Did Trump's China Tariffs Hurt The US Economy? An Examination Of Inflation And Supply

Table of Contents

The Intended Effects of the Tariffs: A Protectionist Stance

The Trump administration's stated goal for imposing tariffs on Chinese goods was twofold: to protect American industries and to gain leverage in trade negotiations.

Protecting American Industries

The administration argued that tariffs would bolster domestic manufacturing and reduce the US's reliance on Chinese goods. This protectionist stance aimed to:

- Reshore Manufacturing: Bring back jobs lost to outsourcing by making imported goods more expensive, thereby increasing the competitiveness of domestically produced alternatives. Specific industries targeted included steel, aluminum, and various agricultural products.

- Boost Domestic Job Creation: By shielding American industries from cheaper imports, the tariffs were intended to spur job growth in sectors like manufacturing and agriculture.

- Reduce Trade Deficits: A core argument was that reducing imports from China would naturally decrease the US trade deficit. However, the actual impact on trade deficits proved more complex.

Reciprocity and Negotiating Leverage

The Trump administration viewed tariffs as a bargaining chip to pressure China into making concessions on issues like intellectual property theft, forced technology transfer, and trade imbalances. The strategy was based on the principle of reciprocity – that is, using tariffs to force reciprocal concessions from China.

- Addressing Specific Trade Disputes: Tariffs were levied in response to specific concerns about unfair trade practices by China, aiming to level the playing field for American businesses.

- Effectiveness as a Negotiation Tactic: The effectiveness of tariffs as a negotiation tactic remains a subject of debate. While some concessions were secured, the overall success of this strategy is contested by economists.

- Unintended Consequences: The use of tariffs as a negotiation tool created considerable uncertainty in global markets, leading to unforeseen negative consequences.

The Unintended Consequences: Inflation and Supply Chain Disruptions

While the intended effects of the Trump tariffs were debated, the unintended consequences were far-reaching and undeniable. The most significant of these were increased inflation and supply chain disruptions.

Increased Consumer Prices

Tariffs directly increased the cost of imported goods, which led to higher prices for consumers. This contributed to a rise in inflation across various sectors.

- Inflation Rate Increases: Statistical data from the period of tariff imposition shows a clear correlation between the implementation of tariffs and a rise in the Consumer Price Index (CPI).

- Specific Goods Affected: Consumers experienced price increases across a wide range of goods, from furniture and electronics to clothing and agricultural products, all of which relied heavily on imports from China.

- Burden on Consumers: The increased cost of goods placed a significant burden on American consumers, particularly those with lower incomes.

Supply Chain Bottlenecks and Shortages

The tariffs contributed to significant disruptions in global supply chains, leading to bottlenecks, shortages, and delays in the delivery of goods.

- Industries Severely Impacted: Industries reliant on intermediate goods imported from China, such as electronics manufacturing and automotive production, faced severe disruptions.

- Ripple Effects: Supply chain issues in one sector often had ripple effects on other industries, exacerbating the overall economic impact.

- Globalization's Role: The interconnectedness of global supply chains, a hallmark of globalization, amplified the effects of the tariffs, making disruptions more widespread and difficult to manage.

Retaliatory Tariffs from China

China responded to the US tariffs with its own retaliatory measures, imposing tariffs on American goods. This escalated the trade war and further harmed both economies.

- Retaliatory Tariffs: China targeted American agricultural exports, impacting farmers and agricultural businesses significantly.

- Impact on Specific Industries: Various American industries exporting to China experienced decreased sales and profitability due to the retaliatory tariffs.

- Overall Economic Fallout: The retaliatory tariffs amplified the negative consequences of the initial tariffs, creating a downward spiral for both economies.

Assessing the Overall Economic Impact: A Balanced Perspective

Assessing the overall economic impact of Trump's China tariffs requires a balanced perspective that considers both the intended and unintended consequences.

Economic Models and Predictions

Numerous economic models were used to predict the impact of the tariffs, with varying results. These models often disagreed due to differing assumptions and limitations.

- Diverse Model Conclusions: Some models predicted minimal economic impact, while others pointed to significant negative consequences.

- Model Limitations: The inherent limitations of economic models, particularly in forecasting complex, real-world scenarios, make definitive conclusions challenging.

- Uncertainty in Economic Forecasting: The uncertainty surrounding the long-term effects of the tariffs remains considerable, highlighting the complexity of assessing their impact.

Long-Term Effects on Trade and Global Relations

The Trump tariffs had lasting impacts on US-China relations and the broader global trading system.

- Erosion of Trust: The trade war significantly damaged trust between the US and China, complicating future trade negotiations and cooperation.

- Impact on Future Trade Negotiations: The experience with the Trump tariffs influenced subsequent trade negotiations, making it more challenging to reach mutually beneficial agreements.

- Potential for Long-Term Economic Damage: The uncertainty and disruptions caused by the trade war may have long-term negative effects on global economic growth and stability.

