DSP India Fund: Top Performance, Cautious Outlook, Cash Raise

Table of Contents

Exceptional Performance of the DSP India Fund

The DSP India Fund has delivered exceptional returns, significantly outperforming its benchmark in several periods. Its success stems from a combination of skillful stock picking, strategic sector allocation, and a keen understanding of the Indian market dynamics.

-

Fund Returns: Over the past 1 year, the DSP India Fund has achieved X% returns (replace X with actual data), while the Nifty 50 index returned Y%. Over 3 years, the fund's returns stand at Z%, compared to W% for the Nifty 50 (replace Y, Z, W with actual data). Five-year performance figures reveal even more impressive results, showcasing the fund manager's consistent ability to generate alpha.

-

Investment Strategy: The fund's success is attributable to its active investment strategy, focusing on identifying fundamentally strong companies with high growth potential. This includes a blend of large-cap, mid-cap, and small-cap stocks, strategically allocated across various sectors.

-

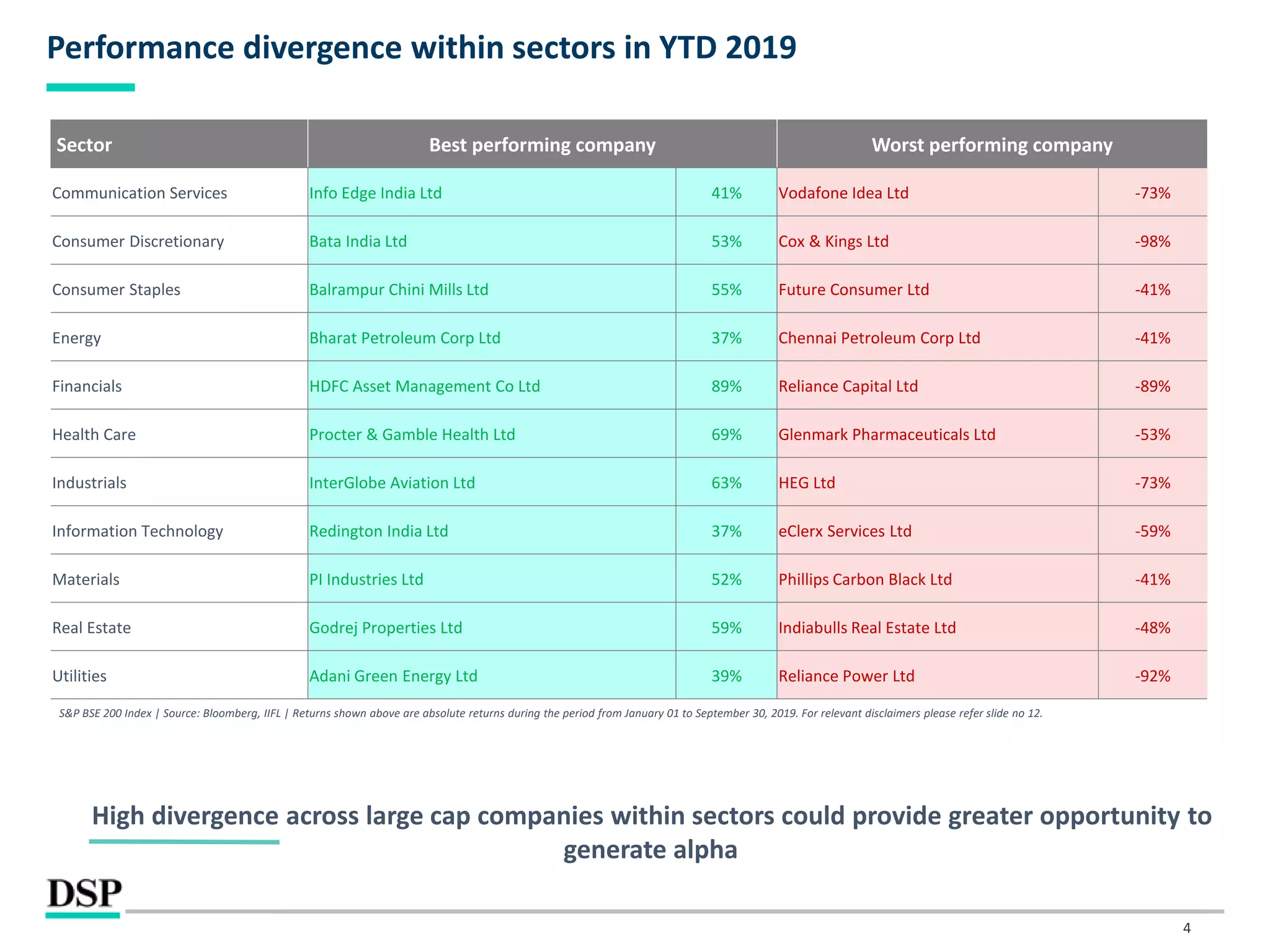

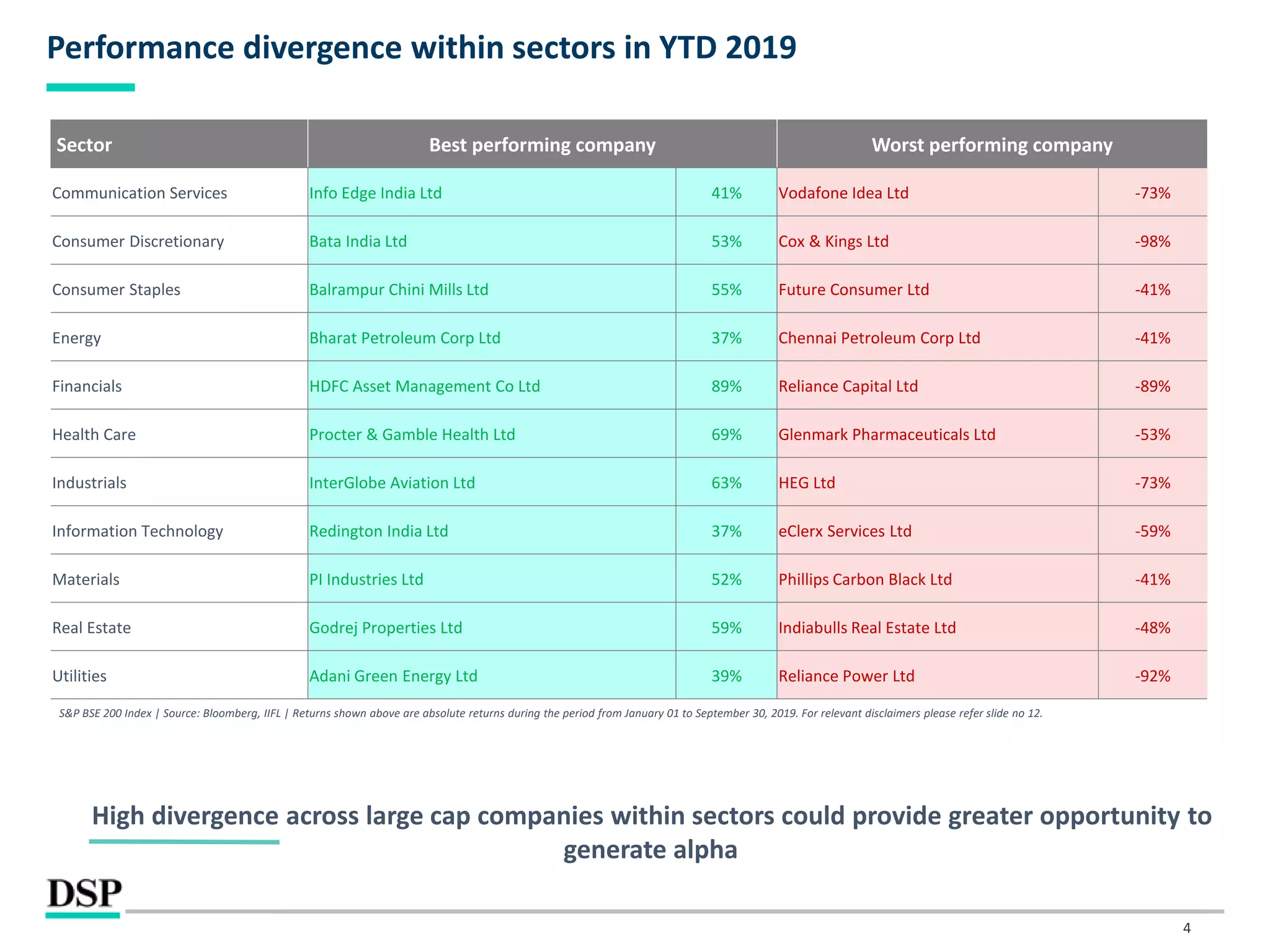

Sector Allocation and Stock Selection: A significant contributor to the fund's outperformance has been its astute sector allocation, particularly its exposure to (mention specific high-performing sectors, e.g., technology, financials, or consumer goods). Specific stock picks within these sectors have also significantly contributed to the overall returns. (Mention specific examples, if publicly available, citing sources).

-

