Dissecting The GOP Mega Bill: Key Points And Anticipated Debate

Table of Contents

Tax Implications of the GOP Mega Bill

The GOP Mega Bill proposes significant changes to the US tax code, impacting both individuals and corporations. Understanding these implications is crucial to assessing the bill's overall impact.

Individual Tax Changes

The bill aims to overhaul the individual income tax system through several key adjustments:

-

Tax Bracket Adjustments: The bill may propose altering existing tax brackets, potentially leading to either tax cuts or increases for different income levels. Specific details on these changes are crucial for understanding the impact on individual taxpayers. For instance, a potential lowering of the highest tax bracket could significantly benefit high-income earners. Conversely, adjustments to lower brackets could affect the tax burden on lower-income families. Further analysis is needed to determine the precise effects of these adjustments.

-

Deduction Modifications: Significant changes are anticipated to various deductions. The elimination or reduction of the State and Local Tax (SALT) deduction could disproportionately affect taxpayers in high-tax states. Similarly, adjustments to itemized deductions and the standard deduction will have a ripple effect across different income groups. Understanding these changes is vital for accurate tax planning.

-

Child Tax Credit Alterations: The bill may include modifications to the child tax credit, potentially impacting families with children. Changes could involve altering the credit amount, eligibility requirements, or the age limit for claiming the credit. The impact of these changes on family budgets needs careful evaluation. These changes could significantly affect low and middle-income families, potentially impacting their financial stability.

Corporate Tax Implications

The corporate tax provisions of the GOP Mega Bill are equally significant. The potential impact on business investment and economic growth warrants careful consideration.

-

Corporate Tax Rate Changes: A reduction in the corporate tax rate is a central component of the bill, potentially stimulating business investment and economic growth. However, the effect on job creation and foreign investment remains a subject of debate among economists. Some argue that reduced corporate taxes lead to increased profits and reinvestment, while others express concerns about potential tax avoidance and minimal impact on job growth.

-

Incentives and Investment: The bill might include incentives designed to encourage domestic investment and job creation. These incentives could take various forms, such as tax credits for specific industries or investments in certain regions. However, the effectiveness of such incentives in achieving their stated goals needs careful scrutiny. A thorough cost-benefit analysis is essential to determine whether the incentives justify the potential cost to taxpayers.

Spending Provisions in the GOP Mega Bill

The GOP Mega Bill outlines significant spending plans across various sectors, prompting questions about fiscal responsibility and the allocation of resources.

Infrastructure Spending

A substantial portion of the bill is allocated to infrastructure development. This includes:

-

Transportation Infrastructure: The bill is expected to earmark significant funds for improvements to roads, bridges, and public transportation systems. The geographical distribution of these funds and their impact on improving national infrastructure require careful analysis. Further details regarding specific projects and their timelines are crucial.

-

Broadband Access: Investment in expanding broadband internet access is another key component. This initiative aims to bridge the digital divide and improve connectivity across the country. Questions remain about the effectiveness and equitable distribution of these funds.

Social Programs and Funding

Changes to social programs are a controversial aspect of the GOP Mega Bill.

-

Healthcare Spending: The bill may propose adjustments to funding for Medicare and Medicaid, potentially impacting access to healthcare for millions of Americans. Analysis of these changes requires a close examination of the bill’s text and potential implications for healthcare providers and beneficiaries. Assessing the impact on healthcare quality and affordability is of paramount importance.

-

Social Safety Net: The overall effect on the social safety net requires careful consideration. Any cuts or reductions in funding for social programs could have substantial implications for vulnerable populations. Analyzing the potential consequences for these groups is crucial for a full understanding of the bill's impact.

Anticipated Political Debate Surrounding the GOP Mega Bill

The GOP Mega Bill is anticipated to spark intense political debate.

Arguments For the Bill

Proponents of the bill argue that:

-

Economic Stimulus: The tax cuts and infrastructure spending will stimulate economic growth, creating jobs and boosting overall prosperity. This argument often centers on supply-side economics, where tax cuts incentivize investment and job creation.

-

Fiscal Responsibility: Supporters claim the bill promotes fiscal responsibility through targeted spending and efficient resource allocation. However, critics may argue that the bill's spending plans are not fiscally responsible enough, leading to increased national debt.

Arguments Against the Bill

Opponents of the bill raise several concerns:

-

Income Inequality: Critics argue that the tax cuts disproportionately benefit the wealthy, exacerbating income inequality. This argument often focuses on the distribution of tax benefits and the impact on lower- and middle-income families.

-

Environmental Impact: Concerns exist about the bill's potential impact on environmental regulations and climate change. Critics are likely to point out a potential lack of environmental considerations within the bill's infrastructure projects.

-

National Debt: The increased national debt resulting from the bill’s spending plans is a major point of contention. Critics will likely highlight the long-term fiscal implications of increased borrowing.

