliance on any single product line and strengthens its overall resilience.

- Access to a new customer base: Gaining access to Travelers Canada's customer base opens doors to new market segments and potentially increases cross-selling opportunities.

- Potential for synergies and cost savings: Consolidation often leads to operational efficiencies and cost reductions through streamlined processes and shared resources. This is a crucial factor in the success of such large acquisitions.

Financial Analysis

The financial implications for Definity are substantial. While the initial investment is considerable, the anticipated long-term returns are expected to be significant, driven by increased market share, expanded product offerings, and operational synergies. The deal's impact on Definity's debt levels and credit ratings will need to be carefully monitored. Investor reactions will be a key indicator of the market's perception of the acquisition's success. Initial market responses suggest a positive outlook, but continued scrutiny and analysis will be necessary.

Strategic Rationale Behind the Acquisition

Market Consolidation

The acquisition reflects a broader trend of market consolidation within the Canadian insurance sector. By acquiring Travelers Canada, Definity gains significant scale, enhancing its bargaining power with reinsurers and enabling investments in technology and innovation. This consolidation can also lead to improved efficiency and better management of risk.

Expansion of Product Offerings

The combined entity offers a wider range of insurance products and services, providing a more comprehensive solution for both personal and commercial clients. This expansion caters to a more diverse customer base and potentially enhances customer loyalty through a one-stop shop approach.

Geographic Expansion

While both companies already have a presence across Canada, the acquisition strengthens Definity's geographic reach and market penetration, particularly in areas where Travelers Canada held a strong market share. This enhanced geographical coverage enhances its overall competitiveness.

Synergies and Cost Savings

The integration of Travelers Canada into Definity's operations presents significant opportunities for cost savings and operational efficiencies. Areas such as IT infrastructure, claims processing, and customer service can be consolidated, leading to reduced overhead and improved profitability.

Regulatory Approvals and Potential Challenges

Regulatory Scrutiny

Securing regulatory approvals from the Competition Bureau of Canada and other relevant authorities is crucial for the deal to proceed. The regulatory process will involve a thorough review to assess potential anti-competitive implications and ensure the acquisition aligns with the interests of consumers and the market.

Integration Challenges

Integrating two large organizations is never without challenges. Successfully merging disparate IT systems, aligning operational processes, and fostering a unified corporate culture will require careful planning and execution. Managing employee transitions and ensuring smooth customer service during the integration is also vital.

Competition Concerns

The acquisition's potential impact on competition within the Canadian insurance market will be closely scrutinized by regulators. Addressing any antitrust concerns and demonstrating the acquisition's positive impact on consumers will be crucial for gaining regulatory approval.

Impact on Travelers Canada Employees and Customers

Employee Transition

Definity has a responsibility to ensure a smooth transition for Travelers Canada's employees. Open communication, transparent plans for integrating employees into Definity's structure, and addressing potential job security concerns will be crucial for maintaining morale and retaining valuable talent. Retention strategies will likely play a significant role in the success of this aspect of the acquisition.

Customer Service Continuity

Maintaining seamless service continuity for Travelers Canada's existing customers is paramount. Assuring customers that their policies remain valid, that claims will be processed efficiently, and that access to customer service remains uninterrupted will be vital in retaining customer loyalty during and after the integration process.

Conclusion

Definity's acquisition of Travelers Canada represents a significant development in the Canadian insurance market. The $3.3 billion deal promises substantial benefits for Definity, including increased market share, product diversification, and operational synergies. However, the successful integration of Travelers Canada and navigating the regulatory hurdles will be critical for realizing the deal's full potential. The impact on employees and customers will also be closely watched. Keep an eye on the unfolding story of the Definity Travelers Canada acquisition for further insights into this transformative deal. For more information, visit Definity's and Travelers' investor relations websites.

