Details Emerge: House Republicans' Trump Tax Proposal

Table of Contents

Proposed Individual Income Tax Changes

The Trump Tax Proposal suggests significant changes to the individual income tax system, impacting taxpayers across different income levels.

Lowering Individual Tax Rates

The core of the proposal involves lowering individual income tax rates. While specific numbers may fluctuate during the legislative process, the general aim is to reduce the burden on taxpayers.

- Proposed Tax Rates (Example): The proposal might suggest rates such as 12%, 22%, 24%, 32%, and 37%, a reduction from current rates. These are illustrative and subject to change.

- Comparison to Current Rates: A direct comparison highlighting the percentage point reduction in each bracket will provide clarity on the magnitude of the proposed changes. This comparison should include a table for easy understanding.

- Impact on Different Income Levels: Analyzing how the changes affect low-income, middle-income, and high-income earners is crucial. This requires detailed calculations showing the potential tax savings or increases for each group.

Standard Deduction and Itemized Deductions

The proposal likely includes adjustments to the standard deduction and itemized deductions.

- Changes to Standard Deduction Amounts: The proposal might increase the standard deduction amounts for single filers, married couples, and heads of households, simplifying tax filing for many. Specific proposed amounts need to be included.

- Impact on the Deductibility of State and Local Taxes (SALT): A critical point of contention is the potential limitation or elimination of the SALT deduction, impacting taxpayers in high-tax states. The details of any proposed changes should be clearly explained.

- Potential Changes to Charitable Deduction Limits: The proposal may alter the limits on charitable deductions, potentially affecting individuals and organizations who rely on these deductions. The nature and extent of any proposed changes must be explicitly stated.

Child Tax Credit Modifications

The Trump Tax Proposal may include modifications to the Child Tax Credit (CTC), a crucial benefit for families.

- Potential Increase or Decrease in the Credit Amount: The proposal might increase or decrease the maximum CTC amount, directly affecting the financial relief provided to families. The proposed amount and any changes to the maximum income limit should be stated.

- Changes to Eligibility Requirements: Any alterations to the eligibility requirements, such as age limits or income thresholds, will significantly impact the number of families who can claim the credit. These changes, if any, need clarification.

- Impact on Families with Multiple Children: The proposal's impact on families with multiple children needs to be analyzed, clarifying whether the credit is per child or has a family cap.

Proposed Corporate Tax Rate Changes

The Trump Tax Proposal includes changes to the corporate tax rate, with potential implications for businesses of all sizes.

Reduction in Corporate Tax Rate

A key component of the proposal involves reducing the corporate tax rate.

- The Proposed Corporate Tax Rate: The specific proposed rate should be stated, along with a clear comparison to the current rate.

- Potential Effects on Business Investment and Job Creation: The reduction in the corporate tax rate is intended to stimulate business investment and job creation. This section should analyze the plausibility of this claim. Economic models or expert opinions can support this analysis.

- Potential Impact on Competitiveness: The change in the corporate tax rate could impact the competitiveness of US businesses on the global stage. A comparison with corporate tax rates in other countries is beneficial.

Impact on Small Businesses

The impact of the proposed changes on small businesses is particularly important.

- Specific Tax Breaks or Incentives for Small Businesses: The proposal might include specific tax breaks or incentives aimed at supporting small businesses. These should be identified and explained.

- Potential Challenges Faced by Small Businesses under the Proposal: There may be unintended negative consequences for small businesses, such as increased administrative burdens or limitations on deductions. These potential challenges need to be discussed.

- Comparison of the Impact on Small Businesses versus Large Corporations: It's essential to compare how the proposal impacts small businesses versus their larger counterparts to assess fairness and equity.

Potential Economic Consequences of the Trump Tax Proposal

The Trump Tax Proposal's economic consequences are a significant area of debate.

