Dividend Investing Made Easy: A High-Return Strategy

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's success, rewarding investors for their participation. This passive income stream can significantly boost your overall investment returns.

- Types of Dividends: Companies can pay dividends in cash (the most common) or through additional shares of stock (stock dividends).

- Dividend Yield Calculation: Dividend yield is calculated by dividing the annual dividend per share by the stock's price. A higher yield generally indicates a higher payout relative to the stock price.

- Tax Implications of Dividends: Dividends are generally taxable income, but the tax rate depends on factors such as your income bracket and whether the dividends are considered "qualified" (typically taxed at a lower rate).

Identifying Dividend-Paying Stocks

Finding the right dividend-paying stocks requires research and careful analysis. Several strategies can help you identify suitable investments for your portfolio.

- Screening Tools: Utilize online broker platforms and financial websites with stock screeners. These tools allow you to filter stocks based on criteria such as dividend yield, payout ratio, and market capitalization.

- Analyzing Financial Statements: Scrutinize a company's financial statements, paying close attention to its dividend history, payout ratio (the percentage of earnings paid out as dividends), and overall financial health. A consistent dividend history and a sustainable payout ratio are crucial indicators of a reliable dividend stock.

- Considering Industry Sectors: Diversify your investments across various sectors. Some sectors, like utilities and real estate investment trusts (REITs), are known for their higher dividend yields.

The Importance of Dividend Reinvestment

One of the most powerful aspects of dividend investing is reinvesting your dividends. This strategy leverages the magic of compounding returns.

- How DRIPs Work: Dividend Reinvestment Plans (DRIPs) allow you to automatically reinvest your dividends to purchase additional shares of the same stock.

- The Snowball Effect: Over time, this reinvestment creates a snowball effect, accelerating your investment growth exponentially.

- Long-Term Wealth Building: Consistent dividend reinvestment is a proven long-term wealth-building strategy, significantly increasing your portfolio's value over time.

Building a Diversified Dividend Portfolio

Diversification Strategies

Diversification is crucial in minimizing risk. Don't put all your eggs in one basket! Spread your investments across various companies and sectors.

- Diversification Approaches: Diversify by sector (e.g., technology, healthcare, consumer goods), market capitalization (large-cap, mid-cap, small-cap), and geographic location.

- Avoiding Over-Concentration: Avoid heavily weighting your portfolio in a single stock, no matter how appealing its dividend yield might seem. Risk mitigation is key.

Risk Management in Dividend Investing

While dividend investing offers numerous benefits, it's essential to understand and manage potential risks.

- Risks of Dividend Cuts: Companies may reduce or eliminate dividends due to financial difficulties.

- Company Bankruptcy: Investment in a company that goes bankrupt can result in complete loss of capital.

- Market Downturns: Even strong dividend stocks can experience price fluctuations during market downturns.

- Risk Management Strategies: Employ dollar-cost averaging (investing a fixed amount regularly regardless of price fluctuations) and diversify your portfolio across multiple sectors and companies to mitigate these risks.

Maximizing Your Dividend Returns

Tax-Efficient Dividend Investing

Understanding tax implications is crucial for maximizing your returns.

- Tax-Advantaged Accounts: Utilize tax-advantaged retirement accounts such as IRAs and 401(k)s to reduce your tax burden on dividend income.

- Understanding Tax Brackets: Your tax bracket significantly impacts the tax rate applied to your dividend income.

- Qualified vs. Non-Qualified Dividends: Qualified dividends are typically taxed at a lower rate than non-qualified dividends.

Long-Term vs. Short-Term Dividend Investing

The choice between long-term and short-term dividend investing depends on your financial goals and risk tolerance.

- Long-Term Benefits: Long-term dividend investing focuses on compounding returns and the stability of established companies. It's ideal for those seeking long-term wealth growth.

- Short-Term Strategies: Short-term strategies might involve focusing on higher-yield stocks for income generation, but this carries higher risk.

- Matching Strategy to Investment Goals: Align your dividend investing strategy with your overall financial objectives. A longer time horizon generally allows for greater risk tolerance and potential for higher returns.

Conclusion

Successful dividend investing hinges on understanding dividends, building a diversified portfolio, and effectively managing risk. By carefully selecting dividend-paying stocks, reinvesting your dividends, and employing tax-efficient strategies, you can unlock the power of passive income and achieve significant long-term growth. Remember, consistent dividend reinvestment leads to the compounding effect, steadily accelerating your wealth accumulation. High-yield dividend investing is a rewarding strategy, offering a pathway to financial independence. Ready to unlock the power of passive income? Begin your journey with dividend investing today! Research reliable dividend-paying stocks and build your portfolio for long-term growth. Start your high-yield dividend investing journey now and experience the benefits of passive income generation.

