Deutsche Bank (DBK): Strategic Expansion Into The Defense Finance Market

Table of Contents

H2: DBK's Rationale for Entering the Defense Finance Market

Deutsche Bank's decision to enter the defense finance market is driven by a combination of factors, all pointing towards a promising and strategically sound opportunity.

H3: Capitalizing on Growing Global Defense Spending

Global defense spending is on the rise, creating a substantial opportunity for financial institutions specializing in this sector. The Stockholm International Peace Research Institute (SIPRI) consistently reports increasing military expenditure worldwide. This growth is fueled by several key trends:

- Rising geopolitical tensions are driving increased military expenditure by nations seeking to enhance their security posture.

- The modernization of armed forces requires significant investment in new technologies, equipment, and infrastructure, opening doors for defense finance solutions.

- Technological advancements in defense, including artificial intelligence, autonomous systems, and cyber warfare capabilities, are creating new and lucrative financial opportunities. These innovations demand substantial funding and sophisticated financial management.

H3: Diversification of Revenue Streams and Reduced Reliance on Traditional Sectors

Deutsche Bank's strategy aims to mitigate risks associated with traditional banking sectors by diversifying into less cyclical industries. The defense finance market offers a relatively stable revenue stream due to the long-term nature of government contracts and military procurement. This diversification offers:

- Mitigation of risks associated with the cyclical nature of traditional banking sectors, creating a more resilient portfolio.

- Access to a new client base consisting of governments, defense contractors, and related organizations, fostering long-term contractual relationships.

- Enhanced portfolio resilience against economic downturns, offering a more stable foundation for long-term growth.

H2: Deutsche Bank's Approach to the Defense Finance Sector

Deutsche Bank's approach to the defense finance sector is likely to be multifaceted, leveraging its existing expertise and building new capabilities tailored to the specific needs of this market.

H3: Targeted Services and Expertise

DBK will likely offer a range of specialized services, leveraging existing strengths within its investment banking division. These services could include:

- Project financing: Providing financing for large-scale defense projects, from aircraft carriers to advanced missile systems.

- Mergers and acquisitions (M&A) advisory: Advising defense companies on mergers, acquisitions, and divestitures.

- Risk management solutions: Developing bespoke risk management strategies for defense contractors navigating complex regulatory environments.

- Investment portfolio management: Managing investment portfolios for defense-related companies and government agencies.

H3: Compliance and Regulatory Considerations

The defense finance sector operates within a highly regulated environment. Strict compliance is paramount. Deutsche Bank's commitment to ethical and transparent business practices will be central to its success. This includes:

- Adherence to international sanctions and export control regulations.

- Robust anti-money laundering (AML) and know-your-customer (KYC) procedures.

- Transparent and ethical business practices, ensuring accountability and building trust with clients and stakeholders.

H2: Potential Challenges and Risks in the Defense Finance Market

While the opportunities in defense finance are substantial, Deutsche Bank must acknowledge and address potential challenges.

H3: Geopolitical Instability and International Relations

The defense finance market is inherently sensitive to geopolitical shifts and international relations. This creates several potential risks:

- Sensitivity to shifts in the geopolitical landscape, potentially impacting project timelines and financial outcomes.

- Potential for project delays or cancellations due to political factors or changes in government priorities.

- Risk of sanctions or boycotts impacting investments in specific regions or projects.

H3: Competition and Market Saturation

Deutsche Bank will face competition from established players already active in the defense finance market. Success requires a strong value proposition and strategic differentiation:

- Competition from established investment banks and financial institutions specializing in government contracts and military finance.

- The need for differentiation through specialized expertise, innovative financial solutions, and a strong commitment to compliance.

- Challenges in acquiring and retaining skilled professionals with specific knowledge and experience in the defense sector.

3. Conclusion:

Deutsche Bank's strategic entry into the defense finance market is a significant development. By leveraging its expertise, adapting to the regulatory environment, and proactively managing risks, DBK is well-positioned to capitalize on the growth opportunities within this sector. However, ongoing monitoring of geopolitical risks and competitive pressures will be crucial for long-term success. Further analysis of Deutsche Bank’s progress in this specialized area of defense finance is essential for investors and stakeholders interested in understanding the bank’s strategic evolution and its impact on the broader financial industry. Follow future developments to track Deutsche Bank's performance in the military finance market.

Featured Posts

-

Edmonton Oilers Draisaitl Expected Return For Playoffs

May 10, 2025

Edmonton Oilers Draisaitl Expected Return For Playoffs

May 10, 2025 -

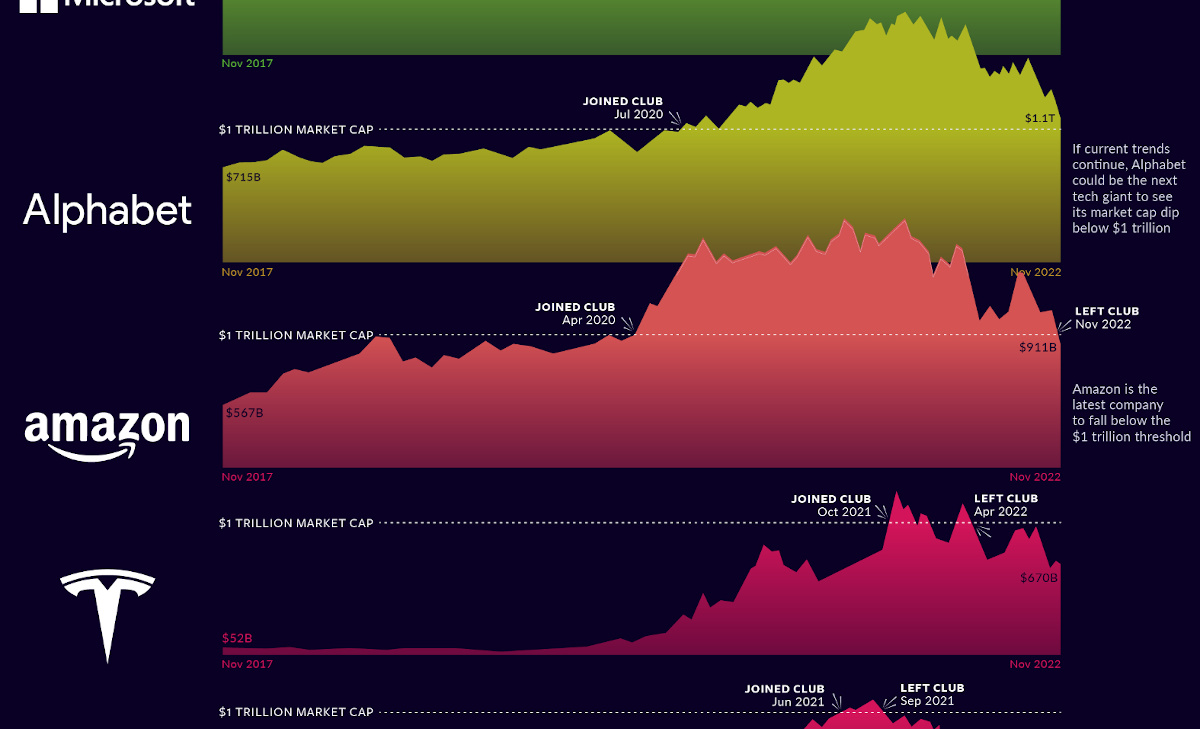

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 10, 2025 -

Lidery Stran Boykotiruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 10, 2025

Lidery Stran Boykotiruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 10, 2025 -

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025 -

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025