Dubai Holding Increases REIT IPO Size To $584 Million

Table of Contents

Reasons Behind the Increased IPO Size

The dramatic increase in the Dubai Holding REIT IPO size from its initial projection is primarily driven by strong investor demand. The overwhelming response to the offering underscores the attractiveness of the investment opportunity and the confidence investors have in Dubai's long-term growth.

Strong Investor Demand

The sheer number of applications received significantly exceeded initial projections, forcing Dubai Holding to increase the IPO size to meet this unprecedented demand. While specific numbers of applications remain undisclosed, market sources indicate a substantial influx from both local and international institutional investors, as well as high-net-worth individuals.

Several factors contribute to this high demand:

- Attractive Yield Projections: The REIT offers a promising yield, enticing investors seeking stable returns in the current market climate.

- Stable Market Conditions: Dubai's real estate market has demonstrated remarkable resilience and stability, making it an attractive haven for investors seeking relatively low-risk, high-reward opportunities.

- Dubai's Economic Growth: Dubai's sustained economic growth, fueled by diversification efforts and strategic investments in infrastructure and tourism, contributes to the confidence in the long-term value of the REIT's underlying assets.

Implications for Investors

The expanded IPO size presents significant implications for both existing and prospective investors.

Increased Investment Opportunity

The increased IPO size translates to a substantially larger investment opportunity for both local and international investors. This expansion allows for broader participation and increased liquidity within the market.

- Potential Returns: While past performance is not indicative of future results, analysts project healthy returns for investors based on the strong performance of Dubai Holding's underlying assets and the projected growth of Dubai's real estate market.

- Diversification Benefits: Investing in the REIT offers a valuable avenue for diversification, allowing investors to gain exposure to a diversified portfolio of high-quality real estate assets.

- Pricing and Allocation: Due to the increased size, the allocation process may have been adjusted to ensure fair distribution among investors. Specific details regarding any changes to pricing remain to be confirmed.

Market Impact of the Increased IPO

The substantial increase in the Dubai Holding REIT IPO size has significant implications for the Dubai real estate market and the wider economy.

- Property Values: The strong demand reflected in the IPO could potentially boost property values in the areas where the REIT holds assets, creating a positive ripple effect across the market.

- Other REITs in the Region: The success of the Dubai Holding REIT IPO could spur increased activity and interest in other REITs operating within the region, creating a more dynamic and competitive environment.

- UAE Economy: The influx of investment into the Dubai real estate market through this REIT contributes positively to the broader UAE economy, boosting investor confidence and supporting economic diversification efforts.

Dubai Holding's REIT Portfolio and Future Outlook

The Dubai Holding REIT comprises a diversified portfolio of high-quality properties, strategically located across key areas within Dubai.

Overview of the Assets Included

The portfolio includes a mix of residential, commercial, and retail properties, strategically positioned to benefit from the ongoing development and growth of the city. Specific details on individual assets are yet to be released publicly, but the portfolio is anticipated to be a mix of established, income-generating properties and promising development projects.

- Property Types: The diversified nature of the portfolio across residential, commercial, and retail properties mitigates risk and offers investors a more balanced investment profile.

- Location and Quality: The portfolio consists of prime locations with high-quality assets, contributing to the overall appeal of the investment opportunity.

- Future Growth: The potential for future growth and expansion of the portfolio is strong, given the continued development and growth potential within Dubai's real estate market.

Conclusion

The expansion of the Dubai Holding REIT IPO to $584 million signifies a major milestone for Dubai's real estate market and the broader economy. The substantial investor demand reflects confidence in Dubai's economic stability and the attractiveness of the investment opportunity. This expanded IPO offers increased investment opportunities, enhanced diversification benefits, and a potential for substantial returns. The success of this REIT is likely to have a positive impact on the broader UAE economy, stimulating further investment and economic growth. Learn more about the Dubai Holding REIT IPO and its investment opportunities. Don't miss out on this expanded opportunity to invest in Dubai's thriving real estate market! Invest in the future of Dubai's real estate with the Dubai Holding REIT.