Alpha Generation: The DSP India Fund has consistently generated positive alpha, indicating its ability to outperform the benchmark even after considering the fund's risk profile. This superior risk-adjusted return demonstrates the fund manager's expertise in identifying undervalued opportunities and navigating market volatility.

Cautious Outlook Amidst Market Volatility

Despite its impressive history, the DSP India Fund has adopted a more cautious outlook, reflecting a prudent response to the prevailing macroeconomic uncertainty.

-

Global Economic Slowdown: The global economic slowdown, coupled with persistent inflation and aggressive interest rate hikes by central banks worldwide, creates significant headwinds for global equity markets, including India.

-

Impact on Indian Equity Market: These global factors directly influence the Indian equity market, increasing volatility and creating uncertainty about future growth prospects. Concerns around rising inflation and potential interest rate hikes in India further contribute to this cautious sentiment.

-

Fund Manager Commentary: The fund manager's commentary emphasizes a need for heightened risk awareness and a more defensive posture. They highlight the increased uncertainty around valuations and the potential for further market corrections.

-

Defensive Strategy: To mitigate potential downside risks, the fund has implemented a more defensive strategy. This includes increased cash allocation to provide a buffer against potential market downturns. This strategic shift aims to safeguard capital and limit potential losses.

Defensive Positioning and Risk Management

The DSP India Fund's risk management strategy focuses on preserving capital while seeking long-term growth.

-

Risk Management Approach: The fund employs a rigorous risk management framework that involves diversification across sectors, asset classes, and market capitalizations. This approach aims to reduce the impact of any single negative event on the overall portfolio performance.

-

Increased Cash Allocation: The heightened cash allocation is a key element of the defensive strategy, providing flexibility to seize opportunities during market corrections and reducing portfolio volatility.

-

Portfolio Diversification: The fund maintains a well-diversified portfolio, minimizing reliance on any single sector or stock. This spreads risk across various asset classes and reduces the overall portfolio's vulnerability to market fluctuations.

-

Downside Protection: The combination of diversification and increased cash allocation provides a measure of downside protection, aiming to limit potential losses during periods of market turbulence.

Strategic Cash Raise and its Implications

The recent cash raise by the DSP India Fund is a strategic move that strengthens its position to capitalize on future investment opportunities.

-

Purpose of Cash Raise: The fund raised [amount] in new capital to enhance its investment capacity and bolster its ability to navigate market fluctuations effectively.

-

Capital Allocation: The raised capital will primarily be used to selectively invest in undervalued assets identified by the fund's research team. This approach allows the fund to capitalize on attractive opportunities as they emerge.