Featured Posts

-

Beach Day In San Diego County What To Expect This Weekend

May 30, 2025

Beach Day In San Diego County What To Expect This Weekend

May 30, 2025 -

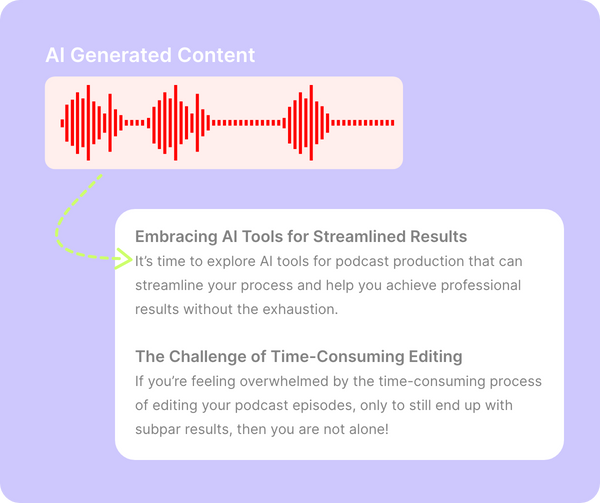

Repetitive Documents Ai Creates A Profound Poop Podcast Experience

May 30, 2025

Repetitive Documents Ai Creates A Profound Poop Podcast Experience

May 30, 2025 -

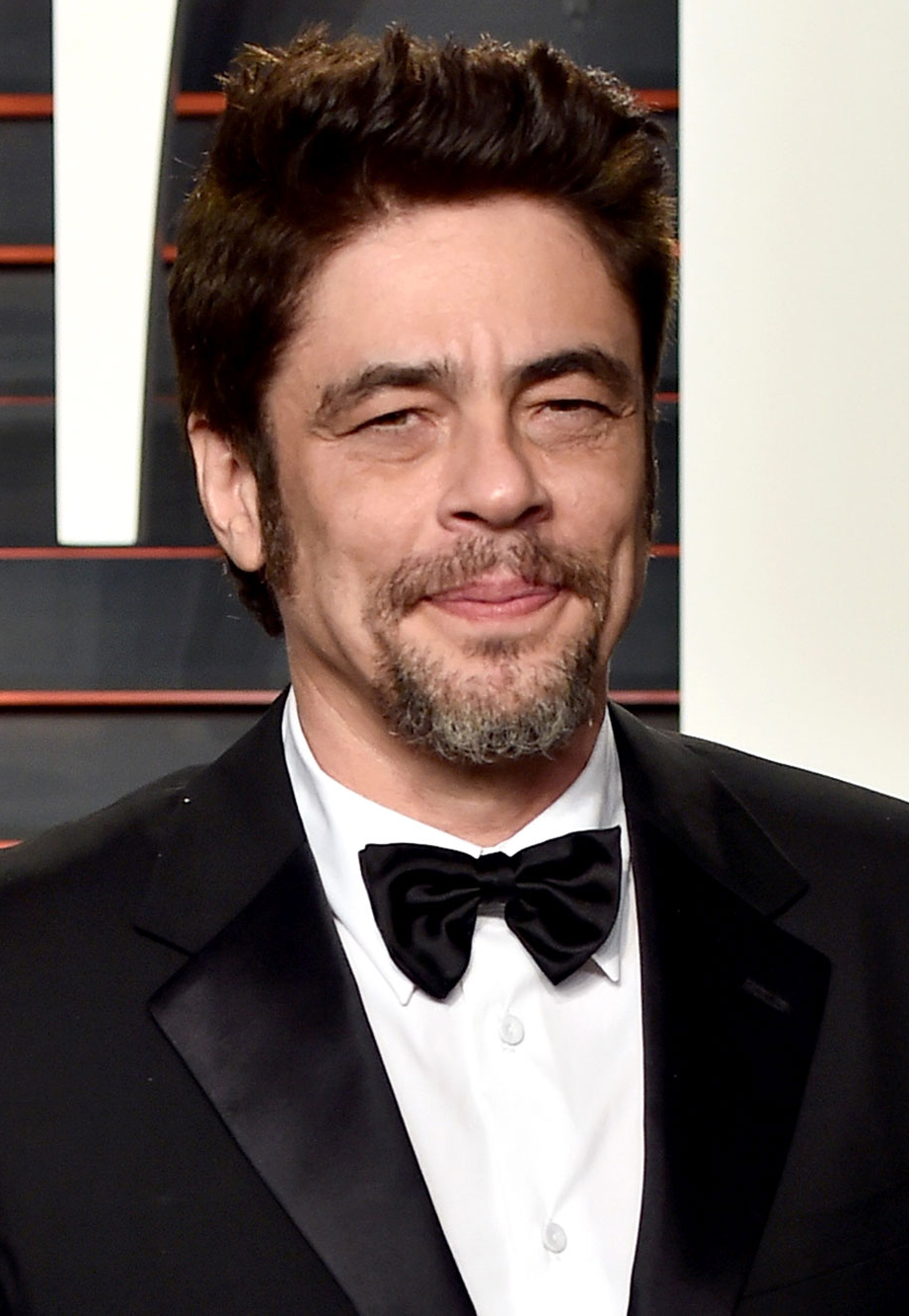

Unveiling The Plan The Gift Designed For Benicio Del Toro

May 30, 2025

Unveiling The Plan The Gift Designed For Benicio Del Toro

May 30, 2025 -

Hl Stnjh Alatfaqyat Almayyt Aljdydt Fy Hl Azmt Almyah Byn Alardn Wswrya

May 30, 2025

Hl Stnjh Alatfaqyat Almayyt Aljdydt Fy Hl Azmt Almyah Byn Alardn Wswrya

May 30, 2025 -

Carlos Alcarazs Monte Carlo Masters Victory 6th Masters 1000 Title

May 30, 2025

Carlos Alcarazs Monte Carlo Masters Victory 6th Masters 1000 Title

May 30, 2025

Latest Posts

-

Zverevs Upset Loss To Griekspoor At Indian Wells A Shocking Defeat

May 31, 2025

Zverevs Upset Loss To Griekspoor At Indian Wells A Shocking Defeat

May 31, 2025 -

Zverev Triumphs Munich Semifinals Await After Tough Matches

May 31, 2025

Zverev Triumphs Munich Semifinals Await After Tough Matches

May 31, 2025 -

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025 -

Munich Open Shelton Beats Darderi To Reach Semifinals

May 31, 2025

Munich Open Shelton Beats Darderi To Reach Semifinals

May 31, 2025 -

Rome Masters Alcaraz And Passaro Secure Wins At Italian International

May 31, 2025

Rome Masters Alcaraz And Passaro Secure Wins At Italian International

May 31, 2025