Despite Trade Disputes, Canadian Investment In US Stocks Soars

Table of Contents

The Unexpected Rise of Canadian Investment in the US Market

The overall trend shows a remarkable increase in Canadian investment in US equities. While precise figures fluctuate daily, reports indicate a double-digit percentage increase in Canadian investment in US stocks over the past [Insert timeframe, e.g., two years], totaling [Insert approximate amount or range, e.g., billions of dollars]. This robust growth demonstrates a strong confidence in the US market despite political headwinds.

- Specific examples: Canadian investment has been particularly strong in major US sectors like technology (think investments in companies like Apple and Microsoft), energy (with significant holdings in oil and gas companies), and finance (including major banks and investment firms).

- Key players: Prominent Canadian investment firms, including [Name a few examples of Canadian investment firms], have significantly increased their US stock holdings, demonstrating the widespread nature of this trend.

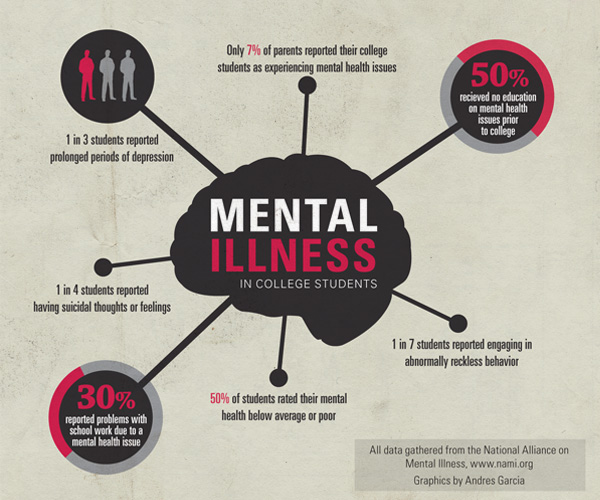

- (Insert Chart/Graph Here): A visual representation of the growth of Canadian investment in US stocks over the past [Timeframe] would significantly enhance understanding. This could be a line graph showcasing the upward trend.

Why are Canadians Still Investing in US Stocks Despite Trade Disputes?

Several factors contribute to this surge in Canadian investment in US stocks despite the ongoing trade uncertainties. The attractiveness of the US market outweighs the perceived risks for many Canadian investors.

- Strong US Economic Performance: The US economy continues to exhibit strength, attracting foreign investment due to its robust growth, innovation, and relatively stable political environment (compared to some other global markets).

- Diversification Strategies: Canadian investors increasingly view US stocks as a crucial element of portfolio diversification, mitigating risks associated with over-reliance on the Canadian market. This reduces the overall volatility of their investment portfolios.

- Attractive Valuations: Some argue that certain sectors of the US stock market offer attractive valuations compared to their Canadian counterparts, providing potential for higher returns.

- Long-Term Investment Horizons: Many Canadian investors adopt a long-term perspective, believing that short-term trade fluctuations will ultimately have minimal impact on their long-term investment goals.

- Specific Sector Attraction: The technology sector, with its consistent innovation and high growth potential, particularly attracts Canadian investment. Similarly, the relatively stable performance of some segments of the US energy sector continues to draw significant interest.

Analyzing the Risks and Rewards of Transborder Stock Investments

While the potential rewards are significant, it's crucial to acknowledge the inherent risks associated with Canadian investment in US stocks, especially given ongoing trade tensions.

- Currency Fluctuations: The CAD/USD exchange rate significantly impacts returns. A weakening Canadian dollar can reduce the value of US-based investments when converted back to Canadian currency.

- Trade Policy Changes: Unexpected shifts in trade policy between the two countries could negatively affect specific sectors and companies, impacting investment values.

- Geopolitical Risks: Broader geopolitical events affecting either the US or Canadian economy could also influence investment performance.

However, the potential rewards are considerable:

- Higher Potential Returns: Historically, the US stock market has offered higher potential returns than the Canadian market, although this is not guaranteed and past performance is not indicative of future results.

- Access to a Wider Range of Investment Opportunities: The US market provides access to a vastly larger and more diverse range of companies and investment options compared to the Canadian market.

Strategies for Canadians Investing in US Stocks

For Canadians interested in investing in US stocks, careful planning and diversification are key:

- Diversification within the US Market: Don't put all your eggs in one basket. Diversify your investments across different sectors and companies to mitigate risk.