-

Impact on Future Performance: The increased capital base provides the fund with greater flexibility to navigate market cycles and to pursue high-conviction investment opportunities. This, in turn, should positively impact the fund's long-term performance.

-

Expense Ratio and Fees: The fund management has clarified that the cash raise will not result in any changes to the existing expense ratio or management fees, ensuring that investors benefit from the scale increase without incurring additional costs.

Conclusion

The DSP India Fund's consistent strong performance reflects its effective investment strategy and the skill of its fund managers. Its cautious outlook in light of current market volatility represents a prudent approach to risk management. The strategic cash raise further strengthens its position for future growth and underscores its commitment to delivering long-term value to its investors. Considering the DSP India Fund's impressive track record and proactive risk management, investors interested in exposure to the dynamic Indian equity market should seriously consider this fund as a core holding within a diversified portfolio. Learn more about the DSP India Fund and its investment strategy today!

Featured Posts

-

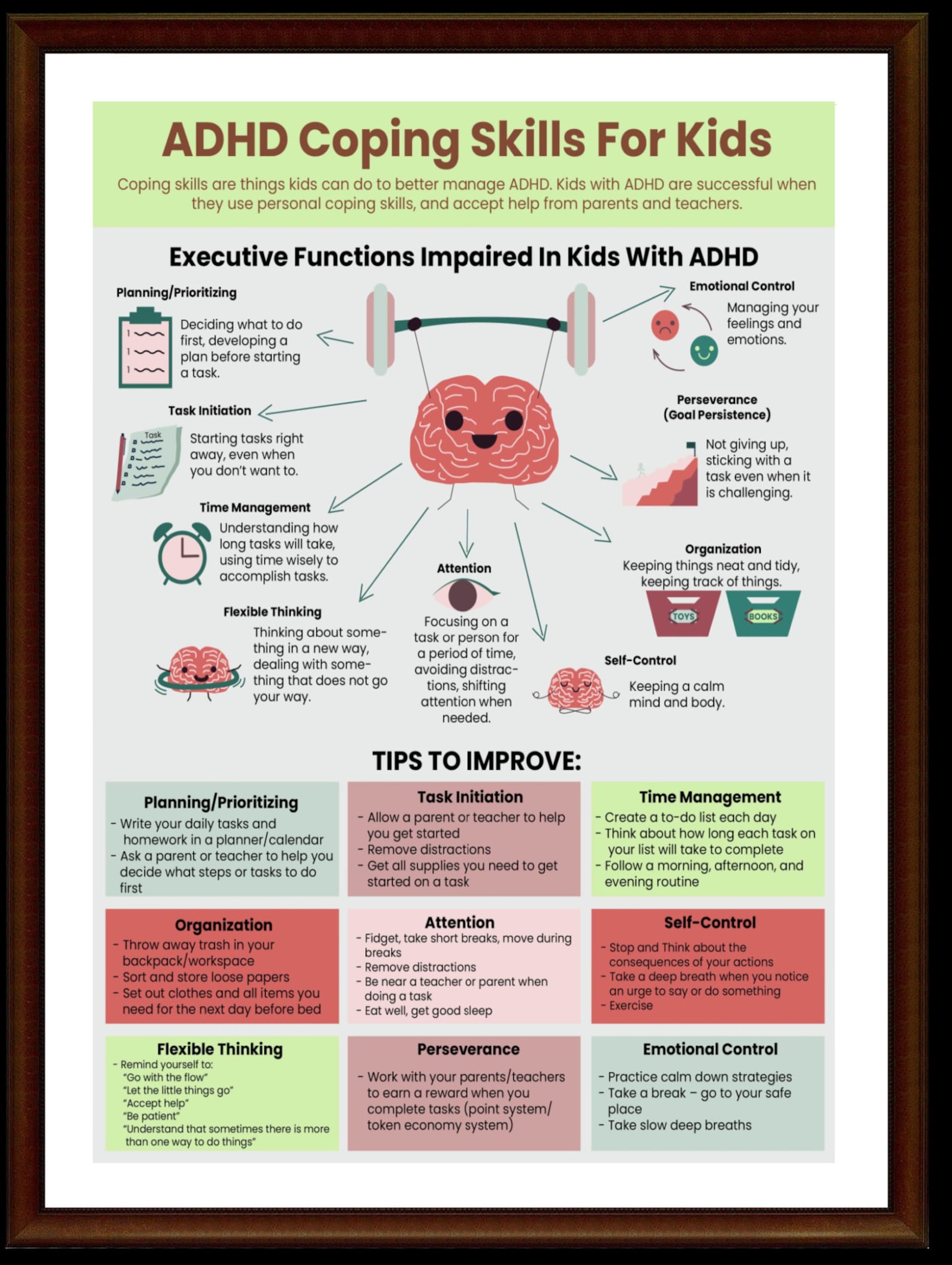

Managing Adhd The Benefits Of Group Support

Apr 29, 2025

Managing Adhd The Benefits Of Group Support

Apr 29, 2025 -

Chargers To Kick Off 2025 Season In Brazil Justin Herbert Leads The Charge

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herbert Leads The Charge

Apr 29, 2025 -

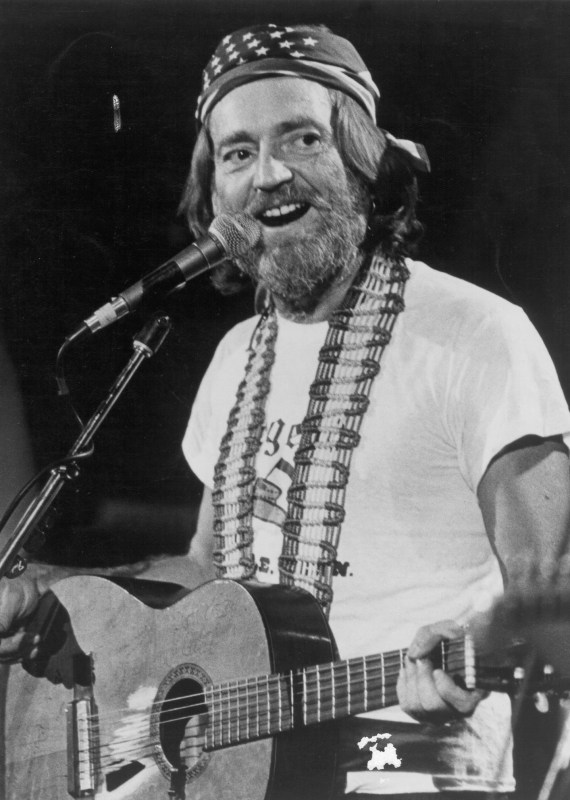

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025 -

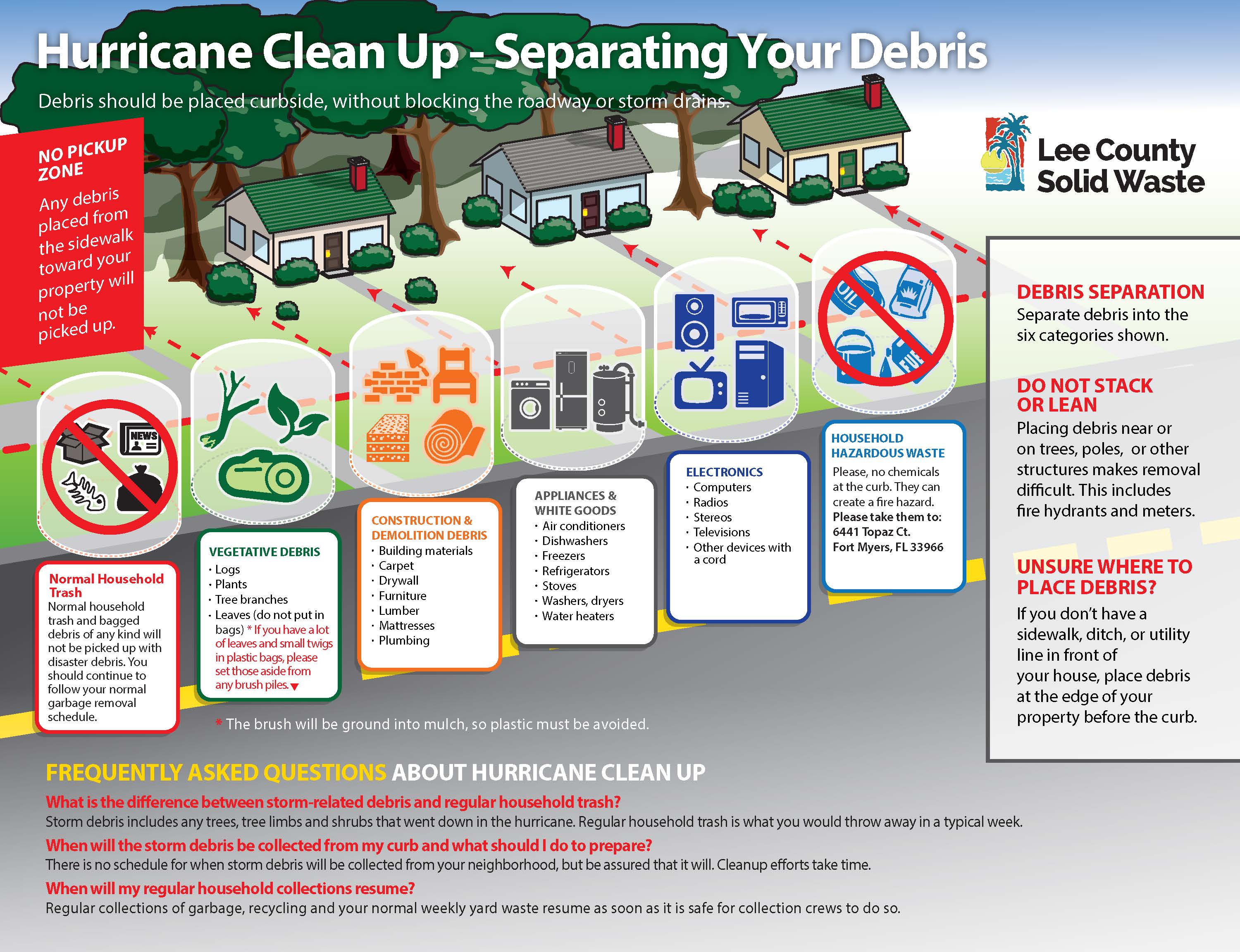

Louisville Opens Storm Debris Removal Submit Your Request Now

Apr 29, 2025

Louisville Opens Storm Debris Removal Submit Your Request Now

Apr 29, 2025 -

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

Apr 29, 2025

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

Apr 29, 2025

Latest Posts

-

Why Meeting Shane Lowry Remains A Popular Goal

May 12, 2025

Why Meeting Shane Lowry Remains A Popular Goal

May 12, 2025 -

Planning Your Meeting With Shane Lowry A Comprehensive Guide

May 12, 2025

Planning Your Meeting With Shane Lowry A Comprehensive Guide

May 12, 2025 -

Golf News Mc Ilroy And Lowry To Play Zurich Classic Together

May 12, 2025

Golf News Mc Ilroy And Lowry To Play Zurich Classic Together

May 12, 2025 -

Zurich Classic Mc Ilroy And Lowry Partnership Confirmed

May 12, 2025

Zurich Classic Mc Ilroy And Lowry Partnership Confirmed

May 12, 2025 -

How To Meet Shane Lowry Tips And Strategies

May 12, 2025

How To Meet Shane Lowry Tips And Strategies

May 12, 2025