Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

Table of Contents

Desjardins' Rationale for Predicted Interest Rate Cuts

Desjardins' prediction of three further Bank of Canada interest rate cuts is rooted in their comprehensive economic modelling and analysis of current market trends. Their reasoning centers on several key observations regarding the Canadian economic outlook.

-

Weakening Economic Growth Projections: Desjardins' analysis suggests a slowdown in GDP growth, indicating a cooling economy. This diminished growth trajectory is a significant factor influencing their prediction for interest rate cuts. They cite weakening consumer confidence and reduced business investment as contributing factors.

-

Persistent Inflation Concerns but Easing Pressures: While inflation remains a concern, Desjardins notes a recent easing of inflationary pressures. They believe that the current rate, while still above the Bank of Canada's target, is trending downwards, providing room for interest rate reductions without significantly exacerbating inflation. The analysis incorporates data on various price indices to support this assertion.

-

Potential Impact of Global Economic Slowdown: The global economic climate significantly influences the Canadian economy. Desjardins' forecast accounts for the potential impact of a global slowdown, predicting a ripple effect that necessitates monetary policy adjustments, including interest rate cuts, to mitigate the economic downturn.

-

Labor Market Dynamics and Unemployment Figures: Desjardins' analysis includes a detailed review of the Canadian labor market. While unemployment remains relatively low, certain sectors are showing signs of weakness, impacting overall economic performance and bolstering the argument for interest rate cuts to stimulate economic activity. The forecast incorporates recent unemployment figures and employment growth projections.

Impact of Predicted Cuts on Canadian Consumers and Businesses

The anticipated interest rate cuts by the Bank of Canada, as predicted by Desjardins, will have a multifaceted impact on Canadian consumers and businesses.

-

Lower Borrowing Costs for Mortgages and Loans: Reduced interest rates translate to lower borrowing costs for mortgages and other loans, potentially boosting consumer spending and housing market activity. This could benefit homeowners and businesses looking to secure financing for expansion or upgrades.

-

Stimulus to Consumer Spending and Investment: Lower interest rates can inject much-needed stimulus into the economy. Reduced borrowing costs could encourage consumers to increase spending and businesses to invest in expansion and innovation, creating a ripple effect throughout the economy.

-

Potential Inflationary Pressures if Spending Increases Too Rapidly: While lower interest rates can stimulate the economy, a rapid surge in consumer spending could reignite inflationary pressures. Desjardins' analysis acknowledges this risk and emphasizes the importance of a carefully calibrated approach to monetary policy.

-

Impact on Savings Accounts and Returns: Lower interest rates typically result in lower returns on savings accounts and other interest-bearing investments. This could negatively impact individuals relying on these sources for income and necessitate adjustments to savings strategies.

Comparison with Other Economic Forecasts

Desjardins' forecast isn't the only one in the market. Several other financial institutions and economists have offered their predictions for Bank of Canada interest rates. While there's some consensus around a further easing of monetary policy, the extent of the cuts varies.

- RBC Economics, for instance, anticipates two interest rate cuts, citing concerns about the resilience of the Canadian economy.

- TD Economics, on the other hand, is slightly more cautious, projecting only one rate cut due to persistent inflationary pressures.

The discrepancies in forecasts highlight the inherent uncertainties in economic prediction. Different institutions employ varying models and assign different weights to various economic indicators, leading to diverse conclusions.

Potential Risks and Uncertainties Associated with the Forecast

Despite the thoroughness of Desjardins' analysis, several risks and uncertainties cloud the forecast.

-

Unpredictable Global Economic Events: Geopolitical instability, unforeseen global crises, and unexpected shifts in global commodity prices can significantly impact the Canadian economy, potentially invalidating the forecast.

-

Changes in Government Policies: Government interventions, including fiscal policies and regulatory changes, can significantly alter the economic landscape and impact the effectiveness of monetary policy adjustments.

-

Unexpected Shifts in Inflation Trends: Inflation remains a significant variable. Unexpected upward pressure on inflation could force the Bank of Canada to revise its monetary policy stance, potentially negating the predicted interest rate cuts.

Conclusion: Desjardins' Forecast and its Implications for Interest Rate Cuts

Desjardins' prediction of three further Bank of Canada interest rate cuts underscores the evolving economic landscape in Canada. Their analysis, which considers weakening economic growth, easing inflationary pressures, global economic headwinds, and labor market dynamics, suggests a need for further monetary easing. This could result in lower borrowing costs, stimulating consumer spending and business investment, but also carries the risk of reigniting inflationary pressures if not managed carefully. It's crucial to acknowledge the inherent uncertainties in economic forecasting and monitor the evolving situation closely. To stay updated on the latest developments regarding Bank of Canada interest rates and Desjardins' economic analysis, regularly review official reports from the Bank of Canada and Desjardins' website. Understanding the Canadian economic outlook and its impact on interest rate policies is vital for both consumers and businesses. Stay informed about future Bank of Canada interest rate cuts and Desjardins' forecasts for a comprehensive understanding of the Canadian economic climate.