Featured Posts

-

New Jersey Transit Engineers Reach Tentative Deal Avert Strike

May 20, 2025

New Jersey Transit Engineers Reach Tentative Deal Avert Strike

May 20, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Hints

May 20, 2025

Nyt Mini Crossword March 5 2025 Solutions And Hints

May 20, 2025 -

Salaries De La Gaite Lyrique Occupation Illegale Et Preoccupations Securitaires

May 20, 2025

Salaries De La Gaite Lyrique Occupation Illegale Et Preoccupations Securitaires

May 20, 2025 -

Army Eyes Drone Truck For Usmc Tomahawk Missile Launch

May 20, 2025

Army Eyes Drone Truck For Usmc Tomahawk Missile Launch

May 20, 2025 -

Atkinsrealis Droit Inc Solutions Juridiques Sur Mesure

May 20, 2025

Atkinsrealis Droit Inc Solutions Juridiques Sur Mesure

May 20, 2025

Latest Posts

-

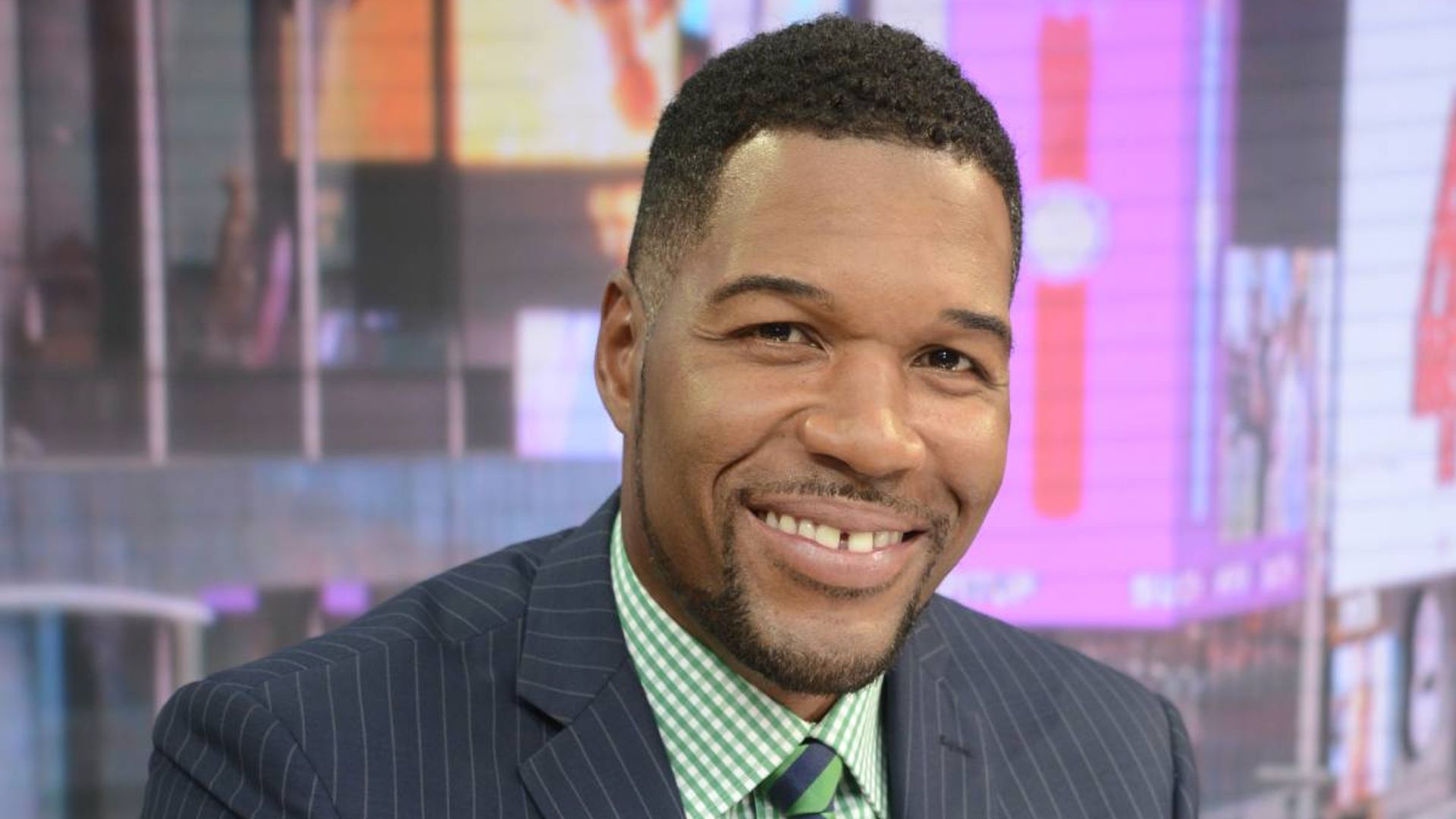

Inside Michael Strahans Interview Strategy Navigating The Ratings War

May 20, 2025

Inside Michael Strahans Interview Strategy Navigating The Ratings War

May 20, 2025 -

The Michael Strahan Interview Strategic Moves In A Competitive Broadcast Landscape

May 20, 2025

The Michael Strahan Interview Strategic Moves In A Competitive Broadcast Landscape

May 20, 2025 -

Michael Strahans Big Interview Get A Look At The Ratings War Strategy

May 20, 2025

Michael Strahans Big Interview Get A Look At The Ratings War Strategy

May 20, 2025 -

Heres How Michael Strahan May Have Secured A Major Interview Amidst A Ratings Battle

May 20, 2025

Heres How Michael Strahan May Have Secured A Major Interview Amidst A Ratings Battle

May 20, 2025 -

50 Years Of Gma A Paley Center Tribute

May 20, 2025

50 Years Of Gma A Paley Center Tribute

May 20, 2025