Dow Jones Index: Cautious Climb Continues After PMI Surprise

Table of Contents

The Purchasing Managers' Index (PMI) is a leading economic indicator that measures the activity levels of purchasing managers in the manufacturing and services sectors. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction. Today's surprisingly strong PMI report suggests a healthier-than-expected economic outlook, although the Dow Jones Index's response has been muted.

PMI Data and its Impact on Market Sentiment

The latest PMI report provided a mixed bag of signals. While the overall PMI exceeded expectations, a closer look reveals nuances.

- Manufacturing PMI: Exceeded forecasts, signaling robust growth in the manufacturing sector. This suggests increased production and investment.

- Services PMI: Remained strong, indicating continued consumer spending and a healthy service sector. This is a positive sign for overall economic health.

- Overall PMI: The combined PMI suggests a stronger-than-anticipated economic outlook, exceeding analyst predictions.

This unexpected positive data initially boosted investor confidence, leading to a modest increase in the Dow Jones Index. However, concerns remain about the long-term implications of inflation and geopolitical instability. Some analysts caution that the current economic strength might be temporary.

Dow Jones Index Performance Analysis – A Cautious Climb

Following the PMI release, the Dow Jones Index experienced a cautious climb. While the index showed gains, the movement was far from dramatic, reflecting the underlying market uncertainty. The index opened slightly higher, experienced some intraday volatility, and ultimately closed with a modest percentage gain of approximately 0.5%. This relatively small gain, despite the positive PMI data, underscores the market's cautious optimism.

Several factors contributed to this tentative upward movement:

- Geopolitical Concerns: Ongoing geopolitical tensions, particularly concerning [mention specific geopolitical event, e.g., the situation in Ukraine], continue to weigh on investor sentiment and create market uncertainty.

- Inflationary Pressures and Interest Rate Expectations: Persistent inflationary pressures and the expectation of further interest rate hikes by the Federal Reserve are creating headwinds for the market. High interest rates increase borrowing costs for businesses and can slow economic growth.

- Corporate Earnings Reports: Recent corporate earnings reports have been mixed, with some companies exceeding expectations while others have fallen short. This uneven performance adds to the overall market uncertainty.

- Overall Market Uncertainty: A general sense of uncertainty prevails, causing investors to adopt a wait-and-see approach before committing to significant investments.

Sector-Specific Performance within the Dow Jones Index

The positive PMI data did not impact all sectors of the Dow Jones Index equally. The technology sector, for example, saw relatively strong gains, possibly reflecting investor confidence in long-term growth prospects. Conversely, the energy sector experienced a more muted response, potentially due to concerns about future energy demand and price volatility.

| Sector | Performance (Approximate) | Reason |

|---|---|---|

| Technology | +1.2% | Positive outlook for long-term growth and technological advancements. |

| Finance | +0.8% | Increased interest rates benefiting some financial institutions. |

| Energy | +0.2% | Concerns about future energy demand and price volatility. |

| Consumer Goods | +0.6% | Strong Services PMI reflecting positive consumer spending. |

Future Outlook and Predictions for the Dow Jones Index

Predicting the future trajectory of the Dow Jones Index is inherently challenging. However, based on the current market conditions, several factors will likely shape its performance in the coming weeks and months. The ongoing geopolitical situation, the Federal Reserve's monetary policy decisions, and the release of further economic data will all play a crucial role.

Short-term projections suggest continued volatility, with the Dow Jones Index potentially experiencing further modest gains or losses depending on the incoming economic news. Long-term forecasts are more optimistic, predicated on the underlying strength of the U.S. economy. Many market analysts predict moderate growth, contingent upon the successful management of inflation and geopolitical stability.

Conclusion: Understanding the Dow Jones Index's Trajectory

The Dow Jones Index's cautious climb following the positive PMI surprise highlights the complexity of market dynamics. While the strong PMI data injected a degree of optimism, other factors, including geopolitical concerns, inflation, and interest rate expectations, continue to temper investor enthusiasm. The varied performance across different sectors further underscores the nuanced nature of the current market environment.