- Due Diligence and Research: Thoroughly research any company before investing. Understand its financials, business model, and competitive landscape.

- ETFs and Mutual Funds: Consider using ETFs (exchange-traded funds) or mutual funds for diversified exposure to the US market without the need for extensive individual stock selection.

- Seek Professional Advice: Consult a qualified financial advisor to discuss your investment goals, risk tolerance, and develop a tailored investment strategy.

Navigating the Future of Canadian Investment in US Stocks

In conclusion, Canadian investment in US stocks is experiencing substantial growth despite ongoing trade disputes. This trend is driven by the strong US economy, the desire for portfolio diversification, attractive valuations in certain sectors, and a long-term investment outlook among many Canadian investors. While currency fluctuations, trade policy changes, and geopolitical risks remain considerations, the potential rewards, including higher potential returns and broader investment opportunities, continue to attract Canadian capital. To make informed decisions about Canadian investment in the US stock market, thorough research, diversification, and professional financial guidance are crucial. Consider researching specific high-growth sectors like technology or renewable energy for potentially higher returns. Begin exploring your options for investing in US equities from Canada and developing a robust cross-border investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 23, 2025

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 23, 2025 -

Aaron Judges 3 Hrs Lead Yankees To 9 Homer Game

Apr 23, 2025

Aaron Judges 3 Hrs Lead Yankees To 9 Homer Game

Apr 23, 2025 -

Dfb Star Adeyemi Stilsicher In Dortmund Bvb

Apr 23, 2025

Dfb Star Adeyemi Stilsicher In Dortmund Bvb

Apr 23, 2025 -

7 Nisan Pazartesi Guenue Tv De Hangi Diziler Yayinlanacak

Apr 23, 2025

7 Nisan Pazartesi Guenue Tv De Hangi Diziler Yayinlanacak

Apr 23, 2025 -

Papal Signet Ring Tradition And Destruction After Pope Franciss Death

Apr 23, 2025

Papal Signet Ring Tradition And Destruction After Pope Franciss Death

Apr 23, 2025

Latest Posts

-

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025 -

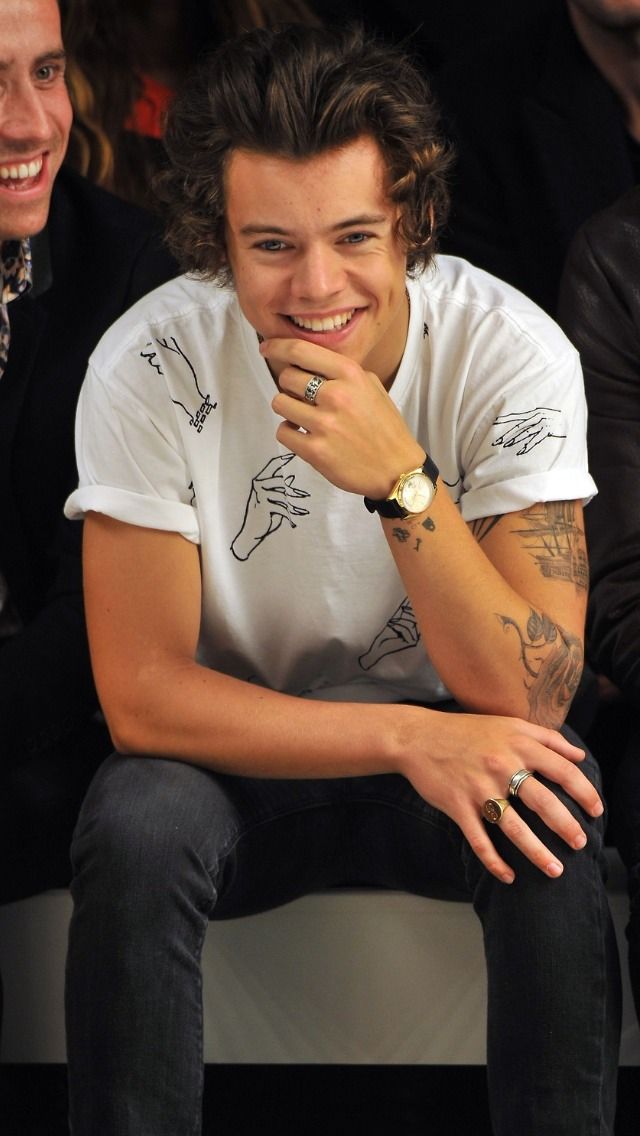

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025 -

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025 -

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025