Conclusion: Understanding the GOP Mega Bill's Impact

The GOP Mega Bill is a complex piece of legislation with potentially far-reaching consequences. Its tax implications, spending provisions, and the ensuing political debate will shape the American political landscape for years to come. Understanding the nuances of its tax reforms, infrastructure investments, and impact on social programs is crucial for informed civic engagement. The potential effects on income inequality, environmental protection, and national debt must be carefully weighed against the promises of economic stimulus and job creation. To fully grasp the long-term consequences, it is crucial to remain engaged and informed about every detail. Stay informed about the implications of this significant GOP legislation and deepen your understanding of the GOP Mega Bill's impact.

Featured Posts

-

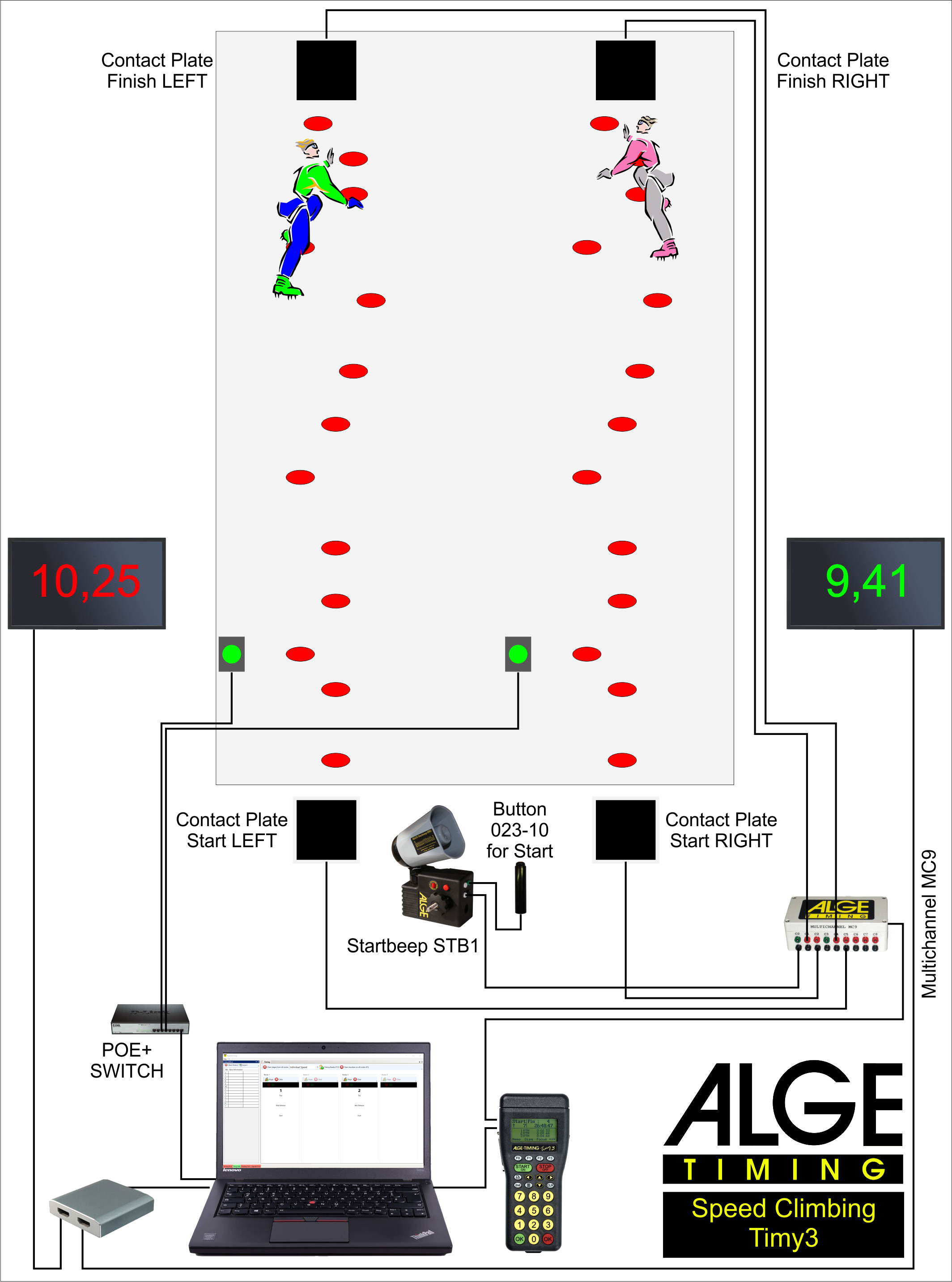

Dangerous Everest Attempt Speed Climbing With Anesthetic Gas Under Scrutiny

May 15, 2025

Dangerous Everest Attempt Speed Climbing With Anesthetic Gas Under Scrutiny

May 15, 2025 -

Vont Weekend 2025 Five Pictures That Tell The Story April 4 6

May 15, 2025

Vont Weekend 2025 Five Pictures That Tell The Story April 4 6