Monitoring the Dow Jones Index and related economic indicators is crucial for understanding the overall health of the U.S. economy. Stay tuned for further updates and in-depth analysis of the Dow Jones Index as the market continues to navigate these uncertain times. Understanding the Dow Jones Index fluctuations is key to making informed investment decisions.

Featured Posts

-

La Repression Chinoise Des Dissidents En France Une Analyse

May 25, 2025

La Repression Chinoise Des Dissidents En France Une Analyse

May 25, 2025 -

Hells Angels Motorcycle Club Mourns Member Killed In Crash

May 25, 2025

Hells Angels Motorcycle Club Mourns Member Killed In Crash

May 25, 2025 -

Increased Retail Sales Reduce Probability Of Bank Of Canada Interest Rate Reduction

May 25, 2025

Increased Retail Sales Reduce Probability Of Bank Of Canada Interest Rate Reduction

May 25, 2025 -

Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025

Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025 -

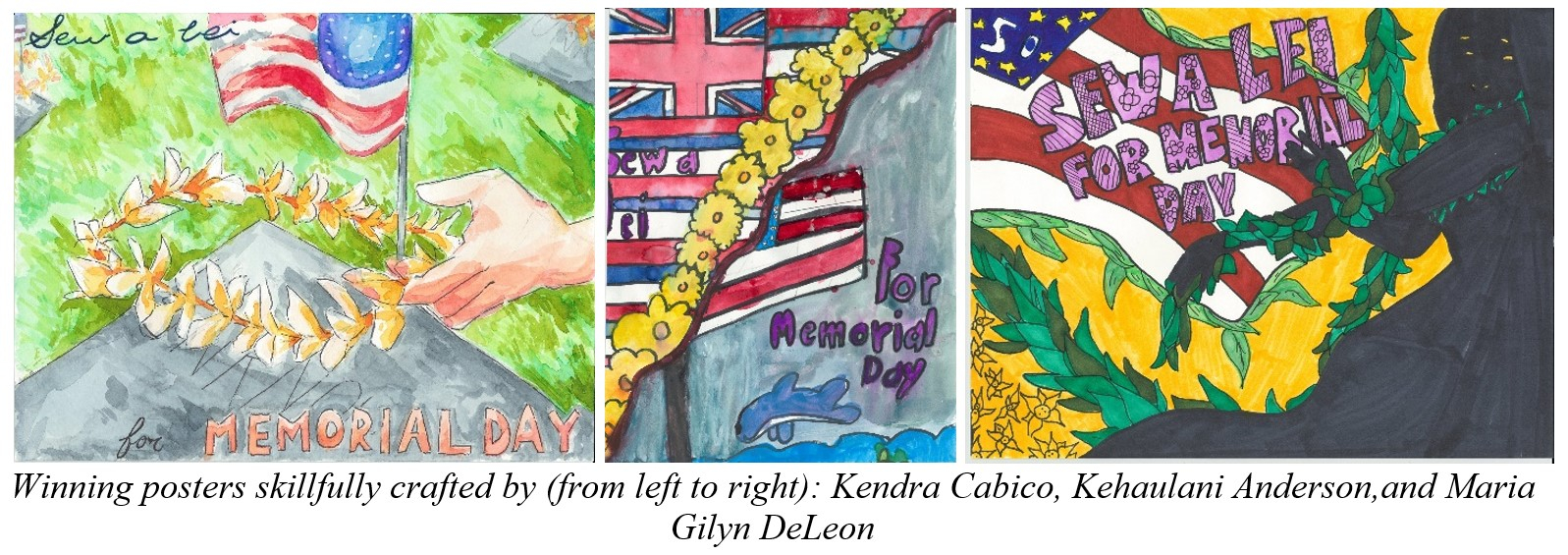

Memorial Day Poster Contest Celebrating Hawaii Keiki Artistic Abilities Through Lei Making

May 25, 2025

Memorial Day Poster Contest Celebrating Hawaii Keiki Artistic Abilities Through Lei Making

May 25, 2025