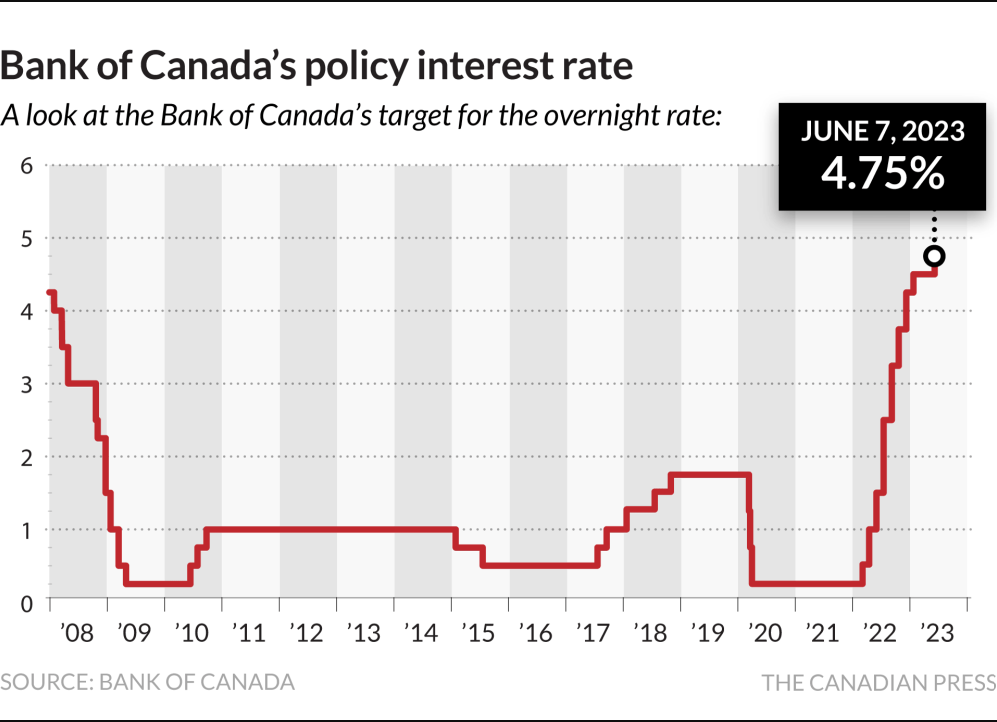

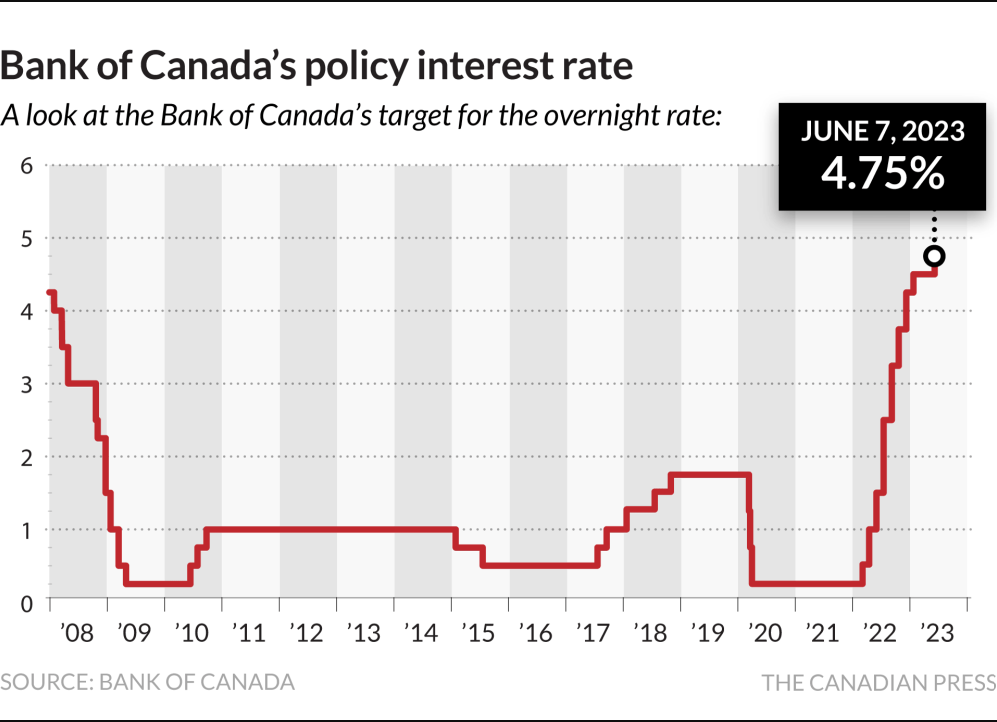

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

Table of Contents

Desjardins' Rationale Behind the Forecast

Desjardins' forecast of three additional Bank of Canada interest rate reductions isn't a random guess; it's based on a careful analysis of several key economic indicators. Their prediction stems from a confluence of factors pointing towards a slower-than-anticipated economic recovery.

- Inflation trends and projections: While inflation has cooled from its peak, Desjardins' analysis suggests it remains stubbornly persistent above the Bank of Canada's target range. This persistent inflation, coupled with slowing economic growth, necessitates further rate cuts to stimulate the economy without fueling runaway price increases.

- Unemployment rate analysis: The unemployment rate, while relatively low, might not reflect the full picture of economic health. Desjardins may have factored in underemployment or potential future job losses in their analysis, influencing their interest rate reduction forecast.