May 15, 2025 -

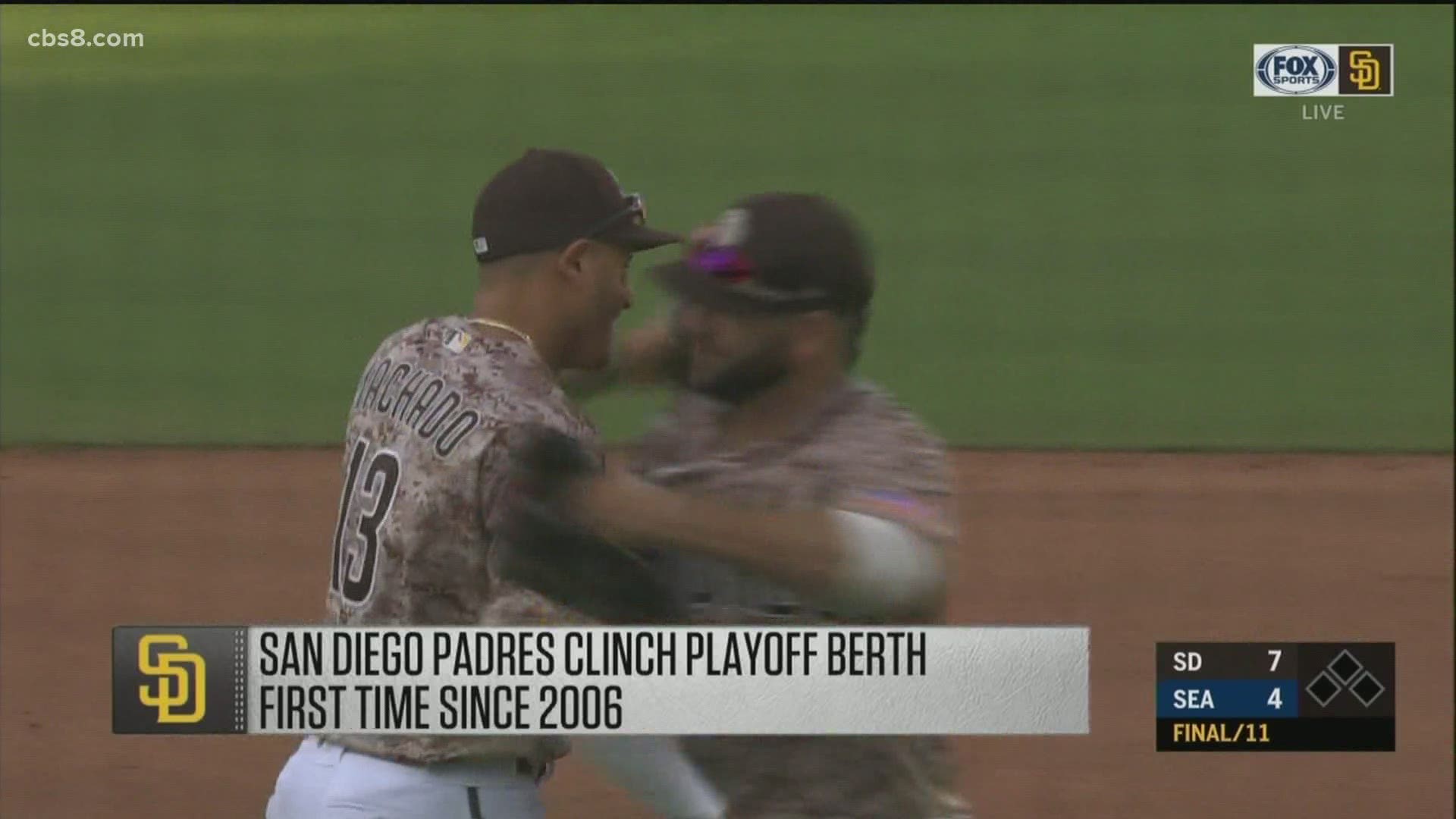

Padres Clinch Series Victory Against Cubs

May 15, 2025

Padres Clinch Series Victory Against Cubs

May 15, 2025 -

Post Game Analysis Rays Clean Sweep Of Padres Fm 96 9

May 15, 2025

Post Game Analysis Rays Clean Sweep Of Padres Fm 96 9

May 15, 2025 -

Rays Sweep Padres A Comprehensive Look At The Series Victory

May 15, 2025

Rays Sweep Padres A Comprehensive Look At The Series Victory

May 15, 2025

Latest Posts

-

Vont Weekend 2025 Five Pictures That Tell The Story April 4 6

May 15, 2025

Vont Weekend 2025 Five Pictures That Tell The Story April 4 6

May 15, 2025 -

1 Kissfms Vont Weekend A Photo Journal April 4th 6th 2025

May 15, 2025

1 Kissfms Vont Weekend A Photo Journal April 4th 6th 2025

May 15, 2025 -

Vont Weekend Photo Diary April 4 6 2025 103 X

May 15, 2025

Vont Weekend Photo Diary April 4 6 2025 103 X

May 15, 2025 -

Vont Weekend Photos From April 4th 6th 2025 96 1 Kissfm

May 15, 2025

Vont Weekend Photos From April 4th 6th 2025 96 1 Kissfm

May 15, 2025 -

Vont Weekend April 4th 6th 2025 In Five Pictures

May 15, 2025

Vont Weekend April 4th 6th 2025 In Five Pictures

May 15, 2025