Conclusion

Trump's China tariffs had a complex and multifaceted impact on the US economy. While intended to protect American industries and gain leverage in trade negotiations, they resulted in unintended consequences such as increased inflation, supply chain disruptions, and retaliatory tariffs from China. The overall economic impact remains a subject of debate, with economic models offering varying conclusions. The lasting effects on US-China relations and the global trading system are undeniable and continue to shape international trade policy today. Further research into the complexities of international trade and the long-term effects of protectionist policies, like the Trump tariffs on China, is crucial for understanding the challenges facing the global economy.

Featured Posts

-

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025 -

Cleveland Fan Ejected For Heckling Jarren Duran After Suicide Attempt Revelation

Apr 29, 2025

Cleveland Fan Ejected For Heckling Jarren Duran After Suicide Attempt Revelation

Apr 29, 2025 -

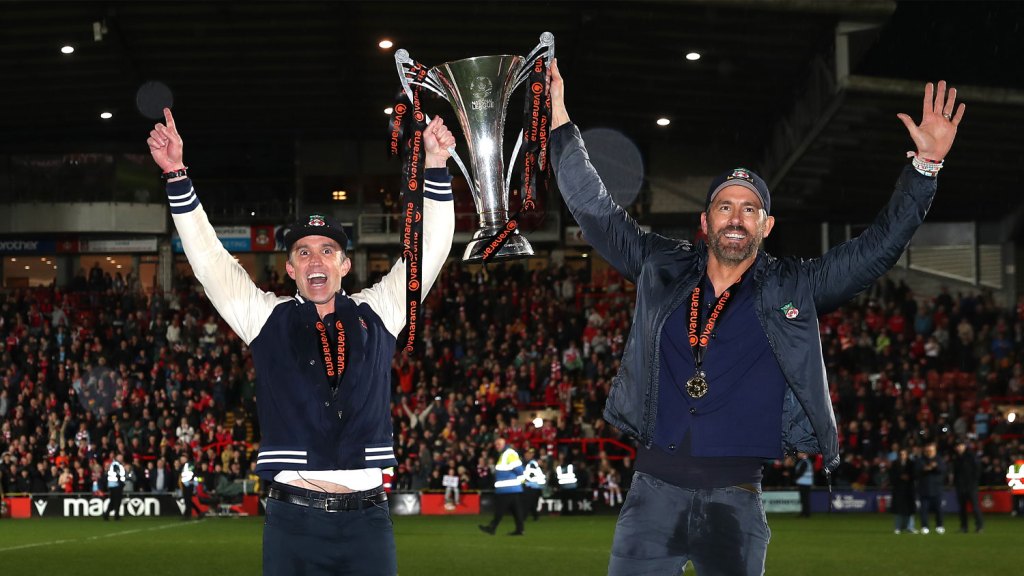

Wrexham Football Club Promoted Ryan Reynolds Celebration Highlights

Apr 29, 2025

Wrexham Football Club Promoted Ryan Reynolds Celebration Highlights

Apr 29, 2025 -

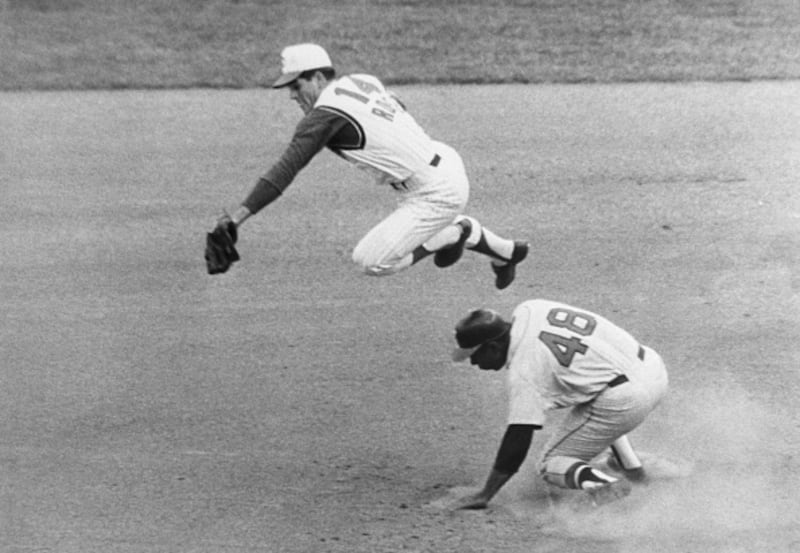

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025

Latest Posts

-

Is Sylvester Stallones Appearance In Jason Stathams Film A Red Herring

May 12, 2025

Is Sylvester Stallones Appearance In Jason Stathams Film A Red Herring

May 12, 2025 -

Debbie Elliott A Retrospective

May 12, 2025

Debbie Elliott A Retrospective

May 12, 2025 -

Getting To Know Debbie Elliott

May 12, 2025

Getting To Know Debbie Elliott

May 12, 2025 -

Debate Ignites Fabers Decision On Coa Volunteer Honours

May 12, 2025

Debate Ignites Fabers Decision On Coa Volunteer Honours

May 12, 2025 -

The Unexpected Duo How Sylvester Stallone And Michael Caine Found Success In Diverse Genres

May 12, 2025

The Unexpected Duo How Sylvester Stallone And Michael Caine Found Success In Diverse Genres

May 12, 2025