Featured Posts

-

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025 -

Andreescu Advances To Madrid Open Second Round

May 23, 2025

Andreescu Advances To Madrid Open Second Round

May 23, 2025 -

Maxine Transformation Devenir Plus Confiant E Pour L Avenir

May 23, 2025

Maxine Transformation Devenir Plus Confiant E Pour L Avenir

May 23, 2025 -

New Tulsa King Season 3 Image Shows Sylvester Stallone In A Stylish Suit

May 23, 2025

New Tulsa King Season 3 Image Shows Sylvester Stallone In A Stylish Suit

May 23, 2025 -

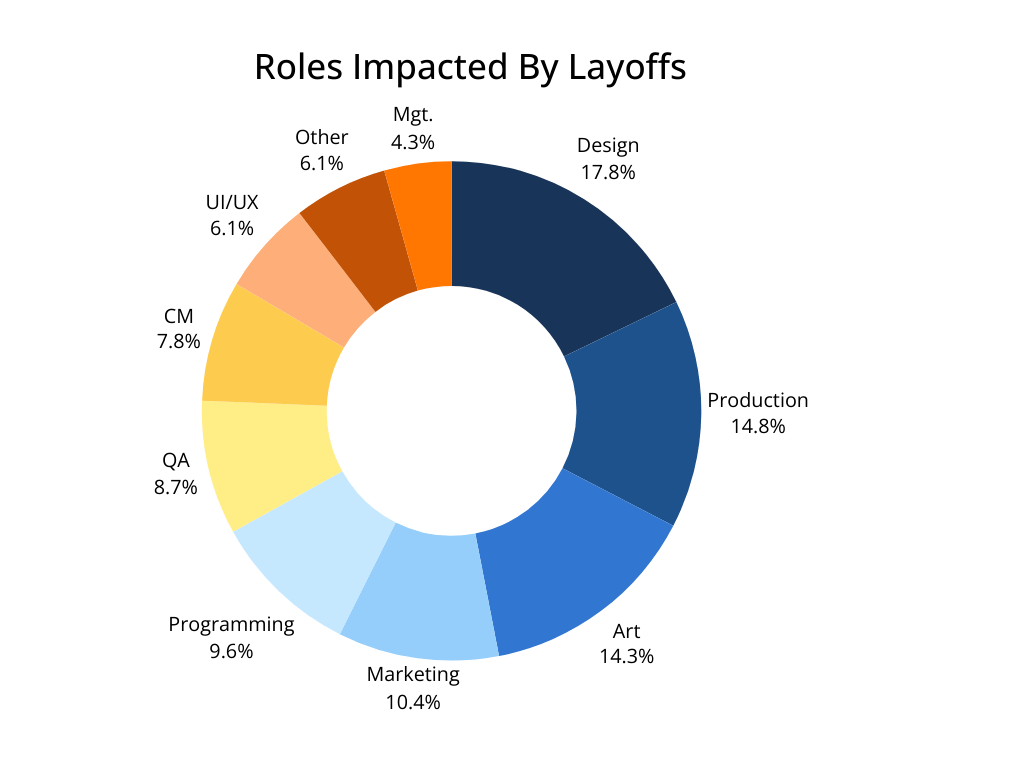

The Impact Of Industry Cuts On Accessible Game Design

May 23, 2025

The Impact Of Industry Cuts On Accessible Game Design

May 23, 2025

Latest Posts

-

Neues Aus Essen Berichte Von Der Umgebung Des Uniklinikums

May 24, 2025

Neues Aus Essen Berichte Von Der Umgebung Des Uniklinikums

May 24, 2025 -

In Der Naehe Des Essener Uniklinikums Eine Bewegende Geschichte

May 24, 2025

In Der Naehe Des Essener Uniklinikums Eine Bewegende Geschichte

May 24, 2025 -

Alajhzt Alamnyt Alalmanyt Wmdahmat Almshjeyn Ma Hy Alasbab

May 24, 2025

Alajhzt Alamnyt Alalmanyt Wmdahmat Almshjeyn Ma Hy Alasbab

May 24, 2025 -

Essen Uniklinikum Aktuelle Ereignisse Und Ihre Auswirkungen

May 24, 2025

Essen Uniklinikum Aktuelle Ereignisse Und Ihre Auswirkungen

May 24, 2025 -

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025