- Housing market performance and its influence on monetary policy: The Canadian housing market has shown signs of softening, impacting consumer confidence and overall economic activity. Desjardins likely considered the housing market's slowdown as a factor requiring further monetary easing through interest rate reductions.

- Global economic outlook and its impact on Canada: The global economy faces headwinds, including geopolitical uncertainties and potential recessionary risks in major economies. Desjardins' analysis likely incorporated these global uncertainties and their potential dampening effect on Canadian growth.

- Specific reports and data: Desjardins' forecast is supported by internal research, economic modelling, and analysis of various economic data sets, likely including government statistics, market reports, and consumer sentiment surveys.

Potential Impact of Further Interest Rate Reductions

The anticipated Bank of Canada interest rate reductions are expected to have a multifaceted impact across the Canadian economy. These changes will likely affect borrowing costs, investments, and the Canadian dollar's exchange rate.

- Impact on borrowing costs for consumers (mortgages, loans): Lower interest rates will translate to lower borrowing costs for consumers, potentially making mortgages and personal loans more affordable. This could stimulate consumer spending and boost economic activity.

- Effect on business investment and expansion: Reduced borrowing costs could encourage businesses to invest in expansion projects, hire more staff, and increase overall economic output.

- Influence on the Canadian dollar exchange rate: Lower interest rates might weaken the Canadian dollar relative to other currencies, potentially impacting import and export prices.

- Potential implications for inflation control: While aimed at stimulating the economy, interest rate reductions carry the risk of reigniting inflationary pressures. The Bank of Canada will need to carefully balance economic growth with inflation control.

- Positive and Negative Consequences: While lower interest rates generally stimulate the economy, there are potential downsides. Reduced returns on savings accounts and increased government borrowing costs are possible negative consequences.

Alternative Views and Expert Opinions

While Desjardins' forecast is significant, it's crucial to consider alternative viewpoints. Not all financial analysts share the same outlook on the future direction of Bank of Canada interest rates.

- Other financial institutions' predictions: Other major financial institutions may have different predictions regarding the number and timing of future interest rate reductions, based on their own economic models and analyses. Some might predict fewer cuts, while others might anticipate a more aggressive reduction.

- Dissenting views and alternative scenarios: There are always dissenting opinions. Some analysts might argue that inflation remains a more significant concern and that further rate cuts are premature.

- Relevant news articles and expert analyses: Staying informed about the evolving economic situation requires consulting various news sources and expert opinions. Many financial news outlets provide in-depth analyses and predictions about interest rate movements.

Strategies for Consumers and Businesses in Response to the Forecast

Navigating the economic landscape requires proactive strategies, especially in anticipation of further Bank of Canada interest rate reductions.

- Strategies for consumers to manage debt and savings: Consumers might consider refinancing existing loans at lower rates, paying down high-interest debt, or adjusting their savings plans based on anticipated lower returns on interest-bearing accounts.

- Investment opportunities and risk management: Lower interest rates might affect investment returns. Individuals should re-evaluate their investment portfolios to ensure they align with the new economic conditions. Professional financial advice is highly recommended.

- Advice for businesses on financing and expansion plans: Businesses should consider taking advantage of lower borrowing costs for expansion, capital investments, or refinancing existing debt.

- Importance of financial planning and professional advice: Seeking advice from financial professionals can help consumers and businesses develop personalized financial strategies that account for the predicted changes in Bank of Canada interest rates.

Conclusion

Desjardins' forecast of three further Bank of Canada interest rate reductions reflects a complex economic situation characterized by persistent inflation, a cooling housing market, and global economic uncertainties. This prediction carries significant implications for the Canadian economy, impacting borrowing costs, investments, and the exchange rate. While lower interest rates offer potential benefits, they also carry risks. Consumers and businesses should proactively manage their finances, re-evaluate investment strategies, and consider seeking professional financial advice. Stay updated on the latest Desjardins forecasts and Bank of Canada interest rate decisions for informed financial planning. Understanding the potential impact of these Bank of Canada interest rate cuts is crucial for making sound financial decisions in the coming months.

Featured Posts

-

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira V Turnire Na 4 Milliarda

May 24, 2025

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira V Turnire Na 4 Milliarda

May 24, 2025 -

Artfae Daks Alalmany Tjawz Mstwa Mars Alqyasy

May 24, 2025

Artfae Daks Alalmany Tjawz Mstwa Mars Alqyasy

May 24, 2025 -

Debate Rages Macrons Party Pushes For Public Hijab Ban On Underage Girls

May 24, 2025

Debate Rages Macrons Party Pushes For Public Hijab Ban On Underage Girls

May 24, 2025 -

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025 -

Porsche Dan Seni Rupa Di Indonesia Classic Art Week 2025

May 24, 2025

Porsche Dan Seni Rupa Di Indonesia Classic Art Week 2025

May 24, 2025

Latest Posts

-

Gas Prices Plunge Memorial Day Weekend Savings

May 24, 2025

Gas Prices Plunge Memorial Day Weekend Savings

May 24, 2025 -

Are Memorial Day Gas Prices The Cheapest In Years

May 24, 2025

Are Memorial Day Gas Prices The Cheapest In Years

May 24, 2025 -

Lowest Gas Prices In Years Expected For Memorial Day Weekend

May 24, 2025

Lowest Gas Prices In Years Expected For Memorial Day Weekend

May 24, 2025 -

Record Low Memorial Day Gas Prices Predicted

May 24, 2025

Record Low Memorial Day Gas Prices Predicted

May 24, 2025 -

Memorial Day Weekend 2025 Date And Significance

May 24, 2025

Memorial Day Weekend 2025 Date And Significance

May 24, 2025