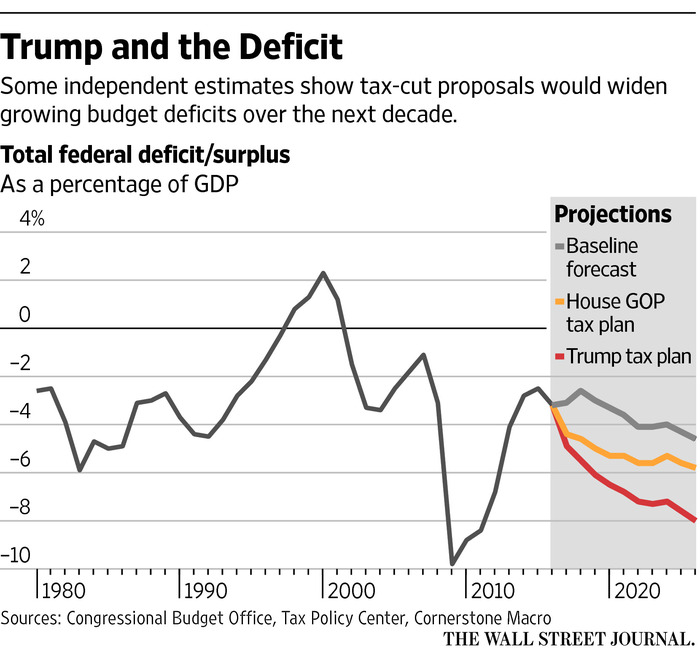

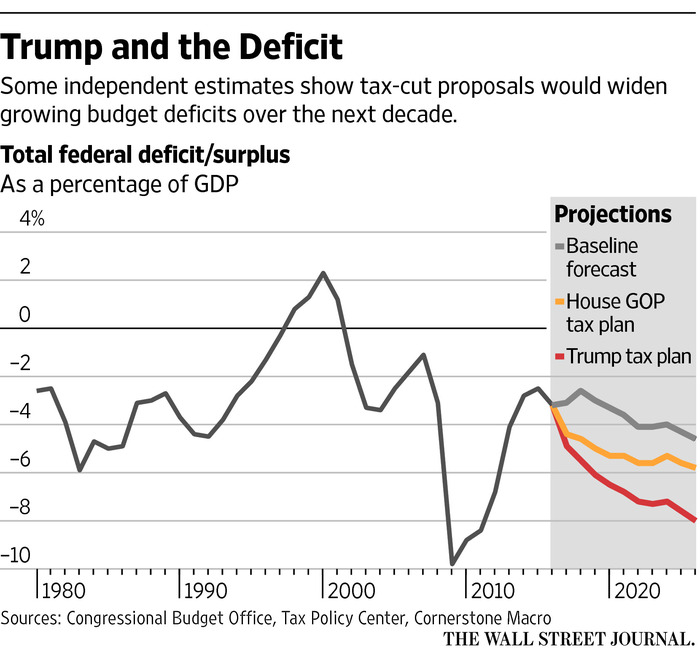

Impact on the National Debt

The proposed tax cuts are likely to increase the national debt.

- Projected Increase in the National Debt: Reliable projections of the increase in the national debt due to the tax cuts should be presented, along with the source of these projections.

- Potential Long-Term Consequences of Increased Debt: The potential long-term consequences of a larger national debt, such as higher interest rates and reduced government spending in other areas, should be addressed.

- Arguments for and Against the Proposal's Economic Impact: Presenting arguments both for and against the economic consequences allows for a balanced perspective. This can include citing economic studies and expert opinions.

Impact on Economic Growth

The proposal's impact on economic growth is hotly debated.

- Projected GDP Growth Under the Plan: Present projections of GDP growth under the proposed plan, along with a discussion of the methodology used to generate these projections.

- Potential for Increased Investment and Job Creation: The proposal aims to spur investment and job creation. This section needs to evaluate the likelihood of this outcome based on economic principles.

- Potential for Inflationary Pressures: The tax cuts could lead to inflationary pressures. An analysis of the potential for inflation, and its implications, is necessary.

- Arguments for and Against the Proposal's Impact on Economic Growth: Present a balanced view by including arguments supporting and opposing the positive impact on economic growth.

Conclusion

The House Republicans' Trump Tax Proposal represents a significant restructuring of the US tax code with potentially far-reaching consequences. Understanding the proposed changes to individual and corporate tax rates, deductions, and credits is vital for individuals and businesses to plan accordingly. This proposal's impact on the national debt and economic growth remains a subject of ongoing debate. To stay informed on the latest developments and implications of this Trump Tax Proposal, continue to monitor reliable news sources and consult with tax professionals. Further analysis is needed to fully understand the long-term effects of this sweeping tax reform.

Featured Posts

-

The Fall Of The King Of Davos Exploring His Downfall

May 16, 2025

The Fall Of The King Of Davos Exploring His Downfall

May 16, 2025 -

Sheikh Hasinas Party Faces Election Ban In Bangladesh

May 16, 2025

Sheikh Hasinas Party Faces Election Ban In Bangladesh

May 16, 2025 -

San Diego Padres Key Players In Defeating The Dodgers Strategy

May 16, 2025

San Diego Padres Key Players In Defeating The Dodgers Strategy

May 16, 2025 -

Menendez Brothers Resentencing A Judges Ruling

May 16, 2025

Menendez Brothers Resentencing A Judges Ruling

May 16, 2025 -

Padres 2025 Season A Preview Of The Cubs Home Opener Matchup

May 16, 2025

Padres 2025 Season A Preview Of The Cubs Home Opener Matchup

May 16, 2025

Latest Posts

-

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025 -

Dodgers Muncy Abandons Torpedo Bat Following 3 At Bats

May 16, 2025

Dodgers Muncy Abandons Torpedo Bat Following 3 At Bats

May 16, 2025 -

Max Muncys Torpedo Bat Experiment 3 At Bats 1 Double

May 16, 2025

Max Muncys Torpedo Bat Experiment 3 At Bats 1 Double

May 16, 2025 -

Cody Poteet Chicago Cubs Pitcher Conquers Abs Challenge In Spring Training

May 16, 2025

Cody Poteet Chicago Cubs Pitcher Conquers Abs Challenge In Spring Training

May 16, 2025 -

Dodgers Shut Out 8 0 Ohtanis Game Winning Home Run

May 16, 2025

Dodgers Shut Out 8 0 Ohtanis Game Winning Home Run

May 16, 2025