Featured Posts

-

Retour De Le Fil D Ariane Sur Tf 1 Avec Chantal Ladesou

May 11, 2025

Retour De Le Fil D Ariane Sur Tf 1 Avec Chantal Ladesou

May 11, 2025 -

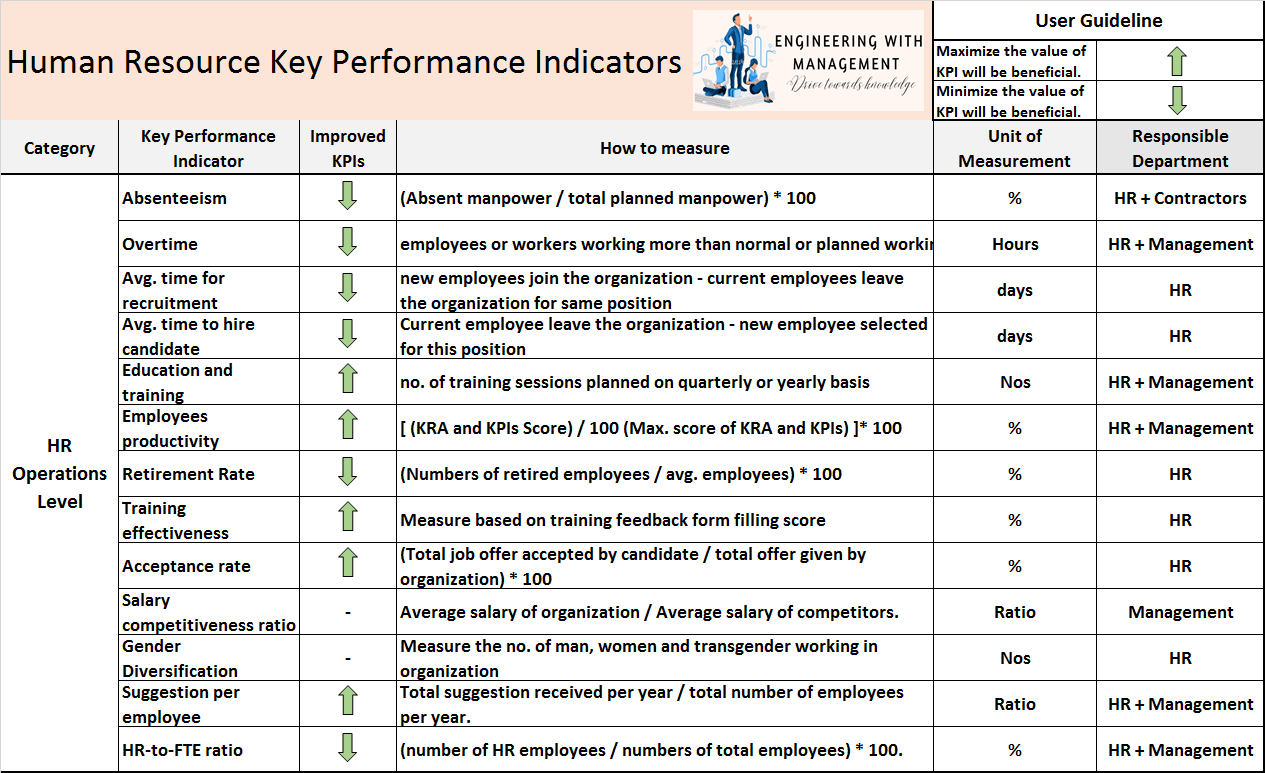

Aaron Judges Key Performance Indicators Predicting Yankees Success In 2025

May 11, 2025

Aaron Judges Key Performance Indicators Predicting Yankees Success In 2025

May 11, 2025 -

John Wick 5 Confirmed Keanu Reeves Epic Return

May 11, 2025

John Wick 5 Confirmed Keanu Reeves Epic Return

May 11, 2025 -

Kya Tam Krwz Ne 36 Salh Adakarh Ke Sath Shady Ky Mnswbh Bndy Ky He

May 11, 2025

Kya Tam Krwz Ne 36 Salh Adakarh Ke Sath Shady Ky Mnswbh Bndy Ky He

May 11, 2025 -

Understanding Jurickson Profars 80 Game Ped Suspension

May 11, 2025

Understanding Jurickson Profars 80 Game Ped Suspension

May